TC

Auto Added by WPeMatico

Auto Added by WPeMatico

Streaming data is not new. Kafka has existed as an open source tool for a decade. Vectorized was founded on the premise that the existing tools were too complex and not designed for today’s streaming requirements. Today the company released its first product, Redpanda, an open source tool designed to make it easier for developers to build streaming data applications.

While it was at it, the startup announced a $15.5 million funding round, which is actually a combination of a previously unannounced $3 million seed round led by Lightspeed Venture Partners and a $12.5 million Series A, which was also from Lightspeed with help from Google Ventures.

Redpanda is an open source tool that is delivered as an “intelligent API” to help “turn data streams into products,” company founder and CEO Alexander Gallego explained. It’s built to be a Kafka replacement, while remaining Kafka-compatible to help deal with backwards compatibility.

At the same time, it takes a more modern approach. Gallego points out that teams building data streaming applications have been getting lost in the complexity and he recognized an opportunity to build a company to simplify that.

“People are drowning in complexity today managing Kafka, ZooKeeper (an open source configuration management tool) and the data lake,” he said, adding “We enable new things that couldn’t be done before for several reasons: one is performance, one is simplicity and the other one is this store procedures.”

He says that the key to developer adoption is making the product free through open source, and having Kafka compatibility so that developers don’t feel like they have to just dump existing projects and start from scratch. While the company is launching with an open source tool, it plans to use the funding to build a hosted version of Redpanda to put it within reach of more organizations. “This funding round in particular is to power our cloud,” he said.

Arif Janmohamed, a partner at Lightspeed Ventures who is leading the investment in Vectorized sees a company looking to improve upon an existing technology with a better approach. “With a simple, elegant solution that doesn’t require any changes to an existing application’s code, Vectorized delivers 10x better performance, a much simpler management paradigm, and new functionality that will unleash the next set of real-time applications for the next decade,” Janmohamed said.

The company has 22 employees today with plans to add another 8 in the first half of this year, mostly engineers to help build the hosted version. As a Latino founder, Gallego is acutely aware of the need for a diverse and inclusive workforce. “What I have found is that being a [Latino] CEO, it attracts more people that look like me, and so that’s been a big thing, and it’s made a difference [in attracting diverse candidates],” he said.

One concrete thing he has done is start a scholarship to encourage under represented groups to become developers. “I started a scholarship where we just give money and mentorship to communities of Latino, Black and female developers, or people that want to transition to software engineering,” he said. While he says he does it without strings attached, he does hope that some of these folks could become part of the tech industry eventually, and perhaps even work at his company.

Powered by WPeMatico

As the world moves towards remote work, the collaborative tools market continues to expand. Jam, a platform for editing and improving your company’s website, is adding to the trend by introducing a new arm to its product today called Jam Genies.

Jam Genies is a network of highly experienced product experts that Jam users can tap for guidance and advice around their specific issue or challenge.

Cofounder Dani Grant explained to TechCrunch that many small and early-stage companies don’t have the deep pockets to hire a consultant when they run into a challenge, as many charge exorbitant rates and they often have a minimum time requirement. It can be incredibly difficult to get bite-sized advice at a reasonable cost.

That’s where Jam Genies comes in.

Genies hail from a variety of ‘verticals’, such as investors, designers, brand people, and growth hackers. The list includes:

Users on the Jam platform can choose a Genie and set an appointment through Calendly. The sessions last half an hour and cost a flat fee of $250, all of which goes to the Genie.

Jam raised $3.5 million in October, from firms like Union Square Ventures, Version One Ventures, BoxGroup, Village Global and a variety of angel investors, to fuel growth and further build out the product. Jam Genies is, in many respects, a growth initiative for the company to better acquaint early-stage startups with the platform.

The main Jam product lets groups of developers and designers work collaboratively on a website, leaving comments, discuss changes and create and assign tasks. The platform integrates with all the usual suspects, such as Jira, Trello, Github, Slack, Figma, and more.

