TC

Auto Added by WPeMatico

Auto Added by WPeMatico

In what feels like an attempt at kicking some bad news under the rug on a Friday, Microsoft announced this morning that the price of Xbox Live Gold is going up.

Here’s how the price changes break down:

“But what about the twelve-month plan? Didn’t they used to offer those?”

They did! It was $60 — or the price that a six-month subscription will go for now. They stopped selling twelve-month plans back in July of last year, presumably because this change was on the horizon and they would’ve had to acknowledge on the price tag that 12 months of Live Gold would cost $120.

The good news: the price hike on the six-month plan only impacts new customers. If you’ve already got a six-month subscription (or are grandfathered into an auto-renewing twelve-month subscription), Xbox Support confirmed in a tweet that the price won’t increase:

If you’re on the one-month or three-month plans, though, it sounds like you’ll be paying the new price.

So why bump the cost? Microsoft doesn’t officially outline their reasoning (beyond pointing out that they haven’t increased the price in years, or as long as a decade in some regions), but one can assume it’s at least partially to make the $15 a month Xbox Game Pass (which bundles Xbox Live Gold with a library of all-you-can-eat, on-demand titles) that much more alluring.

Powered by WPeMatico

eSports “total solutions provider” VSPN (Versus Programming Network) has closed a $60 million Series B+ funding round, joined by Prospect Avenue Capital (PAC), Guotai Junan International and Nan Fung Group.

VSPN facilitates esports competitions in China, which is a massive industry and has expanded into related areas such as esports venues. It is the principal tournament organizer and broadcaster for a number of top competitions, partnering with more than 70% of China’s eSports tournaments.

The “B+” funding round comes only three months after the company raised around $100 million in a Series B funding round, led by Tencent Holdings.

This funding round will, among other things, be used to branch out VSPN’s overseas esports services.

Dino Ying, Founder, and CEO of VSPN said in a statement: “The esports industry is through its nascent phase and is entering a new era. In this coming year, we at VSPN look forward to showcasing diversified esports products and content… and we are counting the days until the pandemic is over.”

Ming Liao, the co-founder of PAC, commented: “As a one-of-its-kind company in the capital market, VSPN is renowned for its financial management; these credentials will be strong foundations for VSPN’s future development.”

Xuan Zhao, Head of Private Equity at Guotai Junan International said: “We at Guotai Junan International are very optimistic of VSPN’s sharp market insight as well as their team’s exceptional business model.”

Meng Gao, Managing Director at Nan Fung Group’s CEO’s Office said: “Nan Fung is honored to be a part of this round of investment for VSPN in strengthening their current business model and promoting the rapid development of emerging services and the esports streaming ecosystem.”

Powered by WPeMatico

Hims & Hers, a San Francisco-based telehealth startup that sells sexual wellness and other health products and services to millennials, began trading publicly today on the NYSE after completing a reverse merger with the blank-check company Oaktree Acquisition Corp.

Its shares slipped a bit, ending the day down 5% from where they started, but the company, which was founded in 2017 and now claims nearly 300,000 paying subscribers for its various offerings, has never been focused on a splashy headline about its first-day performance, co-founder and CEO Andrew Dudum told us earlier today.

On the contrary, Dudum says that while Hims might have once imagined a traditional IPO, it decided to go the special purpose acquisition company (SPAC) route because of their pricing mechanisms and because it was approached by a SPAC led by renowned money manager Howard Marks, the founder of the global alternative investment firm Oaktree Capital Management. (“We fell in love with the Oaktree team and the capital market experience and deep resources they have.”)

We talked with Dudum about that SPAC’s structure; the lockups involved now that Hims’ shares are trading; and how much of the business still centers around one of its first offerings, which was a generic version of erectile dysfunction pills. Our conversation has been edited lightly for length and clarity.

TC: You’re a Bay Area-based company selling to a mostly U.S. audience. How are you thinking about expanding that footprint geographically?

AD: We do have a small operation selling in the U.K.; we’re getting our feet wet in that market and building out a team and infrastructure and fulfillment. If you look at the regulatory landscape, there’s a huge amount of room [to grow] in Europe, Australia, Canada, the Middle East and Asia, and so in that order, we’ll start to [move into those markets].

TC: What is your average customer cost?

