Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

Acapela, a new startup co-founded by Dubsmash founder Roland Grenke, is breaking cover today in a bid to re-imagine online meetings for remote teams.

Hoping to put an end to video meeting fatigue, the product is described as an “asynchronous meeting platform,” which Grenke and Acapela’s other co-founder, ex-Googler Heiki Riesenkampf (who has a deep learning computer science background), believe could be the key to unlock better and more efficient collaboration. In some ways the product can be thought of as the antithesis to Zoom and Slack’s real-time and attention-hogging downsides.

To launch, the Berlin -based and “remote friendly” company has raised €2.5 million in funding. The round is led by Visionaries Club with participation from various angel investors, including Christian Reber (founder of Pitch and Wunderlist) and Taavet Hinrikus (founder of TransferWise). I also understand Entrepreneur First is a backer and has assigned EF venture partner Benedict Evans to work on the problem. If you’ve seen the ex-Andreessen Horowitz analyst writing about a post-Zoom world lately, now you know why.

Specifically, Acapela says it will use the injection of cash to expand the core team, focusing on product, design and engineering as it continues to build out its offering.

“Our mission is to make remote teams work together more effectively by having fewer but better meetings,” Grenke tells me. “With Acapela, we aim to define a new category of team collaboration that provides more structure and personality than written messages (Slack or email) and more flexibility than video conferencing (Zoom or Google Meet)”.

Grenke believes some form of asynchronous meetings is the answer, where participants don’t have to interact in real-time but the meeting still has an agenda, goals, a deadline and — if successfully run — actionable outcomes.

“Instead of sitting through hours of video calls on a daily basis, users can connect their calendars and select meetings they would like to discuss asynchronously,” he says. “So, as an alternative to everyone being in the same call at the same time, team members contribute to conversations more flexibly over time. Like communication apps in the consumer space, Acapela allows rich media formats to be used to express your opinion with voice or video messages while integrating deeply with existing productivity tools (like GSuite, Atlassian, Asana, Trello, Notion, etc.)”.

In addition, Acapela will utilise what Grenke says is the latest machine learning techniques to help automate repetitive meeting tasks as well as to summarise the contents of a meeting and any decisions taken. If made to work, that in itself could be significant.

“Initially, we are targeting high-growth tech companies which have a high willingness to try out new tools while having an increasing need for better processes as their teams grow,” adds the Acapela founder. “In addition to that, they tend to have a technical global workforce across multiple time zones which makes synchronous communication much more costly. In the long run we see a great potential tapping into the space of SMEs and larger enterprises, since COVID has been a significant driver of the decentralization of work also in the more traditional industrial sectors. Those companies make up more than 90% of our European market and many of them have not switched to new communication tools yet”.

Powered by WPeMatico

“I have to choose my words carefully,” says Joe Castelino of Stevens Creek Volkswagen in San Jose, California, when asked about the management software on which most car dealerships rely for inventory information, marketing, customer relationships and more.

Castelino, the dealership’s service director, laughs as he says this. But the joke has apparently been on car dealers, most of whom have largely relied on a few frustratingly antiquated vendors for their dealer management systems over the years — along with many more sophisticated point solutions.

It’s the precise opportunity that former Tesla CIO, Jay Vijayan, concluded he was well-positioned to address while still in the employ of the electric vehicle giant.

As Vijayan tells it, he knew nothing about cars until joining Tesla in 2011, following a dozen years of working in product development at Oracle, then VMware. Yet he learned plenty over the subsequent four years. Specifically, he says he helped to build with Elon Musk a central analysis system inside Tesla, a kind of brain that could see all of the company’s internal systems, from what was happening in the supply chain to its factory systems to its retail platform.

Tesla had to build it itself, says Vijayan; after evaluating the existing software of third-company providers, the team “realized that none of them had anything close to what we needed to provide a frictionless modern consumer experience.”

It was around then that a lightbulb turned on. If Tesla could transform the experience for its own customers, maybe Vijayan could transform the buying and selling experience for the much bigger, broader automotive industry. Enter Tekion, a now four-year-old, San Carlos, California company that now employs 470 people and has come far enough along that just attracted $150 million in fresh funding led by the private equity investor Advent International.

With the Series C round — which also included checks from Index Ventures, Airbus Ventures, FM Capital and Exor, the holding company of Fiat-Chrysler and Ferrari — the company has now raised $185 million altogether. It’s also valued at north of $1 billion. (The automakers General Motors, BMW and the Nissan-Renault-Mitsubishi Alliance are also investors.)

Eric Wei, a managing director at Advent, says that over the last decade, his team had been eager to seize on what’s approaching a $10 billion market annually. Instead, they found themselves tracking incumbents Reynolds & Reynolds, CDKGlobal and Dealertrack, which is owned by Cox Automotive, and waiting for a better player to emerge.

Then Wei was connected to Tekion through Jon McNeill, a former Tesla president and an advisory partner to Advent.

Says Wei of seeing its tech compared with its more established rivals: “It was like comparing a flip phone to an iPhone.”

