Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

Priori Legal, a startup rethinking the way that large corporations hire outside counsel, has raised $6.3 million in Series A funding.

Founded by CEO Basha Rubin and CPO Mirra Levitt (who met while classmates at Yale Law School), Priori launched as a legal marketplace for small and medium businesses before finding its current model in 2016.

Rubin explained that although Fortune 500 companies have their own in-house legal teams, they still spend an average of $150 million a year on outside legal counsel. And finding that counsel can be an arduous process — a consumer goods company, for example, might need to hire lawyers in all 50 states.

So by creating a marketplace of vetted lawyers (it says it only accepts 10% of applicants), by running a bidding process for the work and by streamlining the billing and on-boarding process, the startup can save companies an average of 60% of the money they spend on outside counsel and reduce the search time by 80%.

“We don’t get involved in the substance of the lawyer-client relationship,” Levitt added. “We are not a law firm, we don’t do any of the legal work. Our innovation is focused entirely on the process of rapidly identifying the right talent and, once the matter is up and running, making billing seamless.”

There are currently more than 1,500 lawyers in the marketplace, representing all 50 states in the U.S., as well as 47 countries and 700 practice proficiencies. Levitt said that while the first lawyers to join the platform were usually independent or worked at small firms that might not previously had access to these kinds of clients, there are now larger firms signing up as well.

Priori founders Mirra Levitt and Basha Rubin

And Rubin said interest in Priori has only grown during the pandemic and the resulting economic downturn. Companies are trying to do “more with less,” and “part of our value proposition is fundamentally cost savings.” For example, she noted that client spending on the platform has increased 200% in the last year.

“We began to see so much inbound demand that we would log onto Slack at 11pm and the entire team would be working,” she said. “We have a truly extraordinary team, but a) that’s not sustainable from a human perspective, and b) we saw an opportunity to really grow dramatically if we could throw resources at it.”

The Series A comes from Hearst Corporation (also a Priori customer), Great Oaks Venture Capital, Jambhala, Tim Steinert (former general counsel of Alibaba Group), Mindset Ventures, Bridge Venture Fund and Orrick’s Legal Technology Fund.

In addition to growing the team, Rubin said that the new funding will allow Priori to expand its network of lawyers, especially internationally.

“From a product perspective, we’re really building out our use of data throughout the platform,” Levitt said, adding that the company plans to use machine learning to improve attorney vetting, matchmaking, bidding, project scoping and more.

Powered by WPeMatico

The pandemic has resulted in a growth spurt for gaming, an industry that was already growing on the backs of esports and Twitch streaming. So it makes sense that startups big and small are flocking to the industry to find their own place in the ecosystem.

One such company is Shotcall, founded by Thomas Gentle, Gordon Li and Riley Auten, which aims to increase engagement for streamers by giving their fans what they really want: a chance to play alongside their favorite content creator.

The company today announced the close of a $2.2 million seed round led by Initial Capital, New Stack and Lerer Hippeau .

As it stands now, viewers who tune in to a Twitch stream only have so many ways of interacting with their favorite streamer, whether it’s gifting subscriptions to the channel or cheering with bits, Twitch’s virtual currency. Streamers with a smaller audience are often pretty engaged with their chat, but as they grow their audiences, it’s harder for viewers to stand out in the crowd.

And even if you do manage to stand out and get a shout-out, that’s all it is. The streamer says thanks and reads your message and that’s that. Some streamers host games with their subscribers, but organizing them can be tedious at best, and monetizing them is nearly impossible.

With Shotcall, streamers can engage with their fans in a way that not only gives that fan a chance to really connect with them, but that also creates more high-quality, shareable content.

The platform allows streamers to set up a tournament, coaching session, Q&A, charity event or whatever type of event they’d like, and fans can pay to get in on the action. Shotcall organizes these community events, giving the streamer control over the length of each gaming session, how much they’d like to charge to participate and the rules of engagement (whether fans can use mics, curse on stream, etc.).

“Fans are at the center of the entire global value chain in the gaming world,” said Gentle. “They dictate what games are bought and which content creators rise and fall out of favor. They pay the bills for everything. And yet their interactions are weak. And if you take a look at the data, they have a high desire and a high willingness to pay more if you were to give them what they truly want. And that is engagement.”

