TC

Auto Added by WPeMatico

Auto Added by WPeMatico

The only people who truly understand a relationship are the ones who are in it. Luckily for us, we’re going to have a candid conversation with both parties in the relationship between Ironclad CEO and cofounder Jason Boehmig and his investor and board member Accel partner Steve Loughlin.

Loughlin led Ironclad’s Series A deal back in 2017, making it one of his first Series A deals after returning to Accel.

This episode of Extra Crunch Live goes down on Wednesday at 3pm ET/12pm PT, just like usual.

We’ll talk to the duo about how they met, what made them ‘choose’ each other, and how they’ve operated as a duo since. How they built trust, maintain honesty, and talk strategy are also on the table as part of the discussion.

Loughlin was an entrepreneur before he was an investor, founding RelateIQ (an Accel-backed company) in 2011. The company was acquired by Salesforce in 2014 for $390 million and later became Salesforce IQ. Loughlin then “came back home” to Accel in 2016, and has led investments in companies like Airkit, Ascend.io, Clockwise, Ironclad, Monte Carlo, Nines, Productiv, Split.io, and Vivun.

Not entirely unsurprising for a man who has dominated the legal tech sphere, Jason Boehmig is a California barred attorney who practiced law at Fenwick & West and was also an adjunct professor of law at Notre Dame Law School. Ironclad launched in 2014 and today the company has raised more than $180 million and, according to reports, is valued just under $1 billion.

Not only will we peel back the curtain on how this investor/founder relationship works, but we’ll also hear from these two tech leaders on their thoughts around bigger enterprise trends in the ecosystem.

Then, it’s time for the Pitch Deck Teardown. On each episode of Extra Crunch Live, we take a look at pitch decks submitted by the audience and our experienced guests give their live feedback. If you want to throw your hat pitch deck in the ring, you can hit this link to submit your deck for a future episode.

As with just about everything we do here at TechCrunch, audience members can also ask their own questions to our guests.

Extra Crunch Live has left room for you to network (you gotta network to get work, amirite?). Networking is open starting at 2:30pm ET/11:30am PT and stays open a half hour after the episode ends. Make a friend!

As a reminder, Extra Crunch Live is a members-only series that aims to give founders and tech operators actionable advice and insights from leaders across the tech industry. If you’re not an Extra Crunch member yet, what are you waiting for?

Loughlin and Boehmig join a stellar cast of speakers on Extra Crunch Live, including Lightspeed’s Gaurav Gupta and Grafana’s Raj Dutt, as well as Felicis’ Aydin Senkut and Guideline’s Kevin Busque. Extra Crunch members can catch every episode of Extra Crunch Live on demand right here.

You can find details for this episode (and upcoming episodes) after the jump below.

See you on Wednesday!

Powered by WPeMatico

There’s always a fintech angle, even on Valentine’s Day.

This week, I covered Zeta, a new startup working on joint finances for modern couples. It aims to take away the money chores of a relationship, from splitting the bill at dinner to requesting rent through a payment app every month.

Aditi Shekar, the co-founder, gave me some notes about why the ongoing popularity of Venmo is validation for the company, instead of competition.

The success of Zeta hinges on the idea that people want to share their finances in an ongoing and meaningful way, and that the world of finance is ready to shift from individualism to collectivism earlier and louder. It sounds daunting, but we already know that social finance is big, as shown by apps like Venmo and Splitwise, and phenomena like the GameStop saga from just a few weeks ago.

Other startups have taken notice too, entering the world of multiplayer fintech, a term that categorizes socially focused and consumer-friendly financial services. Braid, a group-financing platform, is trying to make transactions work for various entities, from shared households to side hustles to creative projects.

Money is emotional and complex, and the opportunity within the multiplayer fintech reflects just that. The next wave of products will be able to straddle the line of comfort to successfully get adoption, and cultural shift to successfully deliver a truly collaborative cash experience.

(And in case that wasn’t enough Valentine’s Day content for you, here’s one more piece about a new dating app for gamers).

In the rest of this newsletter, we’ll talk about the new career path to CEO, our favorite startups from Techstars Demo Day and the latest SPAC you should probably know about. As always, you can find me on Twitter @nmasc_ or e-mail me at natasha.m@techcrunch.com. Want this in your inbox each week? Sign up here.

Data about startups is helpful to understand directional trends and how the flow of capital works and changes over time. But as ventures as an asset class grows and the documentation around raises gets thornier, the data can sometimes be missing a big chunk of what’s actually happening on the scenes.

Here’s what to know per Danny Crichton and Alex Wilhelm: PSA: most aggregate VC trend data is garbage and Are SAFEs obscuring today’s seed volume are two pieces that explain some of the reasons why the numbers might be flawed today. The good news is that the government is also in the dark about funding data; the bad news is that without good tracking, we don’t know how progress is being made.

Etc: Shameless plug for you to tip us on Secure Drop, TechCrunch’s submission system for any news you think is important to share. You can stay anonymous.

Image via Getty Images / Sadeugra

Amazon founder and CEO Jeff Bezos announced weeks ago that he was shifting into an executive chairman role and AWS CEO Andy Jassy would take over as chief executive. In this analysis, our enterprise cloud reporter Ron Miller explores the question: is overseeing cloud operations the new path to CEO?

Here’s what to know, per Andrew Bartels, an analyst at Forrester Research:

“In both cases, these hyperscale business units of Microsoft and Amazon were the fastest-growing and best-performing units of the companies. [ … ] In both cases, cloud infrastructure was seen as a platform on top of which and around which other cloud offerings could be developed,” Bartels said. The companies both believe that the leaders of these two growth engines were best suited to lead the company into the future.

Etc: Ember names former Dyson head as consumer CEO as the startup looks beyond the smart mug, and Monzo, the British challenger bank nearing 5 million customers, has recruited a new US CEO.

Image Credits: Amazon / Microsoft

TechCrunch covered favorites from Techstars’ three Demo Days, which were focused on Chicago, Boston and workforce development. Make sure to dig into the startups yourself to form your own opinions, but if you care what stood out to us, here’s what we ended up with.

Here’s what to know: The reason I love Demo Days is that it’s a fast way to understand what the next wave of startups and entrepreneurs are thinking about. In this year’s cohorts, we saw an exclusive sneaker marketplace, flexible life insurance and a part-time childcare platform that helps parents cover random gaps in their childcare schedule.

Etc: Without desks and a demo day, are accelerators worth it?

Image Credits: Paper Boat Creative (opens in a new window) / Getty Images

Archer Aviation, the electric aircraft startup targeting the urban air mobility market, is teaming up with United Airlines to become a publicly traded company via, you guessed it, a SPAC.

Here’s what to know per Kirsten Korosec, our transportation editor:

The agreement to go public and the order from United Airlines comes less than a year after Archer Aviation came out of stealth. Archer was co-founded in 2018 by Adam Goldstein and Brett Adcock, who sold their software-as-a-service company Vettery to The Adecco Group for more than $100 million. The company’s primary backer was Lore, who sold his company Jet.com to Walmart in 2016 for $3.3 billion. Lore was Walmart’s e-commerce chief until January.

