TC

Auto Added by WPeMatico

Auto Added by WPeMatico

Gingko Bioworks, a synthetic biology company now valued at around $15 billion, begins trading on the New York Stock Exchange today.

Gingko’s market debut is one of the largest in biotech history. It’s expected to raise about $1.6 billion for the company. It’s also one of the biggest SPAC deals done to date — Gingko is going public through a merger with Soaring Eagle Acquisition Corp., which was announced in May.

Shares opened at $11.15 each this morning under the ticker DNA — biotech dieharders will recognize it as the former ticker used by Genentech.

The exterior of the NYSE is decked out in Gingko décor. The imagery is clearly sporting Jurassic Park themes, as MIT Tech Review’s Antonio Regalado pointed out. It’s probably intentional: Jason Kelly, the CEO of Ginkgo Bioworks, has been re-reading “Jurassic Park” this week, he tells TechCrunch.

The décor also sports a company motto: “Grow everything.”

Ginkgo was founded in 2009, and now bills itself as a synthetic biology platform. That’s essentially premised on the idea that one day, we’ll use cells to “grow everything,” and Gingko’s plan is to be that platform used to do that growing.

Kelly, who often uses language borrowed from computing to describe his company, likens DNA to code. Gingko, he says, aims to “program cells like you can program computers.” Ultimately, those cells can be used to make stuff: like fragrances, flavors, materials, drugs or food products.

The biggest lingering question over Gingko, ever since the SPAC deal was announced, has centered on its massively high valuation. When Moderna, now a household name thanks to its COVID-19 vaccines, went public in 2018, the company was valued at $7.5 billion. Gingko’s valuation is double that number.

“I think that surprises people to be honest,” Kelly says.

Ginkgo’s massive valuation seems even starker when you look at its existing revenues. SEC documents show that the company pulled in $77 million in revenue in 2020, which increased to about $88 million in the first six months of 2021 (per an August investor call). The company has also reported losses: including $126.6 million in December 2020 and $119.3 million in 2019.

Gingko is aiming to increase revenue a significant amount in 2021. SEC documents initially noted that the company aimed to draw about $150 million in revenue in 2021, but the August earning call updated that total for the year to over $175 million.

Gingko aims to make money in two ways: first it contracts with manufacturers during the research and development phase (i.e. while the company works out how to manufacture a cell that spits out a certain fragrance, bio-based nylon or meatless burger). That process happens in Gingko’s “foundry,” a massive factory for bioengineering projects.

This source of money is already starting to flow. Gingko reported $59 million in foundry revenue for 2020, and anticipates $100 million in 2021, per the August investor call.

This revenue, though, isn’t covering the full costs of Gingko’s operations, according to the information shared by the company in SEC documents. It is covering an increasing share, though, and as Gingko scales up its platform, costs will come down. Based on fees alone, Kelly projects Gingko will break even by 2024 or 2025.

The second type of revenue comes from royalties, milestone payments or, in some cases, equity stakes in the companies that go on to sell products, like fragrances or meatless burgers, made using Gingko’s facilities or know-how. It’s this source of income that will make up the vast majority of the company’s future worth, according to its expectations.

Once the product is made and marketed by another company, it requires little to no more work on Gingko’s part — all the company does is collect cash.

The company is often hesitant to incorporate these earnings into projections, because they rely on other companies bringing products to market. That means it’s hard to know for sure when these downstream payments will emerge. “In our models, we are very sensitive that, at the end of the day, they’re not our products. I cannot predict when Roche might bring a drug to market and give me my milestones,” says Kelly.

Kelly says there’s evidence this model will start to work in the near-term.

Gingko earned a “bolus” milestone payment of 1.5 million shares of The Cronos Group, a cannabis company, for developing a commercially viable, lab-grown rare cannabinoid called CBG for commercial use (there are seven more in strains development, says Kelly). These milestone payments (in cash or shares) are earned when a company achieves some predetermined goal using Gingko’s platform.

Gingko has also worked with Aldevron to manufacture an enzyme critical to the production of mRNA vaccines, and plans to collect royalty payments from that relationship — though no foundry fees were collected from this project.

