TC

Auto Added by WPeMatico

Auto Added by WPeMatico

Latitude, a startup building games with “infinite storylines” generated by artificial intelligence, is announcing that it has raised $3.3 million in seed funding.

The idea of an AI-generated story might make you think of hilariously nonsensical experiments like “Sunspring,” but Latitude’s first title, AI Dungeon, is an impressively open-ended (and coherent) text adventure game where you can choose from a wide variety of genres and characters.

Unlike a classic text adventure like Zork — where players quickly become familiar with “you can’t do that”-style messages when they type something the designers hadn’t planned for — AI Dungeon can respond to any command. For example, when my brave knight was charging into battle, I typed “get depressed” and he quickly sat on a rock with his head between his hands.

“How does the AI know what’s a good story?” said co-founder and CEO Nick Walton. “Because it’s read a lot of good stories and knows the patterns involved in that.”

AI Dungeon actually started out as one of Walton’s hackathon projects. While the initial version didn’t win any prizes, he kept at it, assisted by improvements in OpenAI’s language generator, of which the most recent version is GPT-3.

AI Dungeon, Image Credits: Latitude

“The very first version of AI Dungeon I built was coherent on a sentence level, but on a paragraph level it made no sense,” Walton said. “Once you get to GPT-2, it makes a lot more sense. Once you get to GPT-3, it’s a lot more coherent on a story level. And so I think to a degree, these issues with coherency, the story not making sense, get solved as the AI gets better.”

Latitude says AI Dungeon is attracting 1.5 million monthly active users. The startup plans to create more AI-powered games, and eventually to release a platform allowing other game designers to do the same.

Walton noted that without AI, video games are always constrained by the imagination of its creators. Even when you get to games like The Elder Scrolls II: Daggerfall or No Man’s Sky, with randomly generated towns or planets, he argued that they’re really offering “the same spin on a similar concept.”

For example, he said that in Daggerfall, “When you go to all these towns, they’re all basically the same. That’s the problem with procedural generation: You’re not coming up with unique things.” AI, on the other hand, can come up with “something completely unique that’s so, so different every time.”

Latitude CEO Nick Walton. image Credits: Latitude

From a business perspective, he said that this could lower the cost of developing AAA games from more than $100 million to less than $100,000 — though Latitude has a ways to go before it reaches that level, since it hasn’t even released a game with graphics yet. Walton also said this could lead to new levels of immersion and interactivity.

“With this technology, you could have a world with tens of thousands of characters with their own hopes and wants and dreams,” he said. “You can have worlds that are dynamic, that are alive, rather than something like World of Warcraft, where you’ve got 10 million people who are doing the same quest.”

The startup’s funding was led by NFX, with participation from Album VC and Griffin Gaming Partners.

“Latitude is revolutionizing how games are made, creating a whole new genre of entertainment gaming fueled by AI,” said James Currier of NFX in a statement. “The best AI minds and engineers are gathering there to produce games that the world has never seen before. Latitude is already by far the leading AI games company.“

Powered by WPeMatico

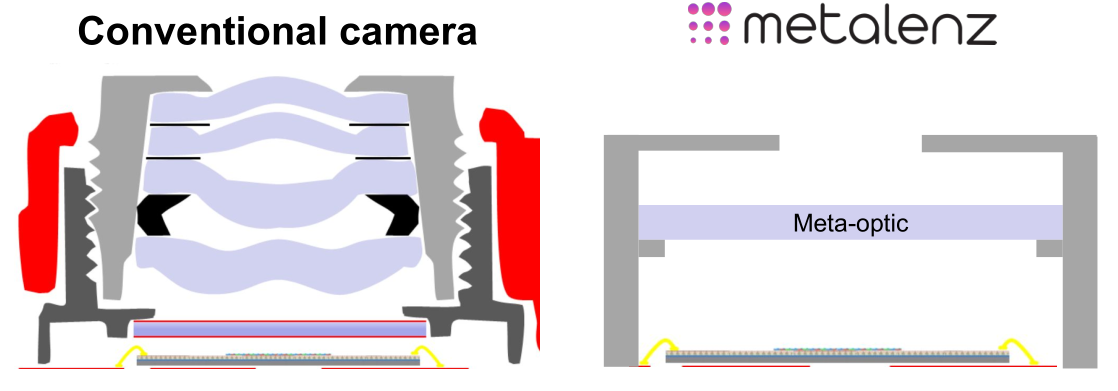

As impressive as the cameras in our smartphones are, they’re fundamentally limited by the physical necessities of lenses and sensors. Metalenz skips over that part with a camera made of a single “metasurface” that could save precious space and battery life in phones and other devices… and they’re about to ship it.

The concept is similar to, but not descended from, the “metamaterials” that gave rise to flat beam-forming radar and lidar of Lumotive and Echodyne. The idea is to take a complex 3D structure and accomplish what it does using a precisely engineered “2D” surface — not actually two-dimensional, of course, but usually a plane with features measured in microns.

