TC

Auto Added by WPeMatico

Auto Added by WPeMatico

Another hour, another billion-dollar round. That’s how February is kicking off. This time it’s Databricks, which just raised $1 billion Series G at a whopping $28 billion post-money valuation.

Databricks is a data-and-AI focused company that interacts with corporate information stored in the public cloud.

News of the new round began leaking last week. Franklin Templeton led the round, which also included new investors Fidelity and Whale Rock. Databricks also raised part of the capital from major cloud vendors including AWS, Alphabet via its CapitalG vehicle, and Salesforce Ventures. Microsoft is a previous investor, and it took part in the round as well.

But we’re not done! Other prior investors including a16z, T. Rowe Price, Tiger Global, BlackRock and Coatue were also involved along with Alkeon Capital Management.

Consider that Databricks just raised a bushel of capital from a mix of cloud companies it works with, public investors it wants as shareholders when it goes public and some private money that is enjoying a stiff markup from their last check into the company.

The company has made its mark with a series of four open-source products with a core data lake product call Delta Lake leading the way. You may recall that another hot data lake company, Snowflake, raised almost a half a billion dollars on a $12.4 billion valuation a year ago before going public last September with a valuation twice that. Databricks has already exceeded that public valuation with this round — as a private company.

When we spoke to Databricks CEO Ali Ghodsi at the time of his company’s $400 million round in 2019, one which valued the company at $6.2 billion at the time, he said his company was the fastest-growing enterprise cloud software companies ever, and that’s saying something.

The company makes money by offering each of those open-source products as a software service and it’s doing exceedingly well at it, so much so that investors were tripping over each other to be part of this deal. In fact, Ghodsi said in a conversation with TechCrunch today that his company had targeted a much more modest $200 million raise, but that figure grew as more parties wanted to invest funds into the company. Even with that, Databricks had to turn capital away, he added, after deciding to cap the round at $1 billion.

The extra $800 million that the company raised will be used for M&A opportunities with an eye on talent, spend on establishing a Lakehouse concept, international expansion, while also expanding its engineering team, the CEO said.

Ghodsi also made clear that he does not intend to let the percentage of revenue that the company spends on R&D to drop, as is common at modern software companies — as many SaaS companies grow, they expend more of their revenue on sales and marketing efforts over product spend, something that Databricks wants to avoid by continuing to invest in engineering talent.

Why? Because Ghodsi says that the pace of innovation in AI is so rapid that IP becomes outdated in just a few years. That means that companies that want to lead in this space will have to stay on the bleeding edge of their market or fall back swiftly.

The Databricks model appears to be working well, with the company closing 2020 at $425 million in annual recurring revenue, or ARR. That figure, up 75% from the year-ago period, is also up from a $350 million run rate at the end of its Q3 2020. (For more on Databricks’ business, product and growth, head here.)

Notably Ghodsi told TechCrunch that this deal only started to come together in December. It’s February 1st today, which means that it took on this bushel of new funding remarkably quickly.

Finally, at $425 million in ARR, is the CEO worried about having a valuation sitting at roughly a 65x multiple? Ghodsi said that he is not. He said that he told his company during an all-hands earlier today that the AI market is a long journey, one that he hopes to be on for decades, and the stock market will go up and down. His point, as far as I could read into it, was that so long as Databricks keeps growing as it has, its valuation will take care of itself (and that seems to be the case so far with this company).

What’s certainly true is that Databricks is now as rich as it has ever been, as large as it has ever been, and in a market that is maturing. Let’s see what it can do with all this money.

Powered by WPeMatico

Many founders only know their own experience fundraising and don’t hear much about what other founders went through. On Extra Crunch Live on Wednesday, we’re going to remedy that.

Grafana Labs has raised upward of $75 million since it launched in 2014. Lightspeed Venture Partners, and partner Gaurav Gupta to be specific, led both the startup’s Series A and Series B rounds. As far as commitments go, that’s a pretty significant one.

The new and improved Extra Crunch Live pairs founders and the investors who led their earlier rounds to talk about how the deal went down, from the moment they met to the conversations they had (including some disagreements) to the relationship as it exists today. Hell, we may even take a peek at the original pitch deck that made it all happen.

Then, we’ll turn our eyes back to you, the audience. That same founder/investor duo (in this case, Grafana Labs CEO Raj Dutt and LVP’s Gaurav Gupta) will take a look at your pitch decks and give their own feedback. (If you haven’t yet submitted a pitch deck to be torn down on Extra Crunch Live, you can do so here.)

The hour-long episode is sandwiched between two 30-minute rounds of networking. From start to finish, it goes from 11:30 a.m. PST/2:30 p.m. EST to 1:30 p.m. PST/4:30 p.m. EST. And Extra Crunch Live will come to you at the same time, every week, with a new pair of speakers.

So let’s learn a little bit more about Gupta and Dutt.

Before becoming an investor, Gupta enjoyed a rich career in the product development sphere, holding positions at Elastic (where he led product management), Splunk (VP of Products), as well as Google, Gateway and the McKenna Group. He joined Lightspeed in 2019 as a partner, focusing primarily on enterprise software. He’s led investments in Impira, Blameless, Hasura and Panther, and of course, Grafana. He sits on the board of the last three companies in that list.

Dutt is the co-founder and CEO at Grafana Labs, but the fast-growing company isn’t his first go at entrepreneurialism. Dutt also founded and led Voxel, a cloud-hosting startup that was acquired by Internap for $30 million in 2012.

We’re absolutely thrilled to have Gupta and Dutt join us on our first episode of Extra Crunch Live in 2021. As a reminder, Extra Crunch Live is for Extra Crunch members only. We’re coming to you with a new pair of speakers every week, and you can catch everything you missed on-demand if you can’t join us live. It’s worth the cost of the subscription on its own, but EC members also get access to our premium content, including market maps and investor surveys. Long story short? Subscribe, smarty. You won’t regret it.