Perhaps unsurprisingly, McNeill, who worked at Tesla with Vijayan, also sings the company’s praises, noting that Tekion even bought a dealership in Gilroy, Calif., to use as a kind of lab while it was building its technology from scratch.

Such praise is nice, but more importantly, Tekion is attracting the attention of dealers. Though citing competitive reasons, Vijayan declined to share how many have bought its cloud software — which connects dealers with both manufacturers and car buyers and is powered by machine learning algorithms — he says it’s already being used across 28 states.

One of these dealerships is the national chain Serra Automotive, whose founder, Joseph Serra, is now an investor in Tekion.

Another is that Volkswagen dealership in San Jose, where Castelino — who doesn’t have a financial interest in Tekion — speaks enthusiastically about the time and expenses his team is saving because of Tekion’s platform.

For example, he says customers need only log-in now to flag a particular issue. After that, with the help of an RFID tag, Stevens Creek knows exactly when that customer pulls into the dealership and what kind of help they need, enabling people to greet him or her on arrival. Tekion can also make recommendations based on a car’s history. It might, for instance, suggest to a customer a brake fluid flush “without an advisor having to look through a customer’s history,” he says.

As important, he says, the dealership has been able to cut ties with a lot of other software vendors, while also making more productive use of its time. Says Castelino, “As soon as a [repair order] is live, it’s in a dispatcher’s hand and a technician can grab the car.”

It’s like that with every step, he insists. “You’re saving 15 minutes again and again, and suddenly, you have three hours where your intake can be higher.”

Interestingly, the steepest competition, should it come, might eventually be from Tesla itself.

In an earnings call earlier today, Musk told analysts that there are essentially a dozen startups housed inside of Tesla, including one centered on vehicle service. It’s the very business that Vijayan helped to create.

As for whether Musk might spin out any of these, he said Tesla currently has no plans to do so, suggesting it has enough on its plate for the time being.

Powered by WPeMatico

Yin Wu has co-founded several companies since graduating from Stanford in 2011, including a computer vision company called Double Labs that sold to Microsoft, where she stayed on for a couple of years as a software engineer. In fact, it was only after that sale she she says she “actually understood all of the nuances with a company’s cap table.”

Her newest company, Pulley, a 14-month-old, Mountain View, Ca.-based maker of cap table management software aims to solve that same problem and has so far raised $10 million toward that end led by the payments company Stripe, with participation from Caffeinated Capital, General Catalyst, 8VC and numerous angel investors.

Wu is going up against some pretty powerful competition. Carta was reportedly raising $200 million in fresh funding at a $3 billion valuation as of the spring (a round the company never official confirmed or announced). Last year, it raised $300 million. Morgan Stanley has meanwhile been beefing up its stock plan administration business, acquiring Solium Capital early last year and more recently purchasing Barclay’s stock plan business.

Of course, startups often manage to find a way to take down incumbents and a distraction for Carta, at least, in the form of a very public gender discrimination lawsuit by a former VP of marketing, could be the kind of opening that Pulley needs. We emailed with Yu yesterday to ask if that might be the case. She didn’t answer directly, but she did mention “values,” as well as sharing some more details about what she sees as different about the two products.

TC: Why start this company? Has Carta’s press of late created an opening for a new upstart in the space?

YW: I left Microsoft in 2018 and started Pulley a year later. We skipped the seed and raised the A because of overwhelming demand from investors. Many wanted a better product for their portfolio companies. Many founders are increasingly thinking about choosing with companies, like Pulley, that better align with their values.

TC: How many people are working for Pulley and are any folks you pulled out of Carta?

YW: We’re a team of seven and have four people on the team who are former Y Combinator founders. We attract founders to the team because they’ve experienced firsthand the difficulties of managing a cap table and want to build a better tool for other founders. We have not pulled anyone out of Carta yet.

TC: Carta has raised a lot of funding and it has long tentacles. What can Pulley offer startups that Carta cannot?

YW: We offer startups a better product compared to our competitors. We make every interaction on Pulley easier and faster. 409A valuations take five days instead of weeks, and onboarding is the same day rather than months. By analogy, this is similar to the difference between Stripe and Braintree when Stripe initially launched. There were many different payment processes when Stripe launched. They were able to capture a large portion of the market by building a better product that resonated with developers.

One of the features that stands out on Pulley is our modeling feature [which helps founders model dilution in future rounds and helps employees understand the value of their equity as the company grows]. Founders switch from our competitors to Pulley to use our modeling tool [and it works] with pre-money SAFEs, post-money SAFEs and factors in pro-ratas and discounts. To my knowledge, Pulley’s modeling tool is the most comprehensive product on the market.

TC: How does your pricing compare with Carta’s?

YW: Pulley is free for early-stage companies regardless of how much they raise. We’re price competitive with Carta on our paid plans. Part of the reason we started Pulley is because we had frustrations with other cap table management tools. When using other services, we had to regularly ping our accountants or lawyers to make edits, run reports or get data. Each time we involved the lawyers, it was an expensive legal fee. So there is easily a $2,000 hidden fee when using tools that aren’t self-serve for setting up and updating your cap table.

