TC

Auto Added by WPeMatico

Auto Added by WPeMatico

While companies have embraced the offerings of software-as-a-service companies with growing vigor, getting those new offerings to work in a seamless way from the outset isn’t so easy, with some business customers feeling forgotten as soon as the digital ink dries.

Enter Onboard, a 10-month-old startup that aims to help SaaS businesses delight those new customers instead of turning them off.

The company was co-founded by CEO Jeff Epstein, who previously launched the referral marketing and affiliate marketing software company Ambassador, which sold in 2018, eight years after it was founded.

Terms of the sale to West Corporation — now Intrado — were never disclosed, but Epstein says it was a “good outcome” for shareholders. (Ambassador was sold again last month to a small Seattle company.)

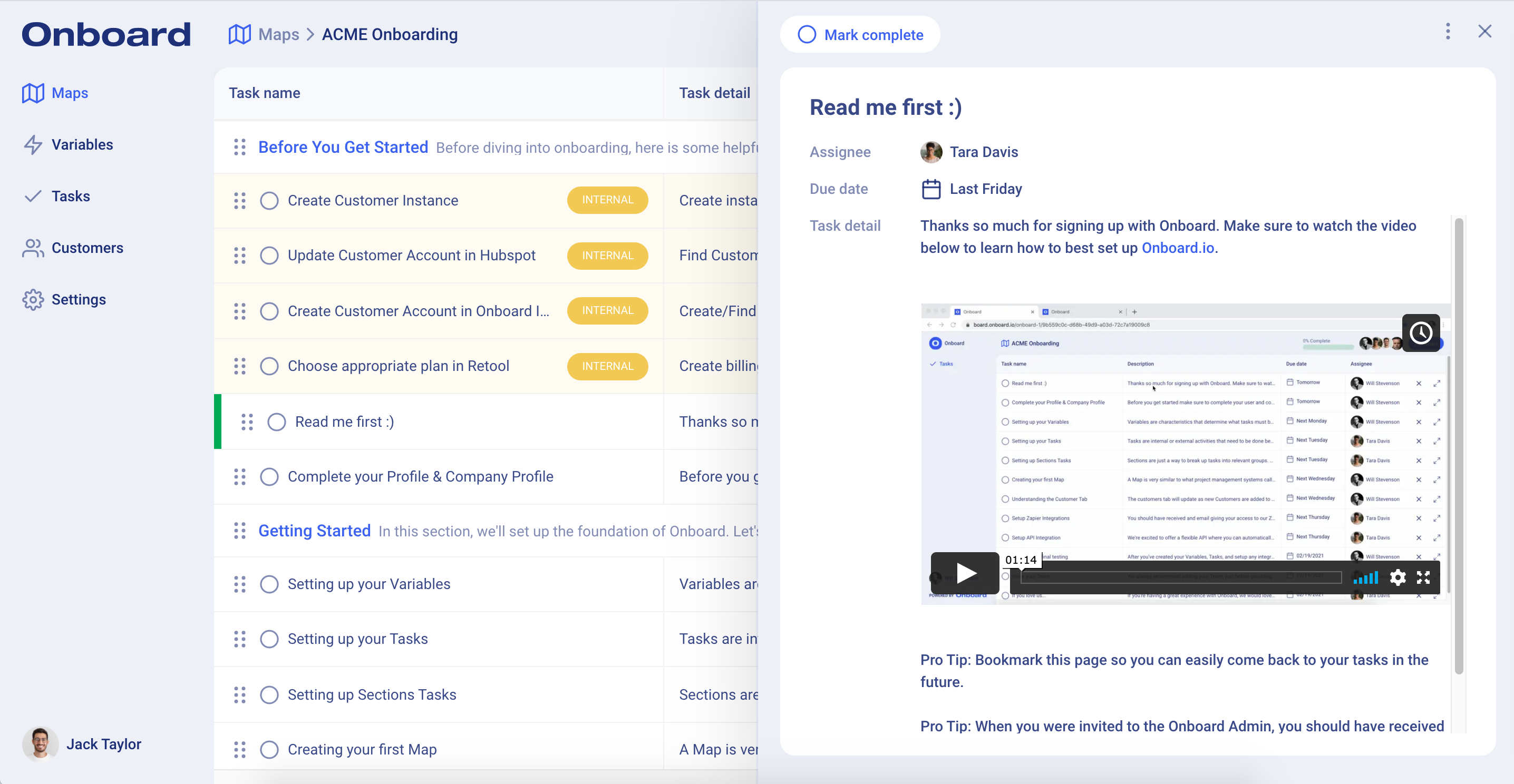

As for how Onboard works, Epstein makes the process sound straightforward. “You determine the variables of your customer segment, because different plan types might mean that companies need to do something different.” (They could use an API or some code snippet, for example.) After that, Onboard works with the SaaS company to create a global task list with requirements it has hopefully gleaned from the sales process, and helps it create a kind of dynamic, drop-down task list with assignees and due dates and alerts and notifications.

It’s largely a self-service product that makes accountability more transparent, ultimately, though Epstein describes the onboarding process as a “shared responsibility” between his company and its customers. He also says his nascent startup is already working on building out a more sophisticated notification layer with automated nudges that are helpful yet not obnoxious.

The five-person company is not charging its dozens of beta customers right now. It wants to get the product right before it shifts into revenue gear, says Epstein. The plan eventually is to charge the types of customers it is chasing — mid-size companies — hundreds of dollars of month, plus a per-person-per-month fee. (“We don’t plan on being enterprise-y in any way,” says Epstein of the company’s plan to eschew long contracts.)

