TC

Auto Added by WPeMatico

Auto Added by WPeMatico

Elon Musk notified the world that he would be donating $100 million to pursue new technologies for carbon capture, methods through which carbon dioxide can be actively extracted from the atmosphere as a means to help stave off climate change. As TechCrunch reported in January when he made the tweet, Musk’s sizeable pool of monetary incentive would be going to the Xprize foundation, a nonprofit that has organized similar ambitious technology competitions aimed at developing world-changing tech. Now, Xprize and Musk have released new details of the competition.

The entire $100 million prize pool is up for grabs with this competition, which will seek solutions that can “pull carbon dioxide directly from the atmosphere or oceans and lock it away permanently in an environmentally benign way.” That’s an ambitious goal, and one that seeks methods for carbon extraction which have a net negative effect on the overall global balance of the element’s presence. Xprize aims to award up to 15 finalists $1 million each, along with three top winners, with $50 million to the Grand Prize victor, and $20 million and $10 million respectively for second and third place. Twenty-five student scholarships valued at $250,000 each will also be up for grabs specifically for student team entrants.

To qualify for victory, solutions must be able to extract one ton of CO2 per day, and be viable in a scaled, validated model at time of presentation, with the ability to scale it to “gigaton levels” in commercially viable ways in the future. Those are big goals for new technologies, but the competition’s stakes are high: Musk has frequently referred to climate change as an existential threat to humanity, and carbon capture is one key means to combat it.

Carbon capture methods exist, and some are at the center of new startups and emerging businesses, like Canadian company Carbon Engineering, which uses CO2 extracted from the atmosphere to create new types of fuel, or Air Vodka, a carbon negative vodka distilled using C02 removed from the atmosphere. Though there are a handful of companies pursuing this, the problem is that it’s typically very expensive to remove carbon in a way that is both safe and that has no subsequent impact on the environment from its resulting byproducts.

The new Xprize competition hopes to spur the development of a wide range of emerging companies in a way similar to how the 2004 $10 million private spaceflight Ansari Xprize led the development of a whole new era in the space industry. The competition will officially begin on April 22, 2021, at which time full guidelines will be made available and registration will open. Applicants will have up to four years to submit their solution, with the competition closing on Earth Day 2025 and the initial $1 million awards distributed 18 months following that. That will provide the funding necessary for teams to build out their full-scale demos to claim the top prizes.

Powered by WPeMatico

Harry Stebbings, the podcaster-turned-VC, is stepping down as a partner of Stride.VC, the London-based venture capital firm he co-founded with Fred Destin, formerly of Accel.

In a series of tweets, Destin said that Stebbings won’t be involved in Stride’s second fund (though he’ll remain a partner in fund one), and will instead be focusing on his podcast franchise “The Twenty Minute VC” and running his own micro fund, the aptly titled “20VC”.

“Harry’s 20VC podcast has remained his passion and been flying high, creating opportunities that are hard to ignore. My bud wants to lean even harder into the 20VC platform,” tweeted Destin.

In the same Twitter thread, Destin said he remains “fully committed to Stride and what the team is building”. That team, however, has now seen a plethora of personnel changes since the VC firm was officially unveiled in late 2018. Most recently, Paris-based partner Pia d’Iribarne departed and has since co-founded New Wave. Stride also lost operating partner Arj Soysa about a year earlier. He’s now a finance director at Mubadala Capital in Europe.

Alongside Destin, Stride’s current team members include investor Pietro Invernizzi, finance and operations partner Ross W., and executive assistant Georgina Gallagher, according to LinkedIn.

Both Stebbings and Destin declined to comment further, pointing me to Destin’s tweets.

Powered by WPeMatico

Demo days at startup accelerators are a pretty big deal around here.

These events aren’t just a chance to review the latest cohort of hopeful entrepreneurs — they also showcase the technology, products and services that will compete for VC and consumer attention over the next few years.

You never know where a hit will come from, which is why these events capture our attention. Here’s just one example from Y Combinator’s Summer 2013 Demo Day:

Positioning itself as the “FedEx of today,” it hopes to provide a logistics framework that goes beyond food and can be used for any type of on-demand order.

That startup was DoorDash, by the way.