Etc: Bumble priced and Nigeria’s IROKO plans to go public on the London Stock Exchange.

Use cloud foam to dollar sign

Seen on TechCrunch

Seen on Extra Crunch

SoftBank earnings always give key insights about how a heavyweight in venture capital is performing (and the bonanza always comes with a healthy share of content and memes). This week on Equity, we couldn’t resist nerding out about it:

Of course, if SoftBank isn’t your jam, there was a whole host of other news we chatted about, from Reddit’s latest raise to DoorDash buying a salad robot. Listen here.

Until next week,

Powered by WPeMatico

Welcome back to This Week in Apps, the weekly TechCrunch series that recaps the latest in mobile OS news, mobile applications and the overall app economy.

The app industry is as hot as ever, with a record 218 billion downloads and $143 billion in global consumer spend in 2020.

Consumers last year also spent 3.5 trillion minutes using apps on Android devices alone. And in the U.S., app usage surged ahead of the time spent watching live TV. Currently, the average American watches 3.7 hours of live TV per day, but now spends four hours per day on their mobile devices.

Apps aren’t just a way to pass idle hours — they’re also a big business. In 2019, mobile-first companies had a combined $544 billion valuation, 6.5x higher than those without a mobile focus. In 2020, investors poured $73 billion in capital into mobile companies — a figure that’s up 27% year-over-year.

This week, we’re taking a look at the Bumble IPO, app store subscription revenue and talk to a developer on a crusade against the fake ratings plaguing the App Store. We’re also checking in on the missing Google privacy labels…with a spreadsheet of all 100 apps.

This Week in Apps will soon be a newsletter! Sign up here: techcrunch.com/newsletters.

Bumble, the dating app positioned as one of Tinder’s biggest rivals, began trading on public markets on Thursday. The company priced its shares at $43, above its earlier target range of $37 to $39. But once live, BMBL began trading up nearly 77% at $76 per share on Nasdaq, closing the day with a market cap of $7.7 billion and the stock at $70.55.

The app itself was founded in 2014 by early Tinder exec Whitney Wolfe Herd, who now, at 31, is the youngest woman founder to take a U.S. company public and, thanks to the IPO, the world’s youngest self-made woman billionaire, as well, said Fortune.

Wolfe Herd successfully leveraged her knowledge of the online dating market, then combined that with an understanding of how to position a dating app to make it more appealing to women.

On Bumble, women message first, for example, and the company often touts features and updates designed to protect women from bad actors. A lot of what Bumble does is just marketing and spin overlaid on the Tinder model. Like other dating apps, Bumble uses a similar format to connect potential matches: a swipeable “people catalog,” where users look at photos, primarily, to determine interest. Bumble, like others, also makes money by charging for extra features that give users a better shot or more efficient experience.

But all this works because users believe Bumble to be different. They believe Bumble is also capable of delivering higher-quality matches than Tinder, which has increasingly re-embraced its persona as a hook-up app.

The IPO’s success also sends a signal that investors are expecting in-person dating to rebound post-pandemic, and getting in early on the next big mass market dating app is an easy win.

Developer Kosta Eleftheriou, a Fleskly co-founder, has been on a crusade against the scammy and spammy apps overrunning the App Store, as well as Apple’s failure to do much about it.

Earlier this month, Kosta complained that copycat apps were undermining his current business, as the developer of an Apple Watch keyboard app, FlickType. Shady clones boosted by fake ratings and reviews promised the same features as his legit app, but then locked their customers into exorbitant subscriptions, earning the scammers hundreds of thousands per month.

In his eyes, the problem wasn’t just that clones existed, but that Apple’s lack of attention to fake reviews made those apps appear to be the better choice.

Although Apple finally removed most of his fraudulent competitors after his rants gained press attention, he’s frustrated that the system was so broken in the first place.

This week, Kosta returned with another Twitter thread detailing the multimillion-dollar scams that pretend to be the best Roku remote control app. One app, “Roku Remote Control – Roki,” for example, had a 4.5 stars across 15K+ ratings. The app was a free download, but immediately tries to lock users into a $4.99/week subscription or a lifetime payment of $19.99. However, the app offers a “buggy, ad-infested, poorly designed” experience, Kosta says.

He then used AppFigures to see only those reviews of the Roki app that also had text. When displayed like this, it was revealed that “Roki” was really just a 1.7-star app, based on consumers who took the time to write a review.

What’s worse, Kosta has also argued, that even when Apple reacts by removing a bad actor’s app, it will sometimes allow the developer to continue to run other, even more profitable scams.

Kosta says he decided to spearhead a campaign about App Store scams to “get the word out about how all these scams manage to sustain themselves through a singular common flaw in the App Store — one that has been broken for years.”

He also notes that although Apple responded to him, he believes the company is hoping for the story to blow over.

“The way Apple tried to communicate with me also didn’t help ease my concern — they either don’t get it, or are actively trying to let the story fizzle out through some token gestures. But what they need to do first and foremost, is acknowledge the issue and protect their customers,” Kosta told TechCrunch.

One potential argument here is that because Apple financially benefits from successful subscription app scams, it’s not motivated to prioritize work that focuses on cleaning up the App Store or fake ratings and reviews. But Kosta believes Apple isn’t being intentionally malicious in an effort to grow the subscription business, it’s just that fake App Store reviews have become “a can that’s been perpetually kicked down the road.” Plus, since Apple touts the App Store as a place users can trust, it’s hard for them to admit fault on this front, he says.

Since the crusade began, Kosta has heard from others developers who have sent him examples “dozens and dozens of scams.”

“I will just keep exposing them until Apple acknowledges the problem,” he says.

Apps saw record downloads and consumer spending in 2020, globally reaching somewhere around $111 billion to $112 billion, according to various estimates. But a growing part of that spend was subscription payments, a report from Sensor Tower indicates. Last year, global subscription app revenue from the top 100 subscription apps (excluding games), climbed 34% year-over-year to $13 billion, up from $9.7 billion in 2019.

The App Store, not surprisingly, accounted for a sizable chunk of this subscription revenue, given it has historically outpaced the Play Store on consumer spending. In 2020, the top 100 subscription apps worldwide generated $10.3 billion on the App Store, up 32% over 2019, compared with $2.7 billion on Google Play, which grew 42% from $1.9 billion in 2019. (Read more here.)

Google said it would update its iOS apps with privacy labels weeks ago. While it did roll out some, it has yet to update top apps with Apple’s new labels, including key apps like the Google search app, Google Pay, Google Assistant, Google One, Google Meet, Google Photos, Google Calendar, Google Maps, Google News, Google Drive, Gmail and others. (Keep track of this with me here. Want to help? Email me.)

Overall, the majority of Google’s apps don’t have labels. While Google probably needed some time (and a lot of lawyers) to look this over, it’s now super late to put its labels out there. At this point, its iOS apps are out of date — which Google accidentally alerted users to earlier this week. This is awful optics for a company users already don’t trust, and a win for Apple as a result. (Which, of course, means we need to know for sure that Apple isn’t delaying Google’s submissions here…)

Still, Google had time to get this done. Its December code freeze is long over, and everyone else, for the most part, has gotten on board with the new labels. Why can’t Google?

