Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

Riverside.fm is a new startup with an easy-to-use platform for recording professional-quality video podcasts.

In fact, although the company only recently came out of stealth, it already has a number of high-profile customers, including TechCrunch’s parent company (Verizon Media) and Hillary Clinton, who’s using Riverside.fm to record her new podcast “You and Me Both with Hillary Clinton.”

“Just imagine, we needed a recording platform that could help us make a podcast during a pandemic, and, boy, did they step up,” Clinton said in a statement.

The startup was founded by brothers Nadav and Gideon Keyson — Nadav, who serves as CEO (Gideon is CTO), explained that they first created a platform where politicians could participate in video debates, but then realized there was a more promising business model for a broader podcasting tool.

In addition to officially launching, Riverside.fm is announcing that it has raised $2.5 million in seed funding led by Oren Zeev .

Gideon gave me a quick demo of the platform, showing me that it’s a fairly straightforward recording experience — the host just shares a link with the guests, no software installation necessary. There are plenty of other browser-based podcasting tools (for example, Zencastr recently expanded beyond audio with video support), but the Keysons suggested that they’ve spent a lot of time solving common technical issues for podcasters.

For one thing, each participants’ audio and video is recorded as a separate track on their device, so that a bad internet connection won’t affect recording quality. The recording is uploaded during the session, so you don’t have to have a long wait for files to upload. And there are automatic backups, in case someone’s browser or computer freezes.

“Stability … is so important,” Nadav said. “[Otherwise,] you could spend half a year to get a certain guest and then you lose their recording.”

Despite its simplicity, Riverside.fm supports 4K video and uncompressed WAV audio. It also includes an interface where podcast producers can monitor each guest’s equipment and adjust audio levels.

“We do really make it easy for the beginner and faster for the professionals,” Nadav said.

Gideon added that Riverside.fm isn’t interested in getting involved in the podcast distribution, but instead focuses on being a reliable production platform, as well as providing cross-platform analytics.

“We don’t want to start competing with Spotify and YouTube,” he said — in fact, Spotify is already a Riverside.fm customer.

The brothers also suggested that even if you’re not interested in creating a full-fledged video podcast, Riverside.fm is still the right choice for recording audio. Plus, you could still use the video recordings to create promotional clips for YouTube and social media.

Powered by WPeMatico

As the pandemic rages on, companies are looking for an edge when it comes to sales. Having the right data about the customers most likely to convert can be a huge boost right now. Slintel, an early-stage startup building a sales intelligence tool, announced a $4.2 million seed round today.

The investment was led by Accel with help from Sequoia Capital India and existing investor Stellaris Venture Partners. The company reports it has now raised $5.7 million, including a pre-seed round last year.

Deepak Anchala, company founder and CEO, says that while sales and marketing teams are trying to target a broad market, most of the time their emails and other forms of communication with customers fall flat. As a sales person in previous startups, Eightfold and Tracxn, this was a problem Anchala experienced first hand. He believed with data, he could improve this, and he started Slintel to build a tool to provide the sales data that he was missing in these previous positions.

“We focus on helping our customers solve that [lack of data] by identifying people with high buying intent. So we are able to tell sales and marketing teams, for example, who is most likely to buy your product or your service, and who is most likely to buy your product today, as opposed to two months or six months from now,” Anchala explained.

They do this by looking at signals that might not be obvious, but which let sales teams know key information about these companies and their likelihood of buying soon. He says that every company leaves a technology footprint. This could be data from SEC filings, annual reports, job openings and so forth.

“In today’s world there is an enormous amount of footprint left online when a company uses a certain product. So what our algorithms do is we map that at scale for about 15 million companies to all the products that they’re using from the different sources we are able to identify — and we track it all from week to week,” he said.

The company has 45 employees today and expects to double that number by the end of 2021. As he builds the company, especially as an immigrant founder, Anchala wants to build a diverse and inclusive organization.

“I think one of the key successes for companies today is having diversity. We have a global workforce, so we have a workforce in the U.S. and India and we want to capitalize on that. In the next phase of hires we are looking at hiring more diverse candidates, more female employees and people of different nationalities,” he said.