Finally, Gingko has negotiated an equity stake in Motif Foodworks, a spinout company based on its technology. That company has so far raised about $226 million, and will aim to launch a lab-grown beef product developed at Gingko’s foundry, paying Gingko the aforementioned foundry fees already for this contribution.

This rich source of cash will depend a lot on the outside contractor’s ability to manufacture and sell products made using Gingko’s platform. This opens the company up to some risk that’s beyond its control. Maybe, for instance, it turns people don’t want bio-manufactured meat as much as many anticipated — that means some types of downstream payments may not materialize.

Kelly says he’s not particularly worried about this. Even if one particular program fails, he’s planning on having so many programs running that one or two are bound to succeed.

“I’m just sorta like: some will work, some won’t work. Some will take a year, some will take three years. It doesn’t really matter, as long as everybody is working with us,” he says. “Apple doesn’t stress about what apps are going to be the next big app in the app store,” he continues.

One key metric to watch for Gingko going forward will be how many new cell programs they’re managing to close. So far, Gingko has added 30 programs this year, says Kelly. Last year, there were 50 programs.

Remember: Some of the projects are Gingko spinouts, like Motif Foodworks, not customers that come to the platform on their own. And historically, the number of companies Gingko has partnered with has been a point of criticism. Per SEC documents, the majority of revenue came from two large partners in 2020 — though Kelly told Business Insider that this was a pandemic-related downturn.

The more programs Gingko has, the more it becomes insulated from the success or failure of any one product. Plus it’s a sign that people are at least using the “app store” for biology.

“The biggest value driver of Gingko is how quickly we add programs,” Kelly says.

Powered by WPeMatico

Startups are raising record sums around the world, thanks to several contributing factors. As The Exchange explored yesterday, historically low interest rates have helped venture capitalists raise more capital than ever, to pick an example.

Low rates have helped startups in another manner: As yields fell for certain assets, investors chased returns by betting on growth. And in recent years, the investing classes turned their attention to public software companies, bidding up the value of their revenue to record highs.

This raised the worth of startups in general terms, and private tech companies’ comps enjoyed a steady, upward climb in the value of their revenues. If the value of a dollar of SaaS revenue was worth $1 one year and $2 the next, the repricing was good for private companies even if we were tracking the metrics from the perspective of public companies.

The free ride could be ending.

The Exchange explores startups, markets and money.

Read it every morning on Extra Crunch or get The Exchange newsletter every Saturday.

I’ve held back from covering the value of software (SaaS, largely) revenues for a few months after spending a bit too much time on it in preceding quarters — when VCs begin to point out that you could just swap out numbers quarter to quarter and write the same post, it’s time for a break. But the value of software revenues posted a simply incredible run, and I can’t say “no” to a chart.

The pace at which software revenues were repriced upwards in the last few years is simply astounding. Per the Bessemer Cloud Index, back in 2016, the median revenue multiple for public SaaS companies was around 5x. When 2018 began, median SaaS multiples had expanded to around 7x.

The pace at which software revenues were repriced upwards in the last few years is simply astounding. Per the Bessemer Cloud Index, back in 2016, the median revenue multiple for public SaaS companies was around 5x. When 2018 began, median SaaS multiples had expanded to around 7x.

That’s a 40% climb in pricing, but it proved to be just a foretaste of the feast to come.

By the end of 2019, the median figure had appreciated to around the 9x mark. And today it has shot to just under 18x. That is why software companies have been able to raise so much money, earlier, and in larger chunks. Every dollar of recurring revenue they sold was worth $5 in market cap in mid-2016. At the end of 2019, that same dollar of revenue was worth $9. And today, for the median public software company, it’s valued at around $18.

There are nuances to the data, but we care less about exacting definitions than the directional change it describes: The median value of SaaS revenues more than tripled from 2016 to 2021. That’s an insane amount of growth.

Powered by WPeMatico

Aircover raised $3 million in seed funding to continue developing its real-time sales intelligence platform.

Defy Partners led the round with participation from Firebolt Ventures, Flex Capital, Ridge Ventures and a group of angel investors.