Full Extra Crunch articles are only available to members

Use discount code ECFriday to save 20% off a one- or two-year subscription

Full disclosure: In 2016, I was 500 Startups’ Journalist-in-residence. I covered one demo day in person, spending most of my time backstage where founder teams practiced their pitches.

It was quite a scene: Several people literally jumped up and down to shake off their nervous energy, but I also recall one who calmly recited their lines while gazing through a window.

Yesterday, Jon Shieber and Alex Wilhelm covered 500 Startups’ 27th virtual demo day and selected eight companies as their favorites:

Thank you very much for reading Extra Crunch this week! I hope you have a safe, relaxing weekend.

Walter Thompson

Senior Editor, TechCrunch

@yourprotagonist

Image Credits: David Malan (opens in a new window) / Getty Images

Image Credits: Nigel Sussman (opens in a new window)

I’ve never used “stonkathon” in a headline before, but it’s been that kind of week.

The war between hedge funds and day traders over GameStop vaulted discount trader Robinhood into the headlines for days.

But how did it affect the company’s financial health?

This morning, Alex Wilhelm examined why Robinhood’s investors were willing to inject $3.4 billion more into the company in just one week.

“More trades means more PFOF (payment for order flow) revenue,” says Alex. “And Robinhood effectively doubled in size.”

Image Credits: Andrew_Rybalko / Getty Images

Reporter Natasha Mascarenhas interviewed Greg Brown, new president of digital learning platform Udemy, after his company announced that it surpassed $100 million ARR.

A new arm of the company, Udemy for Business, just secured a 100,000-employee contract with Cisco Systems to offer software, business and technology courses.

“The opportunity that the company sees has really forced us to reallocate resources and strategy,” said Brown.

Image Credits: Nigel Sussman (opens in a new window)

After scaling its ARR to $425 million and reaching a valuation of $28 billion, data analytics company Databricks is clearly IPO-ready.

Battery Ventures has backed Databricks since 2017, so Alex Wilhelm interviewed General Partner Dharmesh Thakker to understand why he thinks the company may be undervalued.

“Whether it’s digital transformation, whether it’s analytics, data is everywhere,” said Thakker. “So the TAM is massive.”

Image Credits: MirageC (opens in a new window) / Getty Images

Deep tech founders face special challenges when pitching investors: they usually don’t have a product, customers or revenue.

It’s difficult enough to ask a stranger for a check when there’s a beta product, but how do you drum up interest in an unproven idea that may exist largely in your imagination?

“Early-stage investors are in the business of funding dreams,” says angel investor Jessica Li.

“Investors are less interested in the intricacies of your technology and more interested in what impact it can create.”

Step one: use storytelling to highlight your big vision.

Image Credits: Images by Tang Ming Tung (opens in a new window) / Getty Images

Investors funded edtech startups with $10 billion last year as the pandemic forced widespread adoption of remote learning.

The valuations of these companies aren’t rising at the same rate as SaaS or fintech startups, but “where edtech lacks in impressive valuations, investors see it gaining in exit opportunities,” writes Natasha Mascarenhas.

For this edtech investor survey, she interviewed:

Image Credits: MF3d (opens in a new window) / Getty Images

In his latest recap of recent breakthroughs in applied science, Devin Coldewey looked at how researchers are using AI to:

Image Credits: Getty Images

In the latest of a series of articles that examines user experiences for consumer apps, UX expert Peter Ramsey and TechCrunch reporter Steve O’Hear studied Spotify Group Session, the shared-queue feature that permits users to create playlists collaboratively.

“Many of these lessons can be applied to other existing digital products or ones you are currently building,” such as the need to add context for important decisions and how to best use “react and explain” prompts.

Extra Crunch Live returned this week with two guests: Lightspeed Venture Partners’ Gaurav Gupta and Raj Dutt, co-founder and CEO of Grafana Labs.

In addition to walking us through the presentation that encouraged Lightspeed to invest in Grafana’s Series A, the duo also gave direct feedback to audience members about their pitch decks.

Watch a video with our complete episode, or read highlights from the chat to get Gupta and Dutt’s insights on what goes into a successful pitch deck.

New episodes of Extra Crunch Live drop each Wednesday at 12 p.m. PST/3 p.m. EST/8 p.m. GMT.