TC: Is there a business-to-business opportunity here, where maybe attorneys or accountants or wealth managers private label this service? Or are these industry professionals viewed as competitors?

YW: We think there are opportunities to white label the service for accountants and law firms. However, this is currently not our focus.

TC: How adaptable is the software? Can it deal with a complicated scenario, a corner case?

YW: We started Pulley one year ago and we’re launching today because we have invested in building an architecture that can support complex cap table scenarios as companies scale. There are two things that you have to get right with cap table systems, First, never lose the data and second, always make sure the numbers are correct. We haven’t lost data for any customer and we have a comprehensive system of tests that verifies the cap table numbers on Pulley remain accurate.

TC: At what stage does it make sense for a startup to work with Pulley, and do you have the tools to hang onto them and keep them from switching over to a competitor later?

YW: We work with companies past the Series A, like Fast and Clubhouse. Companies are not looking to change their cap table provider if Pulley has the tool to grow with them. We already have the features of our competitors, including electronic share issuance, ACH transfers for options, modeling tools for multiple rounds and more. We think we can win more startups because Pulley is also easier to use and faster to onboard.

TC: Regarding your paid plans, how much is Pulley charging and for what? How many tiers of service are there?

YW; Pulley is free for early-stage startups with less than 25 stakeholders. We charge $10 per stakeholder per month when companies scale beyond that. A stakeholder is any employee or investor on the cap table. Most companies upgrade to our premium plan after a seed round when they need a 409A valuation.

Cap table management is an area where companies don’t want a free product. Pulley takes our customers’ data privacy and security very seriously. We charge a flat fee for companies so they rest assured that their data will never be sold or used without their permission.

TC: What’s Pulley’s relationship to venture firms?

YW: We’re currently focused on founders rather than investors. We work with accelerators like Y Combinator to help their portfolio companies manage their cap table, but don’t have a formal relationship with any VC firms.

Powered by WPeMatico

While certifications for security management practices like SOC 2 and ISO 27001 have been around for a while, the number of companies that now request that their software vendors go through (and pass) the audits to be in compliance with these continues to increase. For a lot of companies, that’s a harrowing process, so it’s maybe no surprise that we are also seeing an increase in startups that aim to make this process easier. Earlier this month, Strike Graph, which helps automate security audits, announced its $3.9 million round, and today, Secureframe, which also helps businesses get and maintain their SOC 2 and ISO 27001 certifications, is announcing a $4.5 million round.

Secureframe’s round was co-led by Base10 Partners and Google’s AI-focused Gradient Ventures fund. BoxGroup, Village Global, Soma Capital, Liquid2, Chapter One, Worklife Ventures and Backend Capital participated. Current customers include Stream, Hasura and Benepass.

Shrav Mehta, the company’s co-founder and CEO, spent time at a number of different companies, but he tells me the idea for Secureframe was mostly born during his time at direct-mail service Lob.

“When I was at Lob, we dealt with a lot of issues around security and compliance because we were sometimes dealing with very sensitive data, and we’d hop on calls with customers, had to complete thousand-line security questionnaires, do exhaustive security reviews, and this was a lot for a startup of our size at the time. But it’s just what our customers needed. So I started to see that pain,” Mehta said.

After stints at Pilot and Scale AI after he left Lob in 2017 — and informally helping other companies manage the certification process — he co-founded Secureframe together with the company’s CTO, Natasja Nielsen.

“Because Secureframe is basically adding a lot of automation with our software — and making the process so much simpler and easier — we’re able to bring the cost down to a point where this is something that a lot more companies can afford,” Mehta explained. “This is something that everyone can get in place from day one, and not really have to worry that, ‘hey, this is going to take all of our time, it’s going to take a year, it’s going to cost a lot of money.’ […] We’re trying to solve that problem to make it super easy for every organization to be secure from day one.”

The main idea here is to make the arcane certification process more transparent and streamline the process by automating many of the more labor-intensive tasks of getting ready for an audit (and it’s virtually always the pre-audit process that takes up most of the time). Secureframe does so by integrating with the most-often used cloud and SaaS tools (it currently connects to about 25 services) and pulling in data from them to check up on your security posture.

“It feels a lot like a QuickBooks or TurboTax-like experience, where we’ll essentially ask you to enter basic details about your business. We try to autofill as much of it as possible from third-party sources — then we ask you to connect up all the integrations your business uses,” Mehta explained.

The company plans to use much of the new funding to staff up and build out these integrations. Over time, it will also add support for other certifications like PCI, HITRUST and HIPAA.

Powered by WPeMatico

Contrast, a developer-centric application security company with customers that include Liberty Mutual Insurance, NTT Data, AXA and Bandwidth, today announced the launch of its security observability platform. The idea here is to offer developers a single pane of glass to manage an application’s security across its lifecycle, combined with real-time analysis and reporting, as well as remediation tools.