The company, headquartered in the Bay Area, aims to give sales teams insights relevant to closing the sale as they are meeting with customers. Aircover’s conversational AI software integrates with Zoom and automates parts of the sales process to lead to more effective conversations.

“One of the goals of launching the Zoom SDK was to provide developers with the tools they need to create valuable and engaging experiences for our mutual customers and integrations ecosystem,” said Zoom’s CTO Brendan Ittelson via email. “Aircover’s focus on building sales intelligence directly into the meeting, to guide customer-facing teams through the entire sales cycle, is the type of innovation we had envisioned when we set out to create a broader platform.”

Aircover’s founding team of Andrew Levy, Alex Young and Andrew’s brother David Levy worked together at Apteligent, a company co-founded and led by Andrew Levy, that was sold to VMware in 2017.

Chatting about pain points on the sales process over the years, Levy said it felt like the solution was always training the sales team more. However, by the time everyone was trained, that information would largely be out-of-date.

Instead, they created Aircover to be a software tool on top of video conferencing that performs real-time transcription of the conversation and then analysis to put the right content in front of the sales person at the right time based on customer issues and questions. This means that another sales expert doesn’t need to be pulled in or an additional call scheduled to provide answers to questions.

“We are anticipating that knowledge and parsing it out at key moments to provide more leverage to subject matter experts,” Andrew Levy told TechCrunch. “It’s like a sales assistant coming in to handle any issue.”

He considers Aircover in a similar realm with other sales team solutions, like Chorus.ai, which was recently scooped up by ZoomInfo, and Gong, but sees his company carving out space in real-time meeting experiences. Other tools also record the meetings, but to be reviewed after the call is completed.

“That can’t change the outcome of the sale, which is what we are trying to do,” Levy added.

The new funding will be used for product development. Levy intends to double his small engineering team by the end of the month.

He calls what Aircover is doing a “large interesting problem we are solving that requires some difficult technology because it is real time,” which is why the company was eager to partner with Bob Rosin, partner at Defy Partners, who joins Aircover’s board of directors as part of the investment.

Rosin joined Defy in 2020 after working on the leadership teams of Stripe, LinkedIn and Skype. He said sales and customer teams need tools in the moment, and while some are useful in retrospect, people want them to be live, in front of the customer.

“In the early days, tools helped before and after, but in the moment when they need the most help, we are not seeing many doing it,” Rosin added. “Aircover has come up with the complete solution.”

Powered by WPeMatico

Six months after securing a $23 million Series A round, Ketch, a startup providing online privacy regulation and data compliance, brought in an additional $20 million in A1 funding, this time led by Acrew Capital.

Returning with Acrew for the second round are CRV, super{set} (the startup studio founded by Ketch’s co-founders CEO Tom Chavez and CTO Vivek Vaidya), Ridge Ventures and Silicon Valley Bank. The new investment gives Ketch a total of $43 million raised since the company came out of stealth earlier this year.

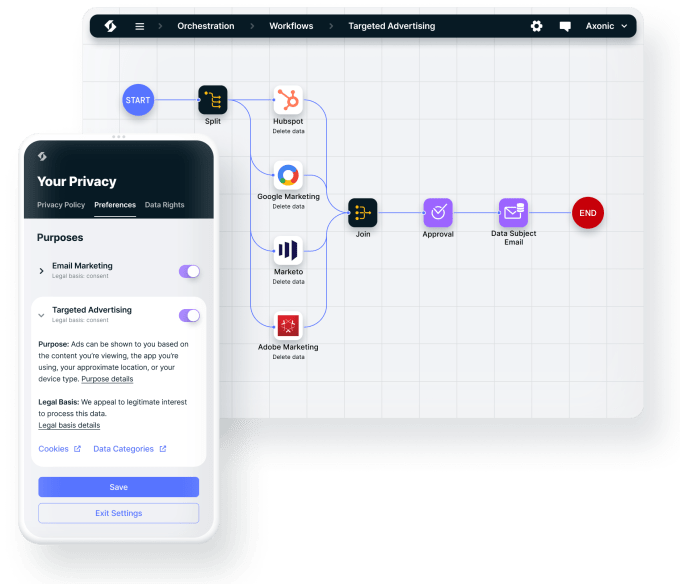

In 2020, Ketch introduced its data control platform for programmatic privacy, governance and security. The platform automates data control and consent management so that consumers’ privacy preferences are honored and implemented.