Apple may soon allow users to set a different default music service. The company already opened up the ability to choose a different default browser and email app, but now a new feature in the iOS 14.5 beta indicates it may allow users to set another service, like Spotify, as the default option when asking Siri to play tunes. This, however, could be an integration with HomePod and Siri voice control support in mind, rather than something as universal as switching from Mail app to Gmail.

Apple Maps to gain Waze-like features for reporting accidents, hazards and speed traps. Another new feature in the iOS 14.5 beta will allow drivers to report road issues and incidents by using Siri on their iPhone or through Apple’s CarPlay. For example, during navigation, they’ll be able to tell Siri things like “there’s a crash up head,” “there’s something on the road,” or “there’s a speed trap here.”

Apple tests a new advertising slot on the App Store. Users of Apple’s new iOS 14.5 beta have reported seeing a new sponsored ad slot that appears on the Search tab of the App Store, under the “Suggested” heading (the screen that shows before you do a search). The ad slot is also labeled “Ad” and is a slightly color to differentiate it from the search results. It’s unclear at this time if Apple is planning to launch the ad slot or is just testing it.

The App Store announces price changes for Cameroon, Zimbabwe, Germany and the Republic of Korea.

Apple alerts developers to Push Notification service server certificate update, taking place on March 29, 2021.

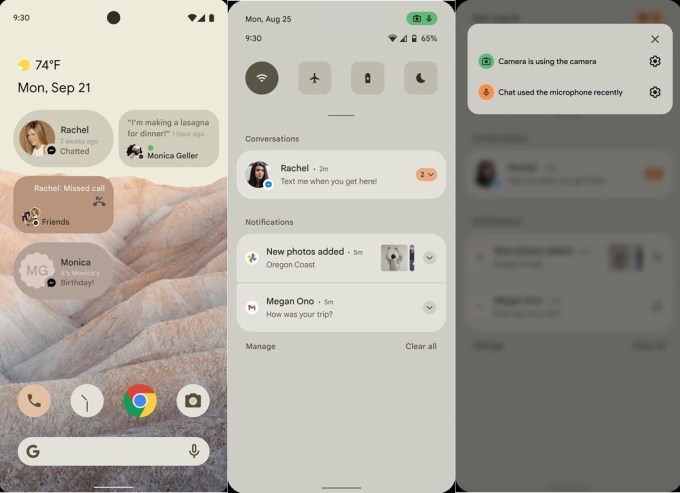

Image Credits: XDA Developers

Alleged Android 12 screenshots snagged from an early draft document by XDA Developers show Google could be borrowing some ideas from Apple’s iOS for its next update. One feature may put colored dots in the status bar to indicate when the camera or microphone are being accessing, for example. Users may also be able to toggle off their camera, microphone or location access entirely. Google may also add a “conversations” widget to show recent messages, calls and activity statuses, among other things.

Google bans data broker Predicio that was selling user data collected from a Muslim prayer app to Venntel, a government contractor that sells location data from smartphones to ICE, CBP and the FBI, following a Motherboard investigation. Google alerted developers they had a week to remove the SDK from their apps or they’d be removed from Google Play.

Google updated its instructor-led curriculum for Android Development with Kotlin, a major update for the course materials that were first released in 2018. The new materials are designed for either in-person or virtual learning, where educators combine lectures and codelabs.

Google briefly notified users that their Google iOS apps were “out of date” — an embarrassing mistake that was later corrected server-side. The bug arrived at a time when Google has yet to have updated its privacy labels for many of its largest apps, including Google, Gmail, Assistant, Maps, Photos and others.

Apple released a new iOS app, For All Mankind: Time Capsule, to promote its Apple TV+ series, “For All Mankind.” The app was built using Apple’s ARKit framework, offering a new narrative experience told in AR format featuring the show’s star. In the app, users join Danny as he examines keepsakes that connect to stories about impacting events in the lives of his parents, Gordo and Tracy Stevens, in the alternative world of the TV show.

TikTok is expanding its e-commerce efforts. The company told marketers it’s planning a push into livestreamed e-commerce, and will also allow creators to share affiliate links to products, giving them a way to earn commissions from their videos. The company also recently announced a partnership with global ad agency WPP that will give WPP agencies and clients early access to TikTok ad products. It will also connect top creators with WPP for brand deals.

TikTok is expanding its e-commerce efforts. The company told marketers it’s planning a push into livestreamed e-commerce, and will also allow creators to share affiliate links to products, giving them a way to earn commissions from their videos. The company also recently announced a partnership with global ad agency WPP that will give WPP agencies and clients early access to TikTok ad products. It will also connect top creators with WPP for brand deals.

The Single Day Shopping festival drove high mobile usage. Consumers spent 2.3 billion hours in Android shopping apps during week of November 8-15, 2020, reports App Annie.

Image Credits: AaronP/Bauer-Griffin/GC Images

TikTok’s sale of its U.S. operations to Oracle and Walmart is shelved. The Biden administration undertook a review of Trump’s efforts to address security risks from Chinese tech firms, including the forced sale of TikTok’s U.S. operations. The Trump administration claimed TikTok was a national security threat, and ordered TikTok owner ByteDance to divest its U.S. operations if it wanted to continue to operate in the country. Several large tech companies stepped up to the plate to take on the potential windfall. But Biden’s review of the agency action puts Trump’s plan on an indefinite pause. As a result, the U.S. government will delay its appeal of of federal district court judge’s December 2020 injunction against the TikTok ban. Discussions between U.S. national security officials and ByteDance are continuing, however.

TikTok’s sale of its U.S. operations to Oracle and Walmart is shelved. The Biden administration undertook a review of Trump’s efforts to address security risks from Chinese tech firms, including the forced sale of TikTok’s U.S. operations. The Trump administration claimed TikTok was a national security threat, and ordered TikTok owner ByteDance to divest its U.S. operations if it wanted to continue to operate in the country. Several large tech companies stepped up to the plate to take on the potential windfall. But Biden’s review of the agency action puts Trump’s plan on an indefinite pause. As a result, the U.S. government will delay its appeal of of federal district court judge’s December 2020 injunction against the TikTok ban. Discussions between U.S. national security officials and ByteDance are continuing, however.

Facebook is said to be building its own Clubhouse rival. Mark Zuckerberg made a brief appearance on Clubhouse earlier this month, which now seems more like a reconnaissance mission, if The NYT’s report is true. Facebook will have to tread lightly, given its still under regulatory scrutiny for anticompetitive practices, which included cloning and acquiring its competition.

Facebook is said to be building its own Clubhouse rival. Mark Zuckerberg made a brief appearance on Clubhouse earlier this month, which now seems more like a reconnaissance mission, if The NYT’s report is true. Facebook will have to tread lightly, given its still under regulatory scrutiny for anticompetitive practices, which included cloning and acquiring its competition.

Microsoft reportedly approached Pinterest about an acquisition of the $51 billion social media platform, but those talks are no longer active.