Onboard is not without competitors. On the contrary, a lot of upstarts have sprung up around this problematic slice of the enterprise universe. That it’s an aggravating period for many new customers was brought to Epstein’s attention by one of his co-founders, William Stevenson, who spent four years as Ambassador’s VP of customer success, where, like a lot of people in his position at other companies, he was trying to make do with a less-than-ideal patchwork of offerings, sometimes from Monday or Asana or Basecamp or Google Docs.

It was the same problem that Jonathon Triest of Ludlow Ventures — whose firm quietly led a $1.25 million seed round for Onboard in late summer, joined by Zelkova Ventures and Detroit Venture Partners — says he knows well.

Image Credits: Onboard

“Over and over again, throughout our portfolio, especially in B2B SaaS sales,” Ludlow’s portfolio companies have been “forced to piece together solutions or use tools not made for them,” Triest says.

The question is whether Onboard can gain a foothold faster than some of its other rivals, and unsurprisingly, Epstein believes his team has what it takes to get started. (A third founder, Matt Majewski, more recently left Ambassador to help the company gain momentum.)

Epstein’s resume is helping, too, he says. As a founder in Detroit who sold a company, he’s known to local investors, and then some. (“We were able to be a big fish in a small pond,” he says.)

Epstein also says that investors realize there’s “an opportunity generally in the space,” adding that “partners [from venture firms] have been calling — not associates — and they are coming through third-party connections on LinkedIn in some cases.”

He has “obviously raised a bit of money” in the past, Epstein says, but he hasn’t seen anything quite like this before. “It’s weird,” he adds, “but cool.”

Powered by WPeMatico

Knoq (formerly known as Polis) was a startup that recruited representatives to go door-to-door in their neighborhoods, talking up client products and services. So for obvious reasons, it faced challenges in 2020.

“We stopped knocking on doors in February, and this summer, we were trying to figure out what the path forward was,” founder and CEO Kendall Tucker told me.