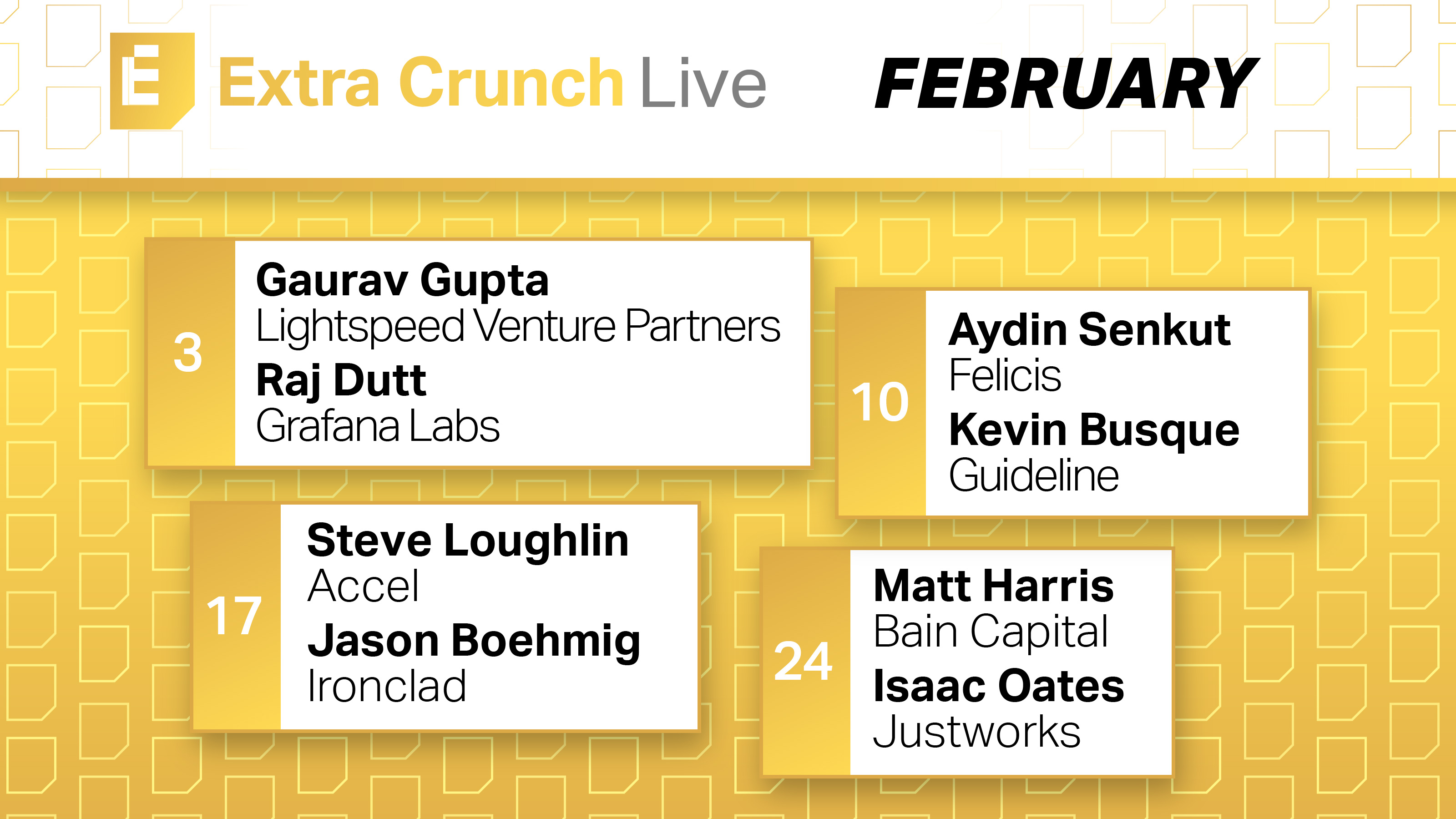

Oh, and here’s a look at other speakers you can expect to see on Extra Crunch Live:

Aydin Senkut (Felicis) + Kevin Busque (Guideline) — February 10

Steve Loughlin (Accel) + Jason Boehmig (Ironclad) — February 17

Matt Harris (Bain Capital Ventures) + Isaac Oates (Justworks) — February 24

And that’s just the February slate!

All the details to register for this upcoming episode (and more) are available below. Can’t wait to see you there!

Powered by WPeMatico

Boston-based security operations company Rapid7 has been making moves into the cloud recently, and this morning it announced that it has acquired Kubernetes security startup Alcide for $50 million.

As the world shifts to cloud native using Kubernetes to manage containerized workloads, it’s tricky ensuring that the containers are configured correctly to keep them safe. What’s more, Kubernetes is designed to automate the management of containers, taking humans out of the loop and making it even more imperative that the security protocols are applied in an automated fashion as well.

Brian Johnson, SVP of Cloud Security at Rapid7 says that this requires a specialized kind of security product and that’s why his company is buying Alcide. “Companies operating in the cloud need to be able to identify and respond to risk in real time, and looking at cloud infrastructure or containers independently simply doesn’t provide enough context to truly understand where you are vulnerable,” he explained.

“With the addition of Alcide, we can help organizations obtain comprehensive, unified visibility across their entire cloud infrastructure and cloud-native applications so that they can continue to rapidly innovate while still remaining secure,” he added.

Today’s purchase builds on the company’s acquisition of DivvyCloud last April for $145 million. That’s almost $200 million for the two companies that allow Rapid7 to help protect cloud workloads in a fairly broad way.

It’s also part of an industry trend with a number of Kubernetes security startups coming off the board in the last year as bigger companies look to enhance their container security chops by buying talent and technology. This includes VMware nabbing Octarine last May, Cisco getting PortShift in October and Red Hat buying StackRox last month.

Alcide was founded in 2016 in Tel Aviv, part of the active Israeli security startup scene. It raised about $12 million along the way, according to Crunchbase data.