The company, which was founded in 2018, and emerged from stealth last year, has amassed 100 enterprise customers and has seen most of the customers actually come on board this year as COVID has forced companies to find ways to be more efficient with their sales processes.

Powered by WPeMatico

No-code is the name of the game in enterprise software, and today a startup called Ushur that has built a platform for any business to create its own AI-based customer communication flows with no coding required is announcing some funding to help fuel its growth.

The startup has picked up $25 million in a Series B round of funding led by Third Point Ventures (the fund founded and led by activist investor and hedge fund supremo Daniel Loeb), with previous investor 8VC (Joe Lonsdale’s fund) also participating. It brings the total raised by Ushur to $36 million.

Ushur is not disclosing its valuation, but it’s growing fast. As a mark of how it is doing, the startup is currently focusing on the insurance sector (a big one when it comes to speaking with customers and amassing data during the conversation) and it counts Aetna, Irish Life, Tower Insurance and Unum among its customers building chatbots (dubbed Virtual Customer Assistants by Ushur), automated email response flows (branded SmartMail) and tools to help customer service agents serve people more quickly (FlowBuilder). It has APIs for those who need them, with integrations into Slack, ServiceNow, Salesforce and Jira, and works in 60 languages (not just English).

It’s now widening the net to also target financial services and telecoms companies, with the plan being to use the funding primarily to expand Ushur’s sales and marketing to keep growing its business after seeing a rise in demand during the COVID-19 pandemic, CEO and co-founder Simha Sadasiva said in an interview.

As companies — not just e-commerce or other online companies, but all companies — have turned to having more virtual interactions with their customers, solutions like Ushur’s have come into their own.

That’s been especially true for companies that are not “tech” at their core. They may lack the in-house talent and other resources to build and run tech-based services from the ground up, but at the same time also are looking for solutions that don’t involve the cost (and time) of working with third-party system integrators to implement them. This is the case, Sadasiva said, with RPA (robotic process automation) solutions, which he described as a competing approach that typically requires technical expertise or systems integrators to create and implement software.

Enter no-code: solutions — software platforms really — that are built with all the nitty gritty coding behind the scenes, and easy-to-use interfaces at the front for users to knit together programs, query databases and run calculations without needing to know how to do these at the coding level, at a typically lower cost.

“For every dollar you spend on RPA tool you have to spend $3-4 more to deploy it so we are very competitive,” Sadasiva said. One email service developed by Irish Life for its agents reduced typical enquiry processing times from between 3 hours – 2.5 days to “less than a second” with 40% fewer resources, the company claims.

To be clear, these are not off-the-shelf pieces of software, but flows that are customised by the customers based on what they need and then powered by natural language processing (which is also baked in behind the scenes).

“We have hundreds of templates already created,” Sadasiva said. “But the key thing is that they are like Lego pieces, or building blocks. We provide the assembly kit to make lots of new shapes and objects.”

Although there are a lot of companies marketing themselves as no-code and low-code, and indeed there is a big demand for more productivity and communication tools that don’t require you to be a programmer to use them but give you the flexibility of building what you need, not what a software company thinks you need, Ushur is finding a lot of traction with investors and customers.

“They’re right at the intersection of some of the biggest developments in enterprise software,” said Third Point Ventures Managing Partner Robert Schwartz in a statement. “Automation that feels personal yet delivers tremendous efficiencies to the enterprise. No-code design that allows customers to get to deployment and benefit easily and incredibly fast. Customer experiences that actually favor the customer. And they’re doing an incredible job with execution.”

Powered by WPeMatico

The race is on to build more efficient chip technology for faster and less power-intensive computing, and today an innovative startup that’s built one solution based on in-package optical interconnect (optical I/O) technology is announcing a round of growth funding from a number of strategic investors that speaks to how its approach is getting traction.

Ayar Labs, which makes chip solutions based on optical networking principals — architecture that promises both faster computing speeds and far less power consumption (and heat) in the process — has picked up $35 million in a Series B round of funding. Co-led by Downing Ventures and BlueSky Capital, the round also includes Applied Ventures (the VC arm of Applied Materials), Castor Ventures and SGInnovate (the Singaporean government’s deep tech fund), with participation also from existing investors Founders Fund, GLOBALFOUNDRIES, Intel Capital, Lockheed Martin Ventures and Playground Global.