In the case of a camera, the main components are of course a lens (these days it’s usually several stacked), which corrals the light, and an image sensor, which senses and measures that light. The problem faced by cameras now, particularly in smartphones, is that the lenses can’t be made much smaller without seriously affecting the clarity of the image. Likewise sensors are nearly at the limit of how much light they can work with. Consequently, most of the photography advancements of the last few years have been done on the computational side.

Using an engineered surface that does away with the need for complex optics and other camera systems has been a goal for years. Back in 2016 I wrote about a NASA project that took inspiration from moth eyes to create a 2D camera of sorts. It’s harder than it sounds, though — usable imagery has been generated in labs, but it’s not the kind of thing that you take to Apple or Samsung.

Metalenz aims to change that. The company’s tech is built on the work of Harvard’s Federico Capasso, who has been publishing on the science behind metasurfaces for years. He and Rob Devlin, who did his doctorate work in Capasso’s lab, co-founded the company to commercialize their efforts.

“Early demos were extremely inefficient,” said Devlin of the field’s first entrants. “You had light scattering all over the place, the materials and processes were non-standard, the designs weren’t able to handle the demands that a real world throws at you. Making one that works and publishing a paper on it is one thing, making 10 million and making sure they all do the same thing is another.”

Their breakthrough — if years of hard work and research can be called that — is the ability not just to make a metasurface camera that produces decent images, but to do it without exotic components or manufacturing processes.

“We’re really using all standard semiconductor processes and materials here, the exact same equipment — but with lenses instead of electronics,” said Devlin. “We can already make a million lenses a day with our foundry partners.”

The thing at the bottom is the chip where the image processor and logic would be, but the meta-optic could also integrate with that. The top is a pinhole. Image Credits: Metalenz

The first challenge is more or less contained in the fact that incoming light, without lenses to bend and direct it, hits the metasurface in a much more chaotic way. Devlin’s own PhD work was concerned with taming this chaos.

“Light on a macro [i.e. conventional scale, not close-focusing] lens is controlled on the macro scale, you’re relying on the curvature to bend the light. There’s only so much you can do with it,” he explained. “But here you have features a thousand times smaller than a human hair, which gives us very fine control over the light that hits the lens.”

Those features, as you can see in this extreme close-up of the metasurface, are precisely tuned cylinders, “almost like little nano-scale Coke cans,” Devlin suggested. Like other metamaterials, these structures, far smaller than a visible or near-infrared light ray’s wavelength, manipulate the radiation by means that take a few years of study to understand.

The result is a camera with extremely small proportions and vastly less complexity than the compact camera stacks found in consumer and industrial devices. To be clear, Metalenz isn’t looking to replace the main camera on your iPhone — for conventional photography purposes the conventional lens and sensor are still the way to go. But there are other applications that play to the chip-style lens’s strengths.

Something like the FaceID assembly, for instance, presents an opportunity. “That module is a very complex one for the cell phone world — it’s almost like a Rube Goldberg machine,” said Devlin. Likewise the miniature lidar sensor.

At this scale, the priorities are different, and by subtracting the lens from the equation the amount of light that reaches the sensor is significantly increased. That means it can potentially be smaller in every dimension while performing better and drawing less power.

Image (of a very small test board) from a traditional camera, left, and metasurface camera, right. Beyond the vignetting it’s not really easy to tell what’s different, which is kind of the point. Image Credits: Metalenz

Lest you think this is still a lab-bound “wouldn’t it be nice if” type device, Metalenz is well on its way to commercial availability. The $10 million Series A they just raised was led by 3M Ventures, Applied Ventures LLC, Intel Capital, M Ventures and TDK Ventures, along with Tsingyuan Ventures and Braemar Energy Ventures — a lot of suppliers in there.

Unlike many other hardware startups, Metalenz isn’t starting with a short run of boutique demo devices but going big out of the gate.

“Because we’re using traditional fabrication techniques, it allows us to scale really quickly. We’re not building factories or foundries, we don’t have to raise hundreds of mils; we can use what’s already there,” said Devlin. “But it means we have to look at applications that are high volume. We need the units to be in that tens of millions range for our foundry partners to see it making sense.”

Although Devlin declined to get specific, he did say that their first partner is “active in 3D sensing” and that a consumer device, though not a phone, would be shipping with Metalenz cameras in early 2022 — and later in 2022 will see a phone-based solution shipping as well.

In other words, while Metalenz is indeed a startup just coming out of stealth and raising its A round… it already has shipments planned on the order of tens of millions. The $10 million isn’t a bridge to commercial viability but short-term cash to hire and cover upfront costs associated with such a serious endeavor. It’s doubtful anyone on that list of investors harbors any serious doubts on ROI.