Powered by WPeMatico

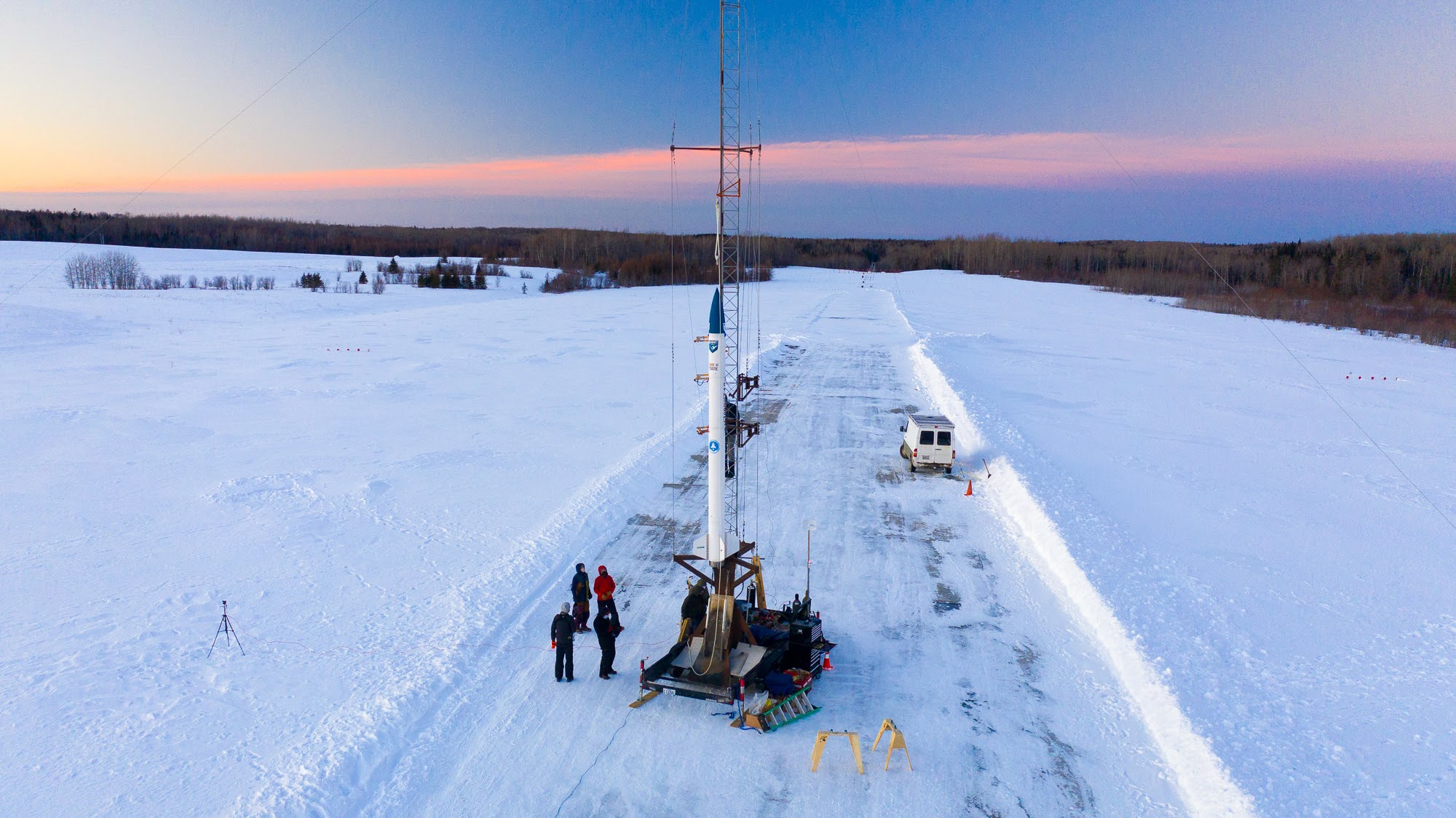

New space startup bluShift wants to bring a new kind of propellant to the small satellite launching market, with rockets powered by bio-derived rocket fuels. These differ from traditional fuels in that they offer safety advantages during handling, and ecological advantages during production and use. The startup has been working on its solid rocket biofuel since its founding in 2014, and has received grants from the Maine Technology Institute and NASA’s Small Business Innovation Research (SBIR) program to refine its fuel formula and rocket engine design to help it get to this point.

The company achieved a milestone on Sunday with its first rocket launch — a low-altitude flight of a small sounding rocket, called Stardust 1.0. It’s a single-stage prototype, which can only carry 18 lbs of payload and is designed to achieve suborbital space. That may not seem like much, but it is enough to put small research equipment up into suborbital space, at costs that put launches within range for small companies and academic institutions.

Image Credits: Knack Factory/Courtesy Aerospace

Stardust 1.0 is designed to be reusable, though it’s still a prototype, and the company is also working on Stardust 2.0, which is a second prototype that’s expected to increase the payload capacity and act as the primary building block for its subsequent production commercial rockets, including Starless Rogue, a two-stage launcher for suborbital missions, and Red Dwarf, a three-stage, 66-lb capacity launch vehicle that can reach low Earth orbit.

Sunday’s launch looked like it might not have been on track to go well at first, with an initial attempt seeing the rocket’s ignition light — but without a takeoff. After resetting for a second try, there wasn’t any ignition. Finally the rocket did take off late in the day, with a flight that the company said “went perfectly” on a follow-up call with media.

Powered by WPeMatico

Welcome back to This Week in Apps, the weekly TechCrunch series that recaps the latest in mobile OS news, mobile applications and the overall app economy.

The app industry continues to grow, with a record 218 billion downloads and $143 billion in global consumer spend in 2020. Consumers last year also spent 3.5 trillion minutes using apps on Android devices alone.

And in the U.S., app usage surged ahead of the time spent watching live TV. Currently, the average American watches 3.7 hours of live TV per day, but now spends four hours per day on their mobile devices.

Apps aren’t just a way to pass idle hours — they’re also a big business. In 2019, mobile-first companies had a combined $544 billion valuation, 6.5x higher than those without a mobile focus. In 2020, investors poured $73 billion in capital into mobile companies — a figure that’s up 27% year-over-year.

This week, we’re taking a look at the biggest news in the world of apps, including how the GameStop frenzy impacted trading apps, as well as how Apple’s privacy changes are taking shape in 2021, and more.

Image Credits: TechCrunch

Was there really any other app news story this week, beside the GameStop short squeeze? That a group of Reddit users took on the hedge funds was the stuff of legends, even if the reality was that Wall Street likely got in on both sides of the trade. Whether you found yourself in the camp of admiring the spectacle or watching the train wreck in horror (or both), what we witnessed — at long last, I suppose — was the internet coming for the stock market. The GameStop frenzy upended the status quo; it rattled the traditional ways of doing things — much like what the internet has done to almost everything else it touches — whether that’s publishing, media, creation, politics, and more.

“This is community,” explained Reddit founder Alexis Ohanian, in an interview on AOC’s Twitch channel on Thursday.

“This is something that spans platforms and the internet, especially in the last 10 years — in particular social media and smartphone ubiquity. All these things have connected us in real-time ways to organize around ideas, around concepts,” he continued. “We seek out those communities. We seek out that sense of identity. We seek out that sense of connection. And the internet supercharges it because of scale,” he said. “I think one of the byproducts of where I think it continues to go is more of a push towards decentralization and more of a push toward individuals being able to take ownership — even individuals being able to get access — to do the same things that institutions, historically, had a monopoly on,” Ohanian noted.

Trading app Robinhood and social app Reddit, home to the WallStreetBets forum driving the GameStop push, immediately benefitted from the community-driven effort to squeeze the hedge funds — and jumped to the top of the App Store.