The revenue split between hosts and Shotcall depends on the type of event, whether that streamer is a partner, etc., but the most Shotcall will ever take is 25%.

The company is in the process of integrating directly with Twitch and Discord (with bots) to make the process even more seamless.

Thus far, Shotcall has amassed around 350 active hosts and more than 4,500 fans have been active on the platform in the past two months.

Powered by WPeMatico

VPNs, or virtual private networks, are a mainstay of corporate network security (and also consumers trying to stream Netflix while pretending to be from other countries). VPNs create an encrypted channel between your device (a laptop or a smartphone) and a company’s servers. All of your internet traffic gets routed through the company’s IT infrastructure, and it’s almost as if you are physically located inside your company’s offices.

Despite its ubiquity though, there are significant flaws with a VPN’s architecture. Corporate networks and VPNs were designed assuming that most workers would be physically located in an office most of the time, and the exceptional device would use a VPN. As the pandemic has made abundantly clear, fewer and fewer people work in a physical office with a desktop computer attached to ethernet. That means the vast majority of devices are now outside the corporate perimeter.

Worse, VPNs can have massive performance problems. By routing all traffic through one destination, VPNs not only add latency to your internet experience, they also transmit all of your non-work traffic through your corporate servers as well. From a security perspective, VPNs also assume that once a device joins, it’s reasonably safe and secure. VPNs don’t actively check network requests to make sure that every device is only accessing the resources that it should.

Twingate is fighting directly to defeat VPNs in the workplace with an entirely new architecture that assumes zero trust, works as a mesh and can segregate work and non-work internet traffic to protect both companies and employees. In short, it may dramatically improve the way hundreds of millions of people work globally.

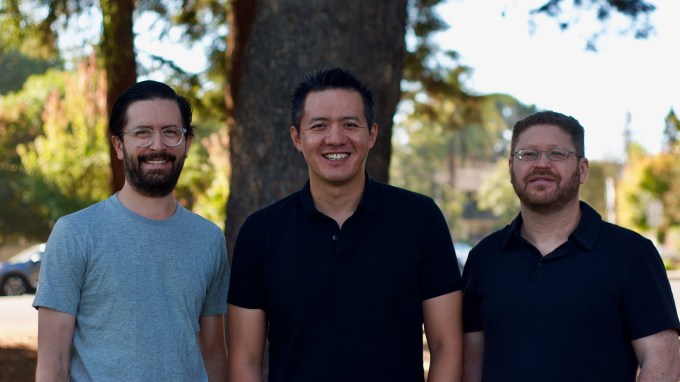

It’s a bold vision from an ambitious trio of founders. CEO Tony Huie spent five years at Dropbox, heading up international and new market expansion in his final role at the file-sharing juggernaut. He’s most recently been a partner at venture capital firm SignalFire . Chief Product Office Alex Marshall was a product manager at Dropbox before leading product at lab management program Quartzy. Finally, CTO Lior Rozner was most recently at Rakuten, and before that Microsoft.

Twingate founders Alex Marshall, Tony Huie and Lior Rozner. Photo via Twingate.

The startup was founded in 2019, and is announcing today the public launch of its product, as well as its Series A funding of $17 million from WndrCo, 8VC, SignalFire and Green Bay Ventures. Dropbox’s two founders, Drew Houston and Arash Ferdowsi, also invested.

The idea for Twingate came from Huie’s experience at Dropbox, where he watched its adoption in the enterprise and saw firsthand how collaboration was changing with the rise of the cloud. “While I was there, I was still just fascinated by this notion of the changing nature of work and how organizations are going to get effectively re-architected for this new reality,” Huie said. He iterated on a variety of projects at SignalFire, eventually settling on improving corporate networks.

So what does Twingate ultimately do? For corporate IT professionals, it allows them to connect an employee’s device into the corporate network much more flexibly than a VPN. For instance, individual services or applications on a device could be set up to securely connect with different servers or data centers. So your Slack application can connect directly to Slack, your JIRA site can connect directly to JIRA’s servers, all without the typical round-trip to a central hub that a VPN requires.