The 3D sensing thing is Metalenz’s first major application, but the company is already working on others. The potential to reduce complex lab equipment to handheld electronics that can be fielded easily is one, and improving the benchtop versions of tools with more light-gathering ability or quicker operation is another.

Though a device you use may in a few years have a Metalenz component in it, it’s likely you won’t know — the phone manufacturer will probably take all the credit for the improved performance or slimmer form factor. Nevertheless, it may show up in teardowns and bills of material, at which point you’ll know this particular university spin-out has made it to the big leagues.

Powered by WPeMatico

The early-stage carbon offset API developer Patch could be another one of Andreessen Horowitz’s early bets on climate tech.

According to several people with knowledge of the investment round, former OpenTable chief executive and current Andreessen Horowitz partner Jeff Jordan is looking at leading the young company’s latest financing.

Such an investment would be a win for Patch, which could benefit from Andreessen Horowitz’s marketing muscle in a space that’s becoming increasingly crowded. And, if the deal goes through, it could be an indicator of more to come from one of the venture industry’s most (socially) active investors.

Companies like Pachama, Cloverly, Carbon Interface and Cooler.dev all have similar API offerings, but the market for these types of services will likely expand as more companies try to do the least amount of work possible to become carbon neutral through offsetting. A growing market could generate space for more than one venture-backed winner.

Neither Patch’s co-founders nor Andreessen Horowitz responded to a request for comment about the funding.

One concern with services like Patch is that its customers will look at offsetting as their final destination instead of a step on the road to removing carbon emissions from business operations. To fix our climate crisis will take more work.

Founded by Brennan Spellacy and Aaron Grunfeld, two former employees at the apartment rental service Sonder, Patch raised its initial financing from VersionOne Ventures back in September.

Around 15 to 20 companies are using the service now, according to people familiar with the company’s operations.

The company has an API that can calculate a company’s emissions footprint based on an integration with their ERP system, and then invests money into offset projects that are designed to remove an equivalent amount of carbon dioxide.

While services like Pachama privilege lower-cost sequestration solutions like reforestation and forest management, Patch offers an array of potential investment opportunities for offsets. And the company tries to nudge its customers to some of the more expensive, high-technology options in an effort to bring down costs for emerging technologies, said one person familiar with the company’s plans.

Like other services automating offsetting, Patch evaluates projects based on their additionality (how much additional carbon they’re removing over an already established baseline), permanence (how long the carbon emissions will be sequestered) and verifiability.

And, as the company’s founders note in their own statement about the company’s service, it’s not intended to be the only solution that customers deploy.

“The majority of climate models indicate that we need to reduce our emissions globally, while also removing carbon dioxide from the atmosphere,” the founders wrote in a Medium post. “We take care of a company’s carbon removal goals, while they focus their efforts on reducing emissions, a more proprietary task that requires intimate operational knowledge. Patch complements this behavioral shift and gives us a real chance to mitigate climate change.”

VersionOne’s Angela Tran addressed any concerns about the defensibility of Patch’s technology in her own September announcement.

“We also believe that defensibility comes with the aggregation and ‘digitization’ of quality supply. When we view Patch as a marketplace, we believe that businesses (demand) care about the type of projects (supply) they purchase to neutralize their emissions,” Tran wrote. “For example, a company might choose their sustainability legacy to be linked with forestry or mineralization projects. Patch is partnering with the best carbon removal developers and the latest negative emission technologies to build a network of low-cost, impactful projects.”

While Patch is explicitly focused on climate change, Andreessen has made a few early investments in a broad sustainability thesis. The firm led a $9 million investment into Silo last year and backed KoBold Metals back in 2019.

Silo has developed an enterprise resource planning tool for perishable food supply chains. Currently focused on wholesale produce, Silo said in a statement last year that it would be extending its services to meat, dairy and pantry items over the next year.

“The market potential for an innovator like Silo to reduce waste and improve margins is enormous and we’re excited to support its efforts as the system of record for food distribution in the United States,” said Anish Acharya, general partner at Andreessen Horowitz, in a statement at the time. “Silo is well-positioned to scale beyond the west coast to help more customers modernize and transition their operations from pen and paper to software.”

Meanwhile, KoBold is a software developer that uses machine learning and big data processing technologies to find new prospects for the precious metals that companies need to make new batteries and renewable energy generation technologies.

“By building a digital prospecting engine — full stack, from scratch — using computer vision, machine learning, and sophisticated data analysis not currently available to the industry, KoBold’s software combines previously unavailable, dark data with conventional geochemical, geophysical, and geological data to identify prospects in models that can only get better over time, as with other data network effects,” wrote Connie Chan in a blog post at the time.

Taken together, these investments coalesce into a picture of how Andreessen Horowitz and its pool of $16.5 billion in assets under management may approach the renewables industry.