But Robinhood’s subsequent failure to be transparent as to why it was forced to stop customers from buying the “meme” stocks, like GameStop and others (it needed more cash), quickly damaged its reputation. Some investors have now sued for their losses. Others started petitions. And even more began downranking the app with one-star reviews, which Google then removed.

Other trading apps have gained not only during the frenzy itself, but also after, as Robinhood users looked for alternative platforms after being burned by the free trading app.

As of Friday, Robinhood remained at No. 1 on the App Store, but is now being closely trailed on the Top Free iPhone apps chart by No. 2 Webull, No. 6 Fidelity, No. 7 Cash App, No. 12 TD Ameritrade and No. 15 E*TRADE, among others.

Crypto apps are also topping the charts, as users realize the potential of collective action in markets not yet dominated by the billionaires. Coinbase popped to No. 4, while Binance-run apps were at No. 9 and No. 19, Voyager was No. 23 and Kraken No. 24.

In addition, forums where traders can join communities are also continuing to do well, with Reddit at No. 3, Discord at No. 14 and Telegram at No. 28, as of the time of writing.

Image Credits: Jaap Arriens/NurPhoto via Getty Images

Google failed to meet its earlier promised deadline of rolling out privacy labels to its nearly 100-some iOS apps. Its initial estimate followed suggestions (aided by Apple’s typical quiet confirmations to press), that Google had been struggling over how to handle the privacy issues the updates would reveal. This week, Google again said its labels were on the way. But now, it’s not making any specific promises about when those labels would arrive. Instead, the company just said the labels would roll out as Google updated its iOS apps with new features and bug fixes, rather than rolling out the labels to all its apps at once.

However, some Google apps have been updated, including Play Movies & TV, Google Translate, Fiber TV, Fiber, Google Stadia, Google Authenticator, Google Classroom, Smart Lock, Motion Stills, Onduo for Diabetes, Wear OS by Google and Project Baseline — but not Google’s main apps like Search, YouTube, Maps, Gmail or its other productivity apps.

Image Credits: Apple (livestream)

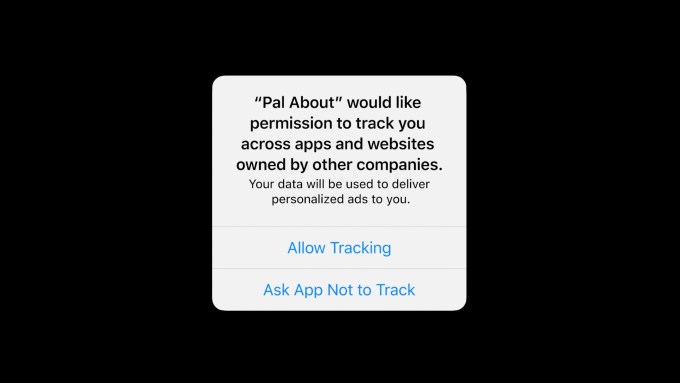

Apple announced this week its tracking restrictions for iOS apps are nearing arrival. The changes had initially been pushed back to give developers more time to make updates, but will now arrive in “early spring.”

Once live, the previous opt-out model for sharing your Identifier for Advertisers (IDFA) will change to an opt-in model, meaning developers will have to ask users’ permission to track them. Most users will likely say “no,” and be annoyed by the request. Users will also be able to adjust IDFA sharing in Settings on a per-app basis, or on all apps at once.

Facebook has already been warning investors of the ad revenue hit that will result from these changes, which it expects to see in the first quarter earnings. It may also be preparing a lawsuit. Google, meanwhile, said it would be adopting Apple’s SKAdNetwork framework and providing feedback to Apple about its potential improvements.

For years, Apple has been laying the groundwork to establish itself as the company that cares about consumer privacy. And it’s certainly true that no other large tech company has yet to give users this much power to fight back against being tracked around the web and inside apps.

But this is not a case of Apple being the “good guy” while everyone else is “bad” — because the multi-billion-dollar ad industry is not that simple. With a change to its software, Apple has effectively carved out a seat at the table for its own benefit.

What many don’t realize is that Apple watches what its users do across its own platform, inside a number of its first-party apps — including in Apple Music, Apple TV, Apple Books, Apple News and the App Store. It then uses that first-party data to personalize the ads it displays in Apple News, Stocks and the App Store.

So while other businesses are tracking users around the web and apps to gain data that lets them better personalize ads at scale, Apple only tracks users inside its own apps and services. (But there sure are a lot of them! And Apple keeps launching new ones, too.)

With the new limits that impact the effectiveness of ads outside of Apple’s ecosystem, advertisers who need to reach a potential customer — say, with an app recommendation — will need to throw more money into Apple-delivered advertising instead. This is because Apple’s ads will be capable of making those more targeted, personalized and, therefore, more effective recommendations.

Apple says it will play by the same rules that it’s asking other developers to abide by. Meaning, if its apps want to track you, they’ll ask. But most of its apps do not “track” using IDFA. Meanwhile, if users want to turn off personalized ads using Apple’s first-party data, that’s a different setting. (Settings –> Privacy –> scroll to bottom –> Apple Advertising –> toggle off Personalized Ads). And no, you won’t be shown a pop-up asking you if that’s a setting you want on or off.

Apple, having masterfully made its case as the privacy-focused company — because wow, isn’t adtech gross? — is now just laying it on. Apple CEO Tim Cook this week blamed the adtech industry for the growth in online extremism, violent incitement (e.g. at the U.S. Capitol) and growing belief in conspiracies, saying companies (cough, Facebook) optimized for engagement and data collection, no matter the damage to society.

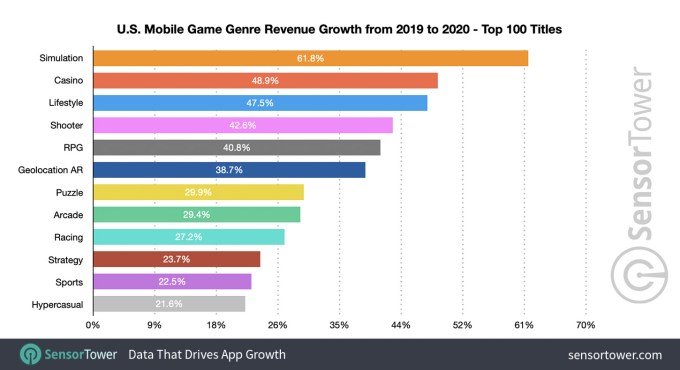

Image Credits: Sensor Tower

Image Credits: Telegram

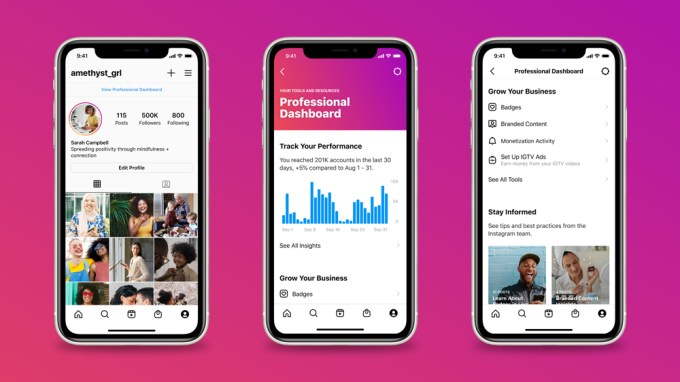

Image Credits: Instagram

Image Credits: Freepik / Kristina Astakhova (opens in a new window) / Getty Images