“Every line of code that’s happening increases the risk to a business if it’s not secure,” said Contrast CEO and chairman Alan Naumann. “We’re focused on securing all that code that businesses are writing for both automation and digital transformation.”

Over the course of the last few years, the well-funded company, which raised a $65 million Series D round last year, launched numerous security tools that cover a wide range of use cases, from automated penetration testing to cloud application security and now DevOps — and this new platform is meant to tie them all together.

DevOps, the company argues, is really what necessitates a platform like this, given that developers now push more code into production than ever — and the onus of ensuring that this code is secure is now also often on that.

Traditionally, Naumann argues, security services focused on the code itself and looking at traffic.

“We think at the application layer, the same principles of observability apply that have been used in the IT infrastructure space,” he said. “Specifically, we do instrumentation of the code and we weave security sensors into the code as it’s being developed and are looking for vulnerabilities and observing running code. […] Our view is: the world’s most complex systems are best when instrumented, whether it’s an airplane, a spacecraft, an IT infrastructure. We think the same is true for code. So our breakthrough is applying instrumentation to code and observing for security vulnerabilities.”

With this new platform, Contrast is aggregating information from its existing systems into a single dashboard. And while Contrast observes the code throughout its lifecycle, it also scans for vulnerabilities whenever a developers check code into the CI/CD pipeline, thanks to integrations with most of the standard tools like Jenkins. It’s worth noting that the service also scans for vulnerabilities in open-source libraries. Once deployed, Contrast’s new platform keeps an eye on the data that runs through the various APIs and systems the application connects to and scans for potential security issues there as well.

The platform currently supports all of the large cloud providers, like AWS, Azure and Google Cloud, and languages and frameworks, like Java, Python, .NET and Ruby.

Powered by WPeMatico

Synthetaic is a startup working to create data — specifically images — that can be used to train artificial intelligence.

Founder and CEO Corey Jaskolski’s experience includes work with both National Geographic (where he was recently named Explorer of the Year) and a 3D media startup. In fact, he told me that his time with National Geographic made him aware of the need for more data sets in conservation.

Sound like an odd match? Well, Jaskolski said that he was working on a project that could automatically identify poachers and endangered animals from camera footage, and one of the major obstacles was the fact that there simply aren’t enough existing images of either poachers (who don’t generally appreciate being photographed) or certain endangered animals in the wild to train AI to detect them.

He added that other companies are trying to create synthetic AI training data through 3D worldbuilding (in other words, “building a replica of the world that you want to have an AI learn in”), but in many cases, this approach is prohibitively expensive.

In contrast, the Synthetaic (pronounced “synthetic”) approach combines the work of 3D artists and modelers with technology based on generative adversarial networks, making it far more affordable and scalable, according to Jaskolski.

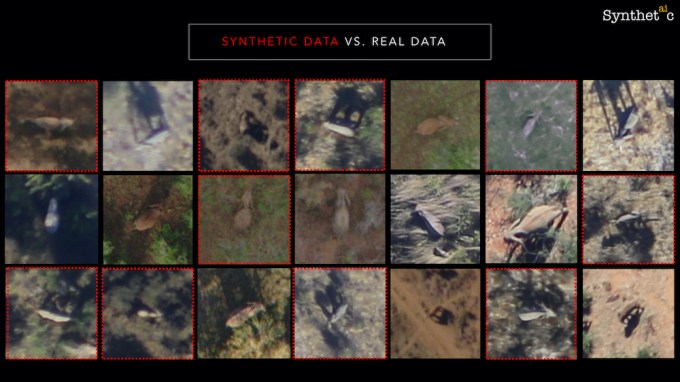

Image Credits: Synthetaic

To illustrate the “interplay” between the two halves of Synthetaic’s model, he returned to the example of identifying poachers — the startup’s 3D team could create photorealistic models of an AK-47 (and other weapons), then use adversarial networks to generate hundreds of thousands of images or more showing that model against different backgrounds.

The startup also validates its results after an AI has been trained on Synthetaic’s synthesized images, by testing that AI on real data.

For Synthetaic’s initial projects, Jaskolski said he wanted to partner with organizations doing work that makes the world a better place, including Save the Elephants (which is using the technology to track animal populations) and the University of Michigan (which is developing an AI that can identify different types of brain tumors).

Jaskolski added that Synthetaic customers don’t need any AI expertise of their own, because the company provides an “end-to-end” solution.

The startup announced today that it has raised $3.5 million in seed funding led by Lupa Systems, with participation from Betaworks Ventures and TitletownTech (a partnership between Microsoft and the Green Bay Packers). The startup, which has now raised a total of $4.5 million, is also part of Lupa and Betaworks’ Betalab program of startups doing work that could help “fix the internet.”