Charles Wuischpard, CEO of Ayar Labs, style=”letter-spacing: -0.1px; font-size: 1.125rem;”> said that the funding will be used to continue developing its product as well as working on further commercialization. “The main application area for our technology is next-generation computing, anywhere that there is massive movement of data,” he said.

That includes aerospace and government applications, artificial intelligence and high-performance computing, telecoms and cloud applications, and lidar for self-driving car and other autonomous systems. Currently Wuischpard said that most of Ayar’s work is in the areas of AI and HPC — it’s a key partner of Intel’s in its work on AI computers for Darpa (see here and here) — and in telecoms/cloud.

Ayar’s focus on optical technology — specifically using silicon photonics and processing to build an optical communication device that can be built into a CPU — is emerging as a key area for chipmakers. Just last week, Marvell announced that it would buy Inphi, an optical networking specialist, for $10 billion.

As Wuischpard describes it, the big breakthrough that Ayar has brought to bear has been bringing down the size and scale of the technology to work within a computer’s core chip architecture, its CPU, which impacts and controls memory, control unit and processing/logic, helping to speed up computing for the most demanding applications.

(The company was co-founded by Mark Wade, Chen Sun, Vladimir Stojanovic and Alexandra Wright-Gladstein based on work at MIT, and they brought in Wuischpard, an engineer by training and also a veteran exec from Intel, to help figure out how to build a commercialised business around that.)

“Optics has been around for a long time,” he points out, first in subsea cabling, then between data centers and then inside the data center. “We think of ourselves as the last or first mile, bringing optical tech into the CPU.”

As he describes it, the company has devised a new type of modulator to turn electrons into photons, a “microing modulator” as he calls it. “There have been 1,000 research papers on this, but it’s typically difficult to manufacture and operate over a wide range of temperatures, and this is where a lot of our patents come in, to develop that into a single chiplet,” he said. The amount of bandwidth the tech can handle, 2 terabits/second, “would fill a whole server, but we are doing it in 5×9 millimeters.”

He adds that the opportunities here are such that there are others also working on the same kind of technology. “There are bigger companies and one or two smaller ones, but they are all still a couple of years behind us in commercialization,” he said. “It’s one thing to build one, versus a million.” Having GLOBALFOUNDRIES as an investor — it’s also fabricating hardware for Ayar — is key in this regard.

The company seems like it would be a key acquisition target, I pointed out, not least because of the race for having ownership of technology that can give a company a leading edge over another, but also because of the trend of consolidation in the chip industry. (Intel’s acquisition of Habana Labs also underscores the interest it has in optical tech.)

Wuischpard laughs a little ironically and says that COVID-19 has been a “help” in this regard: acquisitions have slowed down, giving the startup more time and less pressure to sell up.

“Ayar Labs represents the future of interconnects which have eventual applicability to every electronic device on earth”, said Warren Rogers, partner and head of Ventures at Downing Ventures, in a statement. “We have the highest confidence that when their optical I/O technology is applied to computing, the industry will finally break away from Moore’s Law and redefine the boundaries of computing.”

“We’ve been an investor in Ayar Labs since the beginning and have been looking for opportunities to increase our ownership in the company” added Madison Hamman, managing director of BlueSky Capital. “We are very excited about Ayar Labs and believe in their patented technology and execution of a plan that makes it a core building block of future computing systems.”

Powered by WPeMatico

Online education tools continue to see a surge of interest boosted by major changes in work and learning practices in the midst of a global health pandemic. And today, one of the early pioneers of the medium is announcing some funding as it tips into profitability on the back of a pivot to enterprise services, targeting businesses and governments that are looking to upskill workers to give them tech expertise more relevant to modern demands.

Udacity, which provides online courses and popularized the concept of “Nanodegrees” in tech-related subjects like artificial intelligence, programming, autonomous driving and cloud computing, has secured $75 million in the form of a debt facility. The funding will be used to continue investing in its platform to target more business customers.