Since its launch in October 2020, the company has signed up 4,000 customers for its private beta waitlist, with 14,000 Jam comments created on the platform. The introduction of Jam Genies could add momentum to this growth push.

Powered by WPeMatico

Run:AI, a Tel Aviv-based company that helps businesses orchestrate and optimize their AI compute infrastructure, today announced that it has raised a $30 million Series B round. The new round was led by Insight Partners, with participation from existing investors TLV Partners and S Capital. This brings the company’s total funding to date to $43 million.

At the core of Run:AI’s platform is the ability to effectively virtualize and orchestrate AI workloads on top of its Kubernetes-based scheduler. Traditionally, it was always hard to virtualize GPUs, so even as demand for training AI models has increased, a lot of the physical GPUs often set idle for long periods because it was hard to dynamically allocate them between projects.

The promise behind Run:AI’s platform is that it allows its users to abstract away all of the AI infrastructure and pool all of their GPU resources — no matter whether in the cloud or on-premises. This also makes it easier for businesses to share these resources between users and teams. In the process, IT teams also get better insights into how their compute resources are being used.

Run:AI says that it is currently working with customers in a wide variety of industries, including automotive, finance, defense, manufacturing and healthcare. These customers, the company says, are seeing their GPU utilization increase from 25 to 75% on average.

“The new funds enable Run:AI to grow the company in two important areas: first, to triple the size of our development team this year,” the company’s CEO Omri Geller told me. “We have an aggressive roadmap for building out the truly innovative parts of our product vision — particularly around virtualizing AI workloads — a bigger team will help speed up development in this area. Second, a round this size enables us to quickly expand sales and marketing to additional industries and markets.”

Powered by WPeMatico

Bloomreach, an API company that helps eCommerce customers with search and web site creation, announced a $150 million investment today from Sixth Street Growth. Today’s funding values the company at $900 million.

At the same time, the company announced it has acquired Exponea, a startup that gives Bloomreach a marketing automation component it had been missing. The two companies did not reveal the acquisition price, but along with the pure functionality, the company gains 200 additional employees, which is significant, considering Bloomreach had 300 prior to the acquisition. It also gains 250 net new customers, giving it a total of 750.

“Historically, we have had two major pillars of the business — the search part of it and the content part,” Bloomreach CEO and co-Founder Raj De Datta told TechCrunch. The content management component lets customers build websites, while the search powers the search box, navigation and merchandising. He points out that all of it is powered by an underlying data analysis engine that matches data to people and people to products.

Exponea will give the company more of a complete platform of services, allowing marketers to target and personalize their marketing messages across multiple channels. De Datta says the two companies had similar missions and made a good fit. “We have a common vision and common sort of product direction. […] Both companies are data-driven optimization technologies[…] and both are entrepreneurial product-driven companies,” he said.

It also helped that they had been partnering together for six months prior to the sale, which has now closed. Exponea was founded in 2016 in Slovakia and has raised over $57 million, according to Pitchbook data. The plan is to leave Exponea as a stand-alone product, while finding ways to integrate it more smoothly with the other components in the Bloomreach platform. They expect the integration parts to happen over the next year.

While De Datta did not want to share specific revenue figures, he did say that the company had a record second half as business was pushed online due to the pandemic. Michael McGinn, partner at Sixth Street and co-head at investor Sixth Street Growth doesn’t see the demand for eCommerce abating, even post-COVID, and that will drive a need for more customized online shopping experiences.

“Technology serving more bespoke customer experiences is a rapidly expanding market and we are pleased to join Bloomreach in its leadership of the digital commerce experience and marketing sector,” McGinn said in a statement.

De Datta says the money was used in part to buy Exponea, but he also plans to invest more in engineering to continue building the product line. The ultimate goal is an IPO, but as you would expect, he wasn’t ready to commit to any timeline just yet.

“I wouldn’t say we have a timeline, but our goal is that the company over the course of 2021 should make investments towards that, so that it’s an option for us.”