Image Credits: Confide

Image Credits: Opal

Opal offers a digital well-being assistant for iPhone that allows you to block distracting websites and apps, set schedules around app usage, lock down apps for stricter and more focused quiet periods and more. The service works by way of a VPN system that limits your access to apps and sites. But unlike some VPNs on the market, Opal is committed to not collecting any personal data on its users or their private browsing data. Instead, its business model is based on paid subscriptions, not selling user data, it says. The freemium service lets you upgrade to its full feature set for $59.99/year.

Image Credits: Charlie

Founded by a former mobile game industry vet, Charlie “gamifies” getting out of debt using techniques that worked in gaming, like progress bars, fun auto-save rules that can be triggered by almost any activity, celebrations with confetti and more. The app plans to expand into a fuller fintech product in time to help users refinance debt at a lower rate and bill pay directly from the app.

Powered by WPeMatico

For American importers, finding suppliers these days can be challenging not only due to COVID-19 travel restrictions. The U.S. government’s entity list designations, human-rights-related sanctions, among other trade blacklists targeting Chinese firms have also rattled U.S. supply chains.

One young company called International Compliance Workshop, or ICW, is determined to make sourcing easier for companies around the world as it completed a fresh round of funding. The Hong Kong-based startup has just raised $5.75 million as part of its Series A round, boosting its total funding to around $10 million, co-founder and CEO Garry Lam told TechCrunch.

ICW works like a matchmaker for suppliers and buyers, but unlike existing options like Alibaba’s B2B platform or international trade shows, ICW also vets suppliers over compliance, product quality and accreditation. It gathers all that information into its growing database of over 40,000 suppliers — 80% of which are currently in China — and recommends them to customers based on individual needs.

Founded in 2016, ICW’s current client base includes some of the world’s largest retailers, including Ralph Lauren, Prenatal Retail Group, Blokker, Kmart and a major American pharmacy chain that declined to be named.

ICW’s latest funding round was led by Infinity Ventures Partners with participation from Integrated Capital and existing investors MindWorks Capital and the Hong Kong government’s $2 billion Innovation and Technology Venture Fund.

In line with the ongoing shift of sourcing outside China, in part due to the U.S.-China trade war and China’s growing labor costs, ICW has seen more customers diversifying their supply chains. But the transition has limitations in the short run.

“It’s still very difficult to find suppliers of certain product categories, for example, Bluetooth devices and power banks, in other countries,” observed Lam. “But for garment and textile, the transition already began to happen a decade ago.”

In Southeast Asia, which has been replacing a great deal of Chinese manufacturing activity, each country has its slight specialization. Whereas Vietnam abounds with wooden furniture suppliers, Thailand is known for plastic goods and Malaysia is a good source for medical supplies, said Lam.

When it comes to trickier compliance burdens, such as human rights sanctions, ICW relies on third-party certification institutes to screen and verify suppliers.

“There is a [type of] qualification standard that verifies whether a supplier has fulfilled its corporate social responsibility … like whether the factory fulfills the labor law, the minimum labor rights or the payroll, everything,” Lam explained.

ICW plans to use the fresh proceeds to further develop its products, including its compliance management system, product testing platform and B2B-sourcing site.

Powered by WPeMatico

Edtech is so widespread, we already need more consumer-friendly nomenclature to describe the products, services and tools it encompasses.

I know someone who reads stories to their grandchildren on two continents via Zoom each weekend. Is that “edtech?”

Similarly, many Netflix subscribers sought out online chess instructors after watching “The Queen’s Gambit,” but I doubt if they all ran searches for “remote learning” first.

Edtech needs to reach beyond underfunded public school systems to become more sustainable, which is why more investors and founders are focusing on lifelong learning.

Besides serving traditional students with field trips and art classes, a maturing sector is now branching out to offer software tutors, cooking classes and singing lessons.

For our latest investor survey, Natasha Mascarenhas polled 13 edtech VCs to learn more about how “employer-led up-skilling and a renewed interest in self-improvement” is expanding the sector’s TAM.

Here’s who she spoke to:

Full Extra Crunch articles are only available to members

Use discount code ECFriday to save 20% off a one- or two-year subscription

In other news: Extra Crunch Live, a series of interviews with leading investors and entrepreneurs, returns next month with a full slate of guests. This year, we’re adding a new feature: Our guests will analyze pitch decks submitted by members of the audience to identify their strengths and weaknesses.

If you’d like an expert eye on your deck, please sign up for Extra Crunch and join the conversation.

Thanks very much for reading! I hope you have a fantastic weekend — we’ve all earned it.

Walter Thompson

Senior Editor, TechCrunch

@yourprotagonist

Image Credits: Bryce Durbin

Image Credits: Nigel Sussman (opens in a new window)

After falling into yesterday’s wild news cycle, Alex Wilhelm returned to The Exchange this morning with a close look at venture capital activity across Africa in 2020.

“Comparing aggregate 2020 figures to 2019 results, it appears that last year was a somewhat robust year for African startups, albeit one with fewer large rounds,” he found.

For more context, he interviewed Dario Giuliani, the director of research firm Briter Bridges, which focuses on emerging markets in Africa, Asia and Latin America.

Image Credits: MCCAIG (opens in a new window) / Getty Images

New cybersecurity ecosystems are popping up in different parts of the world.

Some of of that growth has been fueled by an exodus from the Bay Area, but many early-stage security startups already have deep roots in East Coast cities like Boston and New York.

In the United Kingdom and Europe, government innovation programs have helped entrepreneurs close higher numbers of Series A and B rounds.

Investor interest and expertise is migrating out of Silicon Valley: This post will help you understand where it’s going.