Udacity said that part of the business is growing fast, with Q3 bookings up by 120% year-over-year and average run rates up 260% in H1 2020.

Udacity said that customers in the segment include “five of the world’s top seven aerospace companies, three of the Big Four professional services firms, the world’s leading pharmaceutical company, Egypt’s Information Technology Industry Development Agency, and three of the four branches of the United States Department of Defense”, which work with Udacity to build tailor-made courses for their specific needs, as well as use off-the-shelf content from its catalogue.

Udacity also works with companies to build programs as part of their CSR remits, and with tech companies like Microsoft to build programs to get more developers using their tools.

“We’re seeing tremendous demand on the enterprise and government side,” said Gabe Dalporto, Udacity’s CEO who joined the company in 2019. “But to date it’s mostly been inbound, with enterprises, Fortune 500 companies and government organizations coming in and wanting to work with us. Now it’s time to build out a sales team to go after them.”

The news today is a welcome turn of events for a company that has been in the spotlight over the years for less rosy reasons, partly because it found it challenging to land on a profitable business model.

Founded nearly a decade ago by three robotics specialists, including Sebastian Thrun, the Stanford professor who at the time was instrumental in building and running Google’s self-driving car and larger moonshot programs, Udacity initially saw an opportunity to partner with colleges and universities to build online tech courses (Thrun’s academic standing, and the vogue for MOOCs, were possibly two fillips for that strategy).

After that proved to be too challenging and costly, Udacity pivoted to positioning itself as a vocational learning provider targeting adults, specifically those who didn’t have the hours or money to embark on full-time courses but wanted to learn tech skills that could help them land better jobs.

That resulted in some substantial user growth, but still no profit. Eventually, the company faced multiple rounds of layoffs as it restructured and gravitated closer to its current form.

Currently, the company still provides direct-to-consumer (direct-to-learner?) courses, but it won’t be long, Dalporto said, before enterprise and government customers account for about 80% of the company’s business.

Previously, Udacity had raised nearly $170 million from a pretty illustrious group of investors that include Andreessen Horowitz, Ballie Gifford, CRV, Emerson Collective and more. This latest tranche is coming in the form of a debt facility from a single company, Hercules Capital.

Dalporto said the decision to take the debt route came after initially getting a number of term sheets for an equity round.

“We had multiple term sheets on the equity side, but then we received an unsolicited debt term sheet,” he said. That led to the company modelling out the cost of capital and dilution, he said, and “it turned out it was the better option.” For now, he added, equity was “off the table” but it may consider revisiting the idea en route to a public listing. “For the foreseeable future, we are cash flow positive so there is no compelling reason right now, but we might do something closer to an IPO.”

Being a debt facility, this funding does not mean a revisiting of Udacity’s valuation. The company was last capitalized five years ago at $1 billion, but Dalporto would not comment on how that had changed in the (uncompleted) equity term sheets it had received.

The interest Udacity is seeing — both from investors and as a company — is part of the bigger spotlight that online education companies have had in the last year. In K-12 and university education, the focus has been on building better technology and content to help students stay engaged and continue learning even when they cannot be in their normal physical classrooms as schools, districts, governments and public health officials implement social distancing to slow the spread of COVID-19.

But that’s not the only classroom where online education is getting called on. In the world of business, organizations that have also gone remote because of the pandemic are facing a matrix of challenges. How can they keep employees productive and feeling like part of a team when they no longer work next to each other? How do they make sure their workforces have the skills they need to work in the new environment? How do they make sure their own businesses are equipped with the right technology, and the expertise of people to run it, for this latest and future iterations of “work”? And how can governments make sure their economies don’t fall off a cliff as a result of the pandemic?

Online education has been seen as something of a panacea for all of these questions, and that has spelled a lot of opportunity for tech companies building online learning tools and other infrastructure — with others including the likes of Coursera, LinkedIn, Pluralsight, Treehouse and Springboard in the area of tech-related courses and learning platforms for workers.

As with other market segments like e-commerce, this isn’t about a trend emerging out of the blue, but about it accelerating much faster than people projected it would.