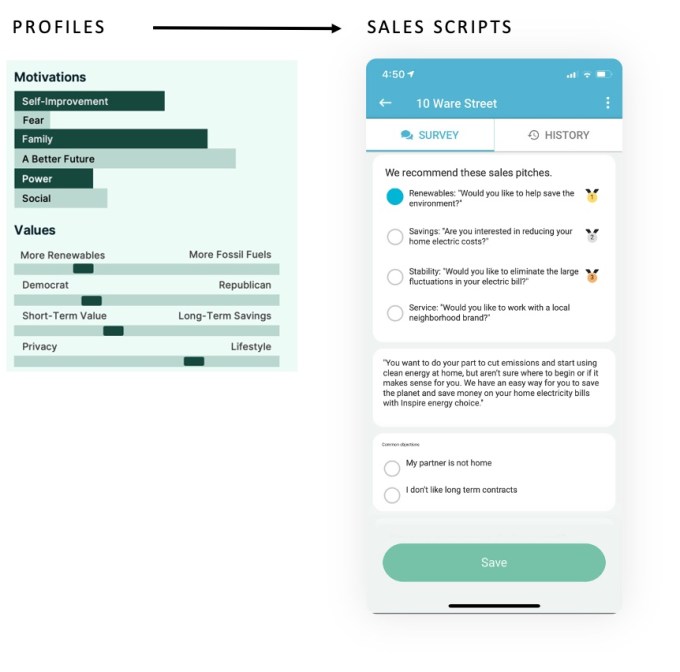

The company had already pivoted once, shifting focus from political work to commercial marketing. But Tucker said Knoq also had some attractive assets, namely its “unique, huge consumer models” designed to predict whether someone would be interested in a given product, as well as “the experience of building out these teams of neighborhood representatives.”

So after what she described as a competitive bidding process, Knoq was acquired by Ad Practitioners, a digital media company that owns properties like Money.com and ConsumersAdvocate.org.

As part of Ad Practitioners, Tucker said Knoq’s network of “Knoqers” will be able to interact with visitors to those properties and help “pair consumers with the right product,” whether that’s auto insurance or software. After all, she noted that plenty of consumers are connecting with Ad Practitioners via chat bots and phone calls: “These are people already asking for help … we’re really just connecting the dots.”

Image Credits: Knoq

In the acquisition announcement, Ad Practitioners CEO Greg Powel made a similar point, saying that the deal represents “a shared vision of helping people make decisions through conversations driven by data and technology while educating people about products and services that matter.”

“The Money and ConsumersAdvocate.org brands are already trusted by millions of highly engaged users,” Powel continued. “Together, we foresee a world where consumers come to our sites for great content [and] reviews and to speak with representatives who can help them find the personal information they need.”

Knoq leadership has already moved to join Ad Practitioners in Puerto Rico, with the rest of the Knoq team set to relocate later this year as well.

You might think a startup would be inclined to stay put in its current location (in Knoq’s case, Boston), at least for the duration of the pandemic, but Tucker said she’s a big believer in seeing your team in person. In fact, the Knoq team had socially distanced outdoor meetups over the summer, “to brainstorm or just hang out and make sure people are okay.” Plus, she’s excited about the possibility of “hiring the amazing people on this island.”

The financial terms of the acquisition were not disclosed. Knoq had most recently raised $2.5 million from Initialized Capital and Haystack.vc, and Tucker said it was crucial that the acquisition provided a good outcome not just for her team and herself, but also her investors.

“We’re so excited for Kendall and her team on their successful exit to Ad Practitioners,” said Initialized General Partner Alda Leu Dennis in a statement. “It’s been a pleasure partnering with Knoq over the last few years. The Knoq team will bring a tech-forward approach to sales outreach and customer analytics. And, Kendall’s skills as a brilliant builder, operator and strategic thinker will be a huge asset for Ad Practitioners.”

Powered by WPeMatico

Metropolis is a new Los Angeles-based startup that’s looking to compete with BMW-owned ParkMobile for a slice of the automated parking lot management market.

Upgrading parking with a computer vision-based system that recognizes cars as they enter and leave garages has been Metropolis’ mission since founder and chief executive Alex Israel first formed the business back in 2017.

Israel, a serial entrepreneur, has spent decades thinking about parking. His last company, ParkMe, was sold to Inrix back in 2015. And it was with those earnings and experience that Israel went back to the drawing board to develop a new kind of parking payment and management service.

Now, the company is ready for its closeup, announcing not only its launch, but $41 million in financing the company raised from investors, including the real estate managers Starwood and RXR Realty; Dick Costolo and Adam Bain’s 01 Advisors; Dragoneer; former Facebook employees Sam Lessin and Kevin Colleran’s Slow Ventures; Dan Doctoroff, the head of Alphabet’s Sidewalk Labs initiative; and NBA All Star and early-stage investor, Baron Davis. Global growth equity firm 3L led the round.