Microsoft reportedly approached Pinterest about an acquisition of the $51 billion social media platform, but those talks are no longer active.

TikTok partnered with recipe app Whisk to add a way for users to save recipes featured in TikTok videos. The feature is currently in pilot testing with select creators.

Mark Cuban is co-founding a new podcast app, Fireside. The Shark Tank star and investor has teamed up with Falon Fatemi, who sold customer intelligence startup Node to SugarCRM last year. Fireside is basically Clubhouse, but adds the ability to export live conversations as podcasts.

TikTok expands its Universal Music Group deal just days after UMG pulled its song catalog from Triller, saying the app was withholding artist payments.

Indian firm ShareChat will integrate Snapchat’s Camera Kit technology into its Moj app to enable AR features. The move will give Snap a foothold in a key emerging market.

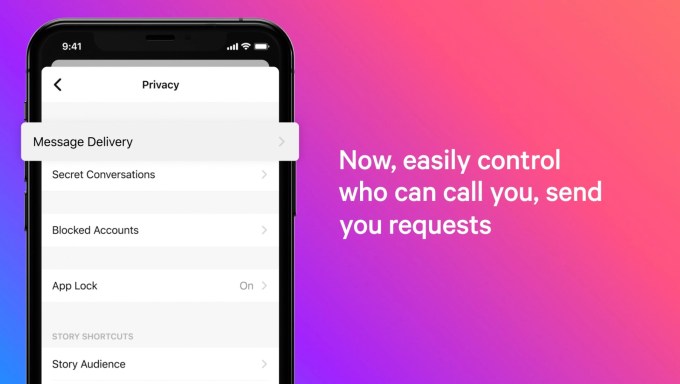

Instagram said it will impose stricter penalties against those who send abusive messages, including account bans, and develop new controls to reduce the abuse people see in their DMs. The announcement followed a recent bout of racist abuse targeted at footballers in the U.K. A joint statement from Everton, Liverpool, Manchester United and Manchester City condemned the abuse, saying “there is no room for racism, hate or any form of discrimination in our beautiful game.”

Instagram tells creators that it won’t promote their recycled TikToks. The company announced via its @creators account a set of best practices for Reels, noting that those featuring a watermark or logo (which TikTok smartly attaches to its content), won’t be recommended frequently on Instagram’s platform. Of course, TikTok creators are already circulating videos with tips about how to cut out the logo from TikTok videos by first exporting the video as a Live Photo, then going to their iOS Photos app, clicking on the Live Photo and choosing “Save as Video.” Problem solved.

Image Credits: Google

Google Photos for Android adds previously Pixel-only features — but only if users subscribe to Google One. The paywalled features include machine learning-powered editing tools like Portrait Blur, Portrait Light and Color Pop. There’s also a new video editor on iOS with an Android update planned. The editor now lets you crop, change perspective, add filters, apply granular edits (including brightness, contrast, saturation and warmth) and more.

Adobe adds collaboration and asynchronous editing to Photoshop, Illustrator and Fresco. The update will be supported across platforms, including desktop, iPad and iPhone.

Waze adds Audible to its list of in-app audio players. The integration allows you to easily play your audiobooks while driving. Waze already supported in-app music integrations, like YouTube Music and Spotify, thanks to developer integrations with the Waze Audio Kit.

HBO Max is going international. The app will be expanded to 39 Latin American and Caribbean territories in June, replacing the existing HBO GO app.

Picture-in-picture mode returned to YouTube on iOS with the launch of the iOS 14.5 beta.

Facebook Messenger added a new feature that makes it easier to block and mass-delete Message Requests from people you don’t know. It also said it’s working on new ways to report abuse and providing better feedback on the status of those reports.

The Biden administration pauses the Trump ban on WeChat. The administration asked a federal appeals court to place a hold on proceedings over the WeChat a day after it asked for a similar delay over the TikTok case, saying it needed time to review the previous administration’s efforts, which are now in the appeals stage.

NHS Covid-tracing app has prevented 600,000 infections in England and Wales, researchers estimated in one of the first studies of smartphone-based tracing. The app used the tracing system built by Apple and Google.

The Robinhood backlash hasn’t stopped the downloads. Many users downrated the app after it halted meme stock trading earlier this month — a move that’s now under Congressional investigation and has prompted multiple lawsuits. But the app continues to receive downloads. The day after it halted trades was its second-largest by downloads ever, and downloads remained high in the days that followed. In January 2021, the app was installed 3.7 million times in the U.S., or 4x the installs of January 2020.

Image credits: Thomas Trutschel/Photothek via Getty Images

The Chinese government blocked Clubhouse, which had been rapidly gaining attention in the country. The app itself had only briefly been made available in Apple’s China App Store last fall, but those had it installed could access its audio chat rooms without a VPN. Prior to the ban, a group discussing the 1989 pro-democracy Tiananmen protest reached 5,000 participants — the max number of participants Clubhouse supports.

A new North Dakota Senate bill proposes to ban app stores like Apple and Google from requiring developers to exclusively use their store and payment mechanisms to distribute apps, and would prevent them from retaliating, at the risk of fines. Apple’s Chief Privacy Engineer Erik Neuenschwander said the bill “threatens to destroy the iPhone as you know it,” and that Apple succeeds because it “works hard to keep the bad apps out of the App Store.”

The Coalition for App Fairness (CAF) announced that Meghan DiMuzio has now joined as its first executive director. The advocacy group fighting against app store anticompetitive behavior is made up of over 50 members, including Spotify, Tile, Basecamp, Epic Games and others.

The U.S. House of Representatives Committee on Energy and Commerce has asked Apple to improve the credibility of App Store privacy labels, so consumers aren’t harmed. The request was made after an investigation by The Washington Post revealed that many labels were false, leading to questions as to whether the labels could be trusted at all.

Apple will begin to proxy Google’s “Safe Browsing” service used by Safari through its own servers starting with iOS 14.5. Safari on iPhone and iPad includes a “Fraudulent Website Warning” feature that warns users if they’re visiting a possible phishing site. The feature leverages Google’s “Safe Browsing” database and blocklist. Before, Google may have collected user’s IP address during its interaction with Safari, when the browser would check the website URL against Google’s list. Now, Apple will proxy the feature through Apple’s own servers to limit the risk of information leaks. The change was reported by The 8-bit, MacRumors and others, after a Reddit sighting, and confirmed by Apple’s head of Engineering for WebKit.

A generically named app “Barcode Scanner” on the Google Play Store had been operating as a legit app for years before turning into malware. Users of the app, which had over 10 million installs, began to experience ads that would open their browser out of nowhere. The malware was traced to the app and Google removed it from the Play Store. Unfortunately, users review-bombed a different, innocent app as a result, leaving it 1-star reviews and accusing it of being malware.

Google Chrome’s iOS app is testing a feature that would lock your Incognito tabs with either Touch ID or Face ID to add more security to the browser app.

Google Fi VPN for Android exits beta and expands to iPhone. The VPN app, designed for Google Fi users, is meant to encrypt connections when on public Wi-Fi networks or when using sites that don’t encrypt data. Users, however, question the privacy offered by VPN from Google.