Enterprises are looking for a way to meet consumer needs and accommodate their rights and consents. At the same time, companies want data to fuel their growth and gain the trust of consumers, Chavez told TechCrunch.

There is also a matter of security, with much effort going into ransomware and malware, but Chavez feels a big opportunity is to bring security to the data wherever it lies. Once the infrastructure is in place for data control it needs to be at the level of individual cells and rows, he said.

“If someone wants to be deleted, there is a challenge in finding your specific row of data,” he added. “That is an exercise in data control.”

Ketch’s customer base grew by more than 300% since its March Series A announcement, and the new funding will go toward expanding its sales and go-to-market teams, Chavez said.

Ketch app. Image Credits: Ketch

This year, the company launched Ketch OTC, a free-to-use privacy tool that streamlines all aspects of privacy so that enterprise compliance programs build trust and reduce friction. Customer growth through OTC increased five times in six months. More recently, Qonsent, which developing a consent user experience, is using Ketch’s APIs and infrastructure, Chavez said.

When looking for strategic partners, Chavez and Vaidya wanted to have people around the table who have a deep context on what they were doing and could provide advice as they built out their products. They found that in Acrew founding partner Theresia Gouw, whom Chavez referred to as “the OG of privacy and security.”

Gouw has been investing in security and privacy for over 20 years and says Ketch is flipping the data privacy and security model on its head by putting it in the hands of developers. When she saw more people working from home and more data breaches, she saw an opportunity to increase and double down on Acrew’s initial investment.

She explained that Ketch is differentiating itself from competitors by taking data privacy and security and tying it to the data itself to empower software developers. With the OTC tool, similar to putting locks and cameras on a home, developers can download the API and attach rules to all of a user’s data.

“The magic of Ketch is that you can take the security and governance rules and embed them with the software and the piece of data,” Gouw added.

Powered by WPeMatico

You’ve probably learned from Reid Hoffman before, either through his inventions, investments or inspirational words. The entrepreneur is the co-founder of LinkedIn, a partner at Greylock and the author of a new book based off of his hit podcast, Masters of Scale.

His storied past makes him chock-full of interesting anecdotes and lessons, which is why we’re excited to have him back on the TechCrunch Disrupt stage happening next week from September 21-23. I’ll sit down with him to learn about his perspective on some of the biggest tensions that entrepreneurs face today. Hoffman’s advice is often fueled by his raw conversations with top tech CEOs and founders, so we’ll broaden access to his speed-dial list to understand how even his own perceptions on blitzscaling, growth and entrepreneurship are changing amid the pandemic. As I explained in my review of his new book, his words read like a well-networked mentor giving you a pep talk — so even if you’re not building a startup, there will be useful lessons to learn just by listening.

Here’s how it impacted my interview process, for example:

While press wasn’t a main character in the book, “Master of Scale” has already changed my perspective on how I interview founders. Lessons from Tristan Walker made me want to ask more questions about founders, and their most controversial beliefs, rather than how they plan to spend their new round of funding. A note from Andrés Ruzo made me realize that a startup that makes too much sense might be a comfortable read, but it might not be a moonshot that disrupts the world; in other words, pursue the startups that have too much seemingly foolish ambition — because they may be where the best strides, and stories, are made. Finally, it confirmed my belief that the best litmus test for a founder is if they are willing to talk about the hardships ahead of them in an honest, humble way.

OK, that’s all I’m hinting. Join me at Disrupt, where I’ll put Hoffman on the hot seat, balance out the cheerfulness with some cynical takes and push him to explain what his inevitable next book is about. Buy your tickets to TechCrunch Disrupt using this link, or use promo code “MASCARENHAS20” for a little discount from me.

Powered by WPeMatico

Mirantis has been around the block, starting way back as an OpenStack startup, but a few years ago the company began to embrace cloud-native development technologies like containers, microservices and Kubernetes. Today, it announced Mirantis Flow, a fully managed open source set of services designed to help companies manage a cloud-native data center environment, whether your infrastructure lives on-prem or in a public cloud.