Here’s a breakdown of the complete episode with Gaurav Gupta and Raj Dutt:

Paper plane made from a ten-dollar bill. Image Credits: LockieCurrie (opens in a new window)/ Getty Images

Some IT managers may still be debating the merits of usage-based pricing versus subscription-based models, but SaaS investors have made up their minds.

Compared to their rivals, companies that employ usage-based pricing trade at a 50% revenue multiple premium. You can argue with success, but seven out of the nine IPOs since 2018 with the best net dollar retention offer usage-based models.

If you’re a founder who hopes to break into the $100M ARR club, this guest post can help you identify the right usage metrics for creating a sustainable customer journey.

For more actionable advice regarding SaaS pricing and sales, see these previously published Extra Crunch stories:

Image Credits: Nigel Sussman (opens in a new window)

How many dating networks can the public market support?

In Tuesday’s column, Alex Wilhelm examined the latest IPO filing from relationship-finding service Bumble.

The company set a range of $28 – $30 per share, so Alex set out to find its simple and diluted valuations, how much it expects investors to pay and “how those stack up compared to Match Group’s own numbers.”

Image Credits: Nigel Sussman (opens in a new window)

Discount brokerage Robinhood stayed in the news last week as it became a proxy battlefield for institutional and retail investors, but its backers “put in another billion just last week,” says Alex Wilhelm.

Why were investors so bullish after days of screaming headlines?

In yesterday’s column, Alex unpacked Robinhood’s Q4 2020 numbers, “which shows a return to sequential-quarterly growth at the trading upstart.”

Image Credits: Towfiqu Photography / Getty Images

Before Redditors came after GameStop, zero-cost trading service Public says it was seeing “steady ~30%” month-over-month growth.

Last week, however, “new user signups went up 20x,” founders Leif Abraham and Jannick Malling told TechCrunch.

After closing a $65 million Series C, Public announced yesterday that it would “stop participating in the practice of Payment for Order Flow,” replacing PFOF with an “optional tipping feature.”

Image Credits: Andrii Yalanskyi (opens in a new window) / Getty Images

Startups that don’t directly engage their earliest customers with purpose and intention are leaving money on the table.

Creating a Customer Advisory Board (CAB) is a proven method for soliciting product ideas, testing marketing plans and turning early users into loyal brand advocates.

Before you call a CAB, read this post to find out how to identify customers who’ll contribute real insights, establish goals and “pick members who play well together.”

Red and white stop sign on the wall. Image Credits: Karl Tapales (opens in a new window)/ Getty Images

Identity and access management company Okta announced in a study last week that its largest customers use an average of 175 different applications to manage their operations.

Managing Editor Danny Crichton says this “explosion of creativity and expressiveness and operational latitude” offers widespread benefits, but it’s “also a recipe for disaster,” since many end users aren’t well-trained when it comes to using these tools.

This enterprise version of the Tower of Babel creates an opening for companies that offer “best practices as a service,” says Danny. “The next generation of SaaS software has to take those abecedarian building blocks and forcibly guide users to using those tools in the best possible way.”

Powered by WPeMatico

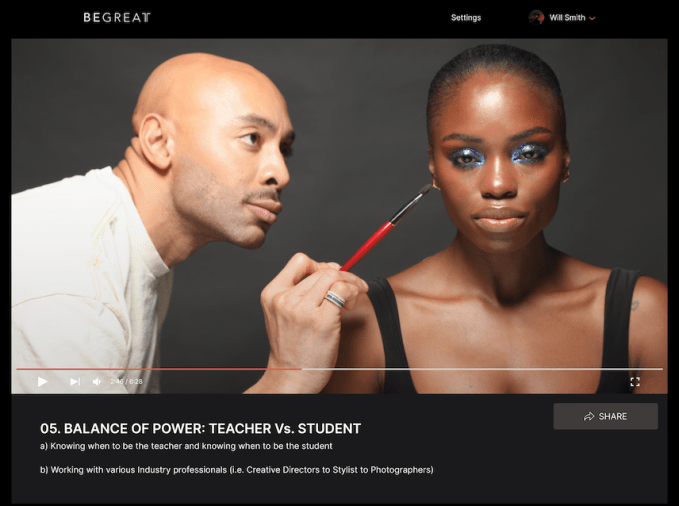

BeGreatTV, an online education platform featuring Black and brown instructors, recently closed a $450K pre-seed round from Stand Together Ventures Lab, Arlan Hamilton, Tiffany Haddish and others.