Powered by WPeMatico

The digital media industry will give us plenty to talk about this year.

When we last surveyed venture capitalists about their media investments, the big topic was the impact that the pandemic would have on the industry, and on the prospects for new startups.

Obviously, the pandemic hasn’t gone away, but when asked to predict the biggest storylines for 2021, VCs pointed to themes as varied as new distribution models, new kinds of interactivity, new tools for creators, the return of advertising business models and even the role of media in a democratic society.

“We are headed toward a content universe where consumers’ power of choice grows to new heights — what premium content to consume and pay for, and how to consume it,” Javelin’s Alex Gurevich wrote. “The consumers will have the final choice! Not traditional media and content distribution companies.”

For this new survey, we heard from 10 VCs — nine who invest in media startups, plus a tenth who’s seeing plenty of media pitches and was happy to share her thoughts. We asked them about the likelihood of further industry consolidation, whether we’ll see more digital media companies take the SPAC route and of course, what they’re looking for in their next investment.

Here’s who we surveyed:

Read their full responses below.

Daniel Gulati: Defining media’s role in a democratic society. What accountability exists when an individual company’s pursuit of scale leads to the spread of disinformation? When a platform’s terms of service appears to collide with constitutional rights, who makes the call and what happens? To what extent should governments support the viability of local media organizations in the face of global competition and a rapidly changing digital landscape?

These are high stakes issues that will be front and center through the year.

Alex Gurevich: The continued disruption of content distribution models, whether that’s the debundling of cable via the plethora of SVOD services, or the way new content is released (i.e., on-demand at home versus movie theaters). We are headed toward a content universe where consumers’ power of choice grows to new heights — what premium content to consume and pay for, and how to consume it. The consumers will have the final choice! Not traditional media and content distribution companies. The pandemic has greatly accelerated this trend.

Matthew Hartman: The two largest social networks, Twitter and Facebook, removed the account of a sitting president and a set of related, follower accounts. This has fundamentally reset the media stack. This will accelerate action the government had already planned to take, including to reshape Section 230. The ripples will be felt throughout media, affecting how news is distributed through social media, what startups can use bigger platforms to grow, what the exit options are for small talent acquisitions and the fragmentation already occurring.

Second, the rise of synthetic media. Algorithmically enhanced or created media is a shift we identified at Betaworks in 2018 and in 2021 it will only increase in scale and scope. Yes, this affects deep fake detection (with companies like Sensity.AI leading the way) and other nefarious uses — but it will also start to fundamentally reshape the way media is created, from the cost of animation to the cost of writing stories, to editing and creating CGI.

Third, game streaming will continue to grow, with audiences that are starting to blow away those of regular TV. An enormous number of people tuned in last year to watch Alexandria Ocasio-Cortez play Among Us on Twitch with popular streamers (she hit 435,000 concurrent viewers at one point). And that wasn’t even close to the biggest event ever on Twitch, David Martinez, aka TheGrefg, hit 2.4 million concurrent viewers for the unveiling of his new Fortnite skin. Game publishers have finally started to understand the power of streamers not just to launch a new game, but to revive old ones, with games that groups of streamers can play together (like Among Us or Rust) soaring in popularity this past year.

Jerry Lu: The emergence of interactive media platforms outside of just gaming.

Because of their isolation due to COVID, people are yearning for social interaction and we’re seeing greater engagement across platforms like Twitch and Zoom, which make interactive communications possible. Previous iterations of media platforms were top-down broadcast, whereby companies produced content they thought consumers would like. Over the past five years, we’ve started to see a greater shift toward the long tail, whereby content comes straight from the consumer.

Gaming and esports were at the forefront of this shift from passive content viewing to interactive entertainment experiences. I believe that 2021 will be the year when we see platforms beginning to embrace interactivity as a form of audience participation, blurring the line between viewer and active participant. I’m excited at the prospect of seeing this form of interactive content consumption applied to other sectors, like education, childcare and commerce, to name a few.