That flexibility offers two main benefits. First, internet performance should be faster, since traffic is going directly where it needs to rather than bouncing through several relays between an end-user device and the server. Twingate also says that it offers “congestion” technology that can adapt its routing to changing internet conditions to actively increase performance.

More importantly, Twingate allows corporate IT staff to carefully calibrate security policies at the network layer to ensure that individual network requests make sense in context. For instance, if you are a salesperson in the field and suddenly start trying to access your company’s code server, Twingate can identify that request as highly unusual and outright block it.

“It takes this notion of edge computing and distributed computing [and] we’ve basically taken those concepts and we’ve built that into the software we run on our users’ devices,” Huie explained.

All of that customization and flexibility should be a huge win for IT staff, who get more granular controls to increase performance and safety, while also making the experience better for employees, particularly in a remote world where people in, say, Montana might be very far from an East Coast VPN server.

Twingate is designed to be easy to onboard new customers according to Huie, although that is almost certainly dependent on the diversity of end users within the corporate network and the number of services to which each user has access. Twingate integrates with popular single sign-on providers.

“Our fundamental thesis is that you have to balance usability, both for end users and admins, with bulletproof technology and security,” Huie said. With $17 million in the bank and a newly debuted product, the future is bright (and not for VPNs).

Powered by WPeMatico

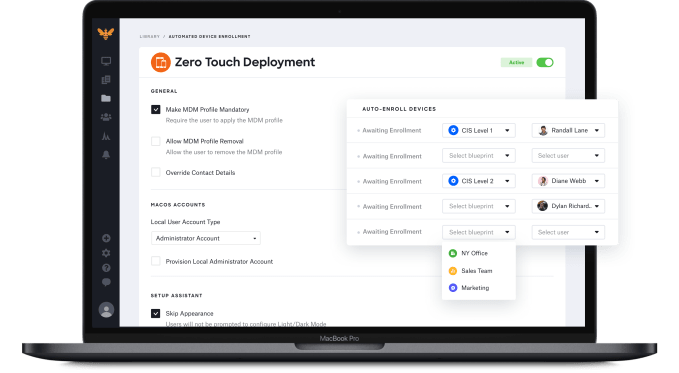

Kandji, a mobile device management (MDM) startup, launched last October. That means it was trying to build the early-stage company just as the pandemic hit earlier this year. But a company that helps manage devices remotely has been in demand in this environment, and today it announced a $21 million Series A.

Greycroft led the round, with participation from new investors Okta Ventures and B Capital Group, and existing investor First Round Capital. Today’s investment brings the total raised to $28.4 million, according to the company.

What Kandji is building is a sophisticated zero-touch device management solution to help larger companies manage their fleet of Apple devices, including keeping them in compliance with a particular set of rules. As CEO and co-founder Adam Pettit told TechCrunch at the time of his seed investment last year:

We’re the only product that has almost 200 of these one-click policy frameworks we call parameters. So an organization can go in and browse by compliance framework, or we have pre-built templates for companies that don’t necessarily have a specific compliance mandate in mind.

Monty Gray, SVP of corporate development at Okta, says Okta Ventures is investing because it sees this approach as a valuable extension of the company’s mission.

“Kandji’s device management streamlines the most common and complex tasks for Apple IT administrators and enables distributed workforces to get up and running quickly and securely,” he said in a statement.

It seems to be working. Since the company’s launch last year it reports it has gained hundreds of new paying customers and grown from 10 employees at launch to 40 today. Pettit says that he has plans to triple that number in the next 12 months. As he builds the company, he says finding and hiring a diverse pool of candidates is an important goal.

“There are ways to extend out into different candidate pools so that you’re not just looking at the same old candidates that you normally would. There are certain ways to reduce bias in the hiring process. So again, I think we look at this as absolutely critical, and we’re excited to build a really diverse company over the next several years,” he said.

Image Credits: Kandji

He notes that the investment will not only enable him to build the employee base, but also expand the product too, and in the past year, it has already taken it from basic MDM into compliance, and there are new features coming as they continue to grow the product.