Powered by WPeMatico

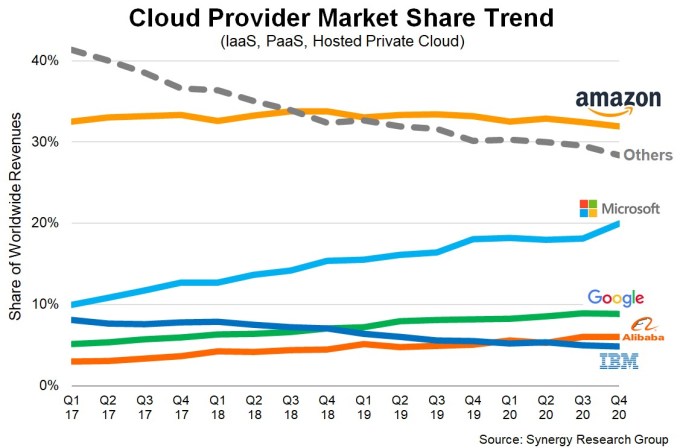

The cloud infrastructure market in 2020 reflected society itself, with the richest companies getting richer and the ones at the bottom of the market getting poorer. It grew to $129 billion for the year, according to data from Synergy Research Group. That’s up from around $97 billion in 2019.

Synergy also reported that the cloud infra market reached $37 billion in the fourth quarter, up from $33 billion in the third quarter, and 35% from a year ago.

I’ve heard from every founder under the sun for the last nine months that the pandemic was accelerating digital transformation, and that a big part of that was an expedited shift to the cloud. These numbers would seem to bear that out.

As usual the big three were Amazon, Microsoft and Google, with Alibaba now firmly entrenched in fourth place and IBM falling back to fifth. But Microsoft grew more quickly than rival Amazon, reaching 20% market share at the end of 2020 for the first time. Keep in mind that the Redmond-based software giant has now doubled its share since 2017. That’s remarkably rapid rapid growth. Meanwhile Google and Alibaba took home 9% and 6%, respectively.

Here’s what that all looks like in chart form:

Image Credits: Synergy Research

Amazon is an interesting case in that it has plateaued at around 33% for four straight years of Synergy data, but because it’s one-third share of an increasingly growing market, that means that it has kept growing its public cloud revenues as the category itself has expanded.

Amazon closed out the year with $12.74 billion in Q4 AWS revenue, putting it on a run rate of just over $50 billion for the first time. That was up from $11.6 billion the prior quarter. While Microsoft’s numbers are always difficult to parse from its earning’s reports, doing the math of 20% of $37 billion, it came in with $7.4 billion up from $5.9 billion last quarter.

Google brought in $3.3 billion, up from $2.98 billion in Q3 2020, and Alibaba pulled in $2.22 billion, up from $1.65 billion over the same time frame.

John Dinsdale, principal analyst at Synergy, says the leaders are pretty firmly entrenched at this point with huge absolute market numbers and also huge gaps between the cloud providers. “AWS has been a great success story for over 10 years now and it remains in an extremely strong market position despite increasing competition from a broad swathe of strong IT industry companies. That is a great testament both to Amazon and to the AWS leadership team and you’d have to suspect that will not change with the new regime,” he told me.

He sees Microsoft as a worthy rival, but one that is bound to hit a growth wall at some point. “It is certainly feasible that Microsoft will continue to narrow the gap between itself and Amazon, but the bigger Microsoft Azure becomes the tougher it is to maintain really high growth rates. That is just the law of large numbers.”

Meanwhile, market share at the bottom of the cloud infrastructure space continued to decline even while the number of dollars at stake have continued to expand dramatically. “The market share losers have been the large group of smaller cloud providers, who collectively have lost 13 percentage points of market share over the last 16 quarters,” Synergy wrote in a statement.

Dinsdale says all is not lost for these players, however. “Regarding the smaller players (or the big companies that have only a small market share), they can either focus on specific market niches (can be based around geography, service type or customer vertical) or they can try to offer a broad range of cloud services to a broad range of customers. Companies doing the former can do quite well, while companies doing the latter will find it extremely tough,” Dinsdale told me.