Jana Messerschmidt: We will see a proliferation of products that enable content creators to build businesses outside of traditional media companies. These creators will leverage their existing brand, following and social media engagement to become entrepreneurs, building revenue streams across multiple different products.

There are a plethora of new tools for creators: for writers (Substack, Medium), personalized video shoutouts from creators (Cameo*, PearPop), new audio platforms (LockerRoom*, Clubhouse) or all-in-one tools for creators that include merch, subscriptions, tipping and more (FourthWall* ). Now is the time for creators to be rewarded by their fans for their content creation.

Historically, the big social platforms (Facebook, Instagram, Snap*, Twitter, TikTok) have failed to create meaningful paths for their creators to monetize. They make money from advertisers and thus their resources are focused on those advertising customer demands.

Michael Palank: If 2020 was the year every major media company either announced or grew their direct-to-consumer video/audio/gaming offering, 2021 will be the year where those offerings optimize and differentiate or die. We expect the hunger for original content to continue, but we feel the type of content will continue to diversify from both a story and IP perspective and a format perspective. It is not unthinkable that a major media company like Apple, Amazon or Disney looks to acquire Clubhouse in 2021.

As the lines between video games and filmed entertainment continue to blur we can also envision new companies popping up to take advantage of this trend. I also feel these content platforms will need to differentiate by way of better discovery and personalization.

I fully expect every major media company from Disney to Apple to Amazon to Microsoft will be looking for new and innovative ways to separate themselves from the rest of the pack in 2021.

Marlon Nichols: I think that the continued creation of streaming platforms from content creators/owners (e.g., Disney+, HBO Max, etc.) will force downward subscription pricing adjustments across the board and streaming platforms will need to revisit advertising as a revenue stream. That said, we know that watching ads on a paid platform won’t fly with consumers so I believe we’ll see contextually relevant product placement become the accepted form of brand/content collaboration going forward. I led MaC’s investment into Ryff because of this thesis.

Pär-Jörgen Pärson: Institutions and legislators will have a big effect on social media platforms. I think there will be pushes on antitrust behavior, and social networks will have to behave like media — meaning that they also need to take responsibility for the content that’s on their platform, not only from a user agreement standpoint like today but from an editorial standpoint. I think we’ll see many more editors-in-chief in this industry, as editorial becomes more and more important in our polarized world. This has the potential to change the social media platform landscape quite dramatically, and I’m not entirely sure yet on the long-term impact commercially.

M.G. Siegler: It’s sort of boring, but I wouldn’t be shocked if we see a swing back toward advertising-based models. I think there are two parts to this: First, if and when the pandemic recedes, I think a lot of traditional big advertising players like travel, will come roaring back. Second, it feels like there’s been a move away from advertising to paid subscriptions for a while now and I think these things are cyclical.

To be clear, I think both will continue to exist, I just think that after years of underindexing on paid subs, now we’re perhaps on the verge of overindexing on it … Obviously, advertising never went away, I just think it may be due for a bit of a renaissance (though I say that hoping the powers that be make those ads a better user experience — I think that’s the only way there’s not another backlash against them).

Laurel Touby: The biggest trend in digital media will be companies that don’t call themselves media companies, but that clearly draw from the business model playbook of media companies. For example: Companies that monetize their communities by giving sponsors and advertisers access to their audiences; or technology startups that sell wearable products and upsell their customers with access to premium high-value content.

Hans Tung: Contextual social networks: Video and livestreaming with the likes of TikTok and with other players like Instagram and Snap will continue to drive creativity and engagement. Clubhouse is now garnering a lot of attention as audio captures the attention of a new generation. This also creates new opportunities for established audio players like YY or Ximalaya. At the same time, apps like Clubhouse are an evolution of Snap or Twitter where influencers of all sorts gather to build a new following on new platforms.

