Extra Crunch roundup: Unpacking BuzzFeed’s SPAC, curb your meeting enthusiasm, more

Meetings should have a clear purpose, but instead, they’ve become a way to measure status and reinforce what is colloquially referred to as CYA culture.

There’s a kernel of truth in every joke, so whenever someone quips, “This meeting could have been an email!” you can bet that some small part of them meant it sincerely.

Few people know how to run meetings effectively and keep conversations on track. Making matters worse, attendees often don’t bother to prepare, which makes a boring session even less productive.

And then there’s the complication of workplace politics: How secure do you feel declining an invitation from a co-worker — or a manager?

“Every time a recurring meeting is added to a calendar, a kitten dies,” says Chuck Phillips, co-founder of MeetWell. “Very few employees decline meetings, even when it’s obvious that the meeting is going to be a doozy.”

Full Extra Crunch articles are only available to members.

Use discount code ECFriday to save 20% off a one- or two-year subscription.

Changing your meeting culture is difficult, but given that 26% of workers plan to look for a new job when the pandemic ends, startups need to do all they can to retain talent.

Aimed at managers, this post offers several testable strategies that will help you boost productivity and say goodbye to poorly run, lazily planned meetings.

“Declining a bad meeting should never be taboo, and you should reiterate your trust in the team and challenge them to spend their and others’ time with more intention,” Phillips says. “Help them feel empowered to decline a bad meeting.”

Thanks very much for reading Extra Crunch, and have a great weekend.

Walter Thompson

Senior Editor, TechCrunch

@yourprotagonist

Why Amazon should pay attention to Shein

Image Credits: Shein

In the last year, online apparel shopping app Shein grew active daily users by 130%, reports Apptopia.

Each day, thousands of new products arrive on the app’s virtual shelves. Items are rapidly designed and prototyped before Shein’s contractors put them into production in Guangzhou factories — two weeks later, those SKUs arrive in fulfillment centers around the globe.

TechCrunch reporter Rita Liao examined how the company’s agile supply chain has become hot talk among e-commerce experts, but beyond a strong logistics game and data-driven product development, Shein’s close relationships with suppliers are integral to its success.

She also tried to answer a question many are asking: Is Shein a Chinese company?

“It’s hard to pin down where Shein is from,” answered Richard Xu from Grand View Capital, a Chinese venture capital firm.

“It’s a company with operations and supply chains in China targeting the global market, with nearly no business in China.”

Inside GM’s startup incubator strategy

Image Credits: Chevrolet

GM Vice President of Innovation Pam Fletcher is in charge of the company’s startups that tackle “electrification, connectivity and even insurance — all part of the automaker’s aim to find value (and profits) beyond its traditional business of making, selling and financing vehicles,” Kirsten Korosec writes.

Fletcher joined TechCrunch at a virtual TC Sessions: Mobility 2021 event to discuss what it’s like to launch a slew of startups under the umbrella of a 113-year-old automaker.

Investor Marlon Nichols and Wonderschool’s Chris Bennett on getting to the point with a pitch deck

Image Credits: MaC Venture Capital / Wonderschool

MaC Venture Capital founding managing partner Marlon Nichols and Wonderschool CEO Chris Bennett joined Extra Crunch Live to tear down the company’s early deck.

“The first thing that jumped out at all of us was just how bare-bones the presentation is: white text on a blue background, largely made up of bullet points,” Brian Heater writes before noting the CEO admitted that “not much changed aesthetically between that first pitch and the Series A deck.”

“It aligned with what we were valuing at the time,” Bennett says. “We were really focused on getting the product-market fit and really trying to understand what our customers needed. And we’re really focused on building the team.”

Dear Sophie: What options would allow me to start something on my own?

Image Credits: Bryce Durbin/TechCrunch

Dear Sophie,

I’ve been working on an H-1B in the U.S. for nearly two years.

While I’m grateful to have made it through the H-1B lottery and to be working, I’m feeling unhappy and frustrated with my job.

I really want to start something of my own and work on my own terms in the United States. Are there any immigration options that would allow me to do that?

— Seeking Satisfaction

Investors’ thirst for growth could bode well for SentinelOne’s IPO

Image Credits: Nigel Sussman (opens in a new window)

Alex Wilhelm calls SentinelOne’s looming debut “fascinating.”

“Why? Because the company sports a combination of rapid growth and expanding losses that make it a good heat check for the IPO market,” he writes. “Its debut will allow us to answer whether public investors still value growth above all else.”

Alex delves into an early dataset from SentinelOne and why public market investors still appear to value growth above anything else.