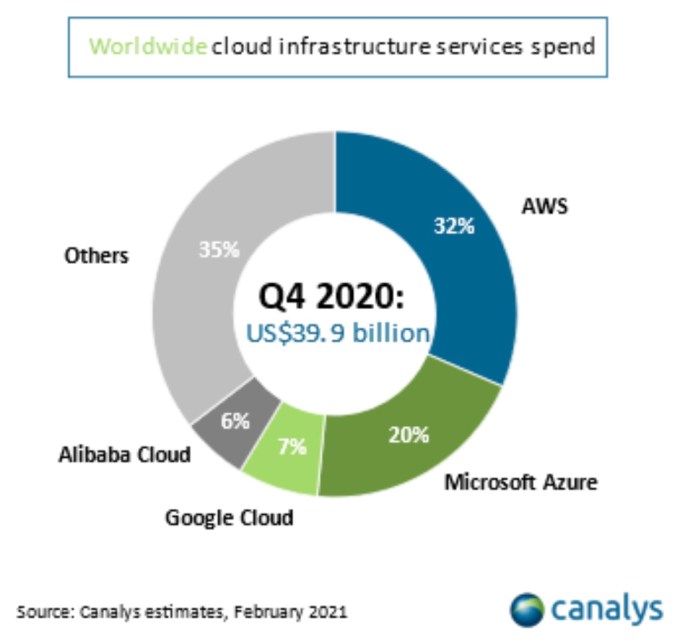

It’s worth noting that Canalys has slightly different numbers with a total market of around $142 billion and almost $40 billion for the quarter, but the percentages are in line with Synergy’s:

Image Credits: Canalys

At some point the numbers get so big they almost cease to have meaning, but as large as the public cloud revenue numbers become, they remain a relatively small percentage of overall worldwide IT spend. According to Gartner estimates, worldwide IT spend in 2020 was $3.6 trillion (with a T). That means that the cloud infrastructure market accounted for just 3.85% of total spend in 2020.

Think about that for a moment: less than 4% of IT spend currently is on cloud infrastructure, leaving so much room for growth and for those billions to grow ever bigger in the coming years.

It would certainly make it more interesting if someone could come in and disrupt the leaders, but for now at least they are going to be hard to push out of the way unless something unforeseen and dramatic happens to the way we think about computing.

Powered by WPeMatico

Chat platforms like Slack have been game-changers when it comes to what business users want and expect out of their work communications. Today, a company that’s aiming to move the goalpost again with an integrated, open-source alternative is announcing some funding to fuel its growth.

Rocket.Chat, a startup and open-source-based platform of the same name used by banks, the U.S. Navy, NGOs and other organizations big and small to set up and run any variety of secure virtual communications services from one place — they can include not just team chat, but also customer service, collaboration platforms covering your staff and outside partners, school classrooms, conferences and more — has raised $19 million.

The company plans to use the funding both to continue adding more customers, but also expanding the platform’s functionality, including more security features, a way to use the service over federated blockchain architecture, apps for marketplaces, options for bots, and more social media and omnichannel customer service integrations, and potentially facilities for virtual events.

As more business interactions have gone virtual, it has essentially opened the door for companies like Rocket.Chat building virtual communications platforms to build in an increasing number of features into what it does.

The Series A round of funding has four lead investors — Valor Capital Group, Greycroft, Monashees and NEA — with e.ventures, Graphene Ventures, ONEVC and DGF also participating. The Porto Alegre, Brazil-based startup (which is incorporated in Delaware) has now raised $27 million to date.

Rocket.Chat is not disclosing its valuation with this round, but it comes on the back of some significant growth in the last year. The startup now has 16 million registered users across 150 countries, with eight million of them monthly active users. Of that 16 million, 11.3 million users registered for the service in the past six months. It’s currently installed on some 845,000 servers, the company said, and has over 1,500 developers building on its platform.

Rocket.Chat’s funding and expanding business comes as part of a bigger focus overall for open-source platforms.

The promise of open source in the world of enterprise IT has been that it provides a platform to customise a service to fit with how the organization in question wants to use it, while at the same time providing tools to make sure it is robust enough in terms of security, extensibility and more for use in a business environment.

Over the years, it has become a big business opportunity, in line with organizations getting more sophisticated in terms of what they expect and need out of their IT services, where off-the-shelf apps may not always fit the bill.

Rocket.Chat positions itself as something of an all-in-one superstore for any and all communications needs, with organizations putting their own services together in whatever way works for their purposes.

It can either be hosted and managed by customers themselves, or used as a cloud-based SaaS, with its pricing ranging between free (for minimal, self-hosted services) to $4 per user per month, or higher, depending on which services customers want to have, whether its hosted and how much the platform is being used each month.

Image Credits: Rocket.Chat

As you can see in the mock-up here, its basic platform looks a little like Slack. But if you are using it for omnichannel communications for customer service, for example, you can build a platform within Rocket.Chat where you incorporate communications from any other platforms that might be used to communicate with customers.

Its work collaboration platform starts with Rocket.Chat’s basic chat interface, but also allows you to integrate alerts and links to other apps that you regularly use, as well as video calls and more. These and other functions built on Rocket.Chat can then be made to interact with each other — for example handing tickets off in customer service to internal tech support teams — or separately.

The idea is that by providing a version that can be hosted and managed by organizations themselves, it gives them more privacy and control over their electronic messaging.

Its thousands of customers reflect an interesting mix of the kinds of organizations that are looking for solutions that do just that.

Gabriel Engel, the CEO and founder, tells me the list includes several military and public sector organizations including the U.S. Navy, financial services companies like Credit Suisse and Citibank, as well as the likes of Cornell, Arizona State, UC Irvine, Bielefeld University and other educational institutions, and a number of other private companies.