However, one of the most interesting things we’re seeing is the emergence of contextual social networks that are focused on solving real-life problems. We see a lot more companies taking the best of audio and video experiences and experimenting with the next iteration of apps like Headspace and Calm, to solve societal issues, personal issues such as how to deal with anxiety, etc. These social networks may not scale as quickly or grab headlines like Clubhouse but they’re designed to bring people together to solve problems. We are also seeing professionalized networks such as Valence or Chief use these audio/video networks to address issues for a particular gender or underrepresented group, or apps that create virtual networking for communities.

Digital media delivered with differentiated experiences: Peloton may not immediately jump to mind as a digital-media company but they are one of the best at producing a high-value experience using extremely high-quality content that goes far beyond simple fitness or even the need for hardware. Increasingly more categories will become “Netflix-ized” where content is king and the experience is delivered through your smartphone.

As with Peloton, the experience is further enhanced with social interaction, such as leader boards, access to the best instructors, etc., which in turn expands the reach of the content. It’s a powerful loop that is driven by quality content, and the components feed off each other to make it more accessible. If you then couple it with Affirm to make it more affordable, you’ve got a flywheel on steroids. This pattern will emerge in other categories.

Consumerization of enterprise communication: Another aspect of media is communication, which we are seeing evolve in the enterprise space. It started with Slack a few years ago and Zoom more recently. Now with companies like Yak or the emergence of various conference apps, we see a higher usage frequency between companies, companies and their customers, and within the enterprise itself.

Powered by WPeMatico

This morning, investor and SPAC raconteur Chamath Palihapitiya announced two new blank-check deals involving Latch and Sunlight Financial.

Latch, an enterprise SaaS company that makes keyless-entry systems, has raised $152 million in private capital, according to Crunchbase. Sunlight Financial, which offers point-of-sale financing for residential solar systems, has raised north of $700 million in venture capital, private equity and debt.

We’re going to chat about the two transactions.

There’s no escaping SPACs for a bit, so if you are tired of watching blind pools rip private companies into the public markets, you are not going to have a very good next few months. Why? There are nearly 300 SPACs in the market today looking for deals, and many will find one.

The Exchange explores startups, markets and money. Read it every morning on Extra Crunch, or get The Exchange newsletter every Saturday.

Think of SPACs are increasingly hungry sharks. As a shark get hungrier while the clock winds down on its deal-making window, it may get less choosy about what it eats (take public). There are enough SPACs on the hunt today that they would be noisy even if they were not time-constrained investment vehicles. But as their timers tick, expect their deal-making to get all the more creative.

This brings us back to Chamath’s two deals. Are they more like the Bakkt SPAC, which led us to raise a few questions? Or more akin to the Talkspace SPAC, which we found pretty reasonable? Let’s find out.

Let’s start with the Latch deal.

New York-based Latch sells “LatchOS,” a hardware and software system that works in buildings where access and amenities matter. Latch’s hardware works with doors, sensors and internet connectivity.

The company has raised a number of private rounds, including a $126 million deal in August of 2019 that valued the company at $454.3 million on a post-money basis, according to PitchBook data. The company raised another $30 million in October of 2020, though its final private valuation is not known.

As Chamath tweeted this morning, Latch is merging with TS Innovation Acquisitions Corp, or $TSIA. The SPAC is associated with Tishman Speyer, a commercial real estate investor. You can see the synergies, as Latch’s products fit into the commercial real estate space.

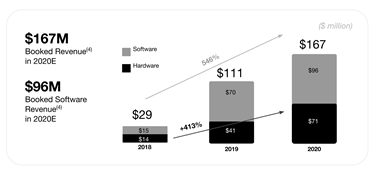

Up front, Latch is not a company that is only reporting future revenues. It has a history as an operating entity. Indeed, here’s its financial data per its investor presentation:

Image Credits: Latch

Doing some quick match, Latch grew booked revenues 50.5% from 2019 to 2020. Its booked software revenues grew 37.1%, while its booked hardware top line expanded over 70% during the same period.

That could be due to strong hardware installation fees, which could later result in software revenues; the company claims an average of a six-year software deal, so hardware revenues that are attached to new software incomes could low key declaim long-term SaaS revenues.