Powered by WPeMatico

On Friday, former Tiger Global Management investor Lee Fixel registered plans for the second fund of his new investment firm, Addition, just four months after closing the first. According to a report on Friday by the Financial Times, the outfit spent last week finalizing the fundraising for the $1.4 billion fund, which Addition reportedly doesn’t plan to begin investing until next year.

But a source close to the firm now says the capital has not been raised. That’s perhaps good news for investors who were shut out of Addition’s $1.3 billion debut fund and who might be hoping to write a check this time around.

The mere fact that Fixel is back in the market already has tongues wagging about the dealmaker, one whose reluctance to talk on the record with media outlets seems only to add to his mystique. Forbes published a lengthy piece about Fixel this summer, in which Fixel seems to have provided just one public statement, confirming the close of Addition’s first fund and adding little else. “We are excited to partner with visionary entrepreneurs, and with our 15-year fund duration, we have the patience to support our portfolio companies on their journey to build impactful and enduring businesses,” it read.

According to Forbes, that first fund — which Fixel is actively putting to work right now — intends to invest one-third of its capital in early-stage startups and two-thirds in growth-stage opportunities.

Whether that includes some of the special purpose acquisition vehicles, or SPACs, that are coming together right and left, isn’t yet known, though one imagines these might appeal to Fixel, who has long seemed to be at the forefront of new trends impacting growth-stage companies in particular. (A growing number of SPACs is right now looking to transform into public companies some of the many hundreds of richly valued private companies in the world.)

Clearer is that Addition is wasting little time in writing some big checks. Among its announced deals is Inshorts, a seven-year-old, New Delhi, India-based popular news aggregation app that last week unveiled $35 million new funding led by Fixel.

The deal represents Addition’s first India-based bet, even while Fixel knows both the country and the startup well. He previously invested in Inshorts on behalf of Tiger; he’s also credited for snatching up a big stake in Flipkart on behalf of Tiger, a move that reportedly produced $3.5 billion in profits when Flipkart sold to Walmart.

Addition also led a $200 million round last month in Snyk, a five-year-old, London-based startup that helps companies securely use open-source code. The round valued the company at $2.6 billion — more than twice the valuation it was assigned when it raised its previous round 10 months ago.

And in August, Addition led a $110 million Series D round for Lyra Health, a five-year-old, Burlingame, California-based provider of mental health care benefits for employers that was founded by former Facebook CFO David Ebersman.

A smaller check went to Temporal, a year-old, Seattle-based startup that is building an open-source, stateful microservices orchestration platform. Last week, the company announced $18.75 million in Series A funding led by Sequoia Capital, but Addition also joined the round, having been an earlier investor in the company.

According to PitchBook data, Addition has made at least 17 investments altogether.

Fixel — whose bets while at Tiger include Peloton and Spotify — isn’t running Addition single-handedly, though according to Forbes, he is the single “key man” around which the firm revolves, as well as the biggest investor in Addition’s first fund.

He has also brought aboard at least three investment principals from Wall Street and a head of data science who worked formerly for Uber (per Forbes). Ward Breeze, a longtime attorney who worked formerly in the emerging companies practice of Gunderson Dettmer, is also working with Fixel at Addition.

(Correction: An earlier version of this story reported that Fixel’s newest fund was already raised, per the FT.)

Powered by WPeMatico

Pear, the eight-year-old, Palo Alto, Calif.-based seed-stage venture firm that has, from its outset, attracted the attention of VCs who think the firm has an eye for nascent talent, staged its seventh annual demo day earlier this week, and while it was virtual, one of the startups has already signed a term sheet from a top-tier venture firm.

To give the rest of you a sneak peak, here’s a bit about all of the startups that presented, in broad strokes:

What it does: Video conferencing platform for enterprise workflows

Website: accessbell.com

Founders: Martin Aguinis (CEO), Josh Payne (COO), Kamil Ali (CTO)

The pitch: Video has emerged as one of the prominent ways for enterprises to communicate internally and externally with their customers and partners. Current video conferencing tools like Zoom and WebEx are great for standalone video but they have their own ecosystems and don’t integrate into thousands of enterprise workflows. That means that API tools that do integrate, like Agora and Twilio, still require manual work from developer teams to customize and maintain. AccessBell is aiming to provide the scalability and reliability of Zoom, as well as the customizability and integrations of Twilio, in a low code integration and no code extensible customization platform.

It’s a big market the team is chasing, one that’s expected to grow to $8.6 billion by 2027. The cost right now for users who want to test out AccessBell is $27 per host per month.

2.) FarmRaise

What it does: Unlock financial opportunities for farmers to create sustainable farms and improve their livelihoods

Website: farmraise.com

Founders: Jayce Hafner (CEO), Sami Tellatin (COO), Albert Abedi (Product)

The pitch: Over half of American farms don’t have the tools or bandwidth they need to identify ways to improve their farms and become profitable. The startup’s API links to farmers’ bank accounts, where its algorithm assesses financials to provide a “farm read,” scoring the farms’ financial health. It then regularly monitors farm data to continuously provide clean financials and recommendations on how to improve its customers’ farms, as well as to connect farmers with capital in order to improve their score. (It might suggest that a farm invest in certain sustainability practices, for example.)