According to Alex Israel, the parking payment application is the foundation for a bigger business empire that hopes to reimagine parking spaces as hubs for a broad array of urban mobility services.

In this, the company’s goals aren’t dissimilar from the Florida-based startup, REEF, which has its own spin on what to do with the existing infrastructure and footprint created by urban parking spaces. And REEF’s $700 million round of funding from last year shows there’s a lot of money to be made — or at least spent — in a parking lot.

Unlike REEF, Metropolis will remain focused on mobility, according to Israel. “How does parking change over the next 20 years as mobility shifts?” he asked. And he’s hoping that Metropolis will provide an answer.

The company is hoping to use its latest funding to expand its footprint to more than 600 locations over the course of the next year. In all, Metropolis has raised $60 million since it was formed back in 2017.

While the computer vision and machine learning technology will serve as the company’s beachhead into parking lots, services like cleaning, charging, storage and logistics could all be part and parcel of the Metropolis offering going forward, Israel said. “We become the integrator [and] we also in some cases become the direct service provider,” Israel said.

The company already has 10,000 parking spots that it’s managing for big real estate owners, and Israel expects more property managers to flood to its service.

“[Big property owners] are not thinking about the infrastructure requirements that allow for the seamless access to these facilities,” Israel said. His technology can allow buildings to capture more value through other services like dynamic pricing and yield optimization as well.

“Metropolis is finding the highest and best use whether that be scooter charging, scooter storage, fleet storage, fleet logistics or sorting,” Israel said.

Powered by WPeMatico

One of the new space startups with the loftiest near-term goals has raised $130 million in a Series B round that demonstrates investor confidence in the scope of its ambitions: Axiom Space, which has been tapped by NASA to add privately developed space station modules to the ISS, announced the new funding led by C5 Capital.

This is the latest in a string of high-profile announcements for Axiom, which was founded in 2016 by a team including space professionals with a history of demonstrated expertise working on the International Space Station. Eventually, Axiom hopes to go from adding the first private commercial modules to the existing station, to creating their own, wholly private on-orbital platforms — for research, space tourism and more.

Axiom announced the people who will take part in its first-ever private astronaut launch to the ISS, which is set to fly next January using a SpaceX Dragon spacecraft and Falcon 9 rocket. Axiom is the service provider for the mission, brokering the deal for the private spacefarers and setting up training and mission profile. That should be the first time we see a crew made up entirely of private individuals (i.e. not astronauts selected, trained and employed by their respective national government) make its way to the station.

The company was also in discussions with Tom Cruise about filming at least part of an upcoming film aboard the ISS, and it’s in development with a production company on a forthcoming competition reality show that will see contestants vie for a spot on a private flight to the station.

Axiom is emerging as the leading linkage between private human spaceflight and the existing infrastructure and industry, covering both public sector partners like NASA, and the “rails” of the bourgeoning industry — SpaceX and its ilk. It’s been focused on this unique opportunity longer than most in the private market, and it has all the relationships and in-house expertise to make it work.

This new, significant injection of capital will help the company hire, as well as boost its ability to construct the pieces of its forthcoming private space station modules, as well as its eventual station itself. The Houston-based company aims to put its ISS modules on the station by 2024, and it has raised $150 million to date.

Powered by WPeMatico

This morning Citadel ID announced a combined $3.5 million raise for its income and employment verification service. The startup provides an API to customer companies, allowing them to rapidly verify details of consumer employment.

The capital came from a blend of venture firms and angels. On the firm side, Abstract and Soma VC were in there, along with ChapterOne. Brianne Kimmel put capital in as well, according to the startup. And denizens with work histories at companies like Zynga (Mark Pincus), Stripe (Lachy Groom), Carta (Henry Ward) and others also put cash into the fundraise. (The company reached out to add that Fathom Capital also put a good amount in the round.)

Citadel was founded back in June of 2020, before raising capital, snagging its first customer and shipping its product all inside of the same year.