Before an exit, founders must get their employment law ducks in a row

Image Credits: Jenny Dettrick (opens in a new window) / Getty Images

Guest columnist Rob Hudock, a litigator who focuses on helping companies recruit the best talent available while avoiding distracting workplace issues or lawsuits, lays out the importance of putting out any employment-related fires before an exit.

“Inattention to employment issues can have a significant impact on deals — from preventing closings and reducing the deal value to altering the deal terms or significantly limiting the pool of potential buyers,” he writes.

“Fortunately, such issues typically can be resolved well in advance with a little forethought and legal guidance.”

Practice agile, iterative change to refine products and build company culture

Image Credits: John M Lund Photography Inc (opens in a new window) / Getty Images

Building an excellent product and a standout company culture require the same process, Heap CEO Ken Fine writes in a guest column.

“At Heap, the analytics solution provider I lead, a defining principle is that good ideas should not be lost to top-down dictates and overrigid hierarchies,” he writes. “The best results come when you approach leadership like you would create a great product — you hypothesize, you test and iterate, and once you get it right, you grow it.”

Here, he lays out his method that argues in favor of iterative change, not “one-and-done decrees.”

a16z’s new $2.2B fund won’t just bet on the crypto future, it will defend it

Image Credits: Nigel Sussman (opens in a new window)

The big news on Thursday was the announcement of Andreessen Horowitz’s new cryptocurrency-focused fund. Most focused on the eye-popping $2.2 billion figure, but Alex Wilhelm dug a bit deeper into the announcement to note that a16z isn’t just pumping a ton of money into the crypto space, it’s putting on gloves to fight for it.

Alex writes that “a16z intends to run defense for crypto in the American, and perhaps global, market. Crypto-focused startups are likely unable to tackle the regulation of their market on their own because they’re more focused on product work in a particular region of the larger crypto economy. The wealthy and connected investment firm that backs them will take on the task for its chosen champions.”

5 takeaways from BuzzFeed’s SPAC deck

Image Credits: Nicholas Kamm / AFP / Getty Images

Alex Wilhelm dives headfirst into BuzzFeed’s announcement that it plans to go public via a blank check company.

He looked at its historical and anticipated revenue growth (the latter is very sunny, which is not atypical for SPAC presentations), what makes up that revenue (more “commerce” as time goes on), its long-term profitability projections, as well as fun stuff, like the Pulitzer Prize-winning BuzzFeed News.

Admit it. You’re curious.

3 issues to resolve before switching to a subscription business model

Image Credits: SaskiaAcht (opens in a new window) / Getty Images

Moving from a pay-as-you-go model to a subscription service is more than just putting a monthly or yearly price tag on a product, CloudBlue’s Jess Warrington writes in a guest column.

“Executives cannot just layer a subscription model on top of an existing business,” Warrington writes. “They need to change the entire operation process, onboard all stakeholders, recalibrate their strategy and create a subscription culture.”

Warrington says that in his role at CloudBlue, companies often approach him for “help with solving technology challenges while shifting to a subscription business model, only to realize that they have not taken crucial organizational steps necessary to ensure a successful transition.”

Here’s how to avoid that situation.