AD: It has come down from $200 when we first launched, to roughly $100 last year, and we make, on average, close to $300 in the first couple of years in terms of a patient’s lifetime value.

TC: How quickly do customers churn?

AD: We break down lifetime value projections by quarter cohorts, and quarter over quarter, year over year, we’re monetizing each of these cohorts better, with high-margin profiles.

As of last quarter, the business was growing 90% year-over-year, with 76% gross margins and greater cash efficiency, and that’s because as we provide more offerings, there is more cross-purchasing. Also, word of mouth is becoming more of a dynamic, with more than 50% of the traffic to the site free at this point because we have built a brand with a young demographic.

TC: When are you projecting that you’ll turn profitable?

AD: We’ve reduced our annual burn and increased our margin efficiency and organic growth, so on a quarterly basis, we think in the next couple of years is a real possibility.

Image Credits: Hims & Hers

TC: Hims’ first wellness offerings included pills for male pattern hair loss and erectile dysfunction. How much revenue does that ED business account for?

AD: What we’ve disclosed is that roughly half [of our revenue] is that sexual health category — which includes [medicines for] generic erectile dysfunction, birth control, STDs, UTIs and premature ejaculation. The other half is predominately dermatology, including hair care [to address hair loss] and acne, and we’ve more recently moved into primary care and behavioral health.

TC: For retail investors, how do you differentiate the business from that of your rival Ro, which heavily promotes its ED products?

AD: There are a number of core differences between us and public and private players. First is our real focus on diversifying our offerings. With our focus on sexual health, dermatology, primary care and behavioral health, it’s in our DNA to quickly expand into new businesses.

We also think we’re different from most [rivals] in that we really invest time in building deep relationships with [those who represent] the future of healthcare markets — people in their teens, 20s and 30s. This demographic has a different set of tech expectations and consumer expectations than people in their 40s, 50s and 60s, and if we want to build for the future, that means building for the largest body of payers in the future.

Traditional healthcare companies monetize only the sick, but optimizing around that demographic precludes you from understanding what the next generation really needs and wants. I’ve never seen such a divergence between a patient population and legacy experience, and that’s a real advantage to us as a business.

TC: Hims just went public through a SPAC in a deal that gives the company around $280 million in cash — $205 million of that from Oaktree’s blank-check company and another $75 million through a private placement deal. How much runway does that give you?

AD: The company doesn’t burn a tremendous amount — between $10 million and $20 million a year — so a relatively long runway if we keep operating the business as is. But it does allow us to expand and grow into new businesses, too, including into big categories like sleep, infertility, diabetes and other chronic conditions.

TC: What about acquisitions?

AD: We’ll keep an eye open for strategic opportunities and consolidation opportunities. More than a dozen businesses a month come to us to be consolidated into the brand, but generally speaking, we’ve had the belief that so much is in front of us that we don’t want to be distracted.

TC: Is there a lockup period for anyone?

AD: There’s a traditional lockup for executives and employees and the board.

TC: Did your SPAC sponsors get a board seat?

AD: No.

TC: How much do they now own of the company, and can they sell?

AD: Oaktree owns a couple percent and [the syndicate they brought to do the private placement] [owns] 12%. But the very reason we went with them was the quality of the team and the organization . . . and they have the added incentive for the next year or two from a compensation standpoint for the company to succeed and to prove [out their thesis that Hims is a smart investment].

TC: Do you think the traditional IPO process is broken?

AD: The traditional IPO market hasn’t changed. It takes 12 to 18 months of preparation, which is a crazy amount of time for management to be distracted, then there’s this one-day PIPE that gives institutions a tremendous amount of money instantaneously. Maybe it makes for a good CNBC headline, but at tremendous cost to the company. It’s atrocious. If you were a founder or employee and getting diluted twice as much as you have to be, you’d be really upset. It’s no surprise to me that founders like myself are looking at other modalities with better pricing and better structures.

Powered by WPeMatico

Late last year, Solugen, a startup using synthetic biology to take hydrocarbons out of the chemicals industry, decided against pursuing a new round of funding that would have valued the company at over $1 billion, TechCrunch has learned.

Instead, the Houston-based bio-manufacturing company raised an internal round of roughly $30 million from existing investors and continued working on its latest project — a new bio-based manufacturing process for a high-value specialty chemical that can act as an anti-corrosive agent.