The idea for Citadel ID came when co-founder Kirill Klokov worked at Carta, the cap-table-as-a-service startup that recently built an exchange for the trading of private stock. Klokov discovered while working on the tech side of the company how hard it was to verify certain data, like employment and income and identity.

As Carta deals with money, stock and the collection and distribution of both, you can imagine why having a quick way to verify who worked where, and since when, mattered to the company. But Klokov came to realize that there wasn’t a good solution in the market for what Carta needed, sans building integrations to a host of payroll managers by hand and dealing with lots of data with varying taxonomies. That or using an in-the-market product, like Equifax’s The Work Number, which the founder described as expensive and offering relatively low coverage.

To fill the market void Klokov helped found Citadel ID, quickly building integrations into payroll managers where there were hooks for code, and working around older login systems when needed. Citadel ID’s service allows regular folks to provide access to their employment data to others, allowing for the verification of their income (a rental group, perhaps), or employment (Carta, perhaps) quickly.

Per the startup the market demand for such verifications is in the hundreds of millions every year in the United States. So, Citadel should have plenty of market space to grow into. Citadel ID has around 20 customers today, it told TechCrunch, and charges on a per verification basis.

Finally, while Citadel also offers data via its website and not merely through its API, the startup still fits inside the growing number of startups we’ve seen in recent quarters foregoing traditional SaaS, and instead offering their products via a developer hook (sometimes referred to as a “headless” approach). API-delivered startups are not new, after all Twilio went public years ago. But their model of product delivery feels like it’s gaining momentum over managed software offerings.

Let’s see how quickly Citadel ID can scale before it raises its Series A.

Powered by WPeMatico

Pex, a startup aiming to give rightsholders more control over how their content is used and reused online, has raised $57 million in new funding.

The round comes from existing investors including Susa Ventures and Illuminate Ventures, as well as Tencent, Tencent Music Entertainment, the CueBall Group, NexGen Ventures Partners, Amaranthine and others.

Founded in 2014, Pex had previously raised $7 million, and it acquired music rights startup Dubset last year. Founder and CEO Rasty Turek told me that while the product has evolved from what he described as “a Google-like search engine for rightsholders to find copyright infringement” into a broader platform, the vision of creating a better system of managing copyright and payments online has remained the same.

The startup describes its Attribution Engine as the “licensing infrastructure for the Internet,” bringing together the individuals and companies who own content rights, creators who might want to license and remix that content, the big digital platforms where content gets shared and the law enforcement agencies that want to monitor all of this.

The product includes six modules — an asset registry, a system for identifying those assets when they’re used in new content, a licensing system, a dispute resolution system, a payment system and data and reporting to see how your content is being used.

Turek said that while Pex is being used by “most of the largest rightsholders in the world,” the system was built to be accessible to “a struggling musician out on the streets of Los Angeles” who doesn’t have the resources to “police all of this content” online.

Pex CEO Rasty Turek. Image Credits: Pex

He also suggested that the broader regulatory environment is calling for a solution like Pex, with the European Union passing a new copyright directive that’s set to take effect this year, and new copyright legislation also on the table in the United States. The EU bill was criticized for potentially prompting larger platforms to preemptively block broad swaths of content, but Turek argued, “There’s so much content out there in search of an audience that this is going to be the opposite of overblocking.”

Not that Pex is relying entirely on regulators. Turek also said the platform is structured to balance the needs of the different groups using it — and that it has an incentive to strike that balance because its revenue comes from licensing deals, so it’s focused on “really being the Switzerland, really being the neutral party.”

“We designed all of our business around the idea that if we try to abuse the system, we lose, too,” he said. “We don’t make money [when someone] abuses the system, we only make money when everybody plays nice.”

Turek also claimed that public domain and Creative Commons licenses are “first-class citizens” on the platform, and that many of the rightsholders using the Attribution Engine don’t necessarily want monetary compensation: “A lot of people are happy to do this for recognition. We are social animals.” (Plus, recognition can lead to moneymaking opportunities.)

Pex says the new funding will allow it to continue scaling the Attribution Engine.

“I don’t believe investments are validation,” Turek added. “I believe they’re more obligation than validation, but they do prove you are directionally correct.”