That flexibility does not always play to Rocket.Chat’s advantage, however. Controversially, it seems that the list also includes the other end of the spectrum of organizations that want to keep their messages limited to a very specific audience: Islamic State it turns out also hosts and runs a Rocket.Chat to disseminate messages.

Engel says that while this is not something that the company supports, and that it works with authorities to shut down users like these as much as it can, it’s a consequence of how the service was built:

“We are not able to track usage if they are running Rocket.Chat servers of their own,” he said. “There’s a reason why the U.S. Navy uses Rocket.Chat. And that’s because we cannot track and know what they’re doing. It’s isolated from any external influence, for better or worse.” He added that the company has policies so that if an illicit organization is using its SaaS version, these get taken down in cooperation with authorities. “But just as with Linux, if you download and run Rocket.Chat on your own computer, then obviously it’s out of our reach.”

Hearing about how a platform built with privacy by design can be abused, with seemingly little to be done about it, does seem to offset some of the benefits. The ethics of that predicament, and whether technology can ever solve it, or whether it will be up to government authorities to address, will continue to be a question not just for Rocket.Chat but for all of us.

In the meantime, investors are interested because of the alternative it provides to those groups that need it.

“In today’s environment, organizations must have a secure communication platform to engage teams internally, communicate with customers and partners externally, and connect with safe interest-based communities,” said Dylan Pearce, partner at Greycroft, in a statement. “Rocket.Chat’s world-class management team and open-source community lead the industry in innovation and provide a communications platform capable of serving every person on the planet.”

Powered by WPeMatico

There is so much data sitting inside companies these days, but getting data to the people who need it most remains a daunting challenge. Polytomic, a graduate of the Y Combinator Winter 2020 cohort set out to solve that problem, and today the startup announced a $2.4 million seed.

Caffeinated Capital led the round with help from Bow Capital and a number of individual investors including the founders of PlanGrid, Tracy Young and Ralph Gootee, the company where Polytomic founders CEO Ghalib Suleiman and CTO Nathan Yergler both previously worked.

“We synch internal data to business systems. You can imagine your sales team living in Salesforce and would like to see who’s using your product from your customer data that lives in other internal databases. We have a no-code web app that moves internal data to the business systems of the office,” Suleiman told me.

Data lives in silos across every company, and Polytomic lets you build the connectors by dragging and dropping components in the Polytomic interface. This new data then shows up as additional fields in the target application. So you might have a usage percentage field added to Salesforce automatically if you were connecting to customer usage data.

The company actually sells the product to business operations teams, who would be charged with setting up a catalogue or menu of data sources that live in Polytomic. This is usually handled by someone like a business analyst who can configure the different sources. Once that’s done, anyone can build connectors to these data sources by selecting them from the menu and then choosing where to deliver the data.

The founders came up with the idea for the company because when they were at PlanGrid, they faced a problem getting data to the people who needed it in the company. The problem became more pronounced as the company grew and they had ever more data and more employees who needed access to it.

They left PlanGrid in 2018 and launched Polytomic a year later to begin attacking the problem. The two founders joined YC as a way to learn to refine the product, and were still working on it on Demo Day, delivering their presentation off the record because they weren’t quite done with it yet.

They released the first iteration of the product last September and report some progress getting customers and gaining revenue. Early customers include Brex, ShipBob, Sourcegraph and Vanta.

The company has no additional employees beyond the two founders as of yet, but with the seed funding in the bank, they plan to begin hiring a few people this year.

Powered by WPeMatico

Box announced this morning that it has agreed to acquire e-signature startup SignRequest for $55 million. The acquisition gives the company a native signature component it has been lacking and opens up new workflows for the company.

Box CEO Aaron Levie says the company has seen increased demand from customers to digitize more of their workflows, and this acquisition is about giving them a signature component right inside Box that will be known as Box Sign moving forward. “With Box Sign, customers can have a seamless e-signature experience right where their content already lives,” Levie told me.

While Box has partnerships with other e-signature vendors, this gives it one to call its own, one that will be built into Box starting this summer. As we have learned during this pandemic, the more work we can do remotely, the safer it is. Even after the pandemic ends and we get back to more face-to-face interactions, being able to do things fully in the cloud and removing paper from the workflow will speed up everything.

“The massive push to remote work effectively instantly highlighted for every enterprise where their digital workflows were breaking down. And e-signature was a major part of that — too many industries still rely on paper-based processes,” he said.

Levie says that the signature component has been a key missing piece from the platform. “As for our platform, when you look at Snowflake, they’re the data cloud. Salesforce is the sales cloud. Adobe is the marketing cloud. We want to build the content cloud. Imagine one platform that can power the entire lifecycle of content. E-signature has been a major missing link for critical workflows,” he said.