Image Credits: NurPhoto (opens in a new window) / Getty Images

Today’s smartphones are unfathomably feature-rich and durable, so it’s logical that sales have slowed.

A phone purchased 18 months ago is probably “good enough” for many consumers, especially in times of economic uncertainty.

Then again, of the record $111.4 billion in revenue Apple earned last quarter, $65.68 billion came from phone sales, largely driven by the release of the iPhone 12.

Even though “Apple’s success this quarter was kind of a perfect storm,” writes Hardware Editor Brian Heater, “it’s safe to project a rebound for the industry at large in 2021.”

Image Credits: Randy Faris (opens in a new window) / Getty Images

Finmark co-founder and CEO Rami Essaid wrote a post for Extra Crunch that candidly describes the traps he laid for himself that made him a less-effective entrepreneur.

As someone who’s worked closely with founders at several startups, each of the points he raised resonated deeply with me.

In my experience, many founders have a hard time delegating, which can quickly create cultural and operational problems. Rami’s experience bears this out:

“I became a human GPS: People could follow my directions, but they struggled to find the way themselves. Independent thinking suffered.”

Image Credits: Bryce Durbin/TechCrunch

Dear Sophie:

I just got my U.S. citizenship! My husband and I want to bring my mom and her husband to the U.S. to help us take care of our preschooler and toddler.

My biological dad passed away several years ago when I was an adult and my mom has since remarried.

— Appreciative in Aptos

Next month, Extra Crunch Live returns with a lineup of guests who are extremely well-qualified to discuss early-stage startups.

Each Wednesday at noon PPST/3 p.m. EST, join a conversation with founders and the investors who backed their companies:

February 3:

Gaurav Gupta (Lightspeed Venture Partners) + Raj Dutt (Grafana Labs)

February 10:

Aydin Senkut (Felicis Ventures) + Kevin Busque (Guideline)

February 17:

Steve Loughlin (Accel) + Jason Boehmig (Ironclad)

February 24:

Matt Harris (Bain Capital) + Isaac Oates (Justworks)

Also, we’re adding a new feature to Extra Crunch Live — our guests will offer advice and feedback on pitch decks submitted by Extra Crunch members in the audience!

Image Credits: Aleksandar Nakic (opens in a new window) / Getty Images

Since the pandemic disrupted the social rhythms of work and school, many of us have compensated by changing our relationship to digital media.

For instance, I purchased a new sofa and thicker living room curtains several months ago when I realized we have no idea when movie theaters will reopen.

Last year, podcast sponsors spent almost $800 million to reach listeners, but ad revenue is estimated to surpass $1 billion this year. Clearly, I’m not the only person who used a discount code to buy a new product in 2020.

At this point, I can scarcely keep track of the multiple streaming platforms I’m subscribed to, but a new voice-activated remote control that comes with my basic cable plan makes it easier to browse my options.

Media reporter Anthony Ha spoke to10 VCs who invest in media startups to learn more about where they see digital media heading in the months ahead. For starters, how much longer can we expect traditional advertising models to persist?

And in a world with hundreds of channels, how are creators supposed to compete for our attention? What sort of discovery tools can we expect to help us navigate between a police procedural set in a Scandinavian village and a 90s sitcom reboot?

Here’s who Anthony interviewed:

Normally, we list each investor’s responses separately, but for this survey, we grouped their responses by question. Some readers say they use our surveys to study up on an individual VC before pitching them, so let us know which format you prefer.

Image Credits: Nigel Sussman (opens in a new window)

Data analytics platform Databricks is reportedly raising new capital that could value the company between $27 billion and $29 billion.

By the end of Q3 2020, Databricks had surpassed a $350 million run rate — a $150 million YoY increase, reports Alex Wilhelm.

At the time, he described the company as “an obvious IPO candidate” with “broad private-market options.”

Which begs the question: “Can we come up with a set of numbers that help make sense of Databricks at $27 billion?”

Image Credits: Natalia Timchenko (opens in a new window) / Getty Images

Rapid shifts in the way we buy goods and services disrupted old-school marketplaces like local newspapers and the Yellow Pages.

Today, I can use my phone to summon a plumber, a week’s worth of groceries or a ride to a doctor’s office.

End-to-end operators like Netflix, Peloton and Lemonade take a lot of time and energy to reach scale, but “the additional capital required is often outweighed by the value captured from owning the entire experience.”

Image Credits: Nigel Sussman (opens in a new window)

On January 25, Social Capital CEO Chamath Palihapitiya tweeted that he was making two blank-check deals.

Enterprise SaaS company Latch makes keyless entry systems; Sunlight Financial helps consumers finance residential solar power installations.

“There are nearly 300 SPACs in the market today looking for deals,” noted Alex Wilhelm, who unpacked both transactions.

“There’s no escaping SPACs for a bit, so if you are tired of watching blind pools rip private companies into the public markets, you are not going to have a very good next few months.”

Image Credits: dan tarradellas (opens in a new window) / Getty Images

On Monday, we published the Matrix Fintech Index, a three-part study that weighs liquidity, public markets and e-commerce trends to create a snapshot of an industry in perpetual flux.

For four years running, the S&P 500 and incumbent financial services companies have been outperformed by companies like Afterpay, Square and Bill.com.

In light of steady VC investment, increasing consumer adoption and a crowded IPO pipeline, “fintech represents one of the most exciting major innovation cycles of this decade.”

Image Credits: Acquia

On January 15, 2001, then-college student Dries Buytaert released Drupal 1.0.0, an open-source content-management platform. At the time, about 7% of the world’s population was online.

After raising more than $180 million, Buytaert exited to Vista Equity Partners for $1 billion in 2019.

Enterprise reporter Ron Miller interviewed Buytaert to learn more about his 18-year journey.

“His story is compelling, but it also offers lessons for startup founders who also want to build something big,” says Ron.

Powered by WPeMatico

As Roblox eyes what could be a historic debut on public markets in the coming months, investors who have valued the company at $29.5 billion are certainly eyeing the gaming company’s dedicated and youthful user base — but it’s the 7 million active creators and developers on the Roblox platform that they are likely most impressed by.

Since 2015, Roblox has been running an accelerator program focused on enabling the next generation of game developers to be successful on its platform. Over the years, the program has expanded from one annual class to now three, each with around 40 developers participating. That means more than 100 developers per year are working directly with Roblox to gain mentorship, education and funding opportunities to get their games off the ground.

As the company’s efforts on this front have grown more formalized, Roblox in 2018 hired former Accelerator alumni Christian Hunter, a Roblox gamer since age 10 and game developer since 13, to run the program full time. Having been through the experience himself, Hunter brought to the program an understanding of how the Accelerator could improve, based on a developer’s own perspective.