The goal with BeGreatTV is to enable anyone to learn from talented Black and brown innovators and leaders, founder and CEO Cortney Woodruff told TechCrunch.

“When you think of being a Black or brown person or individual who wants to learn from a Black or brown person, there’s nothing that really exists that gives you a glossary of every business vertical and where you see representation at every level in a well put together way,” Woodruff said. “That alone makes our market a lot larger because there are just so many verticals where no one has really invested in or shown before.”

The courses are designed to teach folks how to execute and succeed in a particular industry, and enable people to better understand the business aspect of industries while also teaching “you how to deal with the socioeconomic and racial injustices that come with being the only one in the room. Whether you are a Black man or woman who wants to get into the makeup industry, there will always be a lot of biases in the world.”

When BeGreatTV launches in a couple of months (the plan is to launch in April), the platform will feature at least 10 courses — each with around 15 episodes — focused on arts, entertainment, beauty and more. At launch, courses will be available from Sir John, a celebrity makeup artist for L’Oréal and Beyoncé’s personal makeup artist, BeGreatTV co-founder Cortez Bryant, who was also Lil Wayne and Drake’s manager, as well as Law Roach, Zendaya’s stylist.

Hamilton and Haddish will also teach their own respective courses on business and entertainment, Woodruff said. So far, BeGreatTV has produced more than 40 episodes that range anywhere from three to 15 minutes each.

Image Credits: BeGreatTV

Each course will cost $64.99, and the plan is to eventually offer an all-access subscription model once BeGreatTV beefs up its offerings a bit more. For instructors, BeGreatTV shares royalties with them.

“Ultimately, the platform can include a more diverse casting of instructors that aren’t just Black and brown,” Woodruff said. But for now, he said, the idea is to “reverse the course of ‘Now this is our first Black instructor’ but ‘now this is the first white instructor’ ” on the platform.

BeGreatTV’s team consists of just 15 people, but includes heavy hitters like Cortez Bryant and actor Jesse Williams. Currently, BeGreatTV is working on closing its seed round and anticipates a six-figure user base by the end the year.

MasterClass is perhaps BeGreatTV’s biggest competitor. With classes taught by the likes of Gordon Ramsay, Shonda Rhimes and David Sedaris, it’s no wonder why MasterClass has become worth more than $800 million. The company’s $180 annual subscription fee accounts for all of its revenue.

“If you benchmark [BeGreatTV] to MasterClass, we are finding individuals that are not only the best at what they do in the world, but often times these individuals have broken barriers because often times they were the first to do it,” Woodruff said. “And do it without having people who look like them.”

Powered by WPeMatico

Before he was a partner at Lightspeed Venture Partners, Gaurav Gupta had his eye on Grafana Labs, the company that supports open-source analytics platform Grafana. But Raj Dutt, Grafana’s co-founder and CEO, played hard to get.

This week on Extra Crunch Live, the duo explained how they came together for Grafana’s Series A — and eventually, its Series B. They also walked us through Grafana’s original Series A pitch deck before Gupta shared the aspects that stood out to him and how he communicated those points to the broader partnership at Lightspeed.

Gupta and Dutt also offered feedback on pitch decks submitted by audience members and shared their thoughts about what makes a great founder presentation, pulling back the curtain on how VCs actually consume pitch decks.

We’ve included highlights below as well as the full video of our conversation.

We record new episodes of Extra Crunch Live each Wednesday at 12 p.m. PST/3 p.m. EST/8 p.m. GMT. Check out the February schedule here.

As soon as Gupta joined Lightspeed in June 2019, he began pursuing Dutt and Grafana Labs. He texted, called and emailed, but he got little to no response. Eventually, he made plans to go meet the team in Stockholm but, even then, Dutt wasn’t super responsive.