He believes this will open up the platform for a number of scenarios, that while possible before, could not flow as easily between Box components. “Having SignRequest gets us more natively into mission-critical workflows like customer contracts, vendor onboarding, healthcare onboarding and supply chain collaboration,” Levie explained.

It’s worth noting that Dropbox acquired HelloSign for $230 million two years ago to provide it with a similar kind of functionality and workflow capability, but analyst Alan Pelz-Sharpe from Deep Analysis, a firm that follows the content management market, says this wasn’t really in reaction to that.

“I think what is interesting here is that Box is going to integrate SignRequest and bundle it as part of the standard service. That’s what really caught my eye as the challenge with e-sig is that it’s typically a separate product and so gets limited use. They bought it partly in response to Dropbox, but it was a hole that needed fixing regardless so would have done so anyway,” Pelz-Sharpe explained.

As for SignRequest, the company was founded in the Netherlands in 2014. Neither PitchBook nor Crunchbase has a record of it raising funds. The plan is for the company’s employees to join Box and help build the signature component that will become Box Sign. According to a message to customers on the company website, existing customers will have the opportunity over the next year to move to Box Sign, and get all of the other components of the Box platform.

Levie says the basic Box Sign function will be built into the platform at no additional charge, but there will be more advanced features coming that they could charge for. The deal is expected to close soon with the SignRequest team remaining in The Netherlands.

Powered by WPeMatico

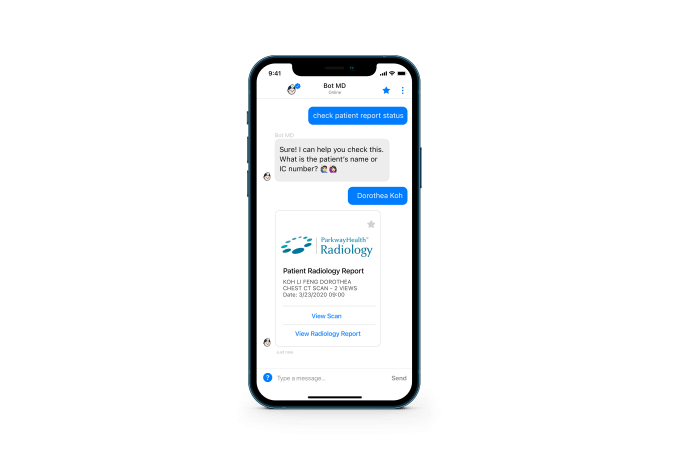

Time is critical for healthcare providers, especially in the middle of the pandemic. Singapore-based Bot MD helps save time with an AI-based chatbot that lets doctors look up important information from their smartphones, instead of needing to call a hospital operator or access its intranet. The startup announced today it has raised a $5 million Series A led by Monk’s Hill Venture.

Other backers include SeaX, XA Network and SG Innovate, and angel investors Yoh-Chie Lu, Jean-Luc Butel and Steve Blank. Bot MD was also part of Y Combinator’s summer 2018 batch.

The funding will be used to expand in the Asia-Pacific region, including Indonesia, the Philippines, Malaysia and Indonesia, and to add new features in response to demand from hospitals and healthcare organizations during COVID-19. Bot MD’s AI assistant currently supports English, with plans to release Bahasa Indonesian and Spanish later this year. It is currently used by about 13,000 doctors at organizations including Changi General Hospital, National University Health System, National University Cancer Institute of Singapore, Tan Tock Seng Hospital, Singapore General Hospital, Parkway Radiology and the National Kidney Transplant Institute.

Co-founder and chief executive officer Dorothea Koh told TechCrunch that Bot MD integrates hospital information usually stored in multiple systems and makes it easier to access.

Image Credits: Bot MDWithout Bot MD, doctors may need to dial a hospital operator to find which staffers are on call and get their contact information. If they want drug information, that means another call to the pharmacy. If they need to see updated guidelines and clinical protocols, that often entails finding a computer that is connected to the hospital’s intranet.

“A lot of what Bot MD does is to integrate the content that they need into a single interface that is searchable 24/7,” said Koh.

For example, during COVID-19, Bot MD introduced a new feature that takes healthcare providers to a form pre-filled with their information when they type “record temperature” into the chatbot. Many were accessing their organization’s intranet twice a day to log their temperature and Koh said being able to use the form through Bot MD has significantly improved compliance.

The time it takes to onboard Bot MD varies depending on the information systems and amount of content it needs to integrate, but Koh said its proprietary natural language processing chat engine makes training its AI relatively quick. For example, Changi General Hospital, a recent client, was onboarded in less than 10 days.

Bot MD plans to add new clinical apps to its platform, including ones for electronic medical records (EMR), billing and scheduling integrations, clinical alerts and chronic disease monitoring.

Powered by WPeMatico

BukuWarung, an Indonesian startup focused on digitizing the country’s 60 million small businesses, announced today it has raised new funding from Rocketship.vc and an Indonesian retail conglomerate.