However, the COVID-19 pandemic threw into disarray the company’s plans to run the program. Instead of being able to invite developers to spend three months participating in classes hosted at Roblox’s San Mateo office, the company had to revamp the program for remote participation.

As it turned out, developers who were used to playing and building games taking place in virtual worlds quickly adjusted to the new online experience.

“Before COVID, everyone was together. It was easier to talk to people. [Developers] could just walk up to someone that was on our product or engineering team if they were running into issues,” explains Roblox Senior Product Manager Rebecca Crose. “But obviously, with COVID-19, we had to switch and think differently.”

The remote program, though differently structured, offered several benefits. Developers could join the program’s Discord server to talk to both current participants and previous classes, and reach out and ask questions. They could also participate in the Roblox company Slack to ask the team questions, and there were more playtests being scheduled to gain reactions and feedback from Roblox employees.

Meanwhile, to get to know one another when they couldn’t meet in person, developers would have game nights where they’d play each other’s games or others that were popular on Roblox, and bond within the virtual environment instead of in face-to-face meetings and classes.

The actual Accelerator content, however, remained fairly consistent during the remote experience. Participants had weekly standups, talks on topics like game design and production, and weekly feedback sessions where they asked Roblox engineers questions.

But by its nature, a remote Accelerator broadened who could attend. Instead of limiting the program to only those who could travel to San Mateo and stay for three months, the program was opened up to a more global and diverse audience. This drove increased demand, too.

The 2020 program saw Roblox receiving the largest number of applications ever — five times the usual number.

As a result, the class included participants from five countries: The Philippines, South Korea, Sweden, Canada and the U.S.

The developers at IndieBox Studios saw the program as a chance to double down on their game development side hustles. The young friends spread across the U.K. and Kentucky spent their time during the accelerator scaling up their photorealistic title called Tank Warfare.

“We’ve actually never once met in real life, like, we’ve been friends for going on, what, nine years now,” Michael Southern tells TechCrunch. “We met on Roblox.”

IndieBox is representative of many of Roblox’s early developer teams — younger gamers that have spent more than a decade learning the ins and outs of the evolving Roblox gaming platform.

“We all joined Roblox way back in 2008,” IndieBox’s Frank Garrison says. “But we only started developing on the platform in 2019. And for us, the decision to choose Roblox was more down to like, well it’s what we know, why not give it a bash?”

The demographics of the accelerator have been shifting in other ways as the developer base grows more diverse.

“I would say, in the beginning, it was mostly young males. But as we’ve watched the program evolve, we’ve been getting so many new interesting teams,” notes Program Manager Christian Hunter.

The 2020 program had more women participants than ever, for example, with 12 in a class of 50. And one team was all women.

The age of participants, who are typically in the 18 to 22-year-old range, also evolved.

“We’ve seen a lot more older folks,” Hunter says. “With [the COVID-19 pandemic], we actually saw our first 50-year-old in the program. We’ve never had anyone older than, I’d say, 24. And in 2020, we had 12 individuals over the age of 30,” he notes.

Two of the teams were also a combination of a kid and a parent.

Shannon Clemens learned about the Roblox platform from her son Nathan, learning to code and bringing her husband Jeff in to form a studio called Simple Games. Nathan’s two sisters help the studio part time, as well as his friend Adrian Holgate.

“Seeing [my son’s] experience on Roblox getting involved with the platform, I thought it would be neat to learn how to make our own games,” Shannon Clemens told TechCrunch.

Their title Gods of Glory has received more than 13.5 million visits from Roblox players since launching in September.

“Our whole family is kind of creatively bent towards having fun with games and coming up with things like that,” Jeff Clemens tells us. “Why would we not try this? So, that’s when we applied to the program and said, ‘well, we’ll try and see if we get accepted,’ and we did and it’s been awesome.”

In addition to the changes facilitated by a remote environment, Roblox notes there were other perks enabled by remote learning. For one thing, the developers didn’t have to wake up so early to benefit from the experience.

“With it being remote, the developers were working their hours,” says Crose. “As a developer, we tend to work later and stay up at night. Having them come in at 9 AM sharp was very difficult. It was hard for them because they’re just like…a zombie. So we definitely saw that by letting them work their own hours, [there is] less burnout and they increase their productivity,” she says.

Though the COVID-19 crisis may eventually end as the world gets vaccinated, the learnings from the Accelerator and the remote advantages it offers will continue. Developers from the program hope that the growth seen on gaming platforms like Roblox continues as well.

“The pandemic has been great for most game studios,” developer Gustav Linde tells TechCrunch. “Obviously, it’s a very weird time, but the timing was good for us.”

The Gang Stockholm, a Swedish game development studio co-founded by Linde, has been building experiences — largely branded ones for clients, exclusively on the Roblox platform. The team of 12 has used the accelerator to slow down development deadlines and dig into some unique areas of the platform as well as focus wholly on their upcoming title, Bloxymon, which they plan to release this year.

“If you look at Steam and the App Store and Google Play, those markets are extremely crowded, and Roblox is a very exciting platform for developers right now,” said Linde. “Roblox is also getting a lot of attention and a lot of big brands are interested in entering the platform.”

Roblox says that going forward, future Accelerator programs will feature a remote element inspired by the COVID experience. The company plans to continue to make its program globally available, with the limitation for now, of English-speaking participants. But it’s looking to expand to reach non-English speakers with future programs.

The fall 2020 Accelerator class graduated in December 2020, and the next spring class will start in February 2021. Roblox says they are already in the process of recruiting for their summer 2021 class, which will again have some 40 participants. Roblox will again aim to continue diversifying the group of creators.