“Given Udacity’s growth, focus on sustainable business practices, and expanding reach across multiple industries, we are excited to provide this investment. We look forward to working with the company to help them sustain their impressive global growth, and continued innovation in upskilling and reskilling,” said Steve Kuo, senior MD and Technology Group head at Hercules Capital, in a statement.

In the areas of enterprise and government, Dalporto described a number of scenarios where Udacity is already active, which are natural progressions of the kind of vocational learning it was already offering.

They include, for example, the energy company Shell retraining structural and geological engineers “who had good math skills but no machine learning expertise” to be able to work in data science, needed as the company builds more automation into its operation and moves into new kinds of energy technology.

And he said that Egypt and other nations — looking to the success that India has had — have been providing technology expertise training to residents to help them find jobs in the “outsourcing economy.” He said that the program in Egypt has seen an 80% graduation rate and 70% “positive outcomes” (resulting in jobs).

“If you take just AI and machine learning, demand for these skills is growing at a rate of 70% year-over-year, but there is a shortage of talent to fill those roles,” Dalporto said.

Udacity is for now not looking at any acquisitions, he added, for another 6-12 months. “We have so much demand and work to do internally that there is no compelling reason to do that. At some point we will look at that but it needs to be linked to our strategy.”

Powered by WPeMatico

Indonesia’s logistics industry is very fragmented, with several large providers operating alongside thousands of smaller companies. This means shippers often have to work with a variety of carriers, driving up costs and making supply chains harder to manage. Logisly, a Jakarta-based startup that describes itself as a “B2B tech-enabled logistics platform,” announced today it has raised $6 million in Series A funding to help streamline logistics in Indonesia. The round was led by Monk’s Hill Ventures.

This brings the total Logisly has raised since it was founded last year to $7 million. Its platform digitizes the process of ordering, managing and tracking trucks. First, it verifies carriers before adding them to Logisly’s platform. Then it connects clients to trucking providers, using an algorithm to aggregate supply and demand. This means companies that need to ship goods can find trucks more quickly, while carriers can reduce the number of unused space on their trucks.

Co-founder and chief executive officer Roolin Njotosetiadi told TechCrunch that about “40% of trucks are utilized in Indonesia, and the rest are either sitting idle or coming back from their hauls empty handed. All of these result in high logistics costs and late deliveries.”

He added that Logisly is “laser focused on having the largest trucking network in Indonesia, providing 100% availability of cost-efficient and reliable trucks.”

Logisly now works with more than 1,000 businesses in Indonesia in sectors like e-commerce, fast-moving consumer goods (FCG), chemicals and construction. This number includes 300 corporate shippers. Logisly’s Series A will be used on growing its network of shippers and transporters (which currently covers 40,000 trucks) and on product development.

The startup’s clients include some of the largest corporate shippers in Indonesia, including Unilever, Haier, Grab, Maersk and JD.ID, the Indonesian subsidiary of JD.com, one of China’s largest e-commerce companies.

Other venture capital-backed startups that are focused on Indonesia’s logistics industry include Shipper, which focuses on e-commerce; logistics platform Waresix; and Kargo.

Powered by WPeMatico

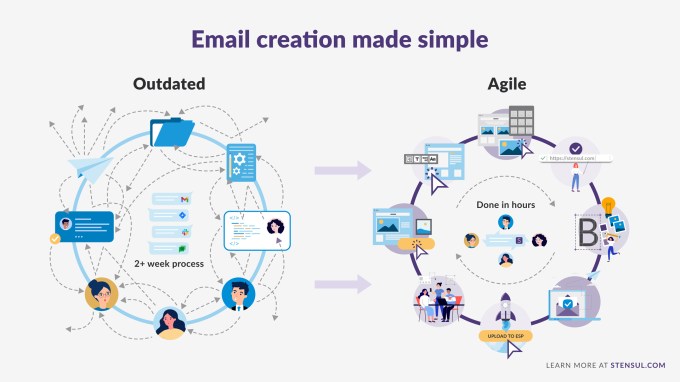

Stensul, a startup aiming to streamline the process of building marketing emails, has raised $16 million in Series B funding.

