Why your startup shouldn’t rush to $1 million in revenue

There is a prevailing belief that the magic formula for early-stage tech startups hinges on how quickly they achieve $1 million in annual recurring revenue (ARR). Investors in SaaS companies, in particular, are very guilty of pushing this or its equally loaded corollary, “When will you sign your first six-figure deal?”

But in the rush toward these numbers, too many startups lose sight of their primary intent: These metrics are supposed to be an indicator of product/market fit. We’ve seen companies reach $1 million in ARR in less than a year, yet not have enough market momentum to get their next million easily. We’ve seen early-stage companies so concerned about getting those first sales, they don’t validate the market and if they’re building the right product. We’ve also watched a focus on new logos make companies forget about keeping existing customers happy, introducing unexpectedly high churn — something startups can’t afford.

Those first customers and that first million are supposed to be the bedrock on which the rest of the business grows. Founders must constantly ask what they’re learning about their market, product and go-to-market approach — in that order! — so the business becomes a flywheel.

Revenue is a lagging indicator of sales success, so must likewise be prioritized accordingly. That’s not to say revenue isn’t vitally important and that there isn’t a great deal of urgency to it, but focusing on it too much too early can mask big problems that will hurt startups later when the stakes are higher.

Here are a few lessons we’ve learned by watching our early-stage companies go through this crucial phase. Every early-stage company needs to do them well.

Customer and market discovery is job No. 1

We talk about product and knowing customers a lot, but that is insufficient. Startups must understand the market, as well. How do customers do this today? Is there urgency around the problem? What is the community saying? An early investor in PagerDuty went onto Reddit and Quora and just looked at who people were talking about. It made his decision easy.

To be really successful, it is as important to understand market dynamics as it is to deliver a great product. This also helps zero in on all the aspects of your ideal customer profile; it needs to be more specific than you think! This also then helps qualify customers for future sales.

Elevate Security stood out in their super-crowded security space because they carved out a unique position around people-powered security. They used their early sales process to carefully qualify who would help them best develop their products. Their first product got shout-outs on social media from users who loved it — a rare occurrence in security — and were indicators they had found good initial customers and were creating something unique.

Build a product that sells itself

You’ll always find smart people saying, “I love what you’re doing.” Some things are so broken even a mediocre improvement is worth a change. But this is why revenue can be a false indicator for scalable success: Founders find enough early adopters to get that first million, which leads them to believe the product is enough. The company starts chasing more revenue, not investing in a product-based growth engine. If sales keeps hitting their numbers, everyone believes things are fine. Until they’re not. And then it’s usually a really heavy lift, with 6-12 months of product, sales or team upgrades.

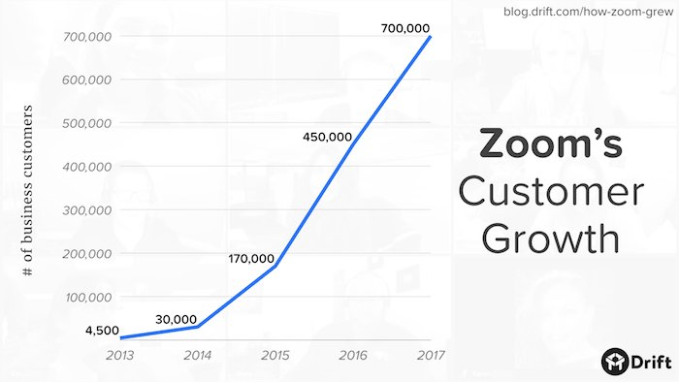

What startup doesn’t want a growth curve like this? Zoom had triple-digit growth for the last four years in a crowded, mature video conferencing category. Janine Pelosi, Zoom’s head of marketing, said the reason they were so successful before and after she arrived was they have a great product. It’s reliable, easy to use, and the founder, Eric Yuan, was selling it every day. Yuan knew the market really well coming out of Webex, and always touching customers meant he could adjust company strategy accordingly. Zoom embodied the real magic formula: know your market + build great product.

Pay attention to customer engagement and delight

Customer satisfaction is simple: It comes from the perception that people get value from their purchase; it’s much less about how much they paid. It’s also always cheaper to make an existing customer happy than it is to acquire a new one, so make sure even in the early days that you’re investing in making current customers happy advocates.

Aquabyte uses computer vision to identify sea lice in the $160 billion aquafarming market. When they showed customers FreckleID (think facial recognition for fish) to uniquely identify fish in a pen of 200,000, fish farmers loved the idea. The price they were willing to pay was 3x what the CEO thought possible. They’re likewise investing heavily in making sure their initial customer is successful with the product and are delighting them in unexpected ways (handwritten holiday cards). They have more prospects in their pipeline than they have capacity, which means they don’t need to expand sales to grow revenue fast.

Your startup may have the coolest tech, be in the biggest market and have the smartest team. No matter what your board says, remember revenue is NOT the primary indicator; it is simply an indicator. To become a breakout success, you need to read the tea leaves of all aspects of your market and build a product and customer experience that is truly superior.

Powered by WPeMatico