That work represents a potentially lucrative new product line for the company and charts a course for a host of other businesses that are refashioning the basic building blocks of life in an attempt to supplant chemistry with biology for manufacturing and production.

If Solugen can get its high-value chemical into commercial production, the company can follow the path that sustainable tech companies like Tesla have mastered — moving from a pricy specialty product into the mass market. And rather than over-promise and underdeliver, Solugen wanted to get the product line right first before raising big bucks, according to people familiar with the company’s thinking.

As the world looks to move away from oil and its byproducts to reduce greenhouse gas emissions and slow down or reverse global climate change, the chemicals industry is in the crosshairs as a huge target for disruption. Vehicle electrification solves only one part of the oil problem. The extractive industry doesn’t just produce fuel, but also the chemicals that make up most of the products that defined consumer goods in the twentieth century.

Chemicals are everywhere and they’re a huge business.

Companies like Zymergen raised hundreds of millions of dollars last year to develop industrial applications for synthetic biology, and they’re not alone. Startups including Geltor, Impossible Foods, Ginkgo Bioworks, Lygos, Novomer and Perfect Day have all raised significant amounts of capital to reduce the environmental footprint of food, chemicals, ingredients and plastics through synthetic biology.

Some of these companies are seeing early success in food replacements and ingredients, but the promise of biologically based chemicals have been elusive — until now.

Solugen’s new product will produce glucaric acid, a tough-to-make chemical that can be used in water treatment facilities and as an anti-corrosive agent — and the company can make it with a zero carbon (or potentially carbon negative) manufacturing process, according to Solugen co-founder and chief technology officer, Sean Hunt.

The glucaric acid from Solugen is cheaper to produce and more environmentally friendly than existing phosphonates that are used for water treatment — and the company has the benefit of competing against chemicals manufacturers in China.

Given the continuing tensions between the two countries, the U.S. is looking to make more high-value products — including chemicals — domestically, and Solugen’s technology is a good way forward to have home-grown supplies of critical materials.

Solugen still intends to raise more capital, the company just wanted to wait until its latest production plant for the acid came online, according to Hunt.

It’s also the fruit of years of planning. The two co-founders, Hunt and Gaurab Chakrabarti, first realized they could potentially use the technology they’d developed to make specialty chemicals back in 2017, according to Hunt. But first the company had to make the hydrogen peroxide as a precursor chemical, Hunt said.

“It’s advantageous for us to focus on this,” said Hunt. “As we scale, we can enter more commodity-type markets down the road.”

It’s all part of the notable strides the entire industry is making, said Hunt. “Synthetic biology has really made significant strides,” he said. “We have our commercial plant coming online this summer [and it proves] synthetic biology has gotten to the point where we can compete on price and performance.”

So the capital infusion will come as the company gets closer to the completion of these commercial scale facilities.

“It’s not like we were sitting on a term sheet and we said no,” Hunt said. “We want to make sure that we are hitting the milestones and the goals at a commensurate pace which is this year. I’m extremely bullish and optimistic of 2021.”

Solugen’s co-founder sees the path that his company is on as one that other startups working in the synthetic biology space will pursue to bring profitable products to market at the higher end before competing with more sustainable versions of commodity chemicals.

“How do you start a company that has this level of capital intensity?” Hunt asked. “You can start in the fine chemicals space where everything sells for tens to hundreds of dollars per pound. For us, glucaric acid is that specialty chemical and then we will do commodity.”

Powered by WPeMatico

PlayVS, the esports company bringing organized leagues to high schools and colleges, is today announcing its first acquisition. The startup, which has raised more than $100 million, has acquired GameSeta, a Vancouver-based startup that is also looking to provide infrastructure for high school esports teams. The terms of the deal were not disclosed.

The deal will accelerate PlayVS during its growth phase and help it expand into the Canadian market. GameSeta has a partnership with BC School Sports, the governing body for organized school sports in British Columbia, which will transfer to PlayVS.

PlayVS has a similar (and exclusive) partnership with NFHS, the high school equivalent of the NCAA, here in the States. The company has also sprinted into the college market, launching a college product as part of a partnership between PlayVS and Epic Games. Since launching a college offering, total player growth is up 460 percent. The company has also launched a new $900,000 scholarship pool for high schools and colleges.