The pair told the story with smiles on their faces. Dutt said that not only was he disorganized and not entirely sure of his own travel plans to see his co-founder in Stockholm, Grafana wasn’t even raising. Still, Gupta persisted and eventually sent a stern email.

“At one point, I was like ‘Raj, forget it. This isn’t working’,” recalled Gupta. “And suddenly he woke up.” Gupta added that he got mad, which “usually does not work for VCs, by the way, but in this case, it kind of worked.”

When they finally met, they got along. Dutt said they were able to talk shop due to Gupta’s experience inside organizations like Splunk and Elastic. Gupta described the trip as a whirlwind, where time just flew by.

“One of the reasons that I liked Gaurav is that he was a new VC,” explained Dutt. “So to me, he seemed like one of the most non-VC VCs I’d ever met. And that was actually quite attractive.”

To this day, Gupta and Dutt don’t have weekly standing meetings. Instead, they speak several times a week, conversing organically about industry news, Grafana’s products and the company’s overall trajectory.

Dutt shared Grafana’s pre-Series A pitch deck — which he actually sent to Gupta and Lightspeed before they met — with the Extra Crunch Live audience. But as we know now, it was the conversations that Dutt and Gupta had (eventually) that provided the spark for that deal.

Powered by WPeMatico

Robotic process automation (RPA) has found a strong foothold in the world of enterprise IT through its effective use of AI and other technology to help automate repetitive tasks to free up people to focus on more complicated work. Today, a startup called Infinitus is coming out of stealth to apply this concept to the world of healthcare — specifically, to speed up the process of voice communication between entities in the fragmented U.S. healthcare industry.

Infinitus uses “voice RPA” to become the machine-generated voice that makes calls from, say, healthcare providers or pharmacies to insurance companies to go through a series of questions (directed at humans at the other end) that typically need to be answered before payments are authorized and other procedures can take place. Those conversations are then ingested into Infinitus’s platform to parse them for relevant information that is input into the right fields to trigger whatever actions need to happen as a result of the calls.

The startup is coming out of “stealth mode” today but it has been around for a couple of years already and has signed on a number of large healthcare companies as customers — for example, the wholesale drug giant AmerisourceBergen — and is in some cases contributing its technology to public health efforts around the current coronavirus pandemic, with one organization currently using it to automate a mass calling system across several states to get a better idea of vaccine availability to help connect the earliest doses with the most vulnerable groups that need them the fastest.

It made 75,000 calls on behalf of 12,000 providers in January alone.

Infinitus’ public launch is also coming with a funding kicker: it has picked up $21.4 million in Series A funding from a group of big-name investors to build the business.

The round is being co-led by Kleiner Perkins and Coatue, with Gradient Ventures (Google’s early-stage AI fund), Quiet Capital, Firebolt Ventures and Tau Ventures also participating, along with individual investments from a selection of executives across the worlds of AI and big tech: Ian Goodfellow, Gokul Rajaram, Aparna Chennapragada and Qasar Younis.

Coatue is shaping up to be a huge investor in the opportunity in RPA. Earlier this week, it emerged that it co-led the latest investment in UiPath, one of the leaders in the space, having been a part of previous rounds as well.

“Coatue is proud to have led the Series A in Infinitus,” says Yanda Erlich, a general partner at Coatue. “We are big believers in the transformative power of RPA and Enterprise Automation. We believe Infinitus’ VoiceRPA solution enables healthcare organizations to automate previously costly and manual calls and faxes and empowers these organizations to see benefits from end-to-end process automation.”

The problem that Infinitus is addressing is the fact that healthcare, in particular in the privatized U.S. market, has a lot of time-consuming and often confusing red tape when it comes to getting things done. And a lot of the most immediate pain points of that process can be found in voice calls, which are the primary basis of critical communications between different entities in the ecosystem.

Voice calls are used to initiate most processes, whether it’s to obtain critical information, follow up on a form or previous communication, or pass on some data, or of course provide clearance for a payment.

There are 900 million calls of these kinds made in the U.S., with the average length of each call 35 minutes, and with the average healthcare professional who works in an administrative role to make those calls dedicating some 4.5 hours each day to being on the phone.

All of this ultimately adds to the exorbitant costs of healthcare services in the U.S. (and likely some of those inscrutable lines of fees that you might see on bills), not to mention delays in giving care. (And those volumes underscore just what a small piece Infinitus touches today.)