Powered by WPeMatico

In an earlier article, I wrote about how and when to build go-to-market teams at deep tech companies. There, I noted that it is more important for growth hires at deep tech companies to have functional expertise than industry expertise.

But how do deep tech companies connect and cultivate strong relationships with talented nontechnical growth people outside of their industry? In this article, I answer this question, articulating exactly how to:

Incredible growth people are independent and creative and are drawn to environments that explicitly value these traits.

Underscore the autonomy. Incredible growth people are independent and creative and are drawn to environments that explicitly value these traits. Growth talent wants to know that they have room to experiment, fail and iterate with the support and trust of their company. Highlight the creative agency you give to your growth team. Paint the role as one of managing a subset of the startup and its initiatives.

Show you are ready for a growth marketer. Do not expect your growth person to be a panacea for the company. Growth people work cross-functionally, but there are boundaries where the growth role starts and ends. Growth people cannot sell a product that is not ready. Growth people cannot fix product bugs. Growth people cannot replace excellent customer service. Ensure your role description is clear on what the growth person would do and what they would lean on other teams for. Demonstrate that you have a team structure in place where a growth marketer could fit in and thrive.

Articulate your talent needs. Growth is a broad category. Some growth marketers are more creative. Others are more quantitative. Some have more industry experience. Others have more functional experience. Be clear on what type of growth marketer you need and how this person’s talents would complement those of the existing team.

Generate excitement and establish credibility. People can naturally be skeptical about new technologies and younger companies. Do anything you can to ameliorate these concerns. Link to relevant news articles from well-known publications and thought leaders in your industry. Incorporate customer testimonials that speak to the transformative impact your product creates. Name drop well-known advisors, investors and team members.

Powered by WPeMatico

Nature’s Fynd, the food technology company with a new food offering cultivated from fungus found in the wilds of Yellowstone National Park, is releasing its first products for pre-order.

Pitching both a non-dairy cream cheese and meatless breakfast patties, Nature’s Fynd had managed to attract some serious investors, including Al Gore’s Generation Investment Management and the Bill Gates-backed investment fund, Breakthrough Energy Ventures. The company most recently raised $80 million in its last round of funding.

The company is part of a wave of innovative products using a range of bacteria, fungi and plants to create meat alternatives. Last year, companies developing meat alternatives raised well over $1 billion in financing and investors show no sign of slowing down in their commitments to the industry.

The commercial launch of the Fy Breakfast Bundle, vegan and non-GMO alternatives to traditional breakfast products, will be the first commercial test for Nature’s Fynd as it looks to go to market.

These limited release bundles are available for $14.99 plus shipping, according to the company, and the products will be available across the 48 contiguous U.S. states.

The company’s product is grown using fermentation technology to cultivate the bacteria that Nature’s Fynd’s chief scientists discovered during their research into organisms around Yellowstone National Park.

Nature’s Fynd touts the resilience and efficiency of the microbe it discovered, leading to a more sustainable production process that uses a fraction of the land, water and energy resources that traditional animal husbandry requires, the company said.

“We choose optimism so that we can find a way to do more with less. Using our novel liquid-air surface fermentation technology, we’re creating a range of sustainable foods that nourish our bodies and nurture our planet for generations to come. We’re really excited to be at the beginning of this journey with the launch of our first-ever limited release of Fy Breakfast Bundles,” said Nature’s Fynd CEO Thomas Jonas. “We’ve deeply studied our consumers and we know that Fy’s unique versatility, which delivers great tasting meat and dairy alternatives for every occasion, is highly appealing.”

Nature’s Fynd chief executive, Thomas Jonas. Image Credit: Nature’s Fynd

Powered by WPeMatico

Earlier this year, 15 top U.S. universities joined forces to launch a one-stop shop where corporations and startups can discover and license patents.

Working in concert, Brown, Caltech, Columbia, Cornell, Harvard, the University of Illinois, Michigan, Northwestern, Penn, Princeton, SUNY Binghamton, UC Berkeley, UCLA, the University of Southern California and Yale formed The University Technology Licensing Program LLC (UTLP) to create a centralized pool of licensable IP.