When the company raised its $7 million Series A two years ago, founder and CEO Noah Dinkin told me about how it spun out of his previous startup, FanBridge. And while there are many products focused on email delivery, he said Stensul is focused on the email creation process.

Dinkin made many similar points when we discussed the Series B last week. He said that for many teams, creating a marketing email can take weeks. With Stensul, that process can be reduced to just two hours, with marketers able to create the email on their own, without asking developers for help. Things like brand guidelines are already built in, and it’s easy to get feedback and approval from executives and other teams.

Dinkin also noted that while the big marketing clouds all include “some kind of email builder, it’s not their center of gravity.”

He added, “What we tell folks [is that] literally over half the company is engineers, and they are only working on email creation.”

Image Credits: Stensul

The team has recently grown to more than 100 employees, with new customers like Capital One, ASICS Digital, Greenhouse, Samsung, AppDynamics, Kroger and Clover Health. New features include an integration with work management platform Workfront.

Plus, with other marketing channels paused or diminished during the pandemic, Dinkin said that email has only become more important, with the old, time-intensive process becoming more and more of a burden.

“We need more emails — whether that’s more versions or more segments or more languages, the requests are through the roof,” he said. “The teams are the same size … and so that’s where especially the leaders of these organizations have looked inward a lot more. The ways that they have been doing it for years or decades just doesn’t work anymore and prevents them from being competitive in the marketplace.”

The new round was led by USVP, with participation from Capital One Ventures, Peak State Ventures, plus existing investors Javelin Venture Partners, Uncork Capital, First Round Capital and Lowercase Capital . Individual investors include Okta co-founder and COO Frederic Kerrest, Okta CMO Ryan Carlson, former Marketo/Adobe executive Aaron Bird, Avid Larizadeh Duggan, Gary Swart and Talend CMO Lauren Vaccarello.

Dinkin said the money will allow Stensul to expand its marketing, product, engineering and sales teams.

“We originally thought: Everybody who sends email should have an email creation platform,” he said. “And ‘everyone who sends email’ is synonymous with ‘every company in the world.’ We’ve just seen that accelerate in that last few years.”

Powered by WPeMatico

When we covered Leena AI as a member of the Y Combinator Summer 2018 cohort, the young startup was firmly focused on building HR chatbots, but in the intervening years it has expanded the vision to a broader HR policy platform. Today, the company announced an $8 million Series A led by Greycroft with help from several individual industry investors.

Company CEO and co-founder Adit Jain says that in 2018 the company was concentrating on building an intelligent virtual assistant for HR-related questions. It allowed employees to ask the bot questions like how many vacation days they have left or what holidays they have off this year.

Over the last couple of years since leaving Y Combinator, the company has moved into broader HR service delivery. “So I’m talking about having an intelligent case management, knowledge management and document management system, which is backing the virtual assistant as well,” Jain explained.

He says that users should think of it as an entire system where the chatbot is the user interface for employees to interact with the HR information on the back end. For example, he says that the knowledge management component is where the chatbots find the answers to questions, and as employees interact with the chatbot, it grows more intelligent based on the feedback from them.

The document management piece enables HR to write or import HR policies and the case management system comes into play when the situation is too complex for the chatbot to handle and it has to be escalated to a human HR representative.

When we spoke to Jain in September 2018 at the time of his startup’s $2 million seed round, he had 16 customers and hoped to have 50 in the next 12-18 months. Today the company has 100 enterprise customers with 300,000 employees using the platform worldwide.

In fact, the pandemic has fueled business with more than half of those customers coming on board this year. He says this is because companies are looking for ways to digitize processes like HR as employees are working from home more.

“This is a trend that’s going to continue as organizations have realized the value of doing things with more and more digital applications taking care of your processes […] especially mundane, repeatable tasks being handed over to technology more and more,” Jain said.

As the business has grown this year, the company has expanded from 30 to 75 employees and he hopes to double that number in the next year. As he does, he has discussed with his lead investor how to build a diverse and inclusive culture at Leena AI .

One thing he is trying to do is raise some money from a diverse group of investors, approximately $400,000, and his hope is that these diverse investors can help him build solid diversity programs as he adds employees to his growing company.