Founder and CEO Ankit Jain — a repeat entrepreneur and ex-Googler who held senior roles in engineering and was a founding partner at Gradient at the search giant — told TechCrunch in an interview that the idea for Infinitus first occurred to him a couple of years ago, when he was still at Gradient.

“We were starting to see a lot of improvements in voice communications technology, turning text into speech and speech into text. I realised that it would soon be possible to automate phone calls where a machine could carry out a full conversation with someone.”

Indeed, around that time, Google itself had launched Duplex, a service built around the same principle, but aimed at consumers, for people to book appointments, restaurant tables and other services.

He determined that just being able to talk like a human and understand natural language wasn’t the only issue, and not even the main one, in enterprises applications like healthcare environments, which rely on specific jargon and particular scenarios that are probably less rather than more like actual human interactions.

“I thought, if someone wanted to build this for healthcare it would change it,” he said. And so he decided to do just that.

Jain said that Infinitus is using public cloud speech to text systems but the natural language processing and flows to triage and use of the information gained from the conversations are built in house. The specialization of the content and interactions potentially is also one reason why Infinitus might not worry so soon about cannibalization from bigger RPA players, at least for now.

The fact that services like these — the new generation of robocalls, as it were — can sound “lifelike”, like actual humans, has been something that consumer versions have aspired to, although that hasn’t always worked out for the best. Duplex, for example, in its early days came under criticism for how its excellent quality might actually be deceptive, because it wasn’t clear to users they were speaking to a machine logging their responses in a data harnessing exercise. Jain notes that Infinitus is actually intentionally choosing voices that sound like bots to help make that clear to those taking the calls.

He said that this also “helps reduce the level of chatter” on the conversation and keeps the person speaking focused on business.

On that front, it seems that while Infinitus works like other voice RPA services, connected up with live, human agents who can take over calls if they get tricky, that hasn’t really needed to be used.

“Today we don’t need to triage with humans because we see high enough success rates with our system,” he said.

You might wonder, why hasn’t the healthcare industry just moved past voice altogether? Surely there are ways of exchanging data between entities so that calls could become obsolete? Turns out that at least for now that isn’t something that will change quickly, Jain said.

Part of it is because the fragmentation in the market means it’s hard to implement new standards across the board, covering hundreds of insurance payers, healthcare providers, pharmaceutical groups, billing and collections organisations and more. And when it comes down to it, a phone call ends up being the easiest route for many admins who might have to typically deal with 100 different payment companies and other entities, each with a different logging mechanism. “It’s a lot of cognitive load, so it’s often easier to just pick up the phone,” Jain said.

Bringing in voiceRPA like Infinitus’s is part of that long haul to update the bigger system.

“By automating one side we are showing the other side that it can be done,” Jain said. “Right now, there are just too many players and getting them to agree on one standard is a gargantuan task, so trying to win one small piece after another is how it’s done. It should not be voice, but by the time standards bodies agree on something else, the world has moved on.”

Powered by WPeMatico

Virtual health and wellness platforms have grown increasingly popular throughout the pandemic, but a new startup wants to focus that effort exclusively on senior citizens. Bold, a digital health and wellness service, plans to prevent chronic health problems in older adults through free and personalized exercise programs. Co-founded by Amanda Rees and her partner Hari Arul, Bold picked up $7 million this week in seed funding led by Julie Yoo of Silicon Valley-based Andreessen Horowitz.

Rees said in an interview that the idea for Bold came from time she spent caring for her grandmother, helping her through health challenges like falls. “I kept thinking about solutions we could build to keep someone healthier longer, rather than waiting for until they have a fall or something else goes off the rails to intervene,” she said. Rees started Bold to use what she’d learned from her own experience in dance and yoga to help her grandmother practice maintaining balance to prevent future falls. “My passion really was around ways to sort of widen the aperture and make these solutions more accessible and built for older people.”

The member experience is pretty straightforward. Users fill out some brief fitness information on the web-based platform, outlining their goals and current baseline. From that information, Bold creates a personalized program that ranges from a short, seated Tai Chi class once a week, to cardio and strength classes meeting multiple times each week. “The idea is to really meet a member where they are, and then through our programming, help them along their journey of doing the types of exercises that are going to have the most immediate benefit for them,” said Rees.