Twitter said the iOS 14 privacy update will have a “modest impact” on its revenue. The companies joins others, including Facebook and Snap, in saying that Apple is impacting their business’s monetization.

Quilt, a “Clubhouse” focused self-care, raised $3.5 million seed round led by Mayfield Fund. The app has a similar format to audio social network, Clubhouse, but rooms are dedicated less to hustle culture and more to wellness, personal development, spirituality, meditation, astrology and more.

Quilt, a “Clubhouse” focused self-care, raised $3.5 million seed round led by Mayfield Fund. The app has a similar format to audio social network, Clubhouse, but rooms are dedicated less to hustle culture and more to wellness, personal development, spirituality, meditation, astrology and more.

Match Group, owner of dating apps like Match and Tinder, will buy Korean social media company Hyperconnect for $1.73 billion. The company runs two apps, Azar and Hakuna Live, both which focus on video, including video chats and live broadcasts.

Match Group, owner of dating apps like Match and Tinder, will buy Korean social media company Hyperconnect for $1.73 billion. The company runs two apps, Azar and Hakuna Live, both which focus on video, including video chats and live broadcasts.

Electronic Arts buys Glu Mobile, maker of the “Kim Kardashian: Hollywood” mobile game in a $2.4 billion deal. The all-cash deal will also bring other games, like “Diner Dash” and “MLB Tap Sports Baseball” to EA, which said it made the acquisition because mobile is the “fastest-growing platform on the planet.”

Electronic Arts buys Glu Mobile, maker of the “Kim Kardashian: Hollywood” mobile game in a $2.4 billion deal. The all-cash deal will also bring other games, like “Diner Dash” and “MLB Tap Sports Baseball” to EA, which said it made the acquisition because mobile is the “fastest-growing platform on the planet.”

French startup Powder raised $12 million for its social app for sharing clips from your favorite games, and follow others with the same interests. The app can capture video content from both desktop and mobile games.

French startup Powder raised $12 million for its social app for sharing clips from your favorite games, and follow others with the same interests. The app can capture video content from both desktop and mobile games.

Reddit’s valuation doubled to $6 billion after raising $250 million in a late-stage funding round led by Vy Capital, following the r/WallStreetBets and GameStop frenzy. The company was previously valued at $3 billion, and is also backed by Andreessen Horowitz and Tencent Holdings Ltd.

Reddit’s valuation doubled to $6 billion after raising $250 million in a late-stage funding round led by Vy Capital, following the r/WallStreetBets and GameStop frenzy. The company was previously valued at $3 billion, and is also backed by Andreessen Horowitz and Tencent Holdings Ltd.

SplashLearn raised $18 million for its game-based edtech platform. The startup offers math and reading courses for Pre-K through 5th grade, and over 4,000 games and interactive activities.

SplashLearn raised $18 million for its game-based edtech platform. The startup offers math and reading courses for Pre-K through 5th grade, and over 4,000 games and interactive activities.

Goody raised $4 million for its mobile app that lets you send gifts to friends, family and other loved ones over a text message. The other user can then personalize the gift and share their address, if you don’t have that information.

Goody raised $4 million for its mobile app that lets you send gifts to friends, family and other loved ones over a text message. The other user can then personalize the gift and share their address, if you don’t have that information.

VerSe Innovation, the Bangalore-based parent firm of news and entertainment app Dailyhunt and short video app Josh, a TikTok rival, raised over $100 million in Series H round led by Qatar Investment Authority and Glade Brook Capital Partners. The round turns the company into a unicorn.

VerSe Innovation, the Bangalore-based parent firm of news and entertainment app Dailyhunt and short video app Josh, a TikTok rival, raised over $100 million in Series H round led by Qatar Investment Authority and Glade Brook Capital Partners. The round turns the company into a unicorn.

Tickr, an app that lets U.K. consumers make financial investments based on their impact to society and the environment, raised $3.4 million in a round led by Ada Ventures, a VC firm focused on impact startups.

Tickr, an app that lets U.K. consumers make financial investments based on their impact to society and the environment, raised $3.4 million in a round led by Ada Ventures, a VC firm focused on impact startups.

Huuuge Inc., a developer of free-to-play mobile casino games, raised $445 million in its IPO in Warsaw, becoming Poland’s largest-ever gaming industry listing.

Huuuge Inc., a developer of free-to-play mobile casino games, raised $445 million in its IPO in Warsaw, becoming Poland’s largest-ever gaming industry listing.

Uptime, an educational app that offers 5-minute bits of insight from top books and courses, raised a $16 million “seed” round led by Tesco CEO Sir Terry Leahy; entrepreneur and chairman of N Brown, David Alliance; and members of private equity firm Thomas H Lee.

Uptime, an educational app that offers 5-minute bits of insight from top books and courses, raised a $16 million “seed” round led by Tesco CEO Sir Terry Leahy; entrepreneur and chairman of N Brown, David Alliance; and members of private equity firm Thomas H Lee.

Modern Health, a mental health services provider for businesses to offer to their employees, raised $74 million, valuing its business at $1.17 billion. The Modern Health mobile app assesses each employee’s need and then provide care options.

Modern Health, a mental health services provider for businesses to offer to their employees, raised $74 million, valuing its business at $1.17 billion. The Modern Health mobile app assesses each employee’s need and then provide care options.

Scalarr raised $7.5 million to fight mobile ad fraud. The company offers products to detect ad fraud before an advertiser bids and other tools used by ad exchanges, demand-side platforms, and supply-side platforms.

Scalarr raised $7.5 million to fight mobile ad fraud. The company offers products to detect ad fraud before an advertiser bids and other tools used by ad exchanges, demand-side platforms, and supply-side platforms.

Dublin-based food ordering app Flipdish, a Deliveroo rival, raised €40 million from global investment firm Tiger Global Management. The app offers a lower commission than other delivery rivals and is even testing drone delivery with startup Manna Aero.

Dublin-based food ordering app Flipdish, a Deliveroo rival, raised €40 million from global investment firm Tiger Global Management. The app offers a lower commission than other delivery rivals and is even testing drone delivery with startup Manna Aero.

Jackpot, an NYC-based lottery ticket app, raised $50 million Series C. The app allows users to play the lottery games in nine different states, including Arkansas, Colorado, Minnesota, New Hampshire, New Jersey, New York, Ohio, Oregon, Texas and Washington, D.C.

Jackpot, an NYC-based lottery ticket app, raised $50 million Series C. The app allows users to play the lottery games in nine different states, including Arkansas, Colorado, Minnesota, New Hampshire, New Jersey, New York, Ohio, Oregon, Texas and Washington, D.C.