Update: Adding some clarity here, the above are “booked” revenues, which I’ve made more clear, not actual revenues. Its net revenues, better known as actual revenues, were $18 million, with $14 million of that coming from hardware. So, today, the company is certainly more hardware-heavy than I first thought. Damn non-S-1 filings!

While some were quick to note that the company is far from pure-SaaS — correct — I suspect that the model that could get some traction amongst investors is that this feels a bit like Peloton for real estate. How so? Peloton has large hardware incomes up front from new users, which convert to long-term subscription revenues. Latch may prove similar, albeit for a different customer base and market.

Per the deal’s reported terms, Latch will be worth $1.56 billion after the transaction. The combined entity will have $510 million in cash, including $190 million from a PIPE — a method of putting private money into a public entity — from “BlackRock, D1 Capital Partners, Durable Capital Partners LP, Fidelity Management & Research Company LLC, Chamath Palihapitiya, The Spruce House Partnership, Wellington Management, ArrowMark Partners, Avenir and Lux Capital.”

Powered by WPeMatico

Goalsetter, a platform that helps parents teach their kids financial literacy, announced the raise of a $3.9 million seed round this morning, led by Astia.

PNC Bank, Mastercard, U.S. Bank, Northwestern Mutual Future Ventures, Elevate Capital, Portfolia’s First Step and Rising America Fund and Pipeline Angels also participated in the round. The round also saw participation from a handful of individual investors including Robert F. Smith, Kevin Durant, Chris Paul, Baron Davis, Sterling K. Brown, Ryan Bathe, CC Sabathia and Amber Sabathia.

Goalsetter launched in 2019 out of the Entrepreneurs Roundtable Accelerator. Founded by Tanya Van Court, who lost over $1 million in the 2001 bubble burst, the platform teaches financial literacy to children of all ages, helping them learn economic concepts, lingo and the principles of financial health.

After long stints at Nickelodeon and ESPN, Van Court understands deeply how kids learn and what keeps their attention. She vowed to make sure that her children were never ignorant of what it takes to protect their wealth and create more.

The app also allows parents to give allowances through the app, and even pay out their own specified amount for every quiz question the kid gets right in the app. Plus, family and friends can give “goal cards” instead of gift cards, helping kids save for the things they really want in the future.

The company recently launched a debit card for kids, as well, letting parents control the way the card is used and even lock it until their kids have passed the week’s financial literacy quiz.

Families save an average of $120 a month on the platform, and Van Court says that two families saved over $10,000 in the last year.

The company is also launching a massive campaign next week for Black History Month with the goal of closing the wealth gap among Black children and kids of color through financial education.

“It’s one thing to put a debit card into your teenager’s hands,” said Van Court. “That’s great. That teaches them how to spend money. It’s another thing to teach kids the core concepts about how to build wealth, or to know the difference between putting your money into an investment account, or putting your money into a CD versus a mutual fund versus a savings account. We teach what interest rates are, and what compound interest means. Our focus is on financial education because it’s not enough to teach kids how to spend.”

Goalsetter raised $2.1 million in 2019 and now adds this latest round to that for a total of $6 million raised. This latest round was oversubscribed, giving Van Court the opportunity to be super selective about her investors.

“Every single one of these investors has a demonstrated commitment prior to people marching in the streets in April, to social justice and to investing in diversity and inclusion initiatives and people,” said Van Court. “Every single one of them. That was really important because we were oversubscribed and we had the luxury of being able to pick who our investors were. Every one of the investors that we invited to our table were investors who we knew invited folks who look like us in 2019 and 2018 and 2017 to their table.”

Powered by WPeMatico

Virgin Orbit isn’t slowing down after joining the exclusive club of small launch companies that have made it to orbit — the company just announced that it’s flying a payload on behalf of the Royal Netherlands Air Force (RNAF). This is the first-ever satellite being put up by the Dutch Ministry of Defense, and it’s a small satellite that will act as a test platform for a number of different communications experiments.