Powered by WPeMatico

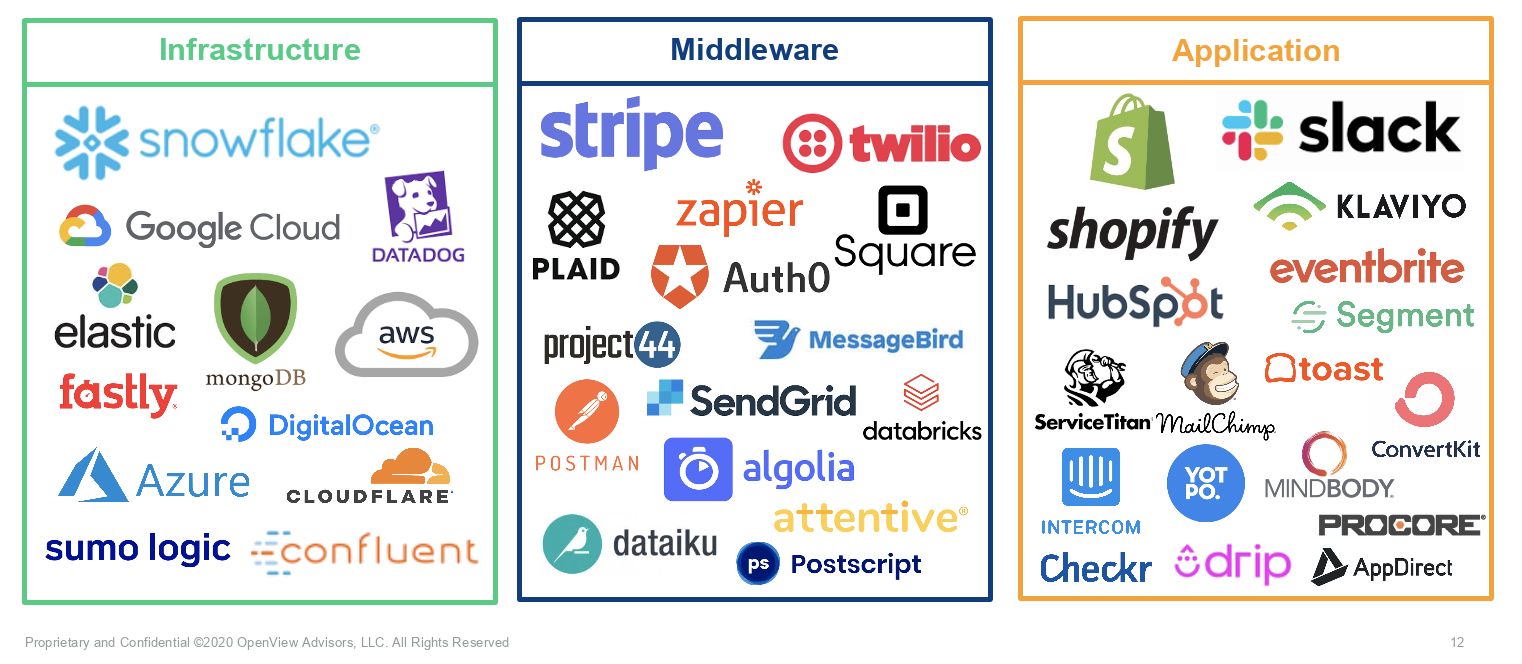

Software buying has evolved. The days of executives choosing software for their employees based on IT compatibility or KPIs are gone. Employees now tell their boss what to buy. This is why we’re seeing more and more SaaS companies — Datadog, Twilio, AWS, Snowflake and Stripe, to name a few — find success with a usage-based pricing model.

The usage-based model allows a customer to start at a low cost, while still preserving the ability to monetize a customer over time.

The usage-based model allows a customer to start at a low cost, minimizing friction to getting started while still preserving the ability to monetize a customer over time because the price is directly tied with the value a customer receives. Not limiting the number of users who can access the software, customers are able to find new use cases — which leads to more long-term success and higher lifetime value.

While we aren’t going 100% usage-based overnight, looking at some of the megatrends in software — automation, AI and APIs — the value of a product normally doesn’t scale with more logins. Usage-based pricing will be the key to successful monetization in the future. Here are four top tips to help companies scale to $100+ million ARR with this model.

Usage-based pricing is in all layers of the tech stack. Though it was pioneered in the infrastructure layer (think: AWS and Azure), it’s becoming increasingly popular for API-based products and application software — across infrastructure, middleware and applications.

Image Credits: Kyle Povar / OpenView

Some fear that investors will hate usage-based pricing because customers aren’t locked into a subscription. But, investors actually see it as a sign that customers are seeing value from a product and there’s no shelf-ware.

In fact, investors are increasingly rewarding usage-based companies in the market. Usage-based companies are trading at a 50% revenue multiple premium over their peers.

Investors especially love how the usage-based pricing model pairs with the land-and-expand business model. And of the IPOs over the last three years, seven of the nine that had the best net dollar retention all have a usage-based model. Snowflake in particular is off the charts with a 158% net dollar retention.

Powered by WPeMatico

Each year Okta processes millions of SaaS logons via its authentication system. It kindly aggregates that data to find the most popular apps and publishes an annual report. This year it found that the most popular tool by far was Microsoft Office 365.

It’s worth noting that while app usage popularity varied by region, Office 365 was number one with a bullet across the board, whether globally or when the report broke it down by geographic area. That wasn’t true of any other product in this report, so Office 365 has extensive usage across the world (at least among companies that use Okta).

But as with everything cloud, it’s not a simple matter to say that because lots of people signed onto Office 365, Microsoft is the clear winner in a broader sense. In reality, the cloud is a complex marketplace, and just because people use one tool doesn’t preclude them from using tools that compete directly with it.

As a case in point, consider that the report found that 36% of Microsoft 365 customers were also using Google Workspace (formerly known as G Suite), which offers a similar set of office productivity tools. Further, Okta found that 42% of Office 365 customers were using Zoom and 32% were using Slack.

This is pretty remarkable when you consider that Office 365 bundles Teams with similar functionality for free. What’s more, so does Google with Google Hangouts, so people use the tool they want when they want, and sometimes it seems they use competing versions of the same tool. The report also found that of those Office 365 users, 44% are using Salesforce, 41% AWS, 15% Smartsheet and 14% Tableau (which is owned by Salesforce). Microsoft has products in all those categories.

Microsoft is clearly a big company with a lot of products, but the report blows a hole in the idea that because people like Office 365, they are going to be big fans of other Microsoft products, or that they can count on any kind of brand loyalty across the range of products or even exclusivity within the same product category.

All of this, and much of the other data in this report makes tremendously interesting reading as far as it goes. It’s not a definitive window on the state of SaaS. It’s a definitive reading on the state of Okta customers’ use of SaaS, on the Okta Integration Network (OIN), a point the company readily acknowledges in the report’s methodology section.

“As you read this report, keep in mind that this data is representative of Okta’s customers, the applications and integrations we connect to through the OIN, and the ways in which users access these tools through our service,” the report stated.

But it is a way to look at the state of SaaS taking advantage of the 9400 Okta customers using the network and the 6,500 integrations to the world’s most popular SaaS tools. That gives the company a unique view into the world of SaaS. What you can conclude is that the cloud is complicated, and it’s not a zero-sum game by any means. In fact, being a winner in one area is not a guarantee of winning across the board.

Powered by WPeMatico