Eventually, the idea is to also use the granular insights it’s garnering and sell these to hedge funds, state governments, and other outfits that want a better handle on what’s coming — be it around food security or climate changes.

3.) Sequel

What it does: Re-engineering life’s essential products – starting with tampons

Website: thesequelisbetter.com

Founders: Greta Meyer (CEO), Amanda Calabrese (COO)

The pitch: Founded by student athletes from Stanford, Sequel argues that seven out of 10 women don’t trust tampons, which were first designed in 1931 (by a man). New brands like Lola have catchy brands and new material, but they perform even worse than legacy products. Sequel has focused instead on fluid mechanics and specifically on slowing flow rates so a tampon won’t leak before it’s full, instilling more confidence in its customers, whether they’re in the “boardroom or the stadium.”

The company says it has already filed patents and secured manufacturing partners and that it expects that the product will be available to buy directly from its website, as well as in other stores, next year.

4.) Interface Bio

What it does: Unlocking the therapeutic potential of the microbiome with a high-throughput pipeline for characterizing microbes, metabolites, and therapeutic response, based on years of research at Stanford

Founders: Will Van Treuren, Hannah Wastyk

The pitch: The microbiome plays a major role in a wide range of human diseases, including heart disease, kidney disease, liver disease, and cancer. In fact, Interface’s founders — both of whom are PhDs — say that microbiome-influenced diseases are responsible for four of the top 10 causes of death in the United States. So how do they better seize on the opportunity to identify therapeutics by harnessing the microbiome? Well, they say they’ll do it via a “high-speed pipeline for characterizing metabolites and their immune phenotypes,” which they’ll create by developing the world’s largest database of microbiome-mediated chemistry . . . which the startup will then screen for potential metabolites that can lead to new therapies. (We spilled our coffee during this pitch so missed some details, but presumably you can learn more from the startup’s founders and site.)

5.) Gryps

What it does: Gryps is tackling construction information silos to create a common information layer that gives building and facility owners both rich and permanent access to document-centric information

Website: gryps.io

Founders: Dareen Salama, Amir Tasbihi

The pitch: The vast size and complexity of the construction industry has resulted in all kinds of software and services that address various aspects of the construction processes. Ye that has led to data and documents being spread across many siloed tools. Gryps says it picks up where all the construction-centered tools leave off: Taking delivery of the projects at the end of a construction job and providing all the information that facility owners need to operate, renovate, or build future projects through a platform that ingests data from various construction tools, mines the embedded information, then provides operational access through owner-centered workflows.

6.) Expedock

What it does: Automation infrastructure for supply chain businesses, starting with AI-powered freight forwarder solutions

Website: expedock.com

Founders: King Alandy Dy (CEO), Jeff Tan (COO), Rui Aguiar (CTO)

The pitch: Freight forwarders take care of all the logistics of shipping containers including financials, approvals and paper work for all the local entities on both sides of the sender and receiver geographies, but communications with these local entities are often done through unstructured data, including forms, documents, and emails and can subsequently eat up to 60% of operational expenses. Expedock is looking to transform the freight forwarding industry by digitizing and automating the processing and inputting of unstructured data into various local partner and governmental systems, including via a “human in the loop” AI software service.

7.) Illume

What it does: A new way to share praise

Website: illumenotes.com

Founders: Sohale Sizar (CEO), Phil Armour (Engineering), Maxine Stern (Design)

The pitch: The process of thanking people is full of friction. Paper cards have to be purchased, signed, passed around; greetings on Facebook only mean so much. Using Illume, teams and individuals can download its app or come together on Slack and create a customized, private, and also shareable note. The nascent startup says one card typically has 10 contributors; it’s charging enterprises $3 per user per month, ostensibly so sales teams, among others, can use them.

8.) Quansa

What it does: Quansa improves Latin American workers’ financial lives via employer-based financial care

Website: quansa.io

Founders: Gonzalo Blanco, Mafalda Barros

The pitch: Fully 40% of employees across Latin America have missed work in the past 12 months due to financial problems. Quansa wants to help them get on the right track financially with the help of employers that use its software to link their employees’ payroll data with banks, fintechs and other financial institutions.

There is strength in numbers, says the firm. By funneling more customers to lenders through employers, for example, these staffers should ultimately be able to access to cheaper car loans, among other things.

9.) SpotlightAI

What it does: Spotlight turns sensitive customer information from a burden to an asset by using NLP techniques to identify, anonymize, and manage access to PII and other sensitive business data

Website: hellospotlight.com

Founder: Austin Osborne (CEO)

The pitch: Data privacy legislation like GDPR and CCPA is creating an era where companies can no longer use their customer data to run their business due to the risks of fines, lawsuits, and negative media coverage. Spotlight’s software plugs into existing data storage engines via APIs and operates as a middleware within a company’s network. Using advanced NLP and OCR techniques, it says it’s able to detect sensitive information in unstructured data, perform multiple types of anonymization, and provide a deep access control layer.