“If someone saw our product a year ago, it’s a very different product today, and it’s allowed us to move up market into the enterprise, which has been very exciting for us,” he said.

Powered by WPeMatico

Amid a pandemic that has closed down fitness centers worldwide, a spate of companies has muscled their way into the booming at-home fitness market.

In just the last two weeks, three-year Future, which promises at-home customers access to elite training, closed on $24 million in Series B funding; and Playbook, a nearly five-year-old fitness platform that helps personal trainers stream their content (and charge a monthly fee for it), raised $9.3 million in Series A funding.

Now, serial entrepreneur Jason Goldberg — who has founded a number of venture-backed startups — is taking the wraps off another live-streaming platform and marketplace. Called Moxie, it connects fitness instructors of all stripes with existing and new students, then enables them to stream classes on a subscription basis — and to keep 85 percent of the revenue for themselves.

Of course, according to Goldberg, it’s all far more sophisticated than that. Indeed, Moxie’s 45 employees were working on a very different company until COVID-19 took hold in Europe and the U.S., following its initial outbreak in China. (Moxie is based in Berlin.) After some soul-searching, the team pivoted completely to fitness, and they’ve been testing and tweaking Moxie ever since.

It’s a compelling proposition, even while other startup founders are also chasing after it. While a year ago, fitness instructors spent 90 percent of their time in studio settings, they now spend 90 percent of their time teaching online, which means they need really solid tools to do their jobs well.

While earlier in the pandemic, many of them turned to Zoom, emailing students links and taking payments via Venmo, it was a janky experience for everyone involved.

With Moxie, an instructor, says Goldberg, can live stream classes, as well as record them; access playlists that Moxie has already licensed through third parties (and that Moxie can smartly dampen sound while an instructor is talking to students); and access internal customer relationship management tools that make it easy to track and communicate with students, along with automatically collect payment from them.

The benefits are resonating, according to Goldberg. He says that largely by finding and pitching instructors on Instagram, Moxie has already attracted more than 2,000 instructors of yoga, pilates, and barre-centered classes among others, and that they are now teaching more than 6,500 classes for a range of prices that the instructors can set themselves.

Classes on average range in price from $5 to $10. Goldberg says that over the last four weeks, customers have been spending an average of $60 on the platform per month. (Moxie uses Stripe for payments and AWS to store and stream video.)

Investors like Howard Morgan, Geoff Prentice, Allen Morgan who’ve backed Goldberg time and again like the idea, clearly. Along with Tencent, they’ve provided Moxie with $2.1 million in seed funding, and Goldberg suggests he’ll be ready for more capital soon.

Whether new investors will need to be convinced that Moxie is “the one,” given Goldberg’s history, remains to be seen.

As longtime readers might know, Goldberg launched his career as a startup founder with Jobster, a recruiting platform that raised about $50 million before laying off half its staff and selling for undisclosed terms to a site called Recruiting.com.

Goldberg then founded a news aggregation service Social Median, which was was later acquired by a German LinkedIn competitor called XING for undisclosed terms; Fabulis, a social network for the LGBT community that pivoted to become a daily-deals site (and later shut down after spending $1 million in seed funding); and most famously Fab .com, a design-focused e-commerce site that was valued at $900 million by its investors at one point, but later went out of business.

In late 2016, Goldberg launched a messaging app called Pepo that enabled anyone to create and join live messaging communities and that raised around $3 million from investors, including Tencent. Indeed, it was a newer iteration of Pepo that Goldberg and his team decided to abandon in March for Moxie.

Certainly, his various endeavors underscore that Goldberg has no shortage of — dare we say it — moxie. To many investors, that’s the most crucial ingredient in growing a nascent company.

In any case, he doesn’t seem worried about fitness platform’s prospects. “We have no shortage of people who want to invest in Moxie,” he told us during a call yesterday.

Powered by WPeMatico

Rockset, a cloud-native analytics company, announced a $40 million Series B investment today led by Sequoia with help from Greylock, the same two firms that financed its Series A. The startup has now raised a total of $61.5 million, according to the company.