“We’re about delivering to customers an open source-based cloud-to-cloud experience in the data center, on the edge, and interoperable with public clouds,” Adrian Ionel, CEO and co-founder at Mirantis explained.

He points out that the biggest companies in the world, the hyperscalers like Facebook, Netflix and Apple, have all figured out how to manage in a hybrid cloud-native world, but most companies lack the resources of these large organizations. Mirantis Flow is aimed at putting these same types of capabilities that the big companies have inside these more modest organizations.

While the large infrastructure cloud vendors like Amazon, Microsoft and Google have been designed to help with this very problem, Ionel says that these tend to be less open and more proprietary. That can lead to lock-in, which today’s large organizations are looking desperately to avoid.

“[The large infrastructure vendors] will lock you into their stack and their APIs. They’re not based on open source standards or technology, so you are locked in your single source, and most large enterprises today are pursuing a multi-cloud strategy. They want infrastructure flexibility,” he said. He added, “The idea here is to provide a completely open and flexible zero lock-in alternative to the [big infrastructure providers, but with the] same cloud experience and same pace of innovation.”

They do this by putting together a stack of open source solutions in a single service. “We provide virtualization on top as part of the same fabric. We also provide software-defined networking, software-defined storage and CI/CD technology with DevOps as a service on top of it, which enables companies to automate the entire software development pipeline,” he said.

As the company describes the service in a blog post published today, it includes “Mirantis Container Cloud, Mirantis OpenStack and Mirantis Kubernetes Engine, all workloads are available for migration to cloud native infrastructure, whether they are traditional virtual machine workloads or containerized workloads.”

For companies worried about migrating their VMware virtual machines to this solution, Ionel says they have been able to move these VMs to the Mirantis solution in early customers. “This is a very, very simple conversion of the virtual machine from VMware standard to an open standard, and there is no reason why any application and any workload should not run on this infrastructure — and we’ve seen it over and over again in many many customers. So we don’t see any bottlenecks whatsoever for people to move right away,” he said.

It’s important to note that this solution does not include hardware. It’s about bringing your own hardware infrastructure, either physical or as a service, or using a Mirantis partner like Equinix. The service is available now for $15,000 per month or $180,000 annually, which includes: 1,000 core/vCPU licenses for access to all products in the Mirantis software suite plus support for 20 virtual machine (VM) migrations or application onboarding and unlimited 24×7 support. The company does not charge any additional fees for control plane and management software licenses.

Powered by WPeMatico

As companies process ever-increasing amounts of data, moving it in real time is a huge challenge for organizations. Confluent is a streaming data platform built on top of the open source Apache Kafka project that’s been designed to process massive numbers of events. To discuss this, and more, Confluent CEO and co-founder Jay Kreps will be joining us at TC Sessions: SaaS on Oct 27th for a fireside chat.

Data is a big part of the story we are telling at the SaaS event, as it has such a critical role in every business. Kreps has said in the past the data streams are at the core of every business, from sales to orders to customer experiences. As he wrote in a company blog post announcing the company’s $250 million Series E in April 2020, Confluent is working to process all of this data in real time — and that was a big reason why investors were willing to pour so much money into the company.

“The reason is simple: though new data technologies come and go, event streaming is emerging as a major new category that is on a path to be as important and foundational in the architecture of a modern digital company as databases have been,” Kreps wrote at the time.

The company’s streaming data platform takes a multi-faceted approach to streaming and builds on the open source Kafka project. While anyone can download and use Kafka, as with many open source projects, companies may lack the resources or expertise to deal with the raw open source code. Many a startup have been built on open source to help simplify whatever the project does, and Confluent and Kafka are no different.

Kreps told us in 2017 that companies using Kafka as a core technology include Netflix, Uber, Cisco and Goldman Sachs. But those companies have the resources to manage complex software like this. Mere mortal companies can pay Confluent to access a managed cloud version or they can manage it themselves and install it in the cloud infrastructure provider of choice.