10.) Bennu

What it does: Bennu closes the loop on management communication

Website: bennu.io

Founder: Brenda Jin (CEO)

The pitch: Today’s work communication is done through forms, email, Slack, and docs; the timelines are unnatural. Bennu is trying to solve the problem with communication loops that use integrations and smart topic suggestions to help employees prepare for substantive management conversations in seconds, not hours.

11.) Playbook

What it does: Playbook automates the people coordination in your repeatable workflows with a simple system to create, execute and track any process with a team, customers, and more

Website: startplaybook.com

Founders: Alkarim Lalani (CEO), Blaise Bradley (CTO)

The pitch: Whether you’re collecting time cards from 20 hourly workers every week, or managing 30 customer on-boardings – you’re coordinating repetitive workflows across people over email and tracking it over spreadsheets. Playbook says it coordinates workflows between people at scale by taking programming concepts such as variables and conditional logic that let its customers model any workflow — and all packaged in an interface that enables anyone to build out their workflows in minutes.

12.) June Motherhood

What it does: Community-based care for life’s most important transitions

Website: junemotherhood.com

Founders: Tina Beilinson (CEO), Julia Cole (COO), Sophia Richter (CPO)

The pitch: June is a digital health company focused on maternal health, with community at the core. Like a Livongo for diabetes management, June combines the latest research around shared appointments, peer-to-peer support and cognitive behavioral therapy to improve outcomes and lower costs, including through weekly programs.

13.) Wagr

What it does: Challenge anyone to a friendly bet

Website: wagr.us

Founders: Mario Malavé (CEO), Eliana Eskinazi (CPO)

The pitch: Wagr will allow sports fans to bet with peers in a social, fair, and simple way. Sending a bet requires just three steps, too: pick a team, set an amount, and send away. Wagr sets the right odds and handles the money.

Users can challenge friends, start groups, track leaderboards, and see what others are betting on, so they feel connected even if they aren’t together. Customers pay a commission when they use the platform to find them a match, but bets against friends are free. The plan is to go live in Tennessee first and expand outward from there.

14.) Federato

What it does: Intelligence for a new era of risk

Website: federato.ai

Founders: Will Ross (CEO), William Steenbergen (CTO)

The pitch: Insurance companies are struggling to manage risk as natural catastrophes continue to grow in volume and severity. Reinsurance is no longer a reliable backstop, with some of the largest insurers taking $600 million-plus single-quarter losses net of reinsurance.

Federato is building an underwriter workflow that uses dynamic optimization across the portfolio to steer underwriters to a better portfolio balance. The software ostensibly lets actuaries and portfolio analysts drive high-level risk analysis into the hands of underwriters on the front lines to help them understand the “next best action” at a given point in time.

15.) rePurpose Global

What it does: A plastic credit platform to help consumer brands of any size go plastic neutral

Website: business.repurpose.global

Founders: Svanika Balasubramanian (CEO), Aditya Siroya (CIO), Peter Wang Hjemdahl (CMO

The pitch: Consumers worldwide are demanding businesses to take action on eliminating plastic waste, 3.8 million pounds of which are leaked into the environment every few minutes. Yet even as brands try, alternatives are often too expensive or worse for the environment.

Through this startup, a brand can commit to the removal of a certain amount of plastic, which will then be removed by the startup’s local waste management partners and recycled on the brand’s behalf (with rePurpose verifying that the process adheres to certain standards). The startup says it can maintain a healthy margin while running this plastic credit market, and that its ultimate vision is to become a “one-stop shop for companies to create social, economic, and environmental impact.”

16.) Ladder

What it does: A professional community platform for the next generation

Website: ladder.io

Founders: Akshaya Dinesh (CEO), Andrew Tan

The pitch: LinkedIn sucks, everyone hates it. Ladder (which may have a trademark infringement battle ahead of it) is building a platform around community instead of networks. The idea is that users will opt in to join communities with like-minded individuals in their respective industries and roles of interest. Once engaged, they can participate in AMAs with industry experts, share opportunities, and have 1:1 conversations.

The longer term ‘moat’ is the data it collects from users, from which it thinks it can generate more revenue per user than LinkedIn. (By the way, this is the startup that has already signed a term sheet.)

Exporta

How it works: Exporta is building a B2B wholesale marketplace connecting suppliers in Latin America with buyers in North America.

Website: exporta.io

Founders: Pierre Thys (CEO), Robert Monaco (President)

The pitch: The U.S. now imports more each year from Latin America than from China, but LatAm sourcing remains fragmented and manual. Exporta builds on-the-ground relationships to bring LatAm suppliers onto a tech-enabled platform that matches them to U.S. buyers looking for faster turnaround times and more transparent manufacturing relationships.

Via

What it does: Via helps companies build their own teams in new countries as simply as if they were in their HQ.