As co-founder and CEO Venkat Venkataramani told me at the time of the Series A in 2018, there is a lot of manual work involved in getting data ready to use and it acts as a roadblock to getting to real insight. He hoped to change that with Rockset.

“We’re building out our service with innovative architecture and unique capabilities that allows full-featured fast SQL directly on raw data. And we’re offering this as a service. So developers and data scientists can go from useful data in any shape, any form to useful applications in a matter of minutes. And it would take months today,” he told me in 2018.

In fact, “Rockset automatically builds a converged index on any data — including structured, semi-structured, geographical and time series data — for high-performance search and analytics at scale,” the company explained.

It seems to be resonating with investors and customers alike as the company raised a healthy B round and business is booming. Rockset supplied a few metrics to illustrate this. For starters, revenue grew 290% in the last quarter. While they didn’t provide any foundational numbers for that percentage growth, it is obviously substantial.

In addition, the startup reports adding hundreds of new users, again not nailing down any specific numbers, and queries on the platform are up 313%. Without specifics, it’s hard to know what that means, but that seems like healthy growth for an early stage startup, especially in this economy.

Mike Vernal, a partner at Sequoia, sees a company helping to get data to work faster than other solutions, which require a lot of handling first. “Rockset, with its innovative new approach to indexing data, has quickly emerged as a true leader for real-time analytics in the cloud. I’m thrilled to partner with the company through its next phase of growth,” Vernal said in a statement.

The company was founded in 2016 by the creators of RocksDB. The startup had previously raised a $3 million seed round when they launched the company and the $18.5 million A round in 2018.

Powered by WPeMatico

Lightyear, a New York City startup that wants to make it easier for large companies to procure networking infrastructure like internet and SD-WAN, announced a $3.7 million seed round today.

Amplo led the round with help from Susa Ventures, Ludlow Ventures, Mark Cuban, David Adelman and Operator Partners. While it was at it, the company announced that it was emerging from stealth and offering its solution in public beta.

Company CEO and co-founder Dennis Thankachan says that while so much technology buying has moved online, networking technology procurement still involves phone calls for price quotes that could sometimes take weeks to get. Thankachan says that when he was working at a hedge fund specializing in telecommunications he witnessed this first hand and saw an opportunity for a startup to fill the void.

“Our objective is to make the process of buying telecom infrastructure, kind of like buying socks on Amazon, providing a real consumer-like experience to the enterprise and empowering buyers with data because information asymmetry and a lack of transparent data on what things should cost, where providers are available, and even what’s existing already in your network is really at the core of the problem for why this is frustrating for enterprise buyers,” Thankachan explained.

The company offers the ability to simply select a service and find providers in your area with costs and contract terms if it’s a simple purchase, but he recognizes that not all enterprise purchases will be that simple and the startup is working to digitize the corporate buying process into the Lightyear platform.

To provide the data that he spoke of, the company has already formed relationships with over 400 networking providers worldwide. The pricing model is in flux, but could involve a monthly subscription or a percentage of the sale. That is something they are working out, but they are using the latter during beta testing to keep the product free for now.

The company already has 10 employees and flush with the new investment, it plans to double that in the next year. Thankachan says as he builds the company, particularly as a person of color himself, he takes diversity and inclusion extremely seriously and sees it as part of the company’s core values.

“Trying to enable people from non-traditional backgrounds to succeed will be really important to us, and I think providing economic opportunity to people that traditionally would not have been afforded several aspects of economic opportunity is the biggest ways to fix the opportunity gap in this country,” he said.

The company, which launched a year ago has basically grown up during the pandemic. That means he has yet to meet any of his customers or investors in person, but he says he has learned to adapt to that approach. While he is based in NYC, his investors are are in the Bay Area and so that remote approach will remain in place for the time being.

As he makes his way from seed to a Series A, he says that it’s up to him to stay focused and execute with the goal of showing product-market fit across a variety of company types. He believes if the startup can do this, it will have the data to take to investors when it’s time to take the next step.

Powered by WPeMatico

Israeli startup SimilarWeb has made a name for itself with an AI-based platform that lets sites and apps track and understand traffic not just on their own sites, but those of its competitors. Now, it’s taking the next step in its growth. The startup has raised $120 million, funding it will use to continue expanding its platform both through acquisitions and investing in its own R&D, with a focus on providing more analytics services to larger enterprises alongside its current base of individuals and companies of all sizes that do business on the web.