Founded by Delane Parnell in the beginning of 2018, PlayVS has grown rapidly, brokering partnerships with school sports organizations and publishers alike. In fact, PlayVS title offerings include League of Legends, Rocket League, SMITE, Overwatch, Fortnite, FIFA 21 and Madden NFL 21. PlayVS has served more than 19,000 high schools across all 50 states. It boasts more than 230,000 registered users.

PlayVS acts as a portal for schools to create esports teams and compete against other schools. Traditional sports like basketball and baseball have established systems (and governing organizations) to organize league schedules, playoffs, referees and more. PlayVS has positioned itself as that governing body and organizational system for esports.

Not only does PlayVS facilitate these leagues, but it also offers colleges and esports organizations a much-needed recruitment tool, letting them view games and track metrics of individual players.

As part of the acquisition, GameSeta’s Tawanda Masawi and Rana Taj will join the PlayVS team and lead Canadian operations.

Alongside geographic expansion, PlayVS is also looking to expand beyond high schools and colleges with plans to launch a direct to consumer product.

“We’re going to launch some direct consumer products directly in partnership with publishers to open up the PlayVS ecosystem so people can organize and join competitions, whether they are associated with high schools or otherwise,” said Parnell. “We’re really excited about that. The markets in general have just shown great appetite for gaming as a form of entertainment and content. Obviously, players are really excited about eSports as a form of content and a way to engage in competition and so we want to make sure that PlayVS is a place where people compete more broadly.”

Powered by WPeMatico

CloudNatix, a startup that provides infrastructure for businesses with multiple cloud and on-premise operations, announced it has raised $4.5 million in seed funding. The round was led by DNX Ventures, an investment firm that focuses on United States and Japanese B2B startups, with participation from Cota Capital. Existing investors Incubate Fund, Vela Partners and 468 Capital also contributed.

The company also added DNX Ventures managing partner Hiro Rio Maeda to its board of directors.

CloudNatix was founded in 2018 by chief executive officer Rohit Seth, who previously held lead engineering roles at Google. The company’s platform helps businesses reduce IT costs by analyzing their infrastructure spending and then using automation to make IT operations across multiple clouds more efficient. The company’s typical customer spends between $500,000 to $50 million on infrastructure each year, and use at least one cloud service provider in addition to on-premise networks.

Built on open-source software like Kubernetes and Prometheus, CloudNatix works with all major cloud providers and on-premise networks. For DevOps teams, it helps configure and manage infrastructure that runs both legacy and modern cloud-native applications, and enables them to transition more easily from on-premise networks to cloud services.

CloudNatix competes most directly with VMware and Red Hat OpenShift. But both of those services are limited to their base platforms, while CloudNatix’s advantage is that it is agnostic to base platforms and cloud service providers, Seth told TechCrunch.

The company’s seed round will be used to scale its engineering, customer support and sales teams.

Powered by WPeMatico

Genflow, a London an0d LA-based brand building agency that offers an e-commerce and mobile tech platform to let influencers start companies, has raised $11 million in funding.

Leading the round is U.K. investor BGF. The injection of capital will be used by Genflow to further scale its offering and for international expansion.

Founded in 2016 by entrepreneur Shan Hanif to help social media influencers develop their brands and extract revenue from their audiences, Genflow combines aspects of a traditional branding agency — such as strategy, design and planning — and a tech company with its own software stack.

This sees Genflow position itself as a brand-as-a-service (BaaS) platform, which helps influencers develop their own digital and physical products instead of promoting other brands, and enables them to launch their own membership club, gated community, mobile app or direct to consumer brand.

“Genflow offers the complete infrastructure from design, development, manufacturing and logistics through to strategy, marketing and content creation to drive revenue and profit,” explains the company.

Genflow says its client base are established influencers who typically have large followings on Instagram and YouTube.

“Genflow allows an influencer to start their own business instead of the traditional brand deals so if someone with an audience wants truly their own audience and business Genflow does that for them,” says Hanif. “We provide them the complete infrastructure to launch a business: design, manufacturing, development, content, strategy and marketing all in one place. This gives us the unique ability to execute to a very high level that drives revenue”.