Bold’s funding round comes at a time of concern around ballooning healthcare expenses for older populations, and a focus on how to reduce these costs for both current and future generations. While falls alone aren’t necessarily complex medical incidents, they have the potential to lead to fractures and other serious injuries. Bold’s preventative approach to falls is a more active solution than necklace or bracelet monitors that send a signal to emergency services when they detect a fall. And by offering virtual programs, they can help at-risk older populations engage in exercise while avoiding potential COVID-19 exposure at gyms.

Research shows that this works. Even simple, low-intensity exercise can improve balance and strength enough to reduce the incidence of falls, which is currently the leading cause of injury and injury death among older adults.

Fewer injuries would mean less need for medical care, which would lead to money saved for hospitals and health insurers alike. That’s why in addition to their seed funding, Bold has plans to start rolling out partnerships with Medicare Advantage organizations and risk-bearing providers, which will help make their exercise programs available to users for free.

Powered by WPeMatico

The recent Databricks funding round, a $1 billion investment at a $28 billion valuation, was one of the year’s most notable private investments so far.

For Databricks signaled its IPO readiness by disclosing to TechCrunch last year that it had scaled its revenue run rate from $200 million to $350 million in a year, so the new capital looked like the capstone on its private fundraising before an eventual public debut.

The Exchange explores startups, markets and money. Read it every morning on Extra Crunch, or get The Exchange newsletter every Saturday.

But I did have a few questions, starting with the price of the round.

At a $28 billion valuation and ARR of $425 million, Databricks is valued at around 66x top line. That’s steep, if not the highest number we can dredge up on the public markets. Of course, for Databricks shareholders, seeing the value of their stock rise so quickly is hardly a bad thing. They are hardly going to complain about having more paper wealth.

But what about the investor perspective? Does the price really make sense? The Exchange caught up with Battery Ventures’ Dharmesh Thakker earlier this week to discuss a number of things, one of which was Databricks’ round and pricing. Thakker is named in the Databricks Series D funding announcement, which brought Battery into the company.

What was surprising about our conversation was not that Thakker was bullish on Databricks — a company that he and his firm have backed since its $140 million, 2017 round when the company was worth just under $1 billion. What surprised me was that he thinks its new $28 billion valuation might be a little low.

What was surprising about our conversation was not that Thakker was bullish on Databricks — a company that he and his firm have backed since its $140 million, 2017 round when the company was worth just under $1 billion. What surprised me was that he thinks its new $28 billion valuation might be a little low.

Intriguing, yeah? So this morning for both of us, I’ve pulled out quotes from our chat to help explain how Thakker views the market for Databricks, unicorns at scale more broadly through the lens of risk-adjusted investing, and the scale of the market some unicorns are playing in.

At the close, we’ll remind ourselves what Databricks CEO Ali Ghodsi told TechCrunch when we asked him the same question. Let’s go!

Here’s how the valuation part of my chat with the Battery Ventures’ investor went down:

The Exchange: I want to talk about Databricks, because I spoke to [CEO] Ali [Ghodsi] yesterday about this round, and hot damn, it’s a lot of money at a valuation that is roughly 64x ARR, give or take. I don’t understand the price, and I know it’s a boring thing to talk about. [It’s a] great company, I get their market, I’ve talked to them a bunch, I know their revenue numbers. [But] I don’t understand the price, and I was hoping you could tell me why I’m being too conservative.

Dharmesh Thakker: I, for what it’s worth, think [the price] fair. If anything, I think it is on the lower end — he could have done better, frankly. But I think it comes down to three major things, right?

One is the addressable market. Just think about the addressable market of data. If there’s a trillion dollars spent in software or technology, I think you and I would be both hard pressed to say, almost all of that [isn’t] influenced by some data-oriented decisioning. Whether it’s digital transformation, whether it’s analytics, data is everywhere. So the TAM is massive … I think you and I both agree on that, whether it is $20 billion or $80 billion — it’s massive.

Powered by WPeMatico

Fundraising is challenging, especially for deep tech founders who need to get investors excited about a complex technology, a complex sales cycle and a complex risk profile.