But not, it seems, necessarily an IPO at the moment.

Co-led by ION Crossover Partners and Viola Growth, the round doubles the total amount that the startup has raised to date to $240 million. Offer said that it was not disclosing its valuation this time around except to say that his company is now “playing in the big pool.” It counts more than half of the Fortune 100 as customers, with Walmart, P&G, Adidas and Google, among them.

For some context, it hit an $800 million valuation in its last equity round, in 2017.

SimilarWeb’s technology competes with other analytics and market intelligence providers ranging from the likes of Nielsen and ComScore through to the Apptopias of the world in that, at its most basic level, it provides a dashboard to users that provides insights into where people are going on desktop and mobile. Where it differs, Offer said, is in how it gets to its information, and what else it’s doing in the process.

For starters, it focuses not just how many people are visiting, but also a look into what is triggering the activity — the “why”, as it were — behind the activity. Using a host of AI tech such as machine learning algorithms and deep learning — like a lot of tech out of Israel, it’s being built by people with deep expertise in this area — Offer says that SimilarWeb is crunching data from a number of different sources to extrapolate its insights.

He declined to give much detail on those sources but told me that he cheered the arrival of privacy gates and cookie lists for helping ferret out, expose and sometimes eradicate some of the more nefarious “analytics” services out there, and said that SimilarWeb has not been affected at all by that swing to more data protection, since it’s not an analytics service, strictly speaking, and doesn’t sniff data on sights in the same way. It’s also exploring widening its data pool, he added:

“We are always thinking about what new signals we could use,” he said. “Maybe they will include CDNs. But it’s like Google with its rankings in search. It’s a never ending story to try to get the highest accuracy in the world.”

The global health pandemic has driven a huge amount of activity on the web this year, with people turning to sites and apps not just for leisure — something to do while staying indoors, to offset all the usual activities that have been cancelled — but for business, whether it be consumers using e-commerce services for shopping, or workers taking everything online and to the cloud to continue operating.

That has also seen a boost of business for all the various companies that help the wheels turn on that machine, SimilarWeb included.

“Consumer behavior is changing dramatically, and all companies need better visibility,” said Offer. “It started with toilet paper and hand sanitizer, then moved to desks and office chairs, but now it’s not just e-commerce but everything. Think about big banks, whose business was 70% offline and is now 70-80% online. Companies are building and undergoing a digital transformation.”

That in turn is driving more people to understand how well their web presence is working, he said, with the basic big question being: “What is my marketshare, and how does that compare to my competition? Everything is about digital visibility, especially in times of change.”

Like many other companies, SimilarWeb did see an initial dip in business, Offer said, and to that end the company has taken on some debt as part of Israel’s Paycheck Protection Program, to help safeguard some jobs that needed to be furloughed. But he added that most of its customers prior to the pandemic kicking off are now back, along with customers from new categories that hadn’t been active much before, like automotive portals.

That change in customer composition is also opening some doors of opportunity for the company. Offer noted that in recent months, a lot of large enterprises — which might have previously used SimilarWeb’s technology indirectly, via a consultancy, for example — have been coming to the company direct.

“We’ve started a new advisory service [where] our own expert works with a big customer that might have more deep and complex questions about the behaviour we are observing. They are questions all big businesses have right now.” The service sounds like a partly-educational effort, teaching companies that are not necessarily digital-first be more proactive, and partly consulting.

New customer segments, and new priorities in the world of business, are two of the things that drove this round, say investors.

“SimilarWeb was always an incredible tool for any digital professional,” said Gili Iohan of ION Crossover Partners, in a statement. “But over the last few months it has become apparent that traffic intelligence — the unparalleled data and digital insight that SimilarWeb offers — is an absolute essential for any company that wants to win in the digital world.”