The project was actually born at LinkedIn in 2011 when their engineers were tasked with building a tool to process the enormous number of events flowing through the platform. The company eventually open sourced the technology it had created and Apache Kafka was born.

Confluent launched in 2014 and raised over $450 million along the way. In its last private round in April 2020, the company scored a $4.5 billion valuation on a $250 million investment. As of today, it has a market cap of over $17 billion.

In addition to our discussion with Kreps, the conference will also include Google’s Javier Soltero, Amplitude’s Olivia Rose, as well as investors Kobie Fuller and Casey Aylward, among others. We hope you’ll join us. It’s going to be a thought-provoking lineup.

Buy your pass now to save up to $100 when you book by October 1. We can’t wait to see you in October!

Powered by WPeMatico

Whatnot, a livestreaming shopping platform for collectors to buy and sell things like rare Pokémon cards and Funko Pops, has closed a $150 million Series C — its third round of fundraising in 2021 alone. This round pins Whatnot’s valuation at $1.5 billion, earning it a spot on the ever-growing list of unicorns.

So what’s a Whatnot? The app captures a trend that had been growing popular on platforms like Instagram in the U.S. (and was already hugely popular in China): live shopping. Verified sellers can go on the air at any time, hosting on-the-fly video auctions for their goods. Sometimes buyers know exactly what they’re getting. Other times it’s more of a mystery bag; with the popular “card break” concept, for example, users buy assigned portions of an unopened (and often itself rare) box of Pokémon or sports cards and watch its contents revealed live.

This round was funded by return investors a16z and Y Combinator’s Continuity Fund, along with one new firm joining them: CapitalG (which was known as Google Capital before the Google/Alphabet name change.) They’ve also added a few well-known names to their list of angel investors, including Andre Iguodala of the Golden State Warriors, Zion Williamson of the New Orleans Pelicans and Logan Paul of the YouTube. Initial word of this round broke last week, via The Information.

Whatnot originally started as a more standard (less live) resale platform, at first focused on authenticating just one kind of collectable: Funko Pops. As the pandemic took over and everyone was suddenly stuck at home, they leaned hard into live shopping — and grew rapidly as a result.

Meanwhile, the company has been quickly expanding its scope; it grew from just Funko Pops to all sorts of other collectables, including Pokémon cards, pins, vintage clothing, sneakers and more. Whatnot co-founder Grant Lafontaine tells me that its biggest driver is sports cards, followed by Pokémon and Funko Pops. With each category it dives into, Whatnot focuses on onboarding sellers that are already known and trusted in their respective community; each streamer on the platform is currently vetted by the company before they can go live, helping them keep fraud to a minimum. Doing anything sketchy just means getting booted off the platform and burning your own reputation in the process.

A few other key bits from my conversation with Lafontaine:

This round brings the company’s total funds raised to $225 million — pretty much all of that in the last year. Meanwhile, competition in the space is heating up; competitors like Popshop have been raising millions for their platforms, and Miami’s Loupe raised $12 million back in June (and is opening a physical retail space soon) with its focus laser-locked on sports cards live sales. Existing giants want in on it too: YouTube is playing with the live shopping concept, and Amazon has been bringing in influencers to host live sessions. In other words: watch this space. Maybe watch it via livestream.

Powered by WPeMatico

Ford said Thursday it will invest another $250 million and add 450 jobs to increase production capacity of its upcoming F-150 Lightning to 80,000 all-electric trucks annually. The announcement comes after receiving more than 150,000 pre-orders for the all-electric pickup truck.

The additional funds and jobs will be spread out across its new Rouge Electric Vehicle Center in Dearborn, Michigan, Van Dyke Electric Powertrain Center and Rawsonville Components Plant, Ford said.

The announcement was made during an event at the Rouge Electric Vehicle Center, a 500,000-square-foot facility expansion that was part of Ford’s $700 million investment in its Rouge Complex. Gas-powered F-Series trucks are also assembled at the Rouge Complex.

Ford also announced that it has started pre-production of the Lightning trucks. These prototypes will be used for real-world testing. The truck will be available to customers in spring 2022.