The UTLP arrives as more higher education institutions are beefing up their investment in the entrepreneurial pipeline to help more students launch startups after graduation. In some instances, schools serve as accelerators, providing students with resources and helping them connect with VCs to find seed funding.

To get a better look at the new program and more insight into the university-to-startup pipeline, we spoke to:

Orin Herskowitz: The UTLP effort is really much more about licensing to the somewhat broken interface between universities and very large companies in the tech space when it comes to licensing intellectual property. But I know USC and Columbia and many of our peers, especially over the last three to seven years, have pivoted in a massive way to helping our faculty students fulfill their entrepreneurial dreams and launch startups around this exciting university technology.

Orin Herskowitz: Universities have traditionally been a source of amazing, life-saving and life-improving inventions, for decades. There’s been a ton of new drugs and medical devices, cybersecurity improvements, and search engines, like Google, that have come out of universities over the years, that were federally funded and developed in the labs, and then licensed to either a startup or the industry. And that’s been great. At least over the last couple of decades, that interface has worked really, really well in some fields, but less well in others. So, in the life sciences, in energy, in advanced materials, in those industries, a lot of the time, these innovations that end up having a huge impact on society are based really on one or two or three core eureka moments. There’s like one or two patents that underlie an enormous new cancer drug, for instance.

In the tech space though, it’s a very different dynamic because, a lot of the time, these inventions are incredibly important and they do launch a whole new generation of products and services, but the problem is that a new device, like an iPhone, or a piece of software, might rely on dozens or even hundreds of innovations from across many different universities, as opposed to just one or two.

Jennifer Dyer: We’ve all had this renewed focus on innovation within the university and really helping our students and faculty that want to start companies, launch those companies. If you look at the space, helping educate our students that launching a company in a high-tech space may mean that they have to go out and acquire 100 different licenses, so maybe it doesn’t make sense. We’re going to be doing nonexclusive licensing, and it doesn’t preclude anyone from moving forward with this technology. This is probably the first pool for nonstandard essential patents in the high-tech space, which makes it somewhat unique. Because if you look back, most of the pools have been around standard essential patents.

Powered by WPeMatico

GoPuff, the U.S.-based startup that operates its own “microfulfillment” network and promises to deliver items such as over-the-counter medicine, baby food and alcohol in 30 minutes or less, is in talks to acquire the U.K.’s Fancy Delivery, TechCrunch has learned.

According to sources, terms of the acquisition are still being fleshed out, and the deal has yet to get over the line. However, an announcement could come in the next few weeks if not sooner. GoPuff declined to comment. Fancy’s founders couldn’t be reached before publication, either.

Launched late last year, Fancy currently operates in four cities in the U.K. and is a graduate of the Silicon Valley accelerator Y Combinator. It has a strikingly similar model to its potential buyer, leading some to describe it as a mini goPuff. The two companies are fully vertically integrated, meaning they each contract their own fleet of drivers and operate their own microfulfillment centres — sometimes dubbed “dark stores” — designed specifically for online ordering and hyperlocal delivery.

Strategically, the potential acquisition of Fancy looks to be a good fit, and most notably would signal goPuff’s intent to expand to the U.K. via purchasing a nascent local player rather than starting entirely from scratch. Sources tell me Fancy will continue to operate under the Fancy brand and that goPuff intends to invest in its growth, including hiring and opening additional fulfillment centers. One source tells TechCrunch the acquisition will be an all-stock deal.

GoPuff was recently valued at $3.9 billion and has raised $1.35 billion in funding to-date (backers include Accel, D1 Capital Partners, Luxor Capital and SoftBank Vision Fund). It already operates in 500 U.S. cities, and isn’t shy of making acquisitions, either, most recently purchasing alcohol-focussed BevMo.

Meanwhile, Europe is seeing a slew of startups inspired by goPuff’s vertically integrated model sprouting up. They include Berlin’s much-hyped Gorillas and London’s Dija and Weezy, and France’s Cajoo, all of which claim to focus more on fresh food and groceries, where margins are arguably tighter. There’s also the likes of Zapp, which is still in stealth and more focused on a higher-margin convenience store offering.

Powered by WPeMatico