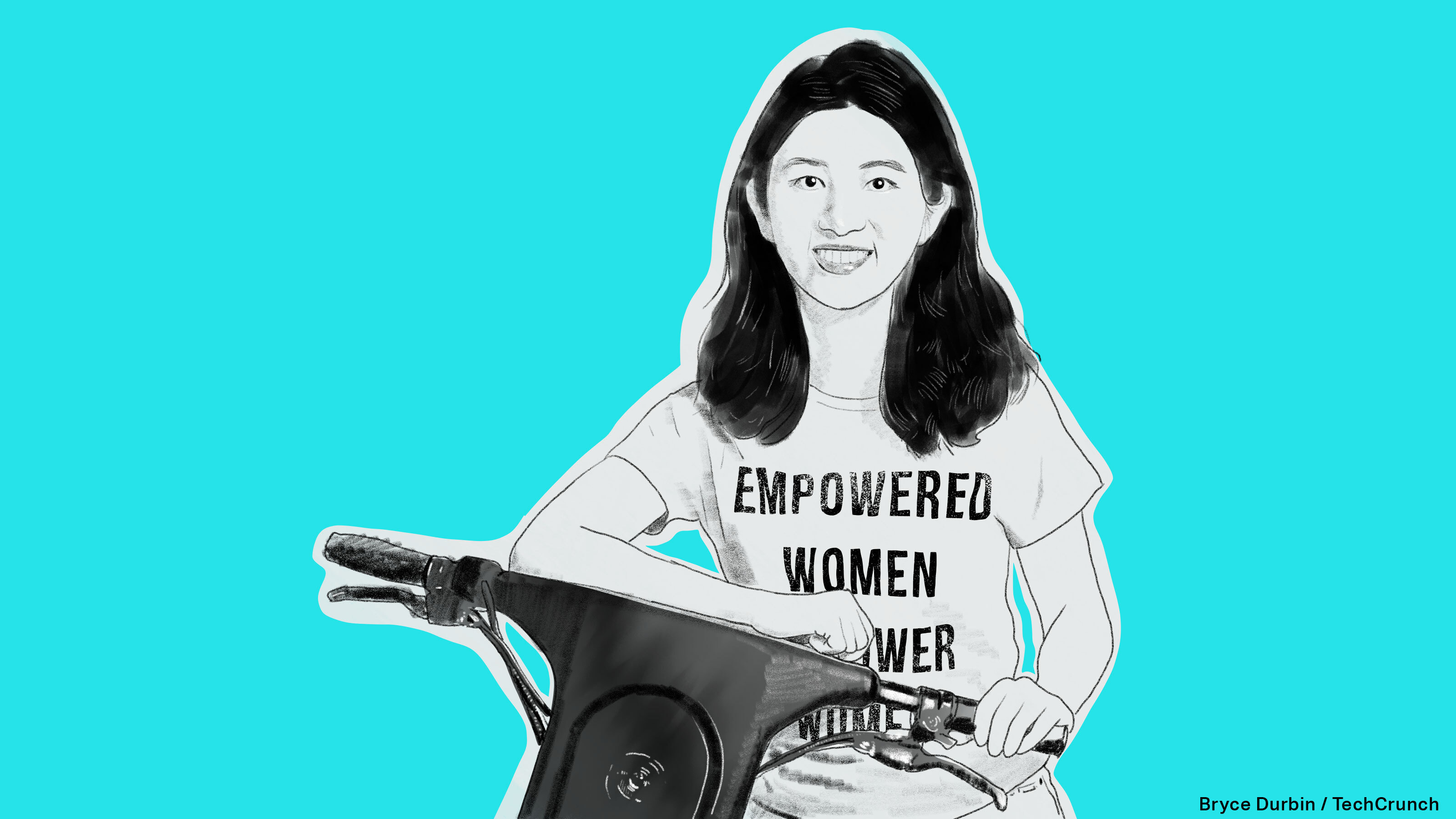

Veo CEO Candice Xie has a plan for building a sustainable scooter company, and it’s working

Image Credits: Bryce Durbin

Rebecca Bellan interviewed Veo CEO Candice Xie about the micromobility startup’s “old-fashioned way” of doing business.

“I understand people are eager to prove their unit economics, their scalability and also improve their matrix to the VC to raise another round,” Xie says. “I would say that’s OK in the consumer industry, like consumer electronics or SaaS.

“But we are in transportation. It is a different business, and transportation takes years of collaboration and building between private and public partners. … So I don’t see it happening from day one, turning over a billion-dollar company, while simultaneously having it all make sense for the cities and users.”

5 companies doing growth marketing right

Image Credits: jayk7 (opens in a new window) / Getty Images

All companies want more or less the same thing: growth. But how do you accomplish it?

Ideally, don’t start from scratch.

The race to grow faster is more pressing than ever before. … “[F]orward-thinking entrepreneurs and growth marketers simply must make time to study their competition, learn best practices and apply them to their own business growth,” Mark Spera, the head of growth marketing at Minted, writes in a guest column.

“Of course, you should still run your own experiments, but it’s just more capital-efficient to emulate than to trial-and-error from scratch. Here are five companies with growth strategies worth emulating — including the most important lessons you can begin applying to your business today.”