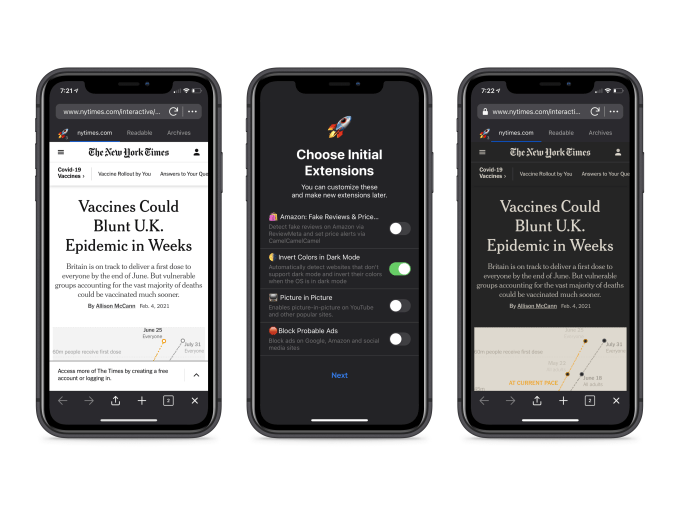

Image Credits: Insight

A new startup called Insight is bringing web browser extensions to the iPhone, with the goal of delivering a better web browsing experience by blocking ads and trackers, flagging fake reviews on Amazon, offering SEO-free search experiences or even calling out media bias and misinformation, among other things. These features are made available by way of the browser’s “extensions,” which work by way of a “sub-tab” workflow where you navigate using swiping gestures. For example, when online shopping, you could view the product you’re interested in, then swipe over to see the available coupons, the trusted product reviews or to comparison shop across other sites.

The app is a free download on iOS.

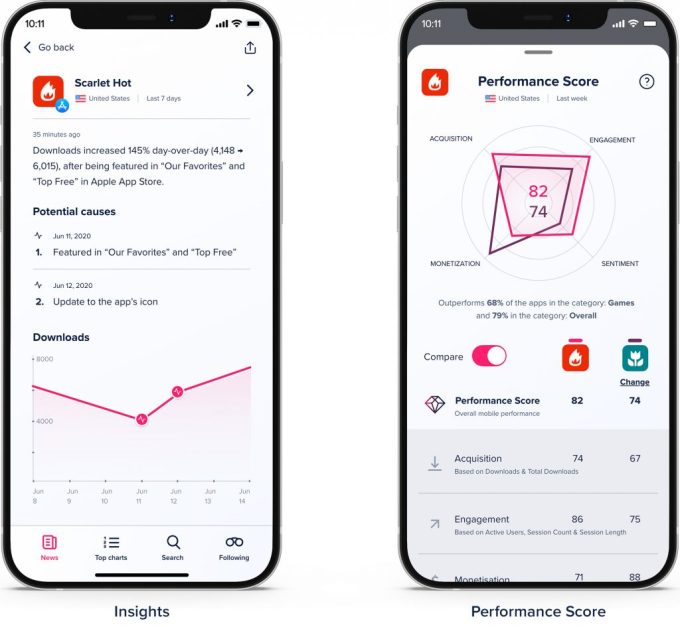

Image Credits: App Annie

App Annie’s new app Pulse is aimed not at the more advanced analyst or marketer immersed in data, but rather at the executive who wants a “more elevated, top-down view” of the app ecosystem, TechCrunch reported. The app offers easy access to the app stores’ top charts, plus tools for tracking apps, and a news feed highlighting recent trends. Another feature, the App Annie Performance score, which aims to distill user acquisition, engagement, monetization and sentiment into a single benchmark.

The app is currently iOS-only.

Powered by WPeMatico

Even though Kevin Busque is a co-founder of TaskRabbit, he didn’t get the response he was hoping for the first time he pitched his new venture to Felicis Ventures’ Aydin Senkut. Nonetheless, he said the outcome was one of the best things that could have happened.

“I’m kind of glad that he didn’t invest at the time because it really forced me to take a hard look at what we were doing and really enabled us to become Guideline,” said Busque. “That seed round was an absolute slog. I think I spent seven or eight months trying to raise a round for a product that didn’t exist, going purely on vision.”

Eventually, that idea evolved into Guideline, which describes itself as “a full-service, full-stack 401(k) plan” for small businesses. Eventually, Senkut did write a check — Felicis led Guideline’s $15 million Series B round. Today, Guideline has more than 16,000 businesses across 60+ cities, with more than $3.2 billion in assets under management. The company has raised nearly $140 million.

This week on Extra Crunch Live, Busque and Senkut discussed Guideline’s Series B pitch deck — which Senkut described as a “role model” — and how they built trust over time.

The duo also offered candid, actionable feedback on pitch decks that were submitted by Extra Crunch Live audience members. (By the way, you can submit your pitch deck to be featured on a future episode using this link right here.)

We’ve included highlights below as well as the full video of our conversation.

We record new episodes of Extra Crunch Live each Wednesday at 12 p.m. PST/3 p.m. EST/8 p.m. GMT. Check out the February schedule here.

Senkut and Busque met nearly a decade ago, when Busque was still at TaskRabbit. Several years later, Busque launched out on his own and went fundraising for his original idea. Even though he got a no from Senkut, it wasn’t an easy decision.

Looking back, Senkut said he had much more freedom to follow his instincts while angel investing.

“As an institutional fund with LPs, we were feeling the pressure of checking all the checkmarks,” explained Senkut. “It’s amazing how, sometimes, being more structured or analytical actually does not always lead you to make better decisions.”

When Busque came back around after the pivot, looking to raise a Series B, Senkut called it a “no-brainer,” particularly because of the type of CEO Busque is.

“My opinion of Kevin as a person is that he’s an excellent wartime CEO, but also he’s a product visionary,” said Senkut. “We call them ‘missionary CEOs.’ There are mercenary CEOs who can extract every ounce of dollar from a rock, but we are gravitating much more toward CEOs like Kevin who are focused on product first. People who have a really acute vision of what the problem is, and. a very specific vision for how to solve that problem and ultimately turn it into a long-term scalable and successful company.”

Busque said he was drawn to Senkut based on his level of conviction, explaining that Senkut doesn’t always have to go by the book.

“If he wants to write a check because the founder is great or the product is great, he does it,” said Busque. “It’s not necessarily that he has to see a certain metric or growth pattern.”

Obviously, years of staying connected and communicating (and not just about Guideline) laid the foundation for building a relationship. Busque said the honesty in their conversations, including Senkut’s initial rejection, lended itself greatly to the trust they have.

Powered by WPeMatico

Remote-first startups were still controversial in Silicon Valley when we launched Extra Crunch two years ago today. Back then, if you can recall, the rest of the world was not even sure how all those unicorns were going to do on the public markets.

Today, Silicon Valley resides on the cloud and is publicly traded. We’ve covered the stunning changes, and as we help founders navigate the path from idea to first check to IPO, we also tripled the number of Extra Crunch members.

Take 20% off the price of a 2-year Extra Crunch membership

Offer expires Monday, February 15, 2021

Now, as the world glimpses a brighter, post-pandemic future, we are doubling down on the news and analysis that’s helped many early-stage companies make better decisions.

As Extra Crunch enters its third year, we’re putting our foot on the gas so we can bring you more:

We’ll also publish more articles with inside tips from industry experts to help you solve nonsoftware problems that face every company, like fundraising, growth and hiring, as well as deep dives into different industry sectors and pre-public companies.