Hanif says influencers typically approach Genflow either with an idea or when they need help figuring out what brand they can launch. “We use ‘Genlytics,’ our in-house built software, to see what the best brand they can release by checking their analytics, breakdown of their followers, what brands they have worked with in the past and to see how much they can potentially sell,” he explains.

Next, Genflow onboards the client and begins the brand building process, offering broadly two options: Gated content, membership clubs, community and mobile apps, or developing direct to consumer brand with physical products.

The first is akin to having your own OnlyFans, Patreon or social media platform. The second is a classic D2C e-commerce play and includes designing the products, and working with factories to create samples, manufacture the products and then handle all logistics etc.

“In both cases then we plan the launch of the brand, the marketing strategy and then work with the influencer to launch the brand itself,” adds Hanif.

“What’s interesting is that traditionally in startups you find a problem, get a team, some funding then try to find customers. What we have invented is the ‘audience first approach’ where we already have the audience and now just need the right products and it’s instantly a success. The metrics that I see for our brands are not normal: conversion rates that are 5-30%, 20% repeat purchase buys and around 6:1 return on Facebook ads.

“We are proud that every brand we have launched to date is profitable and growing year on year so we know our approach works.”

Powered by WPeMatico

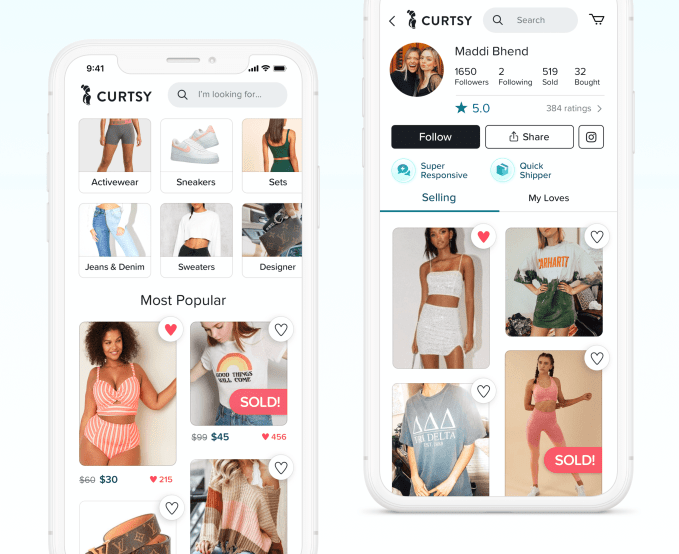

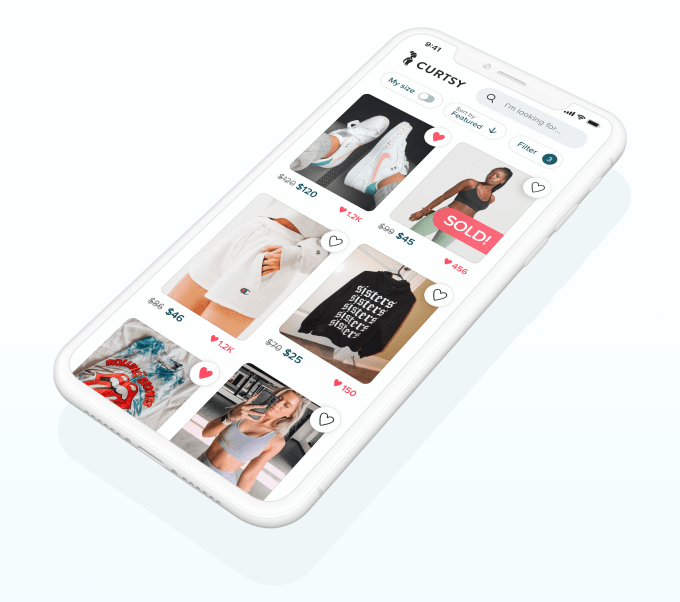

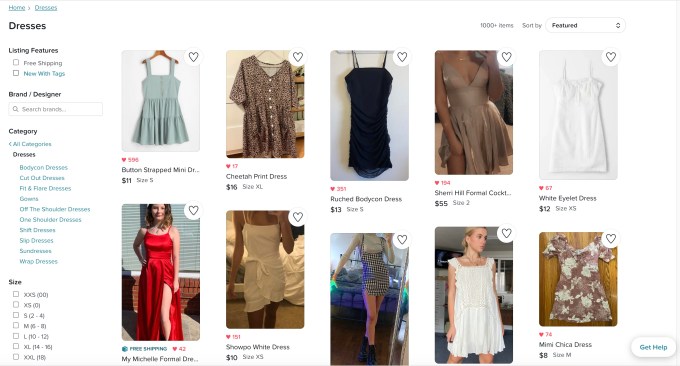

Curtsy, a clothing resale app and competitor to recently IPO’d Poshmark, announced today it has raised $11 million in Series A funding for its startup focused on the Gen Z market. The app, which evolved out of an earlier effort for renting dresses, now allows women to list their clothes, shoes and accessories for resale, while also reducing many of the frictions involved with the typical resale process.

The new round was led by Index Ventures, and included participation from Y Combinator, prior investors FJ Labs and 1984 Ventures, and angel investor Josh Breinlinger (who left Jackson Square Ventures to start his own fund).

To date, Curtsy has raised $14.5 million, including over two prior rounds, which also included investors CRV, SV Angel, Kevin Durant, Priscilla Scala and other angels.

Like other online clothing resale businesses, Curtsy aims to address the needs of a younger generation of consumers who are looking for a more sustainable alternative when shopping for clothing. Instead of constantly buying new, many Gen Z consumers will rotate their wardrobes over time, often by leveraging resale apps.

Image Credits: Curtsy

However, the current process for listing your own clothes on resale apps can be time-consuming. A recent report by Wired, for example, detailed how many women were spinning their wheels engaging with Poshmark in the hopes of making money from their closets, to little avail. The Poshmark sellers complained they had to do more than just list, sell, package and ship their items — they also had to participate in the community in order to have their items discovered.