As a former investor and current angel investor, I have met thousands of founders, many in the deep tech space.

Based on my experience, here’s how to avoid making the most common mistakes deep tech founders make when pitching investors:

Early-stage investors are in the business of funding dreams. They chose to be early-stage investors because they love hearing about new ideas and enthralling futures. They deliberately are not investment bankers or accountants because they do not want to constantly pour over endless spreadsheets or dive deep into financial models. Similarly, they are not operators because they do not want to spend time figuring out the intricacies of a supply chain or a marketing campaign or the configuration of a product component.

Make your pitch tailored to what excites venture capital investors and avoid what does not.

So make your pitch tailored to what excites venture capital investors and avoid what does not. Keep the financial model details and the warehouse system logistics information to your Appendix. You have it in case anyone wants to dive in deeper, but your core presentation should be focused on your biggest, most bullish hopes for the company seven to 10 years from now. Dedicate multiple slides to painting the picture of what society would look like should you meet all your intended milestones as a company.

As a deep tech company, your differentiation is in your intellectual property. However, investors care less about the “what” and much more about the “so what.” Investors are less interested in the intricacies of your technology and more interested in what impact it can create.

Formulate your slides to focus on answering questions like, “What can people or companies do as a result of your technology?” and “How will people save time, money and lives with your product?”

Put your presentation to the “grandma” test. Would your grandmother be able to understand and be excited about everything you share? Investor pitch meetings are not dissertation defenses. You are being evaluated on your potential for impact rather than the intricate details of your research. The best way to succeed in this evaluation framework is to ensure that everything you share is relevant and exciting to a diverse audience of even nontechnical folks.

Five million people are a statistic, but one person is a story. When people read data on massive populations of people, they conceptually understand the implications but only on a logical level, not an emotional one. When pitching, you want to reach the hearts of investors.

Powered by WPeMatico

Flux, the London fintech that has built a technology platform for banks and merchants to power itemised digital receipts and more, has seen its lengthy pilot with Barclays bear fruit.

Announced formally today — but actually quietly rolled out a few months ago — Flux-powered digital receipts are now available as an opt-in for all U.K. Barclays debit card holders within the bank’s main mobile banking app. Previously, the functionality was only available within the Barclays Launchpad app, which is available for customers that want to try out experimental or upcoming features.

Early last year, Barclays announced that it has invested in Flux, taking a minority stake, so the strengthening of its partnership isn’t too much of a surprise. Flux also went through the Techstars-powered Barclays accelerator in its very early days. However, not all corporate accelerators lead to great outcomes as corporates are notoriously risk-adverse. This one certainly wasn’t rushed but it’s meaningful regardless, giving Flux a major shot in the arm in reaching mainstream banking customers beyond the existing challenger bank partnerships it has forged.

“Customers who pay using their Barclays debit card for future in store purchases at H&M, shoe retailer schuh and food outlets, which include Just Eat and Papa Johns, will see their receipts sent automatically to their app after making a purchase. They can then easily and securely view their receipts whenever they need by tapping on the transaction,” says Barclays. Crucially, although opt-in, Barclays customers will receive a prompt to set up digital receipts when they purchase items from retailers currently on-boarded to Flux.

Founded in 2016 by former early employees at Revolut, Flux bridges the gap between the itemised receipt data captured by a merchant’s point-of-sale (POS) system and what little information typically shows up on your bank statement or mobile banking app. Off the back of this, it can also power loyalty schemes and card-linked offers, as well as give merchants much deeper POS analytics via aggregated and anonymised data on consumer behaviour, such as which products are selling best in unique baskets.

On the banking side, along with Barclays, Flux has partnered with challenger banks Starling and Monzo. Once banking customers link their account to the service, Flux delivers digital receipts (and where available rewards and loyalty) for transactions at Flux retailer partners.

Longer term, Flux wants to become a standard for the interchange of item level digital receipt data — and the proprietary platform that powers that standard — but has always faced a chicken-and-egg problem: It needs bank integrations to sign up merchants and it needs merchant integrations to sign up banks. Barclays going live properly is another significant turn in the upstart’s flywheel.

Powered by WPeMatico