We’re tying all of these efforts back in with the editorial coverage and event plans at TechCrunch. And to make this holistic approach truly successful, we’re ramping up efforts to engage and expand the Extra Crunch community.

In recent weeks, reporters and editors have appeared on Clubhouse and Discord to discuss their work with readers. We’re planning to expand this outreach, so stay tuned!

To show our appreciation for your support, we’re offering a 20% discount on two-year subscriptions through Monday, February 15 to celebrate our second anniversary. If you’re already a member, you can renew at a discount.

If you’re not a Extra Crunch member yet, we hope you’ll join us.

Powered by WPeMatico

Five years ago I landed the Solar Impulse 2 in Abu Dhabi after flying around the globe powered solely by solar energy, a first in aviation history.

It was also a milestone in energy and technology history. Solar Impulse was an experimental plane, weighing as little as a family car and using 17,248 solar cells. It was a flying laboratory, full of groundbreaking technologies that made it possible to produce renewable energy, store it and use it when necessary in the most efficient manner.

The time has come to use technology again to address the climate crisis affecting us all. As we enter the most crucial decade of climate action — and most likely our last chance to limit global warming to 1.5°C — we need to ensure that clean technologies become the only acceptable norm. These technologies exist now and they can be profitably implemented at this crucial moment.

Hundreds of clean tech solutions exist that protect the environment in a profitable way,

Here are just four innovations from our solar-powered plane that the market can start using now before it’s too late.

The building sector is one of the largest energy consumers in the world. Next to a reliance on carbon-heavy fuels for heating and cooling, poor insulation and associated energy loss are among the main reasons.

Inside Solar Impulse’s cockpit, insulation was crucial for the plane to fly at very high altitudes. Covestro, one of our official partners, developed an ultra-lightweight and insulating material. The cockpit insulation performance was 10% higher than the standards at the time because the pores in the insulating foam were 40% smaller, reaching a micrometer scale. Thanks to its very low density of fewer than 40 kilograms per cubic meter, the cockpit was ultra-lightweight.

This technology and many others exist. We now need to ensure that all market players are motivated to make hyperefficient building insulation their standard operating procedure.

Solar Impulse was first and foremost an electric airplane when it flew 43,000 km without a single drop of fuel. Its four electric motors had a record-beating efficiency of 97%, far ahead of the miserable 27% of standard thermal engines. This means that they only lost 3% of the energy they used versus 73% for combustion propulsion. Today, electric vehicle sales are soaring. According to the International Energy Agency, when Solar Impulse landed in 2016, there were approximately 1.2 million electric cars on the road; the figure has now risen to over 5 million.

Nevertheless, this acceleration is far from enough. Power sockets are still far from replacing petrol pumps. The transport sector still accounts for one-quarter of global energy-related CO2 emissions. Electrification must happen much more quickly to reduce CO2 emissions from our tailpipes. To do so, governments need to boost the adoption of electric vehicles through clear tax incentives, diesel and petrol engine bans, and major infrastructure investments. 2021 should be the year that puts us on a one-way road to zero-emission vehicles and puts thermal engines in a dead end.

To fly for several days and nights, reaching a theoretically endless flight potential, Solar Impulse relied on batteries that stored the energy collected during the day and used it to power its engines during the night.

What was made possible with Si2 on a small scale should guide the way to future-proofing power-generation systems that are made up entirely of renewable energy. In the meantime, microgrids, like those used in Si2, could benefit off-grid systems in remote communities or energy islands, allowing them to abolish diesel or other carbon-heavy fuels already today.

On a larger scale, we are looking at smart grids. If all “stupid grids” were replaced by smart grids, it would allow cities, for example, to manage production, storage, distribution and consumption of energy and to cut peaks in energy demand that would reduce CO2 emissions dramatically.

Solar Impulse’s philosophy was to save energy instead of trying to produce more of it. This is why the relatively small amount of solar energy we collected became enough to fly day and night. All the airplane parameters, including wingspan, aerodynamics, speed, flight profile and energy systems, had therefore been designed to minimize energy loss.

Unfortunately, this approach still stands out against the inefficiency of most of our energy use today. Even though the IEA found energy efficiency improved by an estimated 13% between 2000 and 2017, it is not enough. We need bolder action by policymakers to encourage investors. One of the best ways to do so is to put strict energy efficiency standards in place.

For example, California has set efficiency standards on buildings and appliances, such as consumer electronics and household appliances, estimated to have saved consumers more than $100 billion in utility bills. These measures are as good for the environment as they are for the economy.

When we used all these different innovations to build Solar Impulse, they were groundbreaking and futuristic. Today, they should define the present; they should be the norm. Next to the technologies mentioned above, hundreds of clean tech solutions exist that protect the environment in a profitable way, many of which have received the Solar Impulse Efficient Solution Label.

Just as for the Si2 technologies, we must now ensure that they enter the mainstream market. The faster we scale them, the faster we will set our economy on track to achieve the Paris Agreement goals and attain sustainable economic growth.

Powered by WPeMatico

Uber and Lyft lost a lot of money in 2020. That’s not a surprise, as COVID-19 caused many ride-hailing markets to freeze, limiting demand for folks moving around. To combat the declines in their traditional businesses, Uber continued its push into consumer delivery, while Lyft announced a push into business-to-business logistics.

But the decline in demand harmed both companies. We can see that in their full-year numbers. Uber’s revenue fell from $13 billion in 2019 to $11.1 billion in 2020. Lyft’s fell from $3.6 billion in 2019 to a far-smaller $2.4 billion in 2020.

The Exchange explores startups, markets and money. Read it every morning on Extra Crunch, or get The Exchange newsletter every Saturday.

But Uber and Lyft are excited that they will reach adjusted profitability, measured as earnings before interest, taxes, depreciation, amortization and even more stuff stripped out, by the fourth quarter of this year.

Ride-hailing profits have long felt similar to self-driving revenues: just a bit over the horizon. But after the year from hell, Uber and Lyft are pretty damn certain that their highly adjusted profit dreams are going to come through.

Ride-hailing profits have long felt similar to self-driving revenues: just a bit over the horizon. But after the year from hell, Uber and Lyft are pretty damn certain that their highly adjusted profit dreams are going to come through.

This morning, let’s unpack their latest numbers to see if what the two companies are dangling in front of investors is worth desiring. Along the way we’ll talk BS metrics and how firing a lot of people can cut your cost base.

Using normal accounting rules, Uber lost $6.77 billion in 2020, an improvement from its 2019 loss of $8.51 billion. However, if you lean on Uber’s definition of adjusted EBITDA, its 2019 and 2020 losses fall to $2.73 billion and $2.53 billion, respectively.