The satellite is called BRIK-II — not because it’s the second of its kind, but rather because it’s named after Brik, the first airplane ever owned and operated by the RNAF. This mission is one of Virgin Orbit’s first commercial operations after its successful test demonstration and will fly sometime later this year. It’s also being planned as a rideshare mission, with other payloads expected to join — likely from the U.S. Department of Defense, which is working with Virgin Orbit’s dedicated U.S. defense industry subsidiary VOX Space on planning what they’ll be adding to the mission load out.

This upcoming mission is actually a key demonstration of a number of Virgin Orbit’s unique advantages in the launch market. For one, it’ll show how the U.S. DOD and its ally defense agencies can work together in the space domain when launching small communications satellites. Virgin Orbit is also going to use the mission as an opportunity to show off its “late-load integration” capabilities — effectively, how it can add a payload to its LauncherOne rocket just prior to launch.

For this particular flight, there’s no real reason to do a late-load integration, since there’s plenty of lead time, but part of Virgin’s appeal is being able to nimbly add satellites to its rocket just before the carrier jet that flies it to its take-off altitude leaves the runway. Demonstrating that will go a long way to help illustrate how it differentiates its services from others in the launch market, such as Rocket Lab and SpaceX.

Powered by WPeMatico

In a year marred by the coronavirus pandemic, it seems that early-stage startups on the African continent are continuing to see some notable growth, both in terms of their business and from investors looking to back them.

Microtraction, an early-stage venture capital firm based in Lagos, Nigeria, saw funding nearly quadruple for its portfolio.

In a review of the year published last week, the firm noted that 21 companies in its portfolio have raised more than $33 million in funding. This represents nearly four-fold growth over a year ago, when its portfolio raised $6 million (and just $3 million in 2018). The companies’ combined valuation stands at more than $147 million, according to the firm.

Founded by Yele Bademosi in 2017, Microtraction arrived on the continent’s early-stage investment scene with all intent to be “the most accessible and preferred source of pre-seed funding for African tech entrepreneurs.”

Bademosi, who returned to Nigeria from the U.K. in 2015, worked as the general manager for Starta Africa, an online community for African tech entrepreneurs. After his stint there, he saw the need to plug the gap of early-stage funding in Nigeria and the continent at large with Microtraction.

Microtraction does not specify the size of its fund, but what is more clear is that it has attracted a great deal of attention and has built a strong network in part because of who backs it.

Michael Seibel, the CEO of Y Combinator, is a global advisor and an investor in the firm, and so is Andy Volk, the head of ecosystem for Google Sub-Saharan Africa. Other investors include Pave Investments and U.S.-based angel investor Chris Schultz.

Being entrepreneurs in the past, some of these investors know what it takes to build a startup in the U.S. But it’s completely different in Africa. With no on the ground knowledge as to which startups to fund but an interest to do so, for portfolio diversification and other personal reasons, Microtraction and a few other early-stage investors present the best bets to accomplish this goal.

At first, Microtraction’s standard deal was to offer portfolio startups $15,000 in exchange for a 7.5% equity. But as a sign of how the market is firming up, that changed last year, and now the firm invests $25,000 for 7% equity.

Microtraction revealed that it accepted more than 500 applications from startups in Nigeria, Ghana, Zambia and Mauritius in its first full year of operation (though, just eight of those companies got investments).

The introductory batch was all Nigerian: four fintech startups — Cowrywise, Riby, Wallets Africa and ThankUCash; a crypto-exchange startup, BuyCoins; a SaaS platform, Accounteer; an edtech startup, Schoolable; and healthtech startup, 54gene.

2019 saw the local VC firm invest in six companies. This time there was a representative outside Nigeria — Ghanaian fintech startup Bitsika. The Nigerian startups included social commerce startup Sendbox; events startup Festival Coins; and communications-as-a-service platform Termii. The rest were unannounced.