Curtsy has an entirely different take. It wants to make it easier and faster for casual sellers to list items by reducing the amount of work involved to sell. It also doesn’t matter how many followers a seller has, which makes its marketplace more welcoming to first-time sellers.

“The big gap in the market is really for casual sellers — people who are not interested in selling professionally,” explains Curtsy CEO David Oates. “In pretty much every other app that you’ve heard about, pro sellers really crowd out everyday women. Part of that is the friction of the whole process,” he says.

On Curtsy, the listing process is far more streamlined.

The app uses a combination of machine learning and human review to help the sellers merchandise their items, which increase their chances of selling. When sellers first list their item in the app, Curtsy will recommend a price, then fill in details like the brand, category, subcategory, shipping weight and the suggested selling price, using machine learning systems training on the previous items sold on its marketplace. Human review fixes any errors in that process.

Also before items are posted, Curtsy improves and crops the images, as well as fixes any other issues with the listing, and moderates listings for spam. This process helps to standardize the listings on the app across all sellers, giving everyone a fair shot at having their items discovered and purchased.

Another unique feature is how Curtsy caters to the Gen Z to young Millennial user base (ages 15-30), who are often without shipping supplies or even a printer for producing a shipping label.

Image Credit: Curtsy / Photo credit: Brooke Ray

First-time sellers receive a free starter kit with Curtsy-branded supplies for packaging their items at home, like poly mailers in multiple sizes. As they need more supplies, the cost of those is built into the selling flow, so you don’t have to explicitly pay for it — it’s just deducted from your earnings. Curtsy also helps sellers to schedule a free USPS pickup to save a trip to the post office, and it will even send sellers a shipping label, if need be.

“One of the things we realized quickly is Gen Z does not really have printers. So we actually have a label service and we’ll send you the label in the mail for free from centers across the country,” says Oates.

Later, when a buyer of an item purchased from Curtsy is ready to resell it, they can do so with one tap — they don’t have to photograph it and describe it again. This also speeds up the selling process.

Overall, the use of technology, outsourced teams who improve listings and extra features like supplies and labels can be expensive. But Curtsy believes the end result is that they can bring more casual sellers to the resale market.

“Whatever costs we have, they should be in service of increased liquidity, so we can grow faster and add more people,” Oates says. “In case of the label service, those are people who otherwise wouldn’t be able to participate in selling online. There’s no other app that would allow them to sell without a printer.”

Image Credits: Curtsy

This system, so far, appears to be working. Curtsy now has several hundred thousand people who buy and sell on its iOS-only app, with an average transaction rates of three items bought or sold per month. When the new round closed late in 2020, the company was reporting a $25 million GMV revenue run rate, and average monthly growth of around 30%. Today, Curtsy generates revenue by taking a 20% commission on sales (or $3 for items under $15).