The amount was undisclosed, but sources say it brings BukuWarung’s total funding so far to $20 million. The company’s last round, announced in September 2020, was between $10 million to $15 million. Launched in 2019, BukuWarung was founded by Chinmay Chauhan and Abhinay Peddisetty and took part in Y Combinator last year.

Rocketship.vc is also an investor in Indian startup Khatabook, which reached a valuation between $275 million to $300 million in its last funding round. Like Khatabook, BukuWarung helps small businesses, like neigborhood stores called warung, that previously relied on paper ledgers transition to digital bookkeeping and online payments. BukuWarung recently launched Tokoko, a Shopify-like tool that lets merchants create online stores through an app, and says Tokoko has been used by 500,000 merchants so far.

Chuahan, BukuWarung’s president, said it has started making revenue through its payments solution. In total, BukuWarung now claims more than 3.5 million registered merchants in 750 Indonesian towns and cities, and says it is recording over $15 billion worth of transactions across its platform and processing over $500 million in terms of volume.

SMEs contribute about 60% to Indonesia’s gross domestic product and employ 97% of its domestic workforce, but many have difficulty accessing financial services that can help them grow. By digitizing their financial records, companies like BukuWarung can make it easier for them to access lines of credit, working capital loans and other services. Other companies serving SMEs in Indonesia, Southeast Asia’s largest economy, include BukuKas and CrediBook.

BukuWarung will use its new funding to grow its tech and product teams in Indonesia, India and Singapore. It plans to launch more monetization products, including credit, and grow its payments solution this year.

Powered by WPeMatico

Blockbuster news struck late this afternoon when Amazon announced that Jeff Bezos would be stepping back as CEO of Amazon, the company he built from a business in his garage to worldwide behemoth. As he takes on the role of executive chairman, his replacement will be none other than AWS CEO Andy Jassy.

With Jassy moving into his new role at the company, the immediate question is who replaces him to run AWS. Let the games begin. Among the names being tossed about in the rumor mill are Peter DeSantis, vice president of global infrastructure at AWS and Matt Garman, who is vice president of sales and marketing. Both are members of Bezos’ elite executive team known as the S-team and either would make sense as Jassy’s successor. Nobody knows for sure though, and it could be any number of people inside the organization, or even someone from outside. Amazon was not ready to comment on a successor yet with the hand-off still months away.

Holger Mueller, a senior analyst at Constellation Research, says that Jassy is being rewarded for doing a stellar job raising AWS from a tiny side business to one on a $50 billion run rate. “On the finance side it makes sense to appoint an executive who intimately knows Amazon’s most profitable business, that operates in more competitive markets. [Appointing Jassy] ensures that the new Amazon CEO does not break the ‘golden goose’,” Mueller told me.

Alex Smith, VP of channels, who covers the cloud infrastructure market at analyst firm Canalys, says the writing has been on the wall that a transition was in the works. “This move has been coming for some time. Jassy is the second most public-facing figure at Amazon and has lead one of its most successful business units. Bezos can go out on a high and focus on his many other ventures,” Smith said.

Smith adds that this move should enhance AWS’s place in the organization. “I think this is more of an AWS gain, in terms of its increasing strategic importance to Amazon going forward, rather than loss in terms of losing Andy as direct lead. I expect he’ll remain close to that organization.”

Ed Anderson, a Gartner analyst also sees Jassy as the obvious choice to take over for Bezos. “Amazon is a company driven by technology innovation, something Andy has been doing at AWS for many years now. Also, it’s worth noting that Andy Jassy has an impressive track record of building and running a very large business. Under Andy’s leadership, AWS has grown to be one of the biggest technology companies in the world and one of the most impactful in defining what the future of computing will be,” Anderson said.

In the company earnings report released today, AWS came in at $12.74 billion for the quarter up 28% YoY from $9.6 billion a year ago. That puts the company on an elite $50 billion run rate. No other cloud infrastructure vendor, even the mighty Microsoft, is even close in this category. Microsoft stands at around 20% marketshare compared to AWS’s approximately 33% market share.

It’s unclear what impact the executive shuffle will have on the company at large or AWS in particular. In some ways it feels like when Larry Ellison stepped down as CEO of Oracle in 2014 to take on the exact same executive chairman role. While Safra Catz and Mark Hurd took over at co-CEOs in that situation, Ellison has remained intimately involved with the company he helped found. It’s reasonable to assume that Bezos will do the same.

With Jassy, the company is getting a man who has risen through the ranks since joining the company in 1997 after getting an undergraduate degree and an MBA from Harvard. In 2002 he became VP/technical assistant, working directly under Bezos. It was in this role that he began to see the need for a set of common web services for Amazon developers to use. This idea grew into AWS and Jassy became a VP at the fledgling division working his way up until he was appointed CEO in 2016.

Powered by WPeMatico