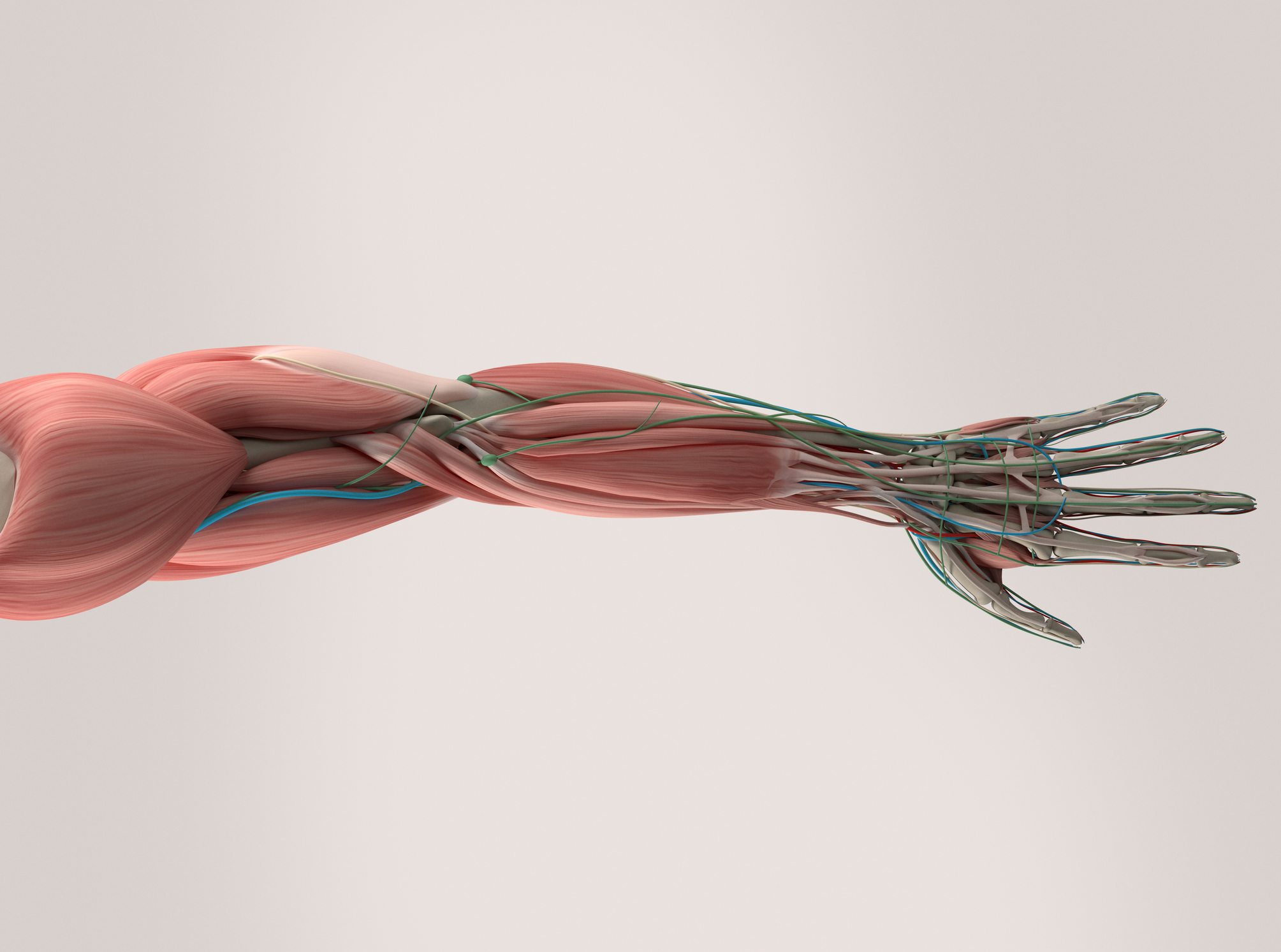

Musculoskeletal medical startups race to enter personalized health tech market

Image Credits: ChrisChrisW (opens in a new window) / Getty Images

With more than 50 million Americans suffering from chronic pain and musculoskeletal (MSK) medical problems, a number of startups are offering patients new products “that don’t resemble the cookie-cutter status quo,” reports Natasha Mascarenhas.

Startups hoping to enter this space have an uphill climb. Setting aside regulations that cover aspects like product packaging and marketing, they must compete with well-entrenched competition from Big Pharma as they try to partner with health insurance companies.

Natasha profiles three companies that are each taking a different approach to personalized health: Clear, Hinge Health and PeerWell.

Like the US, a two-tier venture capital market is emerging in Latin America

Image Credits: Nigel Sussman (opens in a new window)

In the second part of an Exchange series looking at the global early-stage venture capital market, Alex Wilhelm and Anna Heim unpacked the scene in Latin America, discovering it looked a lot like the situation in the United States: slow Series A rounds, fast B rounds.

“Mega-rounds are no longer an exception in Latin America; in fact, they have become a trend, with ever-larger rounds being announced over the last few months,” they write.

Despite that, the funds aren’t being equitably distributed, and the region still lags behind its peers: Brazil has the most $1 billion startups in Latin America, with 12. The U.S., meanwhile, has 369, and China has 159.

But the Latin American market remains hot, if not quite as scorching as the U.S. and China.

Powered by WPeMatico