That the startup hasn’t only grown during these turbulent times, but thrived, shows that companies are looking to modernize every part of the enterprise technology stack, and that includes HR.

Powered by WPeMatico

For years — decades, even — there was little question about whether you could become a venture capitalist if you weren’t comfortable financially. You couldn’t. The people and institutions that invest in venture funds want to know that fund managers have their own “skin in the game,” so they’ve long required a sizable check from the investor’s own pocket before jumping aboard. Think 2% to 3% of the fund’s total assets, which often equates to millions of dollars.

In fact, five years ago, I wrote that the real obstacle to becoming a venture capitalist has less to do with gender than with financial inequality. I focused then on women, who are paid less (especially Black and Hispanic women), and who possess less wealth. But the same is true of anyone of lesser means.

LPs: The ≧1% of a fund capital commitment you expect from GPs makes it hard for POCs to raise funds.

Consider that “for a $20M fund, a 2% commitment with 2 GPs is still a $200K commitment for each partner.” This is out of reach for many of us. https://t.co/bguXpa3CiY

— lolitataub (@lolitataub) October 29, 2020

Thankfully, things are changing, with more ways to help aspiring VCs raise that initial capital commitment. None of these approaches can guarantee success in raising a fund, but they’re paths that other VCs have effectively used and are good to understand better.

First, find investors, i.e. limited partners, who are willing to take less than 2% or 3% and maybe even less than 1% of the overall fund size being targeted. You’ll likely find fewer investors as that “commit” shrinks. But for example Joanna Rupp, who runs the $1.1 billion private equity portfolio for the University of Chicago’s endowment, suggests that both she and other managers she knows are willing to be flexible based on the “specific situation of the GP.”

Says Rupp, “I think there are industry ‘norms,’ but we haven’t required a [general partner] commitment from younger GPs when we have felt that they don’t have the financial means.”

Bob Raynard, founder of the fund administration firm Standish Management, echoes the sentiment, saying that a smaller general partner commitment in exchange for special investor economics is also fairly common. “You might see a reduced management fee for the LP for helping them or reduced carry or both, and that has been done for years.”

Explore management fee offsets, which investors in venture funds often determine to be reasonable. These aren’t uncommon, says Michael Kim of Cendana Capital, a firm that has stakes in dozens of seed stage funds, because they also offer tax advantages (though the IRS has talked about doing away with these).

How do these work? Say your “commit” was $1 million over 10 years (the standard life of a fund). Instead of trying to come up with $1 million that you presumably don’t have, you can offset up to 80% of that, putting in $200,000 instead but reducing your management fees by that same amount over time so that it’s a wash and you’re still getting credit for the entire $1 million. You’re basically converting fee income into the investment you’re supposed to make.

Use your existing portfolio companies as collateral. Kim had at least two highly regarded managers launch a fund not with a “commit” but rather by bringing to the table ownership stakes in startups they’d funded as angel investors.

In both of these cases, it was a great deal for Kim, who says the companies were quickly marked up. For the fund managers’ part, it meant not having to put more of their own money into the funds.

Make a deal with wealthier friends if you can. When Kim launched his fund of funds to invest in venture managers after working for years as a VC himself, he raised $1 million in working capital from six friends to get it off the ground. The money gave Kim, who had a mortgage at the time and young children, enough runway for two years. Obviously, your friends have to be willing to gamble on you, but sweeteners certainly help, too. In Kim’s case, he gave his friends a percentage of Cendana’s economics in perpetuity.

Get a bank loan. Rupp said she would be uncomfortable if a GP funded his or her commit through a bank loan for several reasons. There’s no guarantee a fund manager will make money from a fund, a loan adds risk on top of risk, and should a manager need liquidity related to that loan, he or she might sell a strongly performing position too early.

That said, loans aren’t uncommon, says Raynard. He says banks with venture capital relationships like Silicon Valley Bank and First Republic are typically happy to lend a fund manager a line of credit to help him or her make capital calls, though he says it does depend on who else is involved with the fund. “As long as it’s a diverse group of LPs,” the banks are comfortable moving forward in exchange for winning over a new fund’s business, he suggests.