As for acquisitions, SimilarWeb has historically made these to accelerate its technical march. For example, in 2015 it acquired Quettra to move deeper into mobile analytics and it acquired Swayy to move into content discovery insights (key for e-commerce intelligence). Offer would not go into too much detail about what it has identified as a further target but given that there are quite a lot of companies building tech in this area currently, that there might be a case for some consolidation around bigger platforms to combine some of the features and functionality. Offer said that it was looking at “companies with great data and digital intelligence, with a good product. There are a lot of opportunities right now on the table.”

The company will also be doing some hiring, with the plan to be to add 200 more people globally by January (it has around 600 employees today).

“Since we joined the company three years ago, SimilarWeb has executed a strategic transformation from a general-purpose measurement platform to vertical-based solutions, which has significantly expanded its market opportunity and generated immense customer value,” said Harel Beit-On, Founder and General Partner at Viola Growth, in a statement. “With a stellar management team of accomplished executives, we believe this round positions the company to own the digital intelligence category, and capitalize on the acceleration of the digital era.”

Powered by WPeMatico

Further confirmation that the esports market is booming amid the pandemic comes today with the news that esports “total solutions provider” VSPN (Versus Programming Network) has raised what it describes as “close to” $100 million in a Series B funding round, led by Tencent Holdings . Other investors that participated in the round include Tiantu Capital, SIG (Susquehanna International Group), and Kuaishou. The funding round will go toward improving esports products and its ecosystem in China and across Asia.

Founded in 2016 and headquartered in Shanghai, VSPN was one of the early pioneers in esports tournament organization and content creation out of Asia. It has since expanded into other businesses, including offline venue operation.

In a statement, Dino Ying, CEO of VSPN (see also our exclusive interview) said: “We are delighted to announce this latest round of funding. Thanks to policies supporting Shanghai as the global center for esports, and with Beijing, Chengdu, and Xi’an expressing confidence in the development of esports, VSPN has grown rapidly in recent years. After this funding round, we look forward to building an esports research institute, an esports culture park, and further expanding globally. VSPN has a long-term vision and is dedicated to the sustainable development of the global esports ecosystem.”

Dino Ying, VSPN CEO. Image via VSPN

Mars Hou, general manager of Tencent Esports, commented: “VSPN’s long-term company vision and leading position in esports production are vital for Tencent to optimize the layout of the esports industry’s development.”

We had a hint that Tencent might invest in VSPN when, in March this year, Mark Ren, COO of Tencent Holdings, made a public statement that Tencent would provide more high-quality esports competitions in conjunction with tournament organizers like VSPN.

As we observed in August, Tencent, already the world’s biggest games publisher, said that it would consolidate Douyu and Huya, the previously competing live-streaming sites focused on video games.

In other words, Tencent’s investment into VSPN shows it is once again doubling-down on the esports market.

This Series B funding round comes four years after VSPN’s 2016 Series A funding round, which was led by Focus Media Network, joined by China Jianteng Sports Industry Fund, Guangdian Capital and Averest Capital.

Now, VSPN has become the principal tournament organizer and broadcaster for PUBG MOBILE international competitions, and China’s top competitions for Honor of Kings, PUBG, Peacekeeper Elite, CrossFire, FIFA, QQ Speed and Clash Royale. This will tally-up 12,000 hours of original content. The company has partnered with more than 70% of China’s esports tournaments.

In March, another huge esports player, ESL, joined forces with Tencent to become a part of the PUBG Mobile esports circuit for 2020.

In addition to its core esports tournament and content production business, VSPN has branded esports venues in Chengdu, Xi’an and Shanghai. In May, VSPN launched its first overseas venue, V. SPACE in Seoul, South Korea.

And even offline events are coming back. VSPN hosted the first large-scale esport event with offline audiences in August this year. And the LOL S10 event will open 6,000 tickets. However, all tournaments will operate under strict COVID-19 prevention measures and approval processes by the Chinese government, and not all esports events are allowing offline audiences.

VSPN said it will continue to focus on building an esports short-form video ecosystem, improving the quality of esports content creation, and reaching more users via different channels. VSPN currently houses more than 1,000 employees in five business divisions.

Powered by WPeMatico

Courtney Caldwell and her husband Tye have been building the Dallas-based startup ShearShare, which provides a marketplace service connecting stylists with open seats at hair salons, since 2017.