The all-electric pickup truck is a critical piece of the company’s $30 billion investment into electrification and one of a trifecta of Ford EV debuts and launches in the next 18 months, including the Mustang Mach-E. The Lightning may be the most meaningful in terms of the bottom line. The Ford F-150 Lightning follows the introduction of the all-electric Mustang Mach-E and the E-Transit, a configurable all-electric cargo van focused on commercial customers.

The F-150 Lightning will be offered in four trims, which includes the base, XLT, Lariat and Platinum series, and two battery options. The truck, which has an aluminum alloy body, is powered by two in-board electric motors, comes standard with four-wheel drive and has an independent rear suspension. The base version will be priced at $39,974 before any federal or state tax credits, while the midseries XLT model will start at $52,974. All of these prices exclude the destination fees and taxes.

Powered by WPeMatico

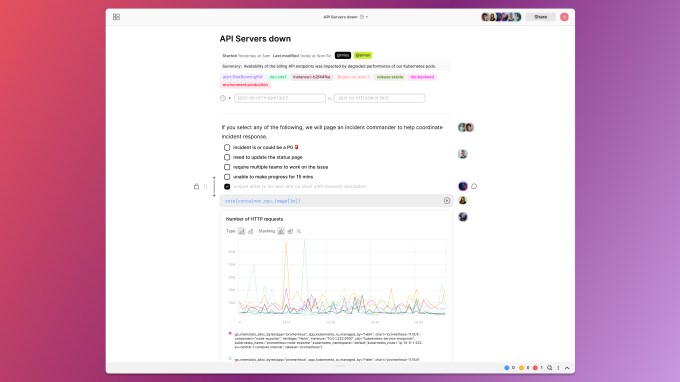

Fiberplane, an Amsterdam-based early-stage startup that is building collaborative notebooks for SREs (site reliability engineers) to collaborate around an incident in a similar manner to group editing in a Google Doc, announced a €7.5 million (approximately $8.8 million USD) seed round today.

The round was co-led by Crane Venture Partners and Notion Capital, with participation from Northzone, System.One and Basecase Capital.

Micha Hernandez van Leuffen (known as Mies) is founder and CEO at Fiberplane. When his previous startup, Werker, was sold to Oracle in 2017, Hernandez van Leuffen became part of a much larger company where he saw people struggling to deal with outages (which happen at every company).

“We were always going back and forth between metrics, logs and traces, what I always call this sort of treasure hunt, and figuring out what was the underlying root cause of an outage or downtime,” Hernandez van Leuffen told me.

He said that this experience led to a couple of key insights about incident response: First, you needed a centralized place to pull all the incident data together, and secondly that as a distributed team managing a distributed system you needed to collaborate in real time, often across different time zones.

When he left Oracle in August 2020, he began thinking about the idea of giving DevOps teams and SREs the same kind of group editing capabilities that other teams inside an organization have with tools like Google Docs or Notion and an idea for his new company began to take shape.

What he created with Fiberplane is a collaborative notebook for SRE’s to pull in the various data types and begin to work together to resolve the incident, while having a natural audit trail of what happened and how they resolved the issue. Different people can participate in this notebook, just as multiple people can edit a Google Doc, fulfilling that original vision.

Fiberplane collaborative notebook example with multiple people involved. Image Credit: Fiberplane

He doesn’t plan to stop there though. The longer-term vision is an operational platform for SREs and DevOps teams to deal with every aspect of an outage. “This is our starting point, but we are planning to expand from there as more I would say an SRE workbench, where you’re also able to command and control your infrastructure,” he said.

Today the company has 13 employees and is growing, and as they do, they are exploring ways to make sure they are building a diverse company, looking at concrete strategies to find more diverse candidates.

“To hire diversely, we’re re-examining our top of the funnel processes. Our efforts include posting our jobs in communities of underrepresented people, running our job descriptions through a gender decoder and facilitating a larger time frame for jobs to remain open,” Elena Boroda, marketing manager at Fiberplane said.

While Hernandez van Leuffen is based in Amsterdam, the company has been hiring people in the U.K., Berlin, Copenhagen and the U.S., he said. The plan is to have Amsterdam as a central hub when offices reopen as the majority of employees are located there.

Powered by WPeMatico