Last year (the one this latest review covers), Microtraction announced seven startups. The latest selection includes Nigerian fintech startups Evolve Credit and Chaka; edtech startup Gradely; bus-hailing platform PlentyWaka; and Kenyan credit data marketplace CARMA.

Of the total investments raised in 2019 and 2020, 54gene contributed more than half of those numbers by raising $4.5 million in seed and a $15 million Series A investment. With an ingenious solution to solve the underrepresentation of African genomics data in global genomics research, 54gene got accepted into the winter batch in January 2019, the same month it officially launched.

Excluding 54gene, there were six other African-focused startups in the YC W19 batch. Two out of the six, Schoolable and Wallets Africa, were Microtraction portfolio companies. Others accepted into YC before and after include BuyCoins, Cowrywise, Termii and two unannounced startups.

Microtraction-backed ThankUCash and a second unannounced startup have also joined cohorts at 500 Startups. On the other hand, Festival Coins is the only startup to be selected into Google for Startups Accelerator. With all accounted for, 11 out of the 21 startups are either backed by Y Combinator, 500 Startups or Google for Startups.

The Microtraction team with founding partner, Yele Bademosi (far right). Image Credits: Microtraction

Getting into these global accelerators is a surefire way to receive follow-up investment, ranging from $125,000 to $150,000. From the outside in, startups see Microtraction and other early-stage VC firms like Ventures Platform as a means to that end. There have also been arguments that these firms build startups to be “YC or any global accelerator ready.”

However, Dayo Koleowo, a partner at Microtraction alongside Chidinma Iwueke, debunks it saying there’s no formula behind the numbers we see. He believes YC and other accelerators share the same fundamentals with Microtraction, which revolves around the team, the market and traction.

“We love super technical teams that understand the industry they are in and are likely to succeed without us. We are always looking for companies that are solving huge problems that a lot of people face,” he told TechCrunch. “Also, the tech and startup world moves fast, so we like teams who understand that and can show in real-time that they can execute. I believe that these global accelerators look for these same things.”

Typically, YC and other accelerators may perform extended due diligence and risk assessments before cutting cheques for any African startup without a local backer. Koleowo points out that this might be why Microtraction portfolio companies get accepted quicker. “The icing on the cake is that there is a level of de-risking that has been done by Microtraction and other local investors on the ground before these global accelerators step in,” he added.

That said, there’s no denying the significance of Microtraction’s advisory board in playing a part as to why half the firm’s portfolio are in global accelerators. Besides the names mentioned earlier, some of its past advisors included Lexi Novitske, former PIO at Singularity Investments; Dotun Olowoporoku, VC at Novastar Ventures; and Monique Woodward, ex-venture partner at 500 Startups.

And with the growing trends of globalization, plus the acceptance of a more decentralised approach to building and operations in the tech industry because of COVID-19, it’s a trend that might continue for a while.

Powered by WPeMatico

Yac, the Orlando, Florida-based startup that’s digitizing voice messages for remote offices, has raised $7.5 million in a new round of funding.

The company’s service has garnered enough attention to pick up a pretty sizable new round from investors led by GGV Capital and a return investment from the Slack Fund.

Apparently, reinventing voicemail is a multi-million-dollar endeavor.

“The future of meetings will be asynchronous, in your ears and hands-free,” says Pat Matthews, the chief executive and founder of Active Capital, when the company announced its seed round nearly a year ago.

Co-founded by Justin Mitchell, Hunter McKinley and Jordan Walker, Yac was spun out of the digital agency SoFriendly, and was developed as a pitch for Product Hunt’s Maker Festival. The voice messaging service won that startup competition at the event and attracted the interest of Boost VC and its founder, the third-generation venture capitalist Adam Draper.

About six months after that seed round, Yac received outreach from Slack thanks to a referral from another entrepreneur. Throughout their negotiations last year, the teams used Yac to conduct due diligence, according to Mitchell. At the time of the company’s August announcement that Slack had come on to finance the company, Yac had a bit over 5,000 users on its service; it charges per seat, in the same way Slack does.

Powered by WPeMatico