So what is this magic wand Uber is waving to make billions of dollars worth of red ink go away? Let’s hear from the company itself:

We define Adjusted EBITDA as net income (loss), excluding (i) income (loss) from discontinued operations, net of income taxes, (ii) net income (loss) attributable to non-controlling interests, net of tax, (iii) provision for (benefit from) income taxes, (iv) income (loss) from equity method investments, (v) interest expense, (vi) other income (expense), net, (vii) depreciation and amortization, (viii) stock-based compensation expense, (ix) certain legal, tax, and regulatory reserve changes and settlements, (x) goodwill and asset impairments/loss on sale of assets, (xi) acquisition and financing related expenses, (xii) restructuring and related charges and (xiii) other items not indicative of our ongoing operating performance, including COVID-19 response initiative related payments for financial assistance to Drivers personally impacted by COVID-19, the cost of personal protective equipment distributed to Drivers, Driver reimbursement for their cost of purchasing personal protective equipment, the costs related to free rides and food deliveries to healthcare workers, seniors, and others in need as well as charitable donations.

Er, hot damn. I can’t recall ever seeing an adjusted EBITDA definition with 12 different categories of exclusion. But, it’s what Uber is focused on as reaching positive adjusted EBITDA is key to its current pitch to investors.

Indeed, here’s the company’s CFO in its most recent earnings call, discussing its recent performance:

We remain on track to turn the EBITDA profitable in 2021, and we are confident that Uber can deliver sustained strong top-line growth as we move past the pandemic.

So, if investors get what Uber promises, they will get an unprofitable company at the end of 2021, albeit one that, if you strip out a dozen categories of expense, is no longer running in the red. This, from a company worth north of $112 billion, feels like a very small promise.

And yet Uber shares have quadrupled from their pandemic lows, during which they fell under the $15 mark. Today Uber is worth more than $60 per share, despite shrinking last year and projecting years of losses (real), and possibly some (fake) profits later in the year.

Powered by WPeMatico

Building off TechCrunch’s coverage of the recent 500 Startups demo day, we’re back today to talk about some favorites from three more accelerator classes. This time we’re digging into Techstars’ latest three accelerator classes.

What follows are four favorites from the Techstars’ Boston, Chicago and “workforce development” programs. As a team we tuned into the accelerator live pitches and dug into recordings when we needed to.

As always, these are just our favorites, but don’t just take our word for it. Dig into the pitches yourself, as there’s never a bad time to check out some super-early-stage startups.

Powered by WPeMatico

Knife Capital, a South African venture capital firm, is raising a $50 million fund for startups looking to raise Series B financing. With Knife Fund III called the African Series B Expansion Fund, the firm seeks to directly invest in the aggressive expansion of South African breakout companies. It also plans to co-invest in companies across the rest of Africa.

The first fund, known as Knife Capital Fund I or HBD Venture Capital, was a closed private equity fund managed by Eben van Heerden and Keet van Zyl. The firm offered seed capital to startups. It also generated significant exits from its portfolio — Visa acquisition of fintech startup Fundamo, and orderTalk’s acquisition by UberEats come to mind.

In 2016, the VC firm launched its current 12J offering with Knife Capital Fund II. The fund (KNF Ventures), which invests primarily in Series A stage, has eight startups in its portfolio. Last year the firm told TechCrunch of its intention to extend the Fund II and open to new investors. The plan was to give startups access to networks, money and expansion opportunities.

“We want to help South African and African companies internationalize,” said co-managing partner Andrea Bohmert at the time. A testament to its cause, one of its portfolio companies, DataProphet, raised $6 million Series A to expand into the U.S. and Europe.

Bohmert tells TechCrunch that the third fund aims to address the critical Series B funding gap that has characterised the venture capital asset class in South Africa, resulting in businesses not reaching full potential or exiting too early.

“Lately, we see an increase in companies able to raise $2 million to $5 million funding rounds. And while the companies are operating within their home country, in our case South Africa, such amounts take you far due to the local cost structure,” Bohmert says. “However, once these companies start gaining international traction and need to build an infrastructure outside of their home country, they need to raise significant amounts to afford so. There are currently hardly any South African VC funds, perhaps other than Naspers Foundry, that can write checks of $5 million or more and are willing to deploy them to finance the externalization of South African companies into larger markets.”

As a result, Bohmert argues that Africa has become an incubator for international VCs who can write these checks but cannot provide the local support most of these companies still need. Likewise, there are instances where international investors actively search for local co-investors in South Africa to invest in a round, and not finding one might blow the chances of them going further with the investment. This is the gap Knife Capital intends to fill by launching this fund, Bohmert says.

“We want to be the local lead investor of choice for South African technology companies looking to internationalise, co-investing with international investors who can lead the Series B discussion and further.”

This week, Knife Capital secured $10 million from Mineworkers Investment Company (MIC), a South Africa-based investment firm. The commitment positions MIC as an anchor investor to the fund alongside other local and international investors.

Nchaupe Khaole, the CIO at MIC, explained that the move to change the way local institutional investors approach venture capital investment has been in MIC’s pipeline for a while. And by partnering with Knife Capital, this idea can begin to materialize.

“Our commitment brings to the table the investment, along with many of our strengths as an experienced player. One of which is our ability to influence the companies within our portfolio to partner with us and effect real, tangible change to the South African economy. We are delighted to be a key catalyst in the success of this funding round,” he said.

As per other details, Knife Capital aims for a first close by May and a final close by the end of the year. Most of its participation will be co-investing, and the idea is to do that in 10 to 12 companies.

Powered by WPeMatico

Public.com, a social-focused free stock trading service, is nearing the close of a Series D just two months after raising a $65 million Series C, sources familiar with the matter told TechCrunch.

The San Francisco-based fintech aims to give people the ability to invest in companies using any amount of money, with a focus on community activity over active trading. It competes with Robinhood, M1 Finance and other American fintech companies that offer consumers a way to invest in equities with low or zero fees.

Public.com apparently got a flurry of investor interest over the past couple of weeks after Robinhood found itself in hot water and essentially raised $3.4 billion in a matter of days to help get itself out of a mess.

That new capital came at a challenging time for the unicorn, which could pursue an IPO this year. And some investors reportedly want a piece of rival Public.com’s pie.

One source told TechCrunch that many of those offering term sheets believe there could be “a mass exodus from Robinhood” and want a way to capture that value.

Public recently shook up its business model, moving from generating revenue from order flow payments, a key way that Robinhood monetizes, to collecting tips from users in exchange for executing their orders. Payment for order flow, or PFOF, has become a touchstone in the debate surrounding low-cost trading platforms, and how users may pay for their transactions if not in direct fees.

Investors betting on Public, then, would be placing a wager on not merely future user growth, but the startup’s ability to monetize effectively in the future.

The sources for this story were granted anonymity due to the sensitivity of the discussions.

Public grew quickly in 2020, expanding its user base by a multiple of 10 since the start of the year.

Co-founder Leif Abraham told TC’s Alex Wilhelm in December that the company’s growth has been consistent instead of lumpy, expanding at around 30% each month. The co-founder also stressed that most of Public’s users find its service organically, implying that the startup’s marketing costs have not been extreme, nor its growth artificially boosted.

We don’t know yet how much Public is raising in its Series D, or who all is investing. Public has not responded to multiple requests for comment. VC firm Accel — which led its Series A, B and C rounds — also declined to comment. But we’ll definitely report details as we get them.

Powered by WPeMatico