The team, until recently, was only five people — including co-founders David Oates, William Ault, Clara Agnes Ault and Eli Allen, plus a contract workforce. With the Series A, Curtsy will be expanding, specifically by investing in new roles within product and marketing to help it scale. It will also be focused on developing an Android version of its app in the first quarter of 2021 and further building out its web presence.

“Never before have we seen such a strong overlap between buyers and sellers on a consumer-to-consumer marketplace,” said Damir Becirovic of Index Ventures, about the firm’s investment. “We believe the incredible love for Curtsy is indicative of a large marketplace in the making,” he added.

Powered by WPeMatico

Ironhack, a company offering programming bootcamps across Europe and North and South America, has raised $20 million in its latest round of funding.

The Miami-based company (with locations in Amsterdam, Barcelona, Berlin, Lisbon, Madrid, Mexico City, Miami, Paris and São Paulo) said it will use the money to build out more virtual offerings to complement the company’s campuses.

Over the next five years, 13 million jobs will be added to the tech industry in the U.S., according to Ironhack co-founder Ariel Quiñones. That’s in addition to another 20 million jobs that Quiñones expects to come from the growth of the technology sector in the EU.

Ironhack isn’t the only bootcamp to benefit from this growth. Last year, Lambda School raised $74 million for its coding education program.

Ironhack raised its latest round from Endeavor Catalyst, a fund that invests in entrepreneurs from emerging and underserved markets; Lumos Capital, which was formed by investors with a long history in education technology; Creas Capital, a Spanish impact investment firm; and Brighteye, a European edtech investor.

Prices for the company’s classes vary by country. In the U.S. an Ironhack bootcamp costs $12,000, while that figure is more like $3,000 for classes in Mexico City.

The company offers classes in subjects ranging from web development to UX/UI design, and data analytics to cybersecurity, according to a statement.

“We believe that practical skills training, a supportive global community and career development programs can give everyone, regardless of their education or employment history, the ability to write their stories through technology,” said Quiñones.

Since its launch in 2013, the company has graduated more than 8,000 students, with a job placement rate of 89%, according to data collected as of July 2020. Companies who have employed Ironhack graduates include Capgemini, Siemens and Santander, the company said.

Powered by WPeMatico

Monzo founder Tom Blomfield is departing the U.K. challenger bank entirely at the end of the month, staff were informed earlier today.

Blomfield held the role of CEO until May last year when he assumed the newly created title of president and resigned from the Monzo board. However, having been given the time and space to consider his long-term future at the bank he helped create six years ago, and with a refreshed executive team now in place, he says it is time to “hand over the baton”.

In a brief but candid telephone interview, Blomfield also revealed that, as well as being unhappy during the last couple of years as CEO when the company scaled well beyond a “scrappy startup”, the pandemic and subsequent lockdowns exacerbated pressures placed on his own mental well-being. “I’m very happy to talk about what’s gone on with me, because I don’t think people do it enough”, he says.

“I stopped enjoying my role probably about two years ago… as we grew from a scrappy startup that was iterating and building stuff people really love, into a really important U.K. bank. I’m not saying that one is better than the other, just that the things I enjoy in life is working with small groups of passionate people to start and grow stuff from scratch, and create something customers love. And I think that’s a really valuable skill but also taking on a bank that’s three, four, five million customers and turning it into a 10 or 20 million customer bank and getting to profitability and IPOing it, I think those are huge exciting challenges, just honestly not ones that I found that I was interested in or particularly good at”.

In early 2019 after realising he was “doing too much and not enjoying it,” Blomfield began talking to Monzo investor Eileen Burbidge of Passion Capital, and Monzo Chair Gary Hoffman, about changing roles and how he needed more help. Then, he says, “COVID just exacerbated things,” a period when Monzo also had to cut staff, shutter its Las Vegas office and raise bridge funding in a highly publicised down round.

“I think [for] a lot of people in the world — and you and I have spoken about this — going through a pandemic, going through lockdown and the isolation involved in that has an impact on people’s mental health,” says Blomfield. “I don’t think I was any different, so I was really struggling. I had a really, really supportive exec team around me and a really supportive set of investors on board and I was really grateful that when I put my hand up and said, ‘I need help,’ they were super receptive to that”.