Since their launch the two co-founders have been committed to the humble hustle of starting their own business — including flying between San Francisco and Dallas weekly to participate in the 19th 500 Startups cohort or participating in Y Combinator’s Fellowship program.

Now, with a seed round of $2.3 million and another non-dilutive cash grant from Google for Startups Black Founders Fund, the early-stage company is ready to expand.

The two co-founders certainly have a pedigree in the beauty industry. Tye Caldwell has been a luminary in the industry and is a member-elect of the Professional Beauty Association’s advisory board. Together with Courtney he runs an award-winning salon in Dallas.

ShearShare co-founders Tye and Courtney Caldwell

Meanwhile, Courtney Caldwell spent more than 20 years working for Oracle in technology marketing. But the two hadn’t really been exposed to the venture capital industry. So when they came up with the idea to start a service providing online matchmaking between salons and stylists — based on their own need to fill a chair at their salon — they didn’t really no where to turn.

Enter TD Lowe. A longtime investor on her own and with organizations like StartupGrind, Lowe introduced the couple to the world of venture capital and startups, and the two were off to the races.

“We pioneered on-demand barbershop and space rentals,” Courtney said. “If a salon or barbershop has an open station a stylist can book it like they would a hotel room.”

According to the Caldwells, the beauty industry is the second largest industry for freelancers and independent contractors. Unlike other companies that are trying to serve stylists by offering them features like booking and appointments independent of salons — or services for salons alone — ShearShare is trying to serve both sides of the marketplace with the tools they need.

“We’re not a StyleSeat. We’re not a Squire,” said Courtney. What they are is expanding rapidly. The company has listings in more than 600 cities ranging from a chair that rents for $15 in Georgia to one that rents for $569 in the heart of Manhattan in New York City.

The company processes payments for the stylists directly through a partnership with a local payment solution called First American Payments based in Ft. Worth, Texas.

“Everyone is setting their sights on direct-to-consumer,” said Courtney. “This is a way we’re helping to keep people at work and refuel the individual economic recovery.”

The next step for the company is to begin launching more ancillary services for stylists. They’re pioneering an insurance policy for stylists that would cover them from on-the-job lawsuits.

“It’s becoming a huge opportunity for the stylist that just didn’t exist,” said Tye. And it all began when the two Caldwells couldn’t find any options when they searched for any terms related to renting space at a barbershop, they said. “We reached out to a friend and told her about the opportunity that we’d been presented with and she said, ‘Guys… that’s a billion-dollar idea.’ ”

That friend was Lowe — who came in to advise the couple and show them the ropes of startup investing.

It’s at least an idea that’s worth tens of millions. That’s how much the startup Mayvenn has raised for its business providing hair extensions and other cosmetics to stylists.

Now with its new funding, ShearShare is ready to expand, the couple said.

ShearShare’s backers include: Precursor Ventures, Revolution’s Rise of the Rest Seed Fund, Structure Capital, Backstage Capital and 500 Startups, alongside new participants Bread and Butter Ventures, ArlanWasHere Investments (Arlan Hamilton’s fund, in which Mark Cuban is the sole LP), Lightspeed Venture Partners Scouts Program (with Veronica Juarez and Jason McBride leading), Jaylon Smith of the Dallas Cowboys through the Minority Entrepreneurship Institute, Thaddeus Young of the Chicago Bulls with Reform Venture, the Bumble Fund, Notley Ventures, Sachse Family Fund and other global investors.

These investors are part of a new breed of investor that’s pushing venture investment into areas that were previously considered beyond the reach of typical firms.

As the chief executive of a beauty and lifestyle startup, Julie Fredrickson told TechCrunch three years ago, “Most of these brands are commensurately underfunded compared to tech companies in similar positions. There’s a chance for a totally new dominant player and no one’s really gunning for it.”

There’s a huge opportunity for businesses serving all aspects of the beauty industry to flourish, entrepreneurs and investors.

“Venture is obsoleting itself as private equity and family offices increasingly go downstream because they’re willing to seek venture-style returns in verticals that venture capital is not prepared or is less educated about,” according to Frederickson.

Powered by WPeMatico