Consider the merits of so-called front loading. This is a technique with which “more creative LPs can sometimes get comfortable,” says Kim. It’s also how investor Chris Sacca, now a billionaire, got started when he first turned to fund management. How does it work? Some beginning managers blend their annual management fee of 2.5% of assets under management and pay themselves a higher percentage — say 5% for each of its first three years — until by the end of the fund’s life, the manager is receiving no management fee at all.

That could mean no income if you aren’t yet seeing profits from your investments. But presumably — especially given pacing in recent years — you, the general partner, have raised another fund by the time that happens so have resources coming in from a second fund.

These are just a few of the ways to get started. There are other paths to take, too, notes Lo Toney of Plexo Capital — which, like Cendana Capital — has stakes in many venture funds. One of these is to use a self-directed IRA to finance that GP commit. Another is to sell a portion of the management company or sell a greater percentage of your carry and use those proceeds to pay your commit. (VCs Charles Hudson of Precursor Ventures and Eva Ho of Fika Ventures avoided that path and suggested that first-time managers do the same if they can.)

Either way, suggests Toney, a former partner with Alphabet’s venture arm, GV, it’s important to keep in mind that there’s no one right way to raise a fund — and no disadvantage in using these strategies. Said Toney via email this week: “I have not seen any data on the front end of a VC’s career that wealth indicates future success.”

Powered by WPeMatico

Daimler’s trucks division has invested in lidar developer Luminar as part of a broader partnership to produce autonomous trucks capable of navigating highways without a human driver behind the wheel.

The deal, which comes just days after Daimler and Waymo announced plans to work together to build an autonomous version of the Freightliner Cascadia truck, is the latest action by the German manufacturer to move away from robotaxis and shared mobility and instead focus on how automated vehicle technology can be applied to freight.

The undisclosed investment by Daimler is in addition to the $170 million that Luminar raised as part of its merger with special purpose acquisition company Gores Metropoulos Inc. Luminar will become a publicly traded company through its merger with Gores, which is expected to close in late 2020.

Daimler is taking two tracks on its mission to commercialize autonomous trucks. The company has been working internally to develop a truck capable of Level 4 automation — an industry term that means the system can handle all aspects of driving without human intervention in certain conditions and environments such as highways. That work has accelerated since spring 2019 when Daimler took a majority stake in Torc Robotics, an autonomous trucking startup that had been working with Luminar the past two years. Lidar, the light detection and ranging radar that measures distance using laser light to generate a highly accurate 3D map of the world around the car, is considered a critical piece of hardware to deploy automated vehicle technology safely and at scale.

The plan is to integrate Torc’s self-driving system, along with Luminar’s sensors, into a Freightliner Cascadia truck as well as build out an operations and network center to run automated trucks. Daimler Trucks’ and Torc’s integrated self-driving product will be designed for on-highway hub-to-hub applications, especially for long-distance, monotonous transport between distribution centers, according to Daimler.

Meanwhile, Daimler Trucks is developing a customized Freightliner Cascadia truck chassis with redundant systems to allow Waymo to integrate its self-driving system. In this case, the software development stays in house at Waymo; Daimler is just concentrating on the chassis development.

This dual approach puts Daimler’s ambitions at center stage, which is to have series-production L4 trucks on highways globally. The deal also provides a clearer view of Luminar’s strategy of focusing on what its founder Austin Russell believes are the most likely and shortest paths to commercialized automated vehicles, and in turn, a profitable company.

“Our focus has really been always centered around highway autonomy use cases, which are specifically applicable to passenger vehicles as well as trucks,” Russell said in a recent interview, adding that the aim is to have a product that you can put into series production in a cost-effective capacity.

Luminar has already publicly announced one deal with an automaker to pursue the passenger vehicle use case. Volvo said in May it will start producing vehicles in 2022 that are equipped with lidar and a perception stack developed by Luminar that the automaker will use to deploy an automated driving system for highways. This deal with Daimler locks in the second use case.

“I absolutely do believe that autonomous trucking is an incredibly valuable business model that’s going to be larger than robotaxis and probably closer to being on par with consumer vehicles for the foreseeable future,” Russell said.

Powered by WPeMatico