Blomfield also comes clean about his role as president, a title that was intended as a way to provide the time and space for him to get well and figure out if he would return longer-term to Monzo or depart entirely. Contrary to rumours, Blomfield says he wasn’t pushed out by investors. Instead, the Monzo board actually put pressure on him to remain as CEO longer than he wanted or perhaps should have (a version of events corroborated by my own sources). “When I took that president role, it was not certain one way or another what would happen,” Blomfield says, apologising in case I felt I was misled when I reported the news.

(The truth is, within weeks of running that news piece, I knew it was far from certain Blomfield would ever return, with multiple sources, including people close to and worried about Blomfield, confiding in me how burned out the Monzo founder was. As weeks turned into months and following additional sourcing, I had enough information to write a follow-up story much earlier but chose to wait until a formal decision was taken.)

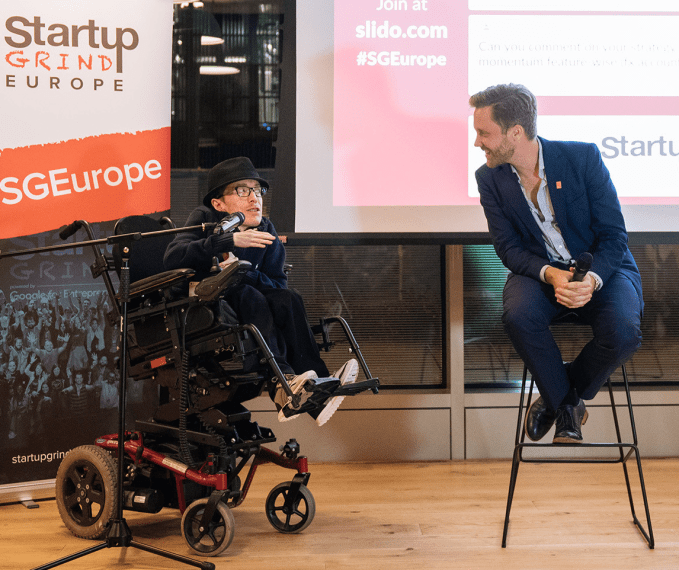

TechCrunch’s Steve O’Hear interviewing Monzo’s Tom Blomfield. Image Credits: Startup Grind

Meanwhile, Blomfield describes his resignation as a Monzo employee as “bitter-sweet,” and is keen to praise what the Monzo team has already achieved, including since his much-reduced involvement. “I think the team has done phenomenally well over the last year or so in really difficult circumstances,” he says. In particular, he cites Monzo’s new CEO TS Anil as doing a “phenomenal” job, while describing Sujata Bhatia, who joined as COO last year, as “an absolute machine, a real operator”.

To that end, Monzo now has almost 5 million customers, up from 1.3 million in 2019. Monzo’s total weekly revenue is now 30% higher than pre-pandemic, helped no doubt by over 100,000 paid subscribers across Monzo Plus and Premium in the last five months (sources tell me the company surpassed £2 million in weekly revenue in December for the first time in its history). Albeit at a lower valuation, the challenger bank also raised £125 million from new and existing investors during the pandemic.

Blomfield also says that Anil and Bhatia and other members of the Monzo executive team have specific skills — that he simply doesn’t have — related to scaling and managing a bank approaching 5 million customers. And even if he did, he has learned the hard way that there are aspects of running a large company that not everyone enjoys.

“Going from a CEO where you’re front and centre dealing with all of the different pressures every day to a much lighter role is a huge huge weight off my shoulders and has given me the time and space to recover”, he adds. “I’m now feeling pretty great. I’m enjoying life again”.

As for what’s next for Blomfield, he says he wants to “chill out” for a bit and perhaps take a holiday. He’s also finishing his vaccination training so that he can volunteer to help deliver the U.K.’s national COVID-19 vaccination rollout. A recent tweet by Blomfield about a side project also led to speculation that he has begun a new venture. Not true, says Blomfield, telling me it was a five-day project designed to get back into coding and play with a robotic 2D printer. And while he’s very much left Monzo, he says he’ll continue cheering on the company from the outside.

Powered by WPeMatico