Website: via.work

Founders: Maite Diez-Canedo, Itziar Diez-Canedo

The pitch: Setting up a team in a new country is very complex. Companies need local entities, contracts, payroll, benefits, accounting, tax, compliance, and more. Via enables companies to build their own teams in new countries quickly and compliantly by leveraging local entities to legally employ teams on their behalf, then integrating local contracts, payroll, and benefits in one platform. By plugging into the local hiring ecosystem, Via does all the heavy lifting for its customers, even promising to stand up a team in 48 hours and at less expense than traditional alternatives. (It’s charging $600 per employee per month in Canada and Mexico, where it says it has already launched.)

Powered by WPeMatico

Lawmatics, a San Diego startup that’s building marketing and CRM software for lawyers, is announcing that it has raised $2.5 million in seed funding.

CEO Matt Spiegel used to practice law himself, and he told me that even though tech companies have a wide range of marketing tools to choose from, “lawyers have not been able to adopt them,” because they need a product that’s tailored to their specific needs.

That’s why Spiegel founded Lawmatics with CTO Roey Chasman. He said that a law firm’s relationship with its clients can be divided into three phases — intake (when a client is deciding whether to hire a firm); the active legal case; and after the case has been resolved. Apparently most legal software is designed to handle phase two, while Lawmatics focuses on phases one and three.

The platform includes a CRM system to manage the initial client intake process, as well as tools that can automate a lot of what Spiegel called the “blocking and tackling” of marketing, like sending birthday messages to former clients — which might sound like a minor task, but Spiegel said it’s crucial for law firms to “nurture” those relationships, because most of their business comes from referrals.

Lawmatics’ early adopters, Spiegel added, have consisted of the firms in areas where “if you need a lawyer, you go to Google and start searching ‘personal injury,’ ‘bankruptcy,’ ‘estate planning,’ all these consumer-driven law firms.” And the pandemic led to accelerated the startup’s growth, because “lawyers are at home now, their business is virtual and they need more tools.”

Spiegel’s had success selling technology to lawyers in the past, with his practice management software startup MyCase acquired by AppFolio in 2012 (AppFolio recently sold MyCase to a variety of funds for $193 million). He said that the strategies for growing both companies are “almost identical” — the products are different, but “it’s really the same segment, running the same playbook, only with additional go-to-market strategies.”

The funding was led by Eniac Ventures and Forefront Venture Partners, with participation from Revel Ventures and Bridge Venture Partners.

“In my 10 years investing I have witnessed few teams more passionate, determined, and capable of revolutionizing an industry,” said Eniac’s Tim Young in a statement. “They have not only created the best software product the legal market has seen, they have created a movement.”

Powered by WPeMatico

Temporal, a Seattle-based startup that is building an open-source, stateful microservices orchestration platform, today announced that it has raised an $18.75 million Series A round led by Sequoia Capital. Existing investors Addition Ventures and Amplify Partners also joined, together with new investor Madrona Venture Group. With this, the company has now raised a total of $25.5 million.

Founded by Maxim Fateev (CEO) and Samar Abbas (CTO), who created the open-source Cadence orchestration engine during their time at Uber, Temporal aims to make it easier for developers and operators to run microservices in production. Current users include the likes of Box and Snap.

“Before microservices, coding applications was much simpler,” Temporal’s Fateev told me. “Resources were always located in the same place — the monolith server with a single DB — which meant developers didn’t have to codify a bunch of guessing about where things were. Microservices, on the other hand, are highly distributed, which means developers need to coordinate changes across a number of servers in different physical locations.”

Those servers could go down at any time, so engineers often spend a lot of time building custom reliability code to make calls to these services. As Fateev argues, that’s table stakes and doesn’t help these developers create something that builds real business value. Temporal gives these developers access to a set of what the team calls “reliability primitives” that handle these use cases. “This means developers spend far more time writing differentiated code for their business and end up with a more reliable application than they could have built themselves,” said Fateev.

Temporal’s target use is virtually any developer who works with microservices — and wants them to be reliable. Because of this, the company’s tool — despite offering a read-only web-based user interface for administering and monitoring the system — isn’t the main focus here. The company also doesn’t have any plans to create a no-code/low-code workflow builder, Fateev tells me. However, since it is open-source, quite a few Temporal users build their own solutions on top of it.

The company itself plans to offer a cloud-based Temporal-as-a-Service offering soon. Interestingly, Fateev tells me that the team isn’t looking at offering enterprise support or licensing in the near future. “After spending a lot of time thinking it over, we decided a hosted offering was best for the open-source community and long-term growth of the business,” he said.

Unsurprisingly, the company plans to use the new funding to improve its existing tool and build out this cloud service, with plans to launch it into general availability next year. At the same time, the team plans to say true to its open-source roots and host events and provide more resources to its community.

“Temporal enables Snapchat to focus on building the business logic of a robust asynchronous API system without requiring a complex state management infrastructure,” said Steven Sun, Snap Tech Lead, Staff Software Engineer. “This has improved the efficiency of launching our services for the Snapchat community.